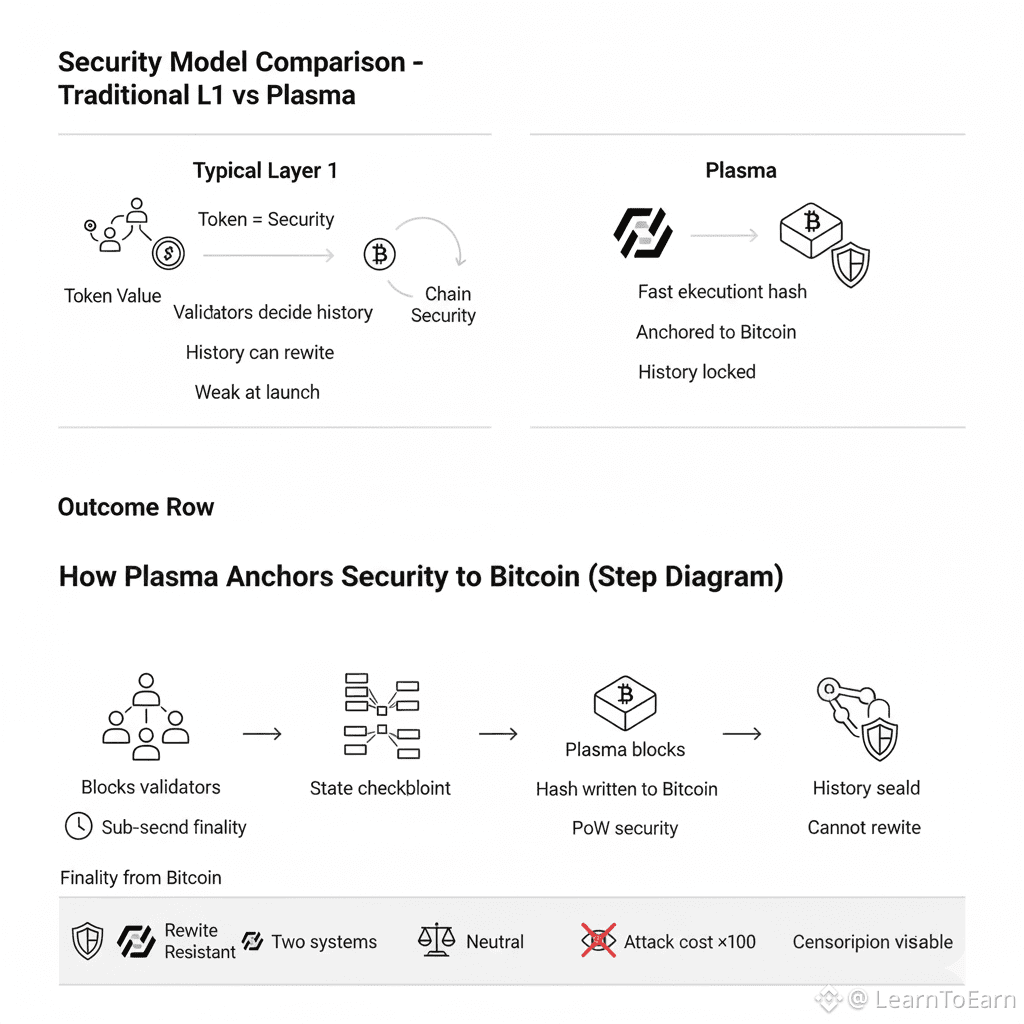

In any decentralized architecture that aspires to support global settlement, security is not a feature to be optimized—it is the foundation upon which all other properties rest. Speed, composability, programmability, and cost efficiency only matter insofar as the system’s history cannot be credibly rewritten. Yet this creates a persistent tension for new Layer 1 blockchains. Most rely on endogenous security: a validator set bonded by the economic value of the chain’s native token. This model is powerful but self-referential. The chain is secure because the token is valuable, and the token is valuable because the chain is secure. For general-purpose ecosystems, this circularity may be acceptable. For a universal settlement layer—especially one designed to host stablecoins, financial instruments, and institutional flows—it raises deeper questions around neutrality, credibility, and early-stage fragility.

Plasma’s architecture represents a deliberate departure from this closed-loop assumption. Rather than anchoring its ultimate security solely in the confidence of its own participants, Plasma externalizes finality to the most neutral and battle-tested cryptographic ledger ever created: Bitcoin. This choice is not cosmetic and not auxiliary. It reframes the security model from one of isolated sovereignty to one of anchored credibility, where the historical truth of the chain is finalized outside the economic influence of its own validator set.

At the heart of this design is a subtle but powerful distinction: Plasma does not bridge assets to Bitcoin, nor does it outsource execution or consensus. Its validators still produce blocks, order transactions, and provide sub-second finality under a high-performance consensus mechanism. What changes is how history is sealed. At predefined intervals, the validator set produces a cryptographic checkpoint—a compact commitment that mathematically represents the entire state of the chain at that moment. This single hash encapsulates every transaction, every balance, and every smart contract interaction finalized up to that point.

That commitment is then published directly onto the Bitcoin blockchain. Once included in a Bitcoin block and buried under subsequent proof-of-work confirmations, the Plasma state becomes part of Bitcoin’s immutable historical record. This creates a one-way anchoring relationship: Plasma depends on Bitcoin for historical finality, while Bitcoin remains completely unaware of Plasma’s existence. The asymmetry is intentional and crucial. There is no shared trust surface, no mutual dependency, and no new attack vector introduced to Bitcoin itself.

The security property this unlocks—history-rewrite resistance—fundamentally alters the threat model. In a conventional Layer 1, an attacker who compromises a supermajority of validators can, at least in principle, reorganize finalized history. In Plasma’s anchored model, that attack must occur across two independent domains simultaneously. An adversary would need to both subvert Plasma’s validator set and re-mine Bitcoin from the checkpoint forward, erasing the proof of the legitimate state. This is not merely additive in cost; it is multiplicative in difficulty. Proof-of-Stake capture and Proof-of-Work history rewriting are orthogonal challenges, requiring different resources, different expertise, and different economic assumptions. The result is that Plasma inherits Bitcoin’s enormous accumulated security expenditure for its historical record, without inheriting Bitcoin’s execution constraints.

The consequences of this design extend beyond adversarial models and into the social and economic fabric of the system. A settlement layer that aspires to global relevance must be credibly neutral. Market participants—especially institutions—must trust that no insider coalition can silently alter the past, selectively reverse transactions, or retroactively enforce political or regulatory preferences. By anchoring its canonical history to Bitcoin, Plasma externalizes trust. The final arbiter of historical truth is not a foundation, a governance council, or even the validator majority, but a decentralized network whose incentives are entirely disconnected from Plasma’s internal economics. This separation is what gives neutrality its credibility.

Anchoring also resolves the security bootstrap problem that plagues new blockchains. Early in a network’s life, its native token typically has limited market value, which constrains the economic cost of attacking its validator set. Plasma avoids this vulnerability by immediately elevating its security floor. From day one, rewriting its settled history is as hard as attacking Bitcoin itself. This allows the network’s stablecoin economy, application layer, and liquidity to grow under a protective umbrella long before Plasma’s own staking economy matures. Security is no longer something that must be patiently accumulated; it is imported at genesis.

There is also a subtler but equally important implication for censorship resistance. In systems where transaction fees are paid in stablecoins rather than volatile native assets, critics often raise concerns about validator-level censorship under external pressure. Plasma’s anchoring turns censorship into an observable, immutable event. Any deviation from honest transaction inclusion is permanently reflected in the state commitments written to Bitcoin. This transforms censorship from a covert act into an auditable liability. Validators cannot quietly rewrite narratives after the fact; the chain’s behavior is sealed into a public, neutral ledger that no single actor controls.

Taken together, this architecture points toward a new security archetype for blockchains. Instead of monolithic chains that must optimize every dimension internally, Plasma separates concerns. Execution and performance are handled by a fast, flexible validator layer optimized for real-time settlement and programmability. Finality and historical truth are handled by Bitcoin, a system optimized not for speed but for absolute immutability and neutrality. Each layer does what it does best, without compromise.

In this sense, Bitcoin anchoring is not about ecosystem interoperability or symbolic alignment. It is a structural response to the core challenges of launching a new financial settlement layer in a world that already has a credible cryptographic bedrock. Plasma does not attempt to replace that bedrock; it builds upon it. By doing so, it establishes a form of trust that is not self-asserted but inherited, not promised but proven. Like an anchor in a storm, its strength lies not in movement or visibility, but in its unyielding connection to something deeper, heavier, and fundamentally immovable.

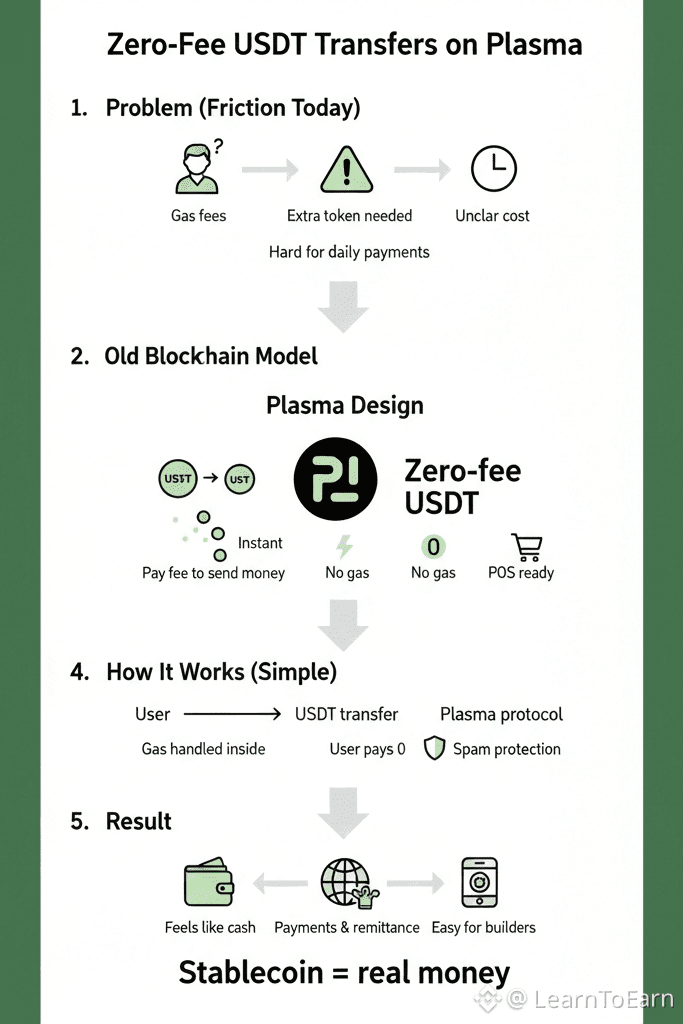

Friction is the quiet enemy of financial systems. It rarely announces itself as a single, dramatic failure; instead, it accumulates as small costs, extra steps, and moments of uncertainty that subtly reshape behavior. In blockchain networks, this friction is most visible in the act of transferring value. Fees, volatile gas tokens, and unpredictable costs do not merely inconvenience users—they fundamentally limit what the system can be used for. Micro-payments disappear, everyday transfers feel risky, and the promise of stablecoins as digital cash remains only partially fulfilled.

For a blockchain designed as a settlement layer, especially one centered on stablecoins, this friction is not incidental. It is structural. The conventional model requires users to hold and manage a separate native token just to move assets whose defining feature is price stability. This design reflects an older prioritization, where the economic security of the network was placed above usability, and where users were expected to adapt their behavior to the protocol rather than the reverse. As adoption expands beyond crypto-native participants, this assumption becomes increasingly untenable.

Plasma’s protocol-level implementation of zero-fee USD₮ transfers represents a conscious rejection of this legacy model. It is not a temporary incentive, nor a subsidy that expires when growth targets are met. It is an architectural decision that redefines what the network considers its core function. By eliminating fees for simple USD₮ transfers, Plasma aligns its design with a basic but often overlooked principle: a stablecoin cannot function as money if the act of sending it is complex, unpredictable, or costly.

Achieving this outcome requires more than waiving fees at the surface level. The underlying computational reality remains unchanged. Every transaction consumes resources, updates state, and competes for block space. Plasma addresses this by shifting gas from a user-visible cost into a protocol-managed abstraction. The execution environment still meters computation internally, preserving determinism and preventing abuse, but the cost of that computation for a defined class of transactions is absorbed by the system itself.

This begins with explicit recognition at the execution layer. Simple USD₮ transfers—operations that do little more than debit one balance and credit another—are identified as a distinct transaction class. These operations are computationally trivial relative to smart contract execution, yet disproportionately important for real-world usage. Once recognized, their gas cost is internally calculated but externally neutralized. The sender sees a zero-fee experience, while validators include the transaction as part of normal block production.

The economic sustainability of this approach rests on alignment rather than extraction. Plasma does not attempt to monetize the most basic act of value transfer. Instead, it treats high-volume stablecoin movement as a public good that increases the network’s overall utility. Validators are compensated through other mechanisms—staking rewards and fees from complex, higher-value interactions—while benefiting from the increased activity, liquidity, and relevance that feeless transfers generate. A chain that becomes the default venue for stablecoin settlement naturally attracts applications, institutions, and developers willing to pay for more advanced functionality.

Concerns around spam and abuse are addressed not through blunt pricing, but through targeted constraints. Because simple transfers are cheap to process, the system can tolerate enormous volumes of legitimate usage. At the same time, protocol-level safeguards such as rate limits, minimum transfer thresholds, or per-account constraints ensure that zero-fee transfers cannot be exploited to degrade performance. These controls preserve openness without reverting to the inefficiencies of universal transaction fees.

The behavioral implications of this design are significant. For end users, the experience begins to resemble modern digital payments rather than blockchain infrastructure. A balance exists, and it can be sent instantly, without secondary assets, fee estimation, or concern about network congestion. This matters most in regions and use cases where transaction sizes are small and predictability is essential. When sending five dollars costs zero dollars every time, stablecoins finally behave like cash rather than financial instruments.

For developers, the removal of gas friction at the base layer becomes a powerful composability advantage. Applications can onboard users without forcing them to acquire unfamiliar tokens. Protocols can accept deposits and issue withdrawals in USD₮ without adding cost or complexity. Entire product categories—payments, remittances, on-chain payroll, retail commerce—become viable in ways that are impractical on fee-heavy networks. The ecosystem grows not by coercion, but by convenience.

At the network level, zero-fee USD₮ transfers act as an identity anchor. They signal that Plasma is not optimized around speculative churn or rent extraction from basic usage, but around the efficient circulation of stable value. This clarity of purpose shapes the type of activity the network attracts and reinforces a virtuous cycle: more stablecoin usage increases relevance, relevance attracts applications, and applications justify deeper liquidity and infrastructure investment.

Ultimately, this design reflects a philosophical shift in how value is captured. Instead of taxing movement, Plasma focuses on enabling it. Instead of forcing users to internalize protocol complexity, it absorbs that complexity at the system level. In doing so, it removes not just a fee, but an entire category of cognitive burden and execution risk.

When the fundamental act of sending money becomes frictionless, predictable, and invisible, the technology recedes into the background—where infrastructure belongs. Plasma’s zero-fee USD₮ transfers are not simply about cost reduction. They are about restoring proportionality between effort and outcome, and about allowing stablecoins to finally operate as what they were always meant to be: simple, reliable, digital money.

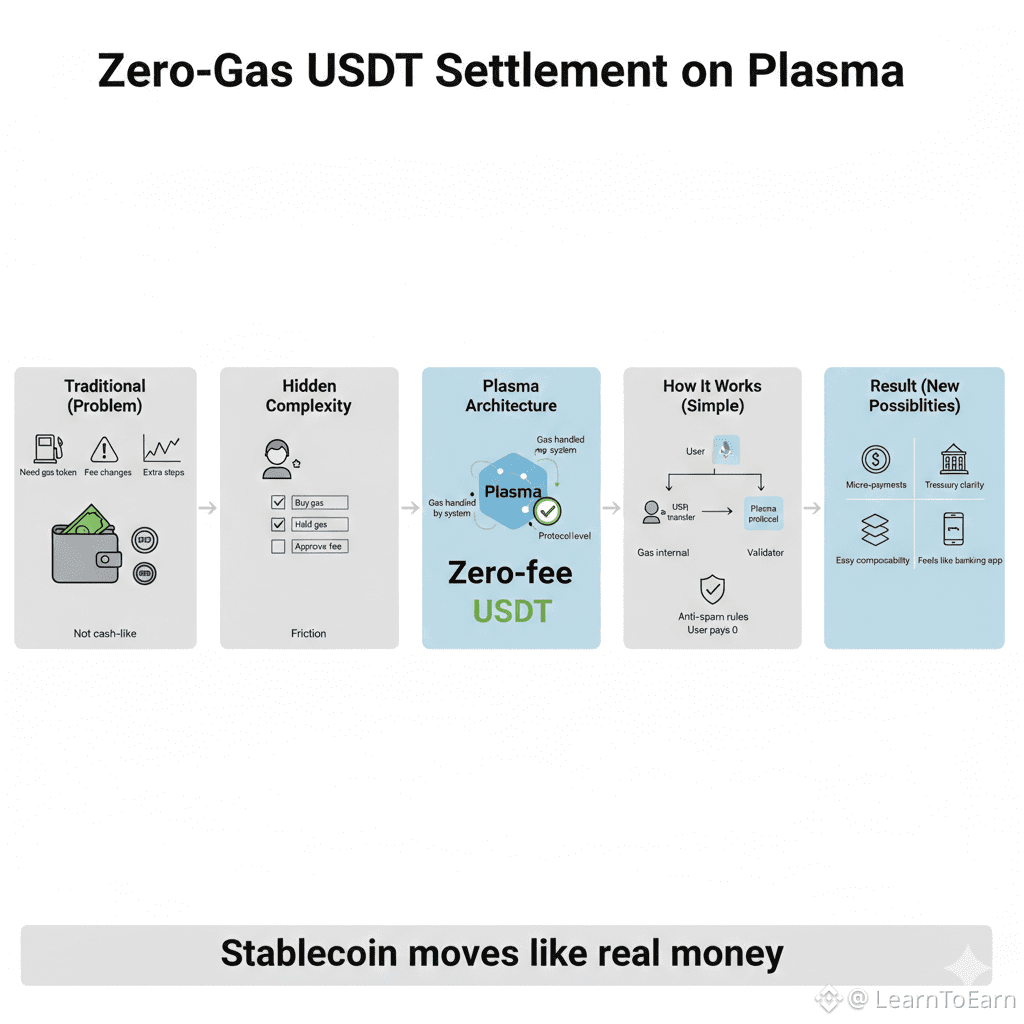

In digital commerce, friction rarely announces itself loudly. It accumulates quietly, hidden in abstractions, intermediaries, and marginal costs that compound over time. Every extra requirement—every prerequisite token, every fluctuating fee, every moment of uncertainty—becomes a point where adoption slows or behavior distorts. Stablecoins were meant to dissolve this friction, to allow value to move with the same ease as information. Yet in most blockchain systems, a paradox persists: to send digital dollars, users must first acquire and manage a separate, volatile asset whose sole purpose is to pay for the act of sending.

This gas-based model imposes more than a financial cost. It introduces cognitive overhead, exposure to price volatility, and operational fragility into what should be the simplest possible action: transferring money. Plasma’s decision to eliminate traditional gas costs for simple USDT payments is a direct challenge to this contradiction. It is not an optimization at the margin, but a structural redesign that treats stablecoin settlement as a first-class primitive rather than a byproduct of general-purpose computation.

To understand the significance of this shift, it is useful to examine the role gas has historically played in blockchain systems. Gas serves two intertwined functions. First, it is a unit of computation, measuring how much work the network must perform to execute a transaction. Second, it operates as an auction mechanism, pricing block space dynamically through supply and demand. These functions are technically sound, but when applied indiscriminately to all transaction types, they create misalignment. A simple USDT transfer—an operation that updates two balances in a state tree—becomes subject to the same fee volatility as complex smart contract execution. The user is forced into a micro-market every time they send money, bidding in a separate asset whose price may have no relationship to the value being transferred.

Plasma’s architecture separates what was previously conflated. Computation still has a cost, and block space is still finite, but the burden of managing those costs is removed from the user for the network’s core activity. At the protocol level, the execution environment explicitly recognizes standard USDT transfer transactions as a distinct class. These transactions are deterministic, low-cost, and predictable in resource consumption. The network meters their computational cost internally, preserving the integrity of execution, but externalizes that cost away from the sender.

Instead of charging users gas, Plasma socializes the cost of these transfers as part of operating the settlement layer. Validators include them by default, knowing that their resource footprint is negligible and that the value they generate—in transaction volume, liquidity, and network relevance—far outweighs their marginal cost. This is not charity; it is economic alignment. A network whose purpose is to settle stable value benefits directly from making that settlement frictionless. Increased usage strengthens the network’s role as a financial hub, attracts higher-order activity, and ultimately increases the value of the staking and governance layer that secures it.

This specialization is what makes the model sustainable. Plasma is not attempting to subsidize all computation indefinitely. Complex smart contracts, DeFi protocols, and custom logic still pay for execution in ways that reflect their variable and sometimes heavy resource demands. What changes is that the most fundamental action—sending stable money—is treated as infrastructure, not a revenue stream. The native token derives its value not from taxing every movement of capital, but from securing and coordinating a high-volume settlement environment that others are willing to build on and pay for.

Concerns about abuse naturally arise whenever a resource appears free. Plasma’s defense lies in the predictability of the transaction itself. A standard USDT transfer consumes a fixed, minimal amount of computation. Even at scale, processing millions of such transfers is a throughput challenge, not a computational one, and modern execution clients are designed for exactly this kind of load. Additional protocol-level safeguards—such as lightweight rate limits or minimum transfer thresholds—can deter spam without reintroducing meaningful friction. The system is designed with the assumption that its primary transaction type will be frequent, and it is optimized accordingly.

The consequences of removing gas from stablecoin settlement are far-reaching. Microtransactions become viable for the first time in a trust-minimized environment. Payments measured in cents or fractions of a dollar no longer collapse under fee pressure. This opens space for new economic models in content, software, gaming, and machine-to-machine payments—domains where blockchain fees have historically been prohibitive.

For businesses and institutions, the benefits are equally concrete. Treasury operations can be conducted entirely in USDT, without exposure to fee volatility or the need to maintain operational balances of a secondary asset. Accounting becomes simpler, forecasting more reliable, and blockchain infrastructure easier to integrate into existing financial workflows.

Within the ecosystem, composability improves dramatically. Users can move USDT between wallets, protocols, and merchants without encountering failed transactions due to insufficient gas or sudden fee spikes. The system behaves less like a collection of loosely connected smart contracts and more like a unified financial rail, where value flows freely between applications.

Perhaps most importantly, this design resets expectations. Sending USDT on such a network feels less like interacting with infrastructure and more like using a modern payment app—instant, predictable, and effortless. The difference is that beneath this simplicity lies cryptographic finality, global accessibility, and censorship resistance. The technology fades into the background, which is precisely when it is doing its job.

In eliminating traditional gas costs for simple USDT payments, Plasma signals a maturation in blockchain economic design. It abandons the assumption that every interaction must be monetized directly and instead prioritizes the activity that gives the network its reason to exist. Stablecoin settlement is no longer treated as just another use case competing for block space; it is the organizing principle around which the system is built. By unburdening the transaction, Plasma brings stablecoins closer to fulfilling their original promise: not merely programmable money, but usable money.