I used to think “RWA chains” were mostly about issuance

For a long time, the RWA narrative in crypto felt predictable: tokenize something, mint it on-chain, show a dashboard, celebrate “real-world adoption.” And to be fair, issuance is important.

But the more I watch @Dusk , the more I feel like it’s playing a different game. It’s not obsessed with creating more assets. It’s obsessed with what happens after assets exist — when markets get stressed, regulators show up, disclosures are contested, and settlement discipline becomes more valuable than raw speed. That’s where markets rupture. And Dusk seems engineered for that moment.

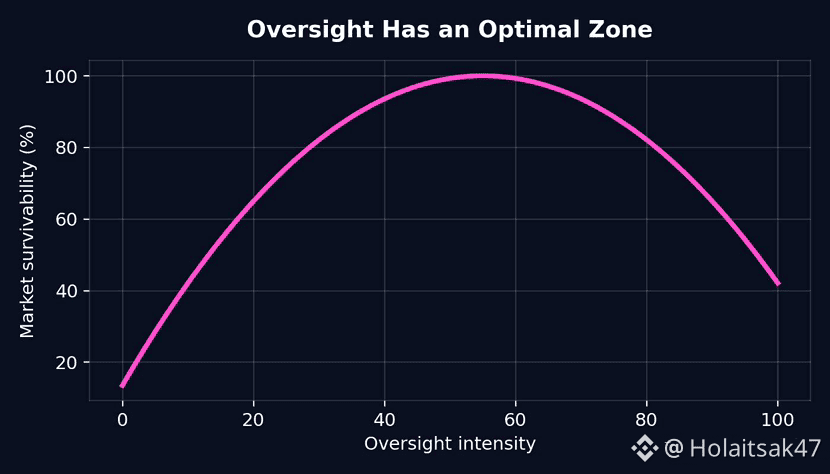

A lot of chains want liquidity first and rules later. Dusk is clearly building to survive rules first… and let liquidity come as a consequence.

The “rupture” isn’t a crash — it’s when disclosure becomes a weapon

Markets don’t always break because of hacks or downtime. They break when information exposure starts changing behavior:

traders front-run because intent is visible

counterparties hesitate because positions can be mapped

institutions stall because they can’t meet privacy requirements

compliance becomes a bolt-on workflow, not a native boundary

This is why Dusk’s framing hits different. Dusk doesn’t treat transparency as a virtue. It treats verifiability as the requirement, and then makes visibility selective. That’s not a philosophical stance — it’s market engineering.

Phoenix and Zedger are basically the clearest expression of that: transactions and assets can be validated without turning the entire market into a public surveillance feed.

DuskDS is the part people ignore — but institutions don’t

When I look at the stack, what grabs me isn’t “another VM.” It’s the base layer: DuskDS.

Because DuskDS is positioned as settlement + consensus + data availability — the foundation that gives finality, security, and native bridging to whatever executes on top (DuskEVM, DuskVM, etc.). This is the kind of modular separation that makes upgrades and compliance frameworks feel more realistic over time.

Most chains talk about modularity like it’s a branding choice. Dusk treats it like an operational necessity: regulated markets don’t tolerate breaking changes, “move fast” governance drama, or hand-wavy upgrade paths.

DuskEVM is a strategic compromise — not a copy of Ethereum

Here’s the part I think many people underestimate: DuskEVM isn’t trying to “out-Ethereum Ethereum.”

It’s basically saying: builders already know EVM tooling — don’t punish them for it. So DuskEVM stays EVM-equivalent for deployment and developer familiarity, but inherits settlement guarantees from DuskDS and is framed around regulated finance requirements.

That’s an important distinction. Because the rupture Dusk is targeting isn’t “who has the fastest EVM.” It’s “who can run programmable markets where privacy and compliance are non-negotiable.”

Controlled destinations: NPEX changes what “RWA” actually means

This is where Dusk stops being abstract.

Dusk’s relationship with NPEX is not just a partnership headline — it’s a clue about intent. NPEX is presented as a regulated venue (MTF, broker, ECSP, and a path toward DLT-TSS), which is basically the kind of licensing stack that turns “tokenized assets” into something closer to real market infrastructure, not just on-chain collectibles.

And then you see Dusk Trade’s waitlist messaging framing it explicitly as a regulated RWA trading platform built with NPEX, referencing €300M AUM on the regulated side. That’s not DeFi-style “anyone can list anything.” That’s closer to controlled distribution — the boring part that real finance runs on.

If markets rupture when regulation tightens, the chains that survive aren’t the ones that issued the most assets — they’re the ones that built the cleanest interface between on-chain execution and off-chain obligations.

Selective auditability is the real product

People talk about privacy like it’s about hiding. In regulated markets, privacy is about scoped visibility.

Dusk’s Phoenix + Zedger direction is interesting because it’s not “everything is dark.” It’s “you can prove correctness, and reveal what must be revealed, to who must see it.” That’s how compliance works in reality: auditors, regulators, counterparties — not the entire internet.

And if you’re thinking about market structure, this matters because it reduces the incentive for:

front-running

copy-trading of strategies

forced transparency that leads to predatory behavior

operational delays caused by manual compliance layers

This is the part that actually makes markets smoother. Not faster blocks.

“Modest validator incentives” signals a chain optimized for continuity

I also pay attention to what a network rewards.

Dusk’s staking and tokenomics documentation frames incentives around consensus participation, rewards, and slashing—classic PoS discipline, but positioned as a stability mechanism rather than a hype engine.

That matters because in regulated environments, validators aren’t just “decentralization points.” They’re part of the trust story. If incentives push short-term games, the network becomes fragile. If incentives reward continuity and correctness, the network starts to look like infrastructure.

So… does Dusk rupture markets? My honest take

I don’t think Dusk “ruptures” markets in the meme way people use that word.

I think it targets a quieter rupture — the moment when the industry realizes that:

issuance isn’t the bottleneck

disclosure discipline is

settlement certainty is

and compliance can’t be bolted on forever

If that future arrives the way it seems to be trending, Dusk doesn’t need to be the loudest chain. It needs to be the one that institutions can actually run without rewriting how finance works.

And the presence of a regulated partner track (NPEX), a modular base layer (DuskDS), and privacy models designed for selective disclosure (Phoenix/Zedger) makes $DUSK feel less like “RWA narrative” and more like “market plumbing that survives stress.”

That’s the kind of design that doesn’t trend every day…

but it’s exactly the kind of design that matters when everything else gets forced to grow up.