Strategy and the 712K Bitcoin Bet: When Conviction Becomes an Art In the crypto world, people often talk about having “diamond hands.” But looking at how Strategy just spent another $264 million to scoop up 2,932 BTC, you truly see what top-tier, unshakable conviction looks like.

Buying When the Market Is in Chaos

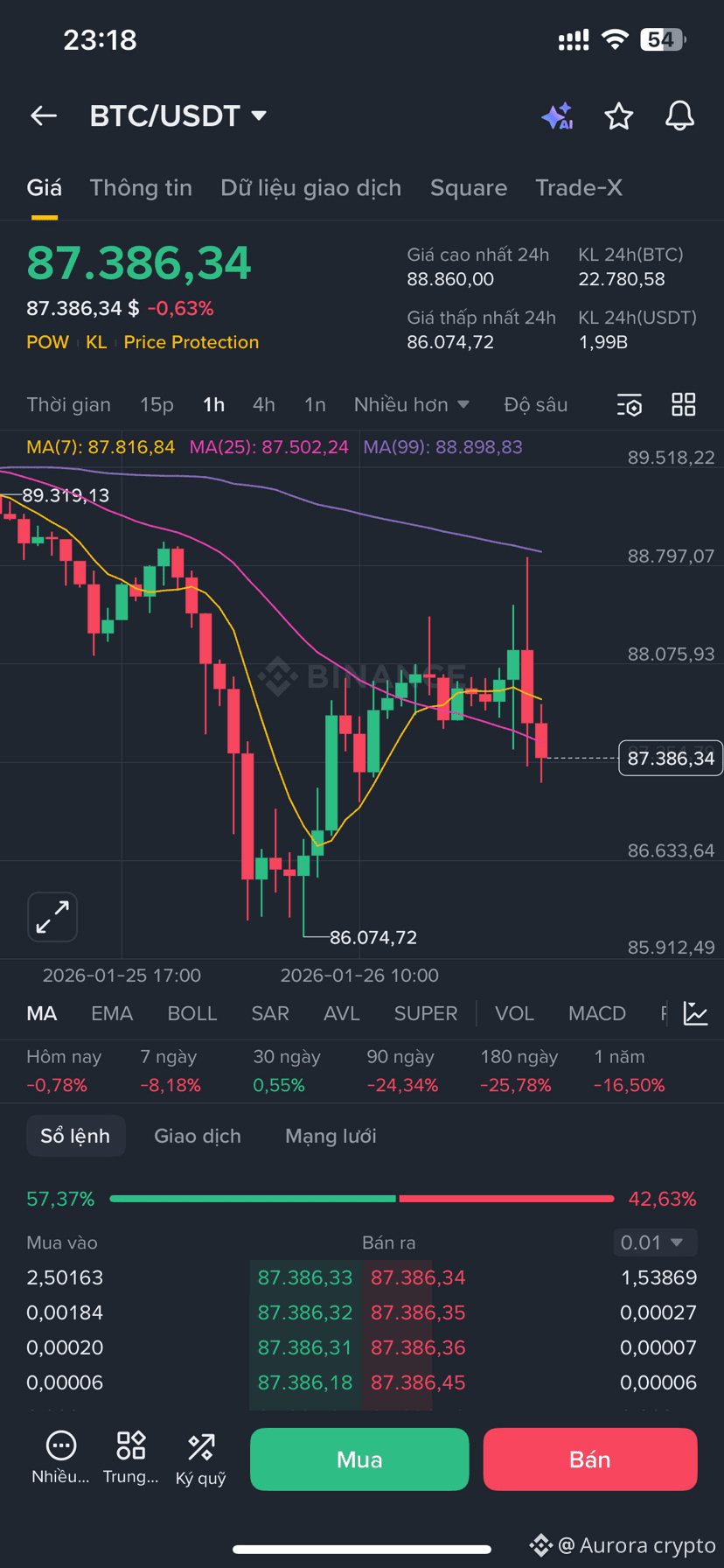

Strategy’s purchase at $90,061 per BTC was far from reckless. It came at a time when the market was extremely turbulent: investor sentiment was fragile after repeated shocks, debates over macroeconomic risks were raging everywhere, and price was still far below its previous all-time high. While the majority feared another leg down, Strategy chose to move against the crowd.

Weakness means buying. Pullbacks mean accumulating.

They don’t buy out of FOMO when prices are euphoric — they buy because they believe in Bitcoin’s long-term intrinsic value.

The Numbers Speak for Themselves: The Position of a Titan Look at the bigger picture to grasp the sheer scale:

• Total holdings: 712,647 BTC (a number that commands respect from any investment fund)

• Total cost: Approximately $54.2 billion

• Average entry price: Around $76,037

Even if Bitcoin experiences sharp volatility or short-term pullbacks, Strategy remains in an exceptionally strong position. Their profits don’t come from luck or perfectly timing the bottom, but from relentless discipline across multiple market cycles.

This Is a “Treasury,” Not a “Trading Play”

The biggest difference between Strategy and most market participants lies in mindset. They don’t think in terms of “pausing the strategy” or “hedging risk.”

• They don’t care about daily ETF inflows and outflows.

• They ignore short-term macro forecasts.

• They are not swayed by crowd psychology on forums and social media.

To management, Bitcoin has long shed the label of a “speculative asset” and has become a strategic reserve asset. They are building a digital treasury for the future — where every additional BTC purchased is another brick reinforcing their financial empire.

Buying nearly 3,000 BTC around the $90K level is a blunt statement of intent:

“Noise belongs to the market. Accumulation is our job.”

In this game, the one with the strongest conviction is the one who ultimately wins.