Understanding how transactions move through a blockchain is essential when building serious financial applications. Dusk approaches this lifecycle with a level of structure and clarity that reflects its broader mission: creating infrastructure that institutions and regulated markets can rely on. The network’s transaction flow is not just about moving data from one wallet to another — it is about guaranteeing predictability, auditability, and finality in environments where financial certainty matters.

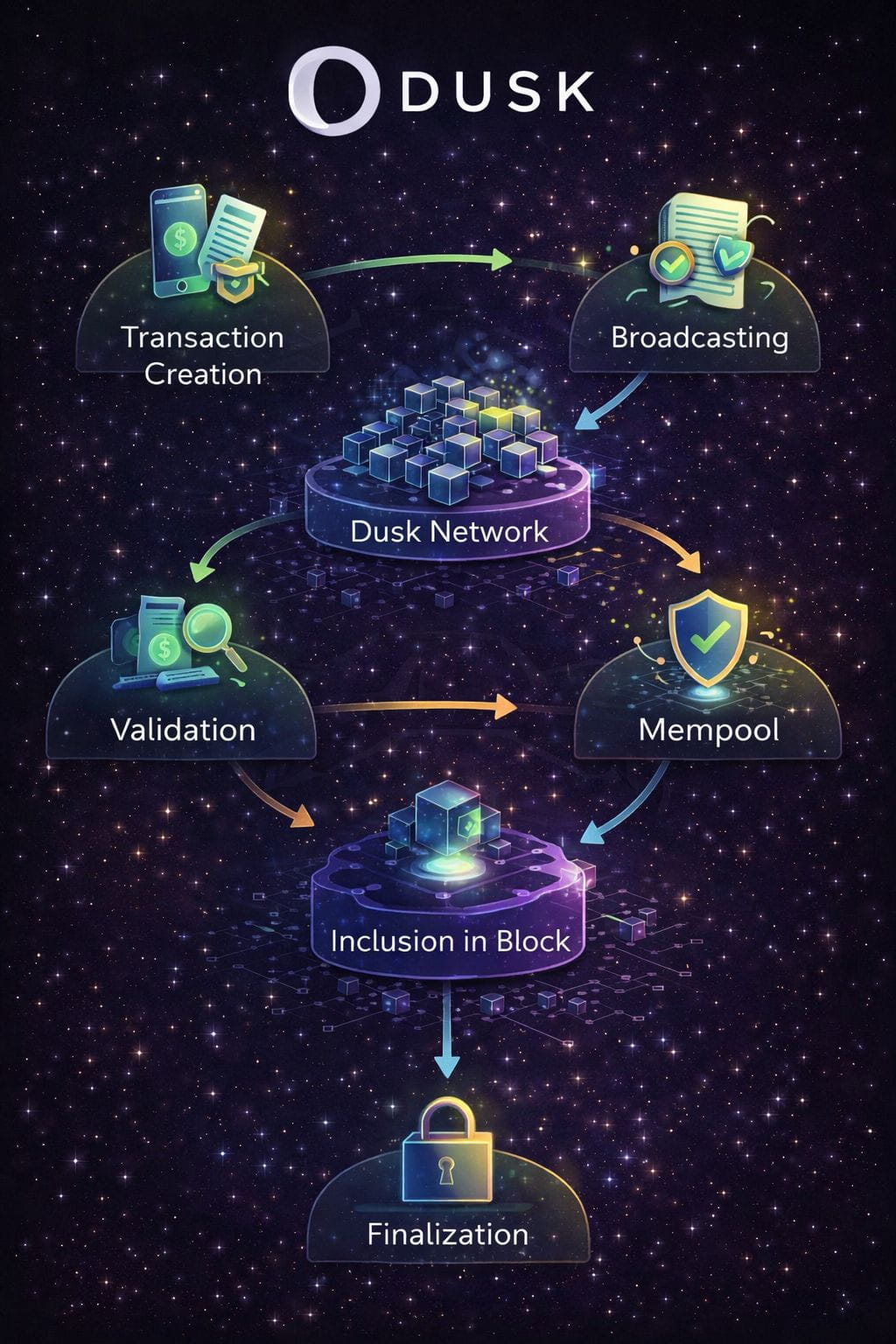

Every interaction on Dusk begins with transaction creation. A wallet or application constructs a transaction that defines the intended action, whether that is transferring value, interacting with a smart contract, or updating state within a financial application. This transaction is then broadcast to the network, where multiple nodes receive and independently validate it. Validation at this stage ensures that malformed or rule-breaking transactions never move further into the system, protecting both performance and integrity.

Once validated, the transaction enters the mempool — a temporary holding area where pending transactions wait to be included in a block. This stage is crucial for understanding real-time network behavior. Transactions can remain here briefly or longer depending on network conditions and prioritization. If a transaction becomes outdated or is replaced by a newer version with adjusted parameters, it may be removed from this pool. This dynamic handling helps maintain efficiency and prevents stale data from clogging the pipeline.

The next step is block production. A block generator selects transactions from the mempool and packages them into a candidate block. This is where the transaction transitions from “pending” to “about to be committed.” However, inclusion in a candidate block is not yet a guarantee of permanence. The block must still be accepted by the network’s consensus process before its contents are considered part of the canonical chain.

Acceptance is a key milestone. When the network agrees on a block, the transactions inside it are executed. Execution means the smart contract logic runs, balances update, and state transitions occur. Importantly, Dusk clearly distinguishes between execution success and contract-level errors. A transaction may be successfully processed by the chain while still returning an application-level error, such as a contract revert. This nuance is vital for developers building financial logic, because it separates network reliability from business rule enforcement.

After execution, the block moves toward confirmation and finalization. Confirmation reduces the likelihood that the block will be replaced by an alternative chain version, while finalization represents the point at which reversal becomes practically impossible. Once finalized, transactions are immutable — a property especially important for regulated financial records, where legal and accounting standards demand durable settlement.

Dusk also provides a robust event model that allows applications to track this lifecycle in detail. Developers can listen for execution events, confirmation signals, and finalization markers to understand exactly where a transaction stands. This event-driven design supports sophisticated monitoring systems, enabling exchanges, custodians, and financial service providers to automate their operations with confidence.

Another important aspect of the lifecycle is handling reverts and block reorganizations. Before finality, there is always a small window where a block might be replaced according to consensus rules. Dusk addresses this by encouraging applications to re-check transaction states when such events occur. Rather than treating the chain as instantly final, the system embraces a realistic model where software must respond to changing states until finalization is reached. This approach aligns well with institutional risk management practices, where staged settlement and reconciliation are standard.

Invalid or discarded transactions are also handled in a predictable way. Transactions that fail to meet protocol rules — for example due to malformed data or insufficient execution parameters — are filtered out early and never threaten network stability. For end users and compliant applications using standard tools, these edge cases remain largely invisible, but their existence shows the depth of defensive design within the protocol.

All of these mechanics support Dusk’s broader goal of powering compliant financial infrastructure. In regulated markets, knowing the exact status of a transaction is not optional. Settlement times, reporting obligations, and counterparty risk all depend on precise state tracking. By providing a clearly defined lifecycle, granular event signals, and strong finality guarantees, Dusk delivers the kind of operational clarity that traditional financial systems require.

This structured transaction model also reinforces Dusk’s positioning as a network for tokenized securities and regulated digital assets. Financial instruments often involve complex contract logic, conditional execution, and strict audit requirements. A lifecycle that distinguishes between network execution, contract outcomes, confirmation depth, and finality allows these instruments to function onchain without sacrificing legal or operational rigor.

In essence, Dusk transforms blockchain transactions from opaque technical events into transparent, trackable financial processes. Each stage — from creation to finality — is designed with the assumption that real money, real institutions, and real regulatory frameworks are involved. That philosophy sets Dusk apart as infrastructure not just for decentralized applications, but for the next generation of compliant, onchain financial markets.