Vanar Chain is built around a simple, slightly stubborn idea: blockchain won’t reach real people until it stops behaving like “crypto” and starts behaving like infrastructure.

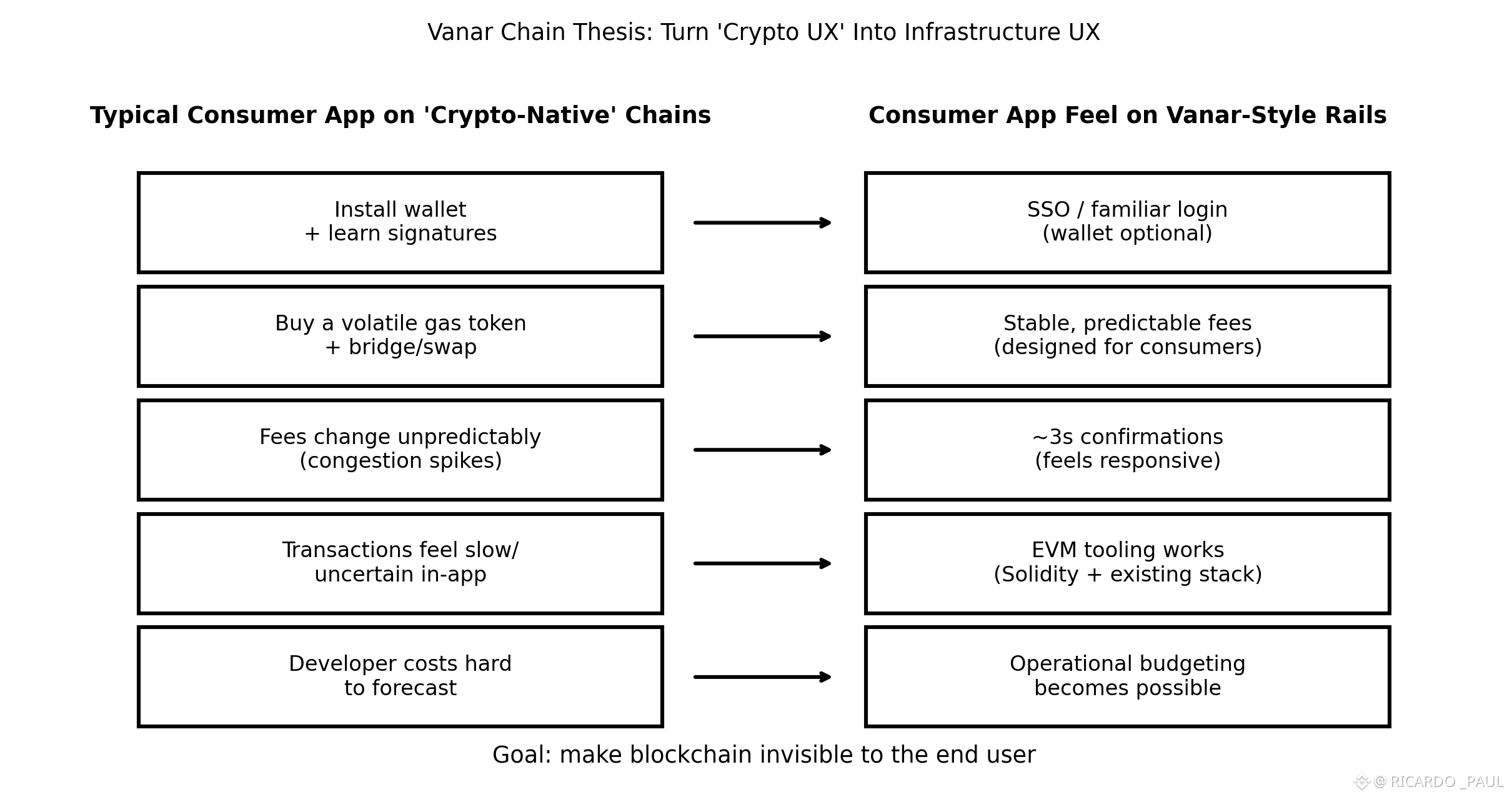

Most networks work fine if you’re a trader or a power user. But the moment you try to build something for everyday users—games, entertainment platforms, brand experiences—you run into the same problems. Fees change without warning. Transactions feel slow or uncertain. Users have to learn wallets, signatures, and token swaps just to click a button. And for teams building products, costs become impossible to forecast.

Vanar exists because that model doesn’t scale to the real world.

The team’s focus is not on impressing crypto insiders, but on removing the friction that keeps blockchain from feeling normal. Fast confirmations, stable costs, and predictable behavior aren’t “nice to have” features in this context—they’re requirements. Without them, consumer adoption simply doesn’t happen.

That mindset shows up immediately in Vanar’s technical choices. The chain is EVM-compatible and built on a modified version of Ethereum’s Geth client. That’s not a flashy decision, but it’s a smart one. It means developers don’t have to relearn everything to build on Vanar. Existing tools, Solidity contracts, and workflows already make sense here. Instead of forcing innovation at the language level, Vanar focuses on improving how the network behaves in production.

Speed is handled in a similarly pragmatic way. Vanar targets a block time capped around three seconds. For crypto natives, that might just look like another performance metric. For normal users, it’s the difference between something feeling responsive and something feeling broken. In games or consumer apps, even a short delay can break immersion. Vanar is tuned for interaction, not occasional financial transactions.

The clearest expression of Vanar’s philosophy is its approach to fees. Most blockchains rely on variable pricing. When the network gets busy, fees rise. That might be acceptable for traders, but it’s a deal-breaker for consumer products. You can’t design a game economy or a brand campaign around costs that fluctuate wildly from day to day.

Vanar tries to solve this by keeping fees stable in dollar terms, with typical transactions priced extremely low and heavier operations handled through tiered pricing. The important part isn’t the exact number—it’s the predictability. Vanar is trying to make blockchain costs feel like an operating expense, not a gamble. That’s a subtle shift, but it changes what kinds of applications are viable on-chain.

Because fees are fixed rather than bid-based, transaction ordering can also feel more natural. Instead of users competing by paying more, the network can lean toward fairness and consistency. For everyday users, that simply feels like “the app works.” And that’s exactly the point.

On the security side, Vanar takes a pragmatic approach. It uses Proof of Authority as its foundation, prioritizing stability and performance in the early stages. There’s a stated intention to broaden participation through a reputation-based model over time. This approach isn’t about pretending decentralization doesn’t matter—it’s about acknowledging that consumer-grade reliability is difficult to achieve without some structure early on. The real test for Vanar will be how it evolves this model as the network grows, expanding trust without sacrificing usability.

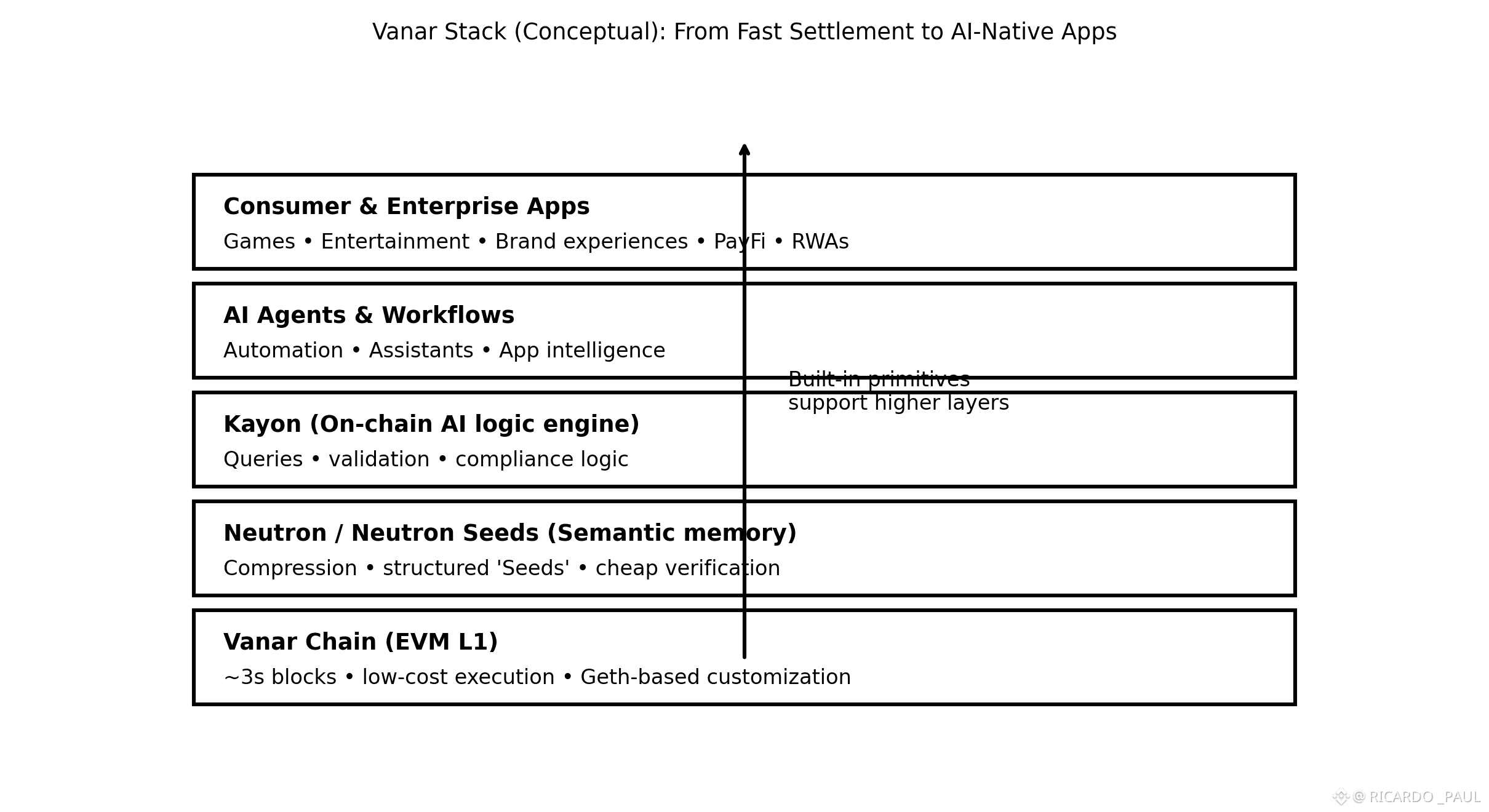

What really separates Vanar from many other Layer-1s is that it doesn’t stop at being “a fast, cheap chain.” The project is positioning itself as a broader platform, especially in the context of AI. The ecosystem is built around multiple layers, with the base chain supporting higher-level systems designed for memory, reasoning, and eventually automation.

Neutron, the semantic memory layer, is central to this vision. It’s designed to turn data into compact, structured units that can be stored, queried, and verified efficiently. Whether every marketing claim holds perfectly isn’t the most important part. The real insight is that AI systems don’t just need compute—they need memory. They need to store information, retrieve it cheaply, verify it, and reuse it inside workflows. If Vanar can make that behavior affordable and native to the chain, it creates a new kind of on-chain activity that goes far beyond trading and speculation.

This is where Vanar’s long-term strategy starts to make sense. Instead of relying solely on transaction volume driven by hype cycles, it’s aiming for recurring usage driven by utility. That’s also why the VANRY token plays a more interesting role than just “gas.” It pays for transactions and supports staking and validation, but it’s also meant to sit behind paid products and services. If Neutron-based tools and related applications generate subscription revenue, and that revenue feeds back into the token economy through buybacks or burns, VANRY becomes tied to real economic activity rather than pure narrative.

Tokenomics always come down to a single question: will demand eventually outweigh emissions? Vanar’s supply structure and long-term reward schedule are designed with that tension in mind. The project’s answer isn’t to promise miracles—it’s to build demand sinks that come from actual usage. That’s a harder path, but it’s also the only sustainable one.

The choice to focus on gaming and entertainment as entry points fits naturally into this vision. These sectors already generate high-frequency interactions, microtransactions, and digital ownership. Users don’t need to be convinced to participate—they already do. If the underlying blockchain is fast, cheap, and predictable, the technology fades into the background and the product takes center stage. That’s how mainstream adoption usually works.

In the end, Vanar’s success won’t be measured by how loud its marketing is or how impressive its benchmarks look on paper. It will be measured by something much simpler: whether people keep using applications built on Vanar without thinking about the chain underneath.

If Vanar succeeds at that, VANRY won’t gain value because people are speculating on it. It will gain value because it quietly powers systems that feel reliable, useful, and worth paying for. And that kind of adoption doesn’t arrive in waves of hype—it grows steadily, the way real infrastructure always does.