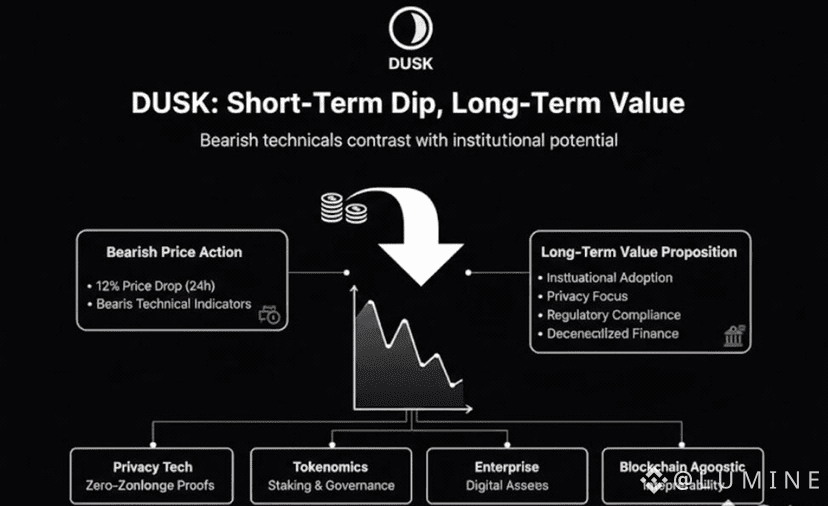

In the ever volatile world of digital assets, price movements often tell only part of the story. Over the past 24 hours, DUSK has experienced a notable pullback a sharp 12% decline that has caught the attention of traders, analysts, and long term believers alike. On the surface, the market narrative appears bearish, reinforced by technical indicators flashing red. Yet beneath this short-term turbulence lies a fundamentally different picture one rooted in institutional relevance, regulatory alignment, and long-horizon value creation.

This is not the first time a fundamentally strong project has faced temporary market pressure. And history shows us that moments like these often separate reactive speculation from strategic accumulation.

Let’s break down what’s happening and why DUSK’s long-term value proposition remains firmly intact.

Bearish Price Action: Short-Term Pain, Clear Technical Signals

There’s no denying the numbers. Over the last 24 hours, DUSK has seen a 12% price decrease, accompanied by an increase in selling pressure and weakening momentum indicators. From a technical standpoint, the market is currently favoring caution.

Several bearish signals are at play:

Momentum oscillators have rolled over, indicating reduced buying strength

Key support levels were tested, triggering stop-loss cascades

Volume spikes suggest emotional, short-term exits rather than strategic repositioning

For traders operating on lower time frames, this environment is challenging. Fear tends to accelerate downside moves, and algorithms often amplify these reactions. In the short term, price action is driven less by fundamentals and more by market psychology.

But price is not value especially in infrastructure-level blockchain projects.

Market Sentiment vs. Market Substance

What we’re witnessing with DUSK is a classic divergence between sentiment and substance.

Short-term sentiment is shaped by charts, candles, and momentum. Long-term substance is shaped by use cases, adoption pathways, and institutional alignment. DUSK belongs firmly in the second category.

While traders may be reacting to technical weakness, institutions and strategic investors look at a completely different dashboard — one that includes regulatory readiness, real-world integration, and technological differentiation.

And this is where DUSK quietly stands apart.

Institutional-Grade Vision: Built for Regulated Markets

DUSK Network is not trying to be everything to everyone. Its focus is precise and deliberate: privacy-preserving financial infrastructure for regulated environments.

At a time when global regulators are tightening oversight, many blockchain projects struggle to adapt. DUSK, on the other hand, was designed from the ground up with compliance in mind — without sacrificing decentralization or confidentiality.

This positions DUSK uniquely for:

Tokenized securities

Institutional DeFi

Privacy-compliant asset issuance

On-chain settlement for regulated entities

In a future where blockchain adoption is driven not just by retail speculation but by banks, funds, and governments, this design philosophy matters — a lot.

Privacy as a Feature, Not a Risk

Privacy is often misunderstood in crypto. For institutions, privacy isn’t about secrecy — it’s about confidentiality, data protection, and competitive integrity.

DUSK’s technology enables:

Selective disclosure

Confidential transactions

Compliance-friendly privacy

This is the kind of privacy that institutions require, not fear.

As traditional finance increasingly explores blockchain rails, solutions that balance transparency with discretion will become non-negotiable. DUSK isn’t chasing trends here it’s solving a structural problem that legacy finance cannot ignore.

Long-Term Value Is Built in Quiet Markets

Historically, the most meaningful accumulation phases occur during periods of uncertainty and negative sentiment. When hype fades and price dips, fundamentals either collapse or reveal their strength.

DUSK’s roadmap, architectural choices, and target market suggest a project playing the long game.

Short-term volatility does not invalidate:

Years of research and development

A clear institutional narrative

A technology stack aligned with future regulation

A growing conversation around tokenization and on-chain finance

Markets may be impatient, but infrastructure takes time.

Zooming Out: Time Frames Change the Story

On a 24-hour chart, DUSK looks weak. On a multi-year horizon, it represents something far more compelling: a bet on how financial markets will operate in the next decade.

Every emerging technology goes through cycles:

Innovation

Speculation

Disillusionment

Adoption

Price drops often occur between stages three and four — right before real utility begins to matter more than narratives.

Final Thought: Conviction Is Forged in Red Candles

The current bearish price action around DUSK is real and it deserves acknowledgment. But it does not erase the deeper thesis behind the project. For those who understand the difference between trading noise and structural value, moments like this are not just setbacks they’re signals.

Signals that the market is testing patience.

Signals that conviction matters more than emotion.

Signals that long-term value rarely moves in straight lines.

DUSK’s journey is not about the next 24 hours. It’s about where regulated finance, privacy, and blockchain intersect and that story is still very much being written.

Sometimes, the strongest foundations are built when the market is looking the other way. 🌘

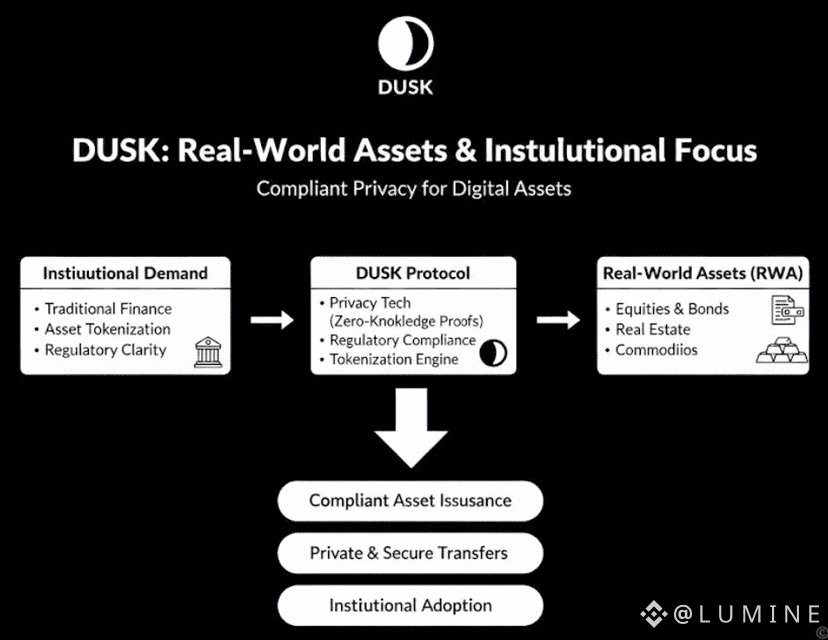

Where Blockchain Meets the Real World: DUSK’s Institutional-Grade Vision for Real-World Assets

In an industry often dominated by hype cycles, meme narratives, and short term speculation, true long-term value is built quietly at the intersection of regulation, real world utility, and institutional trust. This is precisely where DUSK positions itself. While market attention may fluctuate, the project’s core focus on Real-World Assets (RWA) and compliant privacy remains one of the strongest fundamental narratives in the blockchain space today.

As global finance moves toward tokenization, the question is no longer if real-world assets will migrate on chain but which infrastructures are actually capable of supporting them. DUSK’s answer is clear, deliberate, and deeply institutional.

The Rise of Real-World Assets: A Structural Shift, Not a Trend

Real World Assets equities, bonds, funds, real estate, and other financial instruments represent trillions of dollars in traditional markets. As institutions explore blockchain adoption, RWAs have emerged as one of the most credible bridges between legacy finance and decentralized infrastructure.

However, tokenizing RWAs is not simple.

Institutions require:

Regulatory compliance

Legal clarity

Confidential transaction handling

Selective transparency

Data protection and privacy

Most blockchain networks were never designed for this reality. They prioritize radical transparency, which works for open systems but fails institutional standards.

DUSK, by contrast, was designed specifically for this moment.

Compliant Privacy: The Missing Piece Institutions Demand

Privacy in institutional finance is not optional it is mandatory.

Banks, funds, issuers, and asset managers cannot operate in fully transparent environments where positions, counterparties, and transaction sizes are exposed. At the same time, they must remain compliant with regulators, auditors, and legal frameworks.

This creates a paradox:

Regulators require oversight

Institutions require confidentiality

DUSK solves this paradox through compliant privacy.

Its infrastructure allows:

Confidential transactions

Selective disclosure to authorized parties

Privacy without sacrificing regulatory access

This is not “privacy for privacy’s sake.” This is privacy as a professional requirement engineered to meet real financial standards.

Built for Institutions, Not Speculation

One of DUSK’s greatest strengths is also why it often flies under the radar: it was never built for hype-driven retail cycles.

Instead, its architecture, governance philosophy, and technical roadmap reflect a deep understanding of institutional needs:

Long implementation timelines

Risk-averse decision-making

Compliance-first design

Legal and regulatory alignment

This makes DUSK less reactive to market noise and more resilient in the face of long-term adoption curves.

Institutions don’t chase pumps.

They build systems.

And DUSK speaks their language.

Tokenization With Legal Integrity

Tokenizing a real-world asset isn’t just a technical process it’s a legal transformation.

Ownership rights, transfer rules, investor protections, and jurisdictional compliance must all be respected. DUSK’s framework acknowledges this reality and integrates it into its design philosophy.

This enables:

Regulated asset issuance

On-chain settlement with legal enforceability

Investor-level privacy controls

Compliance with evolving financial regulations

In other words, DUSK doesn’t try to bypass the system it modernizes it.

Why This Matters in the Bigger Picture

Global financial infrastructure is outdated.

Settlement takes days.

Transparency is fragmented.

Intermediaries add cost and friction.

Blockchain promises efficiency but only if it can coexist with regulation.

DUSK represents a third path:

Not fully permissionless chaos

Not centralized legacy systems

But a privacy-preserving, compliant blockchain layer for real finance

As tokenization expands, infrastructure like this will not be optional it will be essential.

Long-Term Fundamentals Over Short-Term Narratives

Markets often misprice projects that focus on fundamentals rather than narratives. RWAs and institutional adoption don’t move at the speed of social media they move at the speed of legislation, boardrooms, and legal frameworks.

This means:

Slower hype cycles

Longer development timelines

Higher barriers to entry

But it also means far greater staying power.

DUSK’s commitment to RWAs positions it on the right side of history even if the market hasn’t fully caught up yet.

Institutions Follow Stability, Not Volatility

Institutional capital seeks:

Predictability

Regulatory clarity

Infrastructure longevity

Projects built around speculation struggle to meet these standards. DUSK, by focusing on stable, compliant, real-world use cases, aligns naturally with institutional decision-making.

This is why RWA infrastructure is increasingly viewed as one of the most valuable segments in crypto — and why DUSK’s fundamentals continue to strengthen regardless of short-term price action.

Adoption Happens Quietly — Until It Doesn’t

Some of the most impactful technologies grow in silence.

They are tested in controlled environments.

They are reviewed by legal teams.

They are integrated gradually.

Then one day, they become the standard.

DUSK’s focus on RWAs and institutional privacy suggests it is building infrastructure for a future that is inevitable, not speculative.

Final Perspective: A Foundation for the Next Financial Era

The convergence of blockchain and real-world assets is no longer theoretical. It is happening — slowly, carefully, and deliberately. In this transition, infrastructure matters more than narratives.

DUSK stands out by:

Prioritizing compliant privacy

Aligning with institutional requirements

Designing for regulated asset tokenization

Building for longevity, not hype

While markets may fluctuate and attention may drift, fundamentals like these do not disappear. They compound.

In a world moving toward tokenized finance, DUSK isn’t asking whether institutions will come on chain it’s preparing for when they do.

And when that shift accelerates, the value of compliant, privacy-preserving RWA infrastructure will no longer be underestimated it will be undeniable.

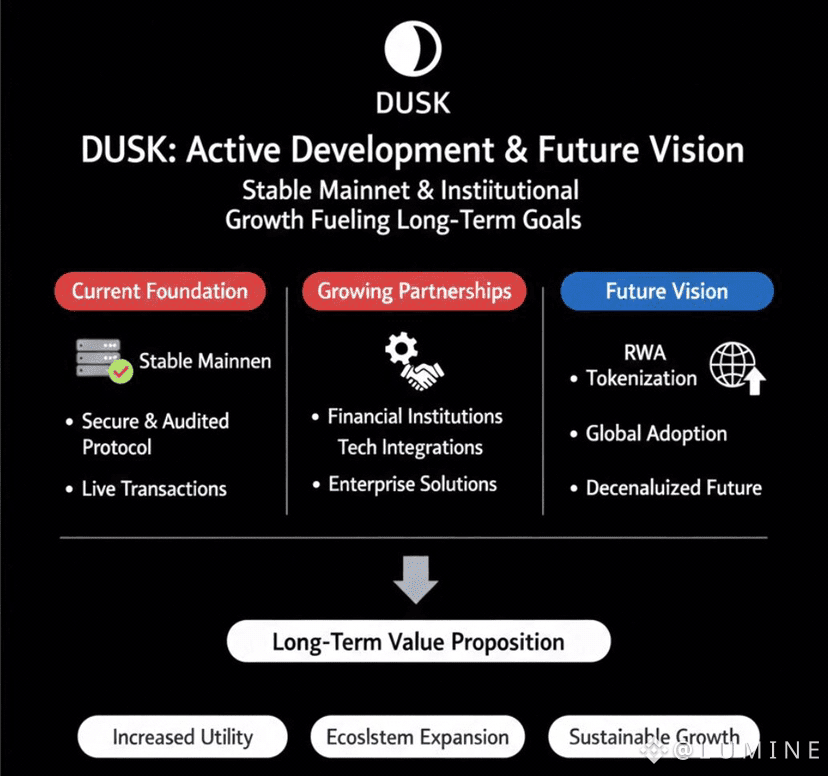

Active Development: The Quiet Strength Powering DUSK’s Long-Term Vision

In the blockchain space, long-term success is rarely driven by hype alone. It is built through consistent development, reliable infrastructure, and trust earned over time. While market cycles rise and fall, projects with active development and real-world alignment continue to move forward. This is exactly where DUSK Network stands today.

At the core of DUSK’s value proposition is a stable, production-ready mainnet, supported by continuous upgrades and an expanding ecosystem of institutional relationships. These elements form the backbone of a vision that looks far beyond short-term market fluctuations.

A Stable Mainnet Built for Real Use

Many blockchain projects never progress beyond experimental or semi-functional networks. DUSK is different. Its live and stable mainnet demonstrates a level of technical maturity that institutions require before engaging seriously.

A stable mainnet signals several critical strengths:

Proven network reliability

Secure transaction processing

Functional smart contract capabilities

Readiness for real-world financial applications

For institutions, this stability is non-negotiable. Capital, compliance, and reputation cannot be risked on untested systems. DUSK’s operational mainnet provides the confidence necessary for long-term integration and experimentation within regulated environments.

Continuous Development Over Constant Noise

Active development is not always loud — but it is always visible to those paying attention. DUSK’s progress is defined by steady technical iteration, protocol refinement, and infrastructure enhancement rather than short-lived announcements.

This approach reflects a deep understanding of institutional adoption cycles. Financial entities move carefully, demanding robustness, security audits, and long-term support. DUSK’s development culture aligns with these expectations, reinforcing its credibility as a serious infrastructure provider.

Consistency builds trust — and trust is the currency institutions value most.

Growing Institutional Partnerships

DUSK’s expanding institutional engagement further validates its long-term direction. Partnerships in regulated finance are not formed casually; they are the result of extensive due diligence, legal review, and technical evaluation.

These relationships signal that DUSK is:

Solving real institutional problems

Meeting compliance and privacy standards

Positioned as a viable blockchain layer for regulated assets

Rather than chasing mass retail adoption, DUSK is embedding itself where it matters most — within the frameworks of real finance. This creates durable demand for the network’s technology, independent of market sentiment.

Infrastructure That Scales With Time

Long-term visions require foundations that can scale not just technically, but institutionally. DUSK’s combination of a stable mainnet and active development ensures the network can evolve alongside regulatory changes, market demands, and technological innovation.

This adaptability is crucial. Financial systems do not transform overnight. They evolve incrementally, and DUSK’s development trajectory mirrors this reality.

Final Thought: Progress That Outlasts Market Cycles

Price charts may dominate daily conversations, but development tells the real story. DUSK’s stable mainnet, ongoing protocol improvements, and growing institutional partnerships highlight a project focused on permanence, not speculation.

While others compete for attention, DUSK continues to build quietly, consistently, and with purpose. And in an industry where trust and reliability define long-term winners, that may be its greatest strength of all.