Vanar Chain arrives at a moment when promises of AI plus blockchain have been spoken more as marketing than as architecture. What sets Vanar apart is not a catalogue of buzzwords, but a deliberate redesign. Intelligence becomes a protocol primitive so that memory, reasoning, and semantic data exist as first class citizens within the ledger. This allows the chain to behave with steadiness and predictability that feels closer to a trusted financial rail than an experimental research environment. The mission is to align cryptographic immutability with explainable and contextual intelligence that supports real world outcomes.

Vanar’s central thesis is simple but radical. Do not attach AI on top of a chain, build the chain around AI. With native vector and semantic storage, on chain inference, and an intelligence reasoning layer called Kayon, Vanar preserves context across transactions and workflow states. Memory in this environment is persistent and queryable. A payment can recall conversation history, a compliance event can recall attestations, and a tokenized asset can recall provenance data. Traditional dApps treat context as external and fragile. Vanar rewrites that design so context becomes inherent and durable.

Technical foundations, immutable truth and contextual intelligence

Vanar maintains the essential blockchain guarantee of immutable records while layering semantics and reasoning on top. The whitepaper explains the tradeoffs. AI workloads are integrated through optimized data structures, an AI aware consensus that prioritizes deterministic inference for on chain logic, and first class primitives for semantic retrieval. AI outputs do not live outside the chain as black boxes. Instead, inference results become auditable, reproducible, and anchored to signed evidence. This reconciles two demands that often conflict. Institutions want immutability for audit and compliance, and developers want flexible semantic reasoning for integration with the real world.

This auditable intelligence is crucial for financial automation. A tokenized invoice, an insurance event, or a supply chain checkpoint may trigger a settlement and the stakeholders must understand why the settlement occurred. Vanar enables that clarity by storing raw data, semantic summaries, and versioned inference artifacts. An auditor can reconstruct the reasoning path. Trust becomes stronger because the outputs are anchored in immutable context.

Product primitives, Neutron, Kayon, Flows

Vanar organizes its intelligence stack into intuitive primitives. Neutron offers persistent memory storage that supports semantic search and vector similarity. Kayon provides reasoning and natural language translation so human instructions and compliance rules become verifiable on chain operations. Flows automate sequences of actions with contextual checkpoints that can remember past decisions. Together these primitives allow developers to build applications that remember, reason, and act without stitching fragile off chain services into dApps. SDKs for JavaScript, Python, and Rust lower the adoption friction and support rapid prototyping for AI native applications.

Real world outcomes, payments, tokenization, and compliance

In the area of PayFi, Vanar enables payments that become context aware. A cross border settlement can authenticate invoices, verify identity attestations, adjust routing for cost and compliance, and record each reasoning step for later audit. For tokenized real world assets, persistent memory allows provenance, enriched metadata, and dispute resolution to follow the asset through its lifecycle. For compliance automation, Kayon can translate regulatory logic into inference triggers that produce on chain reports with verifiable trails. These use cases are grounded and practical because the intelligence is not grafted onto the chain. It is embedded within the chain’s execution model.

Token economy and incentives

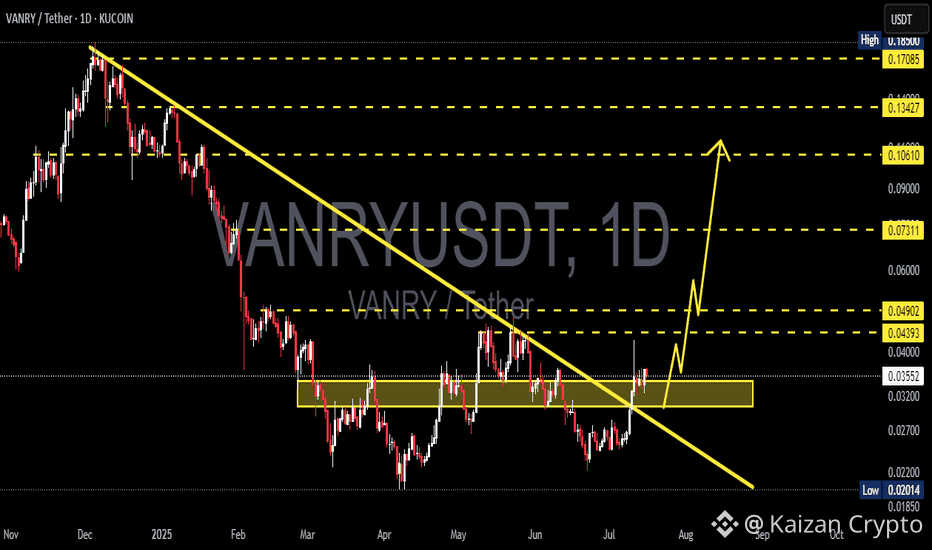

Vanar’s token model ties utility with real usage. The token called VANRY handles gas, staking, and subscription access for premium AI services inside the chain such as advanced Neutron queries and Kayon inference cycles. This shifts token demand toward protocol usage rather than pure speculation. Validator staking not only secures the chain, it aligns incentives for hosting vector indices and inference nodes. The open questions are pragmatic. How do you price memory access. How do you prevent state from growing uncontrollably. The project acknowledges these challenges and has begun implementing economic levers and tiered storage strategies to maintain balance.

Safety, explainability, and regulatory pathways

On chain AI increases the surface area of safety concerns. Vanar attempts to address this through deterministic inference where possible, strict model versioning, explainable intermediate artifacts, and auditable context preservation. Regulators care deeply about accountability. If an automated decision triggers a financial event, the entity must prove why it happened. Vanar’s model of logging signed evidence and inference paths creates an environment where accountability can exist without sacrificing automation.

Where Vanar matters most, predictability and human trust

Beyond technical novelty, Vanar’s impact is emotional and behavioral. Real world commerce values predictable outcomes. Humans trust systems that behave consistently and that remember their own past. Vanar treats memory and reasoning as first class protocol elements and makes them persistent and verifiable. That is how intelligence becomes more than a feature. It becomes a foundation for trust. Institutions evaluating alternatives to legacy rails will study this dimension more seriously than performance benchmarks.

Risks and open questions

No architecture is without risk. Persistent semantic memory increases state pressure. Inference workloads increase cost complexity. Governance becomes more delicate because model updates affect economic outcomes. Adversarial inputs and regulatory requirements introduce difficult constraints. Vanar must maintain stability while navigating these realities. These are long term engineering and governance questions that require constant iteration.

The emerging horizon

Vanar’s recent initiatives show a go to market strategy that prioritizes developer ecosystems and real use cases instead of marketing abstractions. The AI Excellence Program and regional partnership efforts indicate pathways for adoption in payments, logistics, compliance, and tokenized financial markets. Developer documentation and SDKs reduce onboarding friction and encourage experimentation.

Conclusion, intelligence designed for trust

Vanar Chain represents a shift in how Web3 relates to the real world. By integrating persistent memory, semantic context, and explainable reasoning into the ledger itself, Vanar transforms automation into something both accountable and credible. The future of tokenized finance and digital infrastructure depends on systems that behave predictably, integrate smoothly, and preserve immutable context for years. Vanar aims to be that bridge. Execution will determine the degree of success. The architecture however points in a direction that feels inevitable once observed, a chain that remembers and a chain that can explain itself