Most blockchains talk about finality like it’s the end of the story. In finance, finality is often just the point where the real work begins. A trade can be technically final while still being legally unsettled and legally settled while still being economically exposed. Crypto rarely models these extra layers because it has historically favored “fast closure” over “accurate closure.” Dusk is one of the few networks that designs for the reality that regulated markets operate with multi-phase settlement windows, each with different forms of risk, accountability and legal responsibility.

Most blockchains talk about finality like it’s the end of the story. In finance, finality is often just the point where the real work begins. A trade can be technically final while still being legally unsettled and legally settled while still being economically exposed. Crypto rarely models these extra layers because it has historically favored “fast closure” over “accurate closure.” Dusk is one of the few networks that designs for the reality that regulated markets operate with multi-phase settlement windows, each with different forms of risk, accountability and legal responsibility.

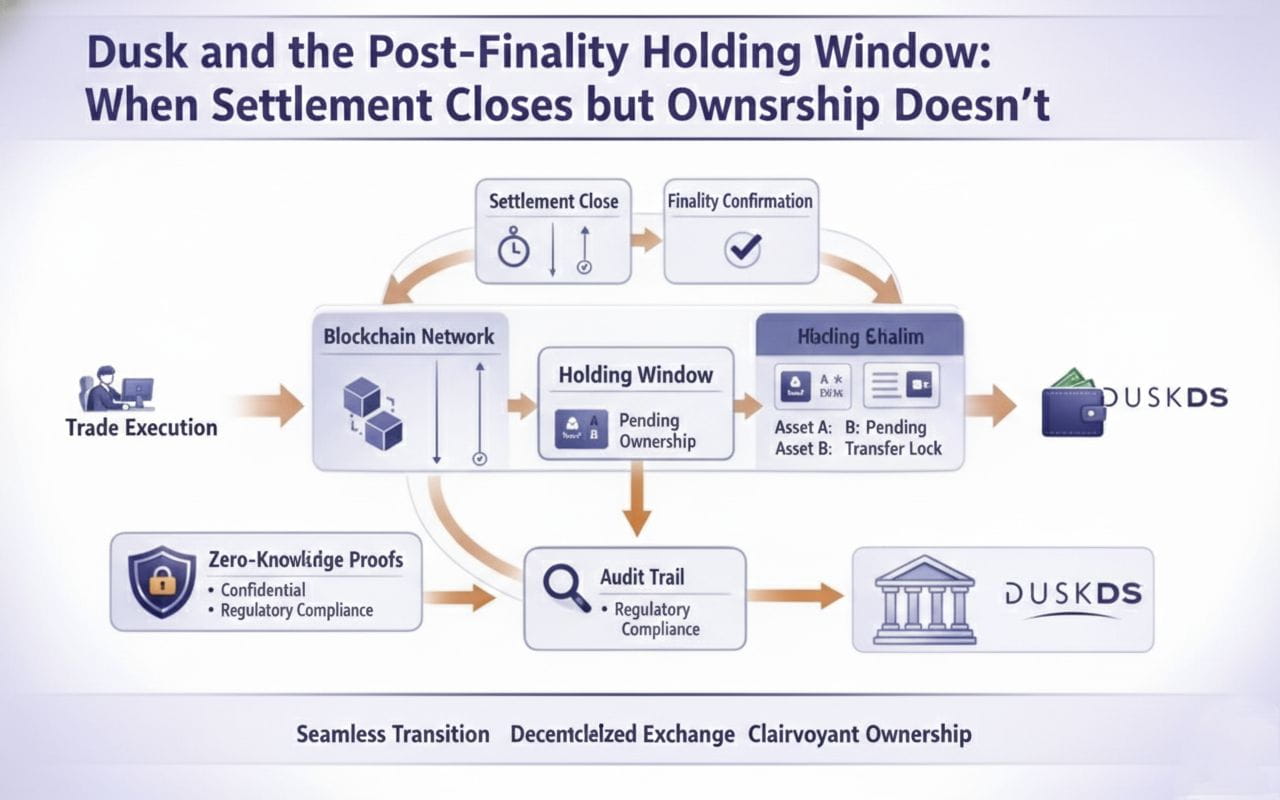

The reason this matters is simple: for regulated assets, settlement does not equal ownership. Settlement is a statement about the ledger. Ownership is a statement about the law. Between the two sits the post-finality holding window a period where the transaction is technically confirmed, economically binding and cryptographically complete, but still pending regulatory clearance, eligibility confirmation, AML/KYC compliance or venue-specific release rules. In traditional markets this window is commonplace, often expressed as T+ cycles. In crypto, it barely exists as a concept. Dusk brings it back into the design layer.

The brilliance of Dusk’s approach is that it accepts the uncomfortable truth most chains avoid: a compliant market must distinguish between “transfer intent,” “transfer execution,” “transfer finality,” and “transfer release.” This is not academic hair-splitting. These layers govern risk. A counterparty should not know whether they are economically exposed, operationally exposed, or legally exposed. Without that clarity, no regulated institution can safely operate a settlement stack on a public ledger.

In Dusk’s model, consensus finality closes the ledger event, but does not automatically trigger legal release. That release may require identity verification, jurisdictional compliance, investor eligibility, issuer constraints or market venue policies. Instead of forcing all of this logic off-chain and trusting intermediaries to reconcile it, Dusk embeds selective compliance at the execution layer not to make settlement slower, but to make it real. Fast without enforceability is not settlement. It’s messaging.

The post-finality window introduces a new category of financial state that crypto has never modeled well: suspended value. In this state, the asset has moved, but cannot legally be exercised. It resembles the “pending” states used in clearing houses, custody chains and CSDs around the world. The difference is that Dusk encodes these boundaries into the network architecture itself rather than outsourcing them to paper, clerks and legal disclaimers. Crypto talks about disintermediating finance. Dusk disintermediates the paperwork that rules finance.

Legally-aware settlement also forces a second distinction that crypto tends to collapse: “who sees the trade” versus “who approves the trade.” Markets have spent decades optimizing to prevent information leakage. A participant can legally buy a bond without the entire market being able to observe the trade flow. Dusk preserves this confidentiality while still allowing compliance functions to operate during the post-finality window. This is what selective disclosure actually means visibility moves in gradients, not universals.

Traditional blockchains treat finality as a single point because their assets have no lifecycle obligations. Regulated securities do. They can be frozen, clawed back, reported, corporate-actioned, recalled, redeemed or converted. If finality is absolute, those lifecycle events become impossible without breaking the chain’s own guarantees. Dusk solves this not by weakening finality but by placing legal and compliance triggers outside the finality boundary. This separation preserves mathematical integrity while allowing regulatory reality to breathe.

Traditional blockchains treat finality as a single point because their assets have no lifecycle obligations. Regulated securities do. They can be frozen, clawed back, reported, corporate-actioned, recalled, redeemed or converted. If finality is absolute, those lifecycle events become impossible without breaking the chain’s own guarantees. Dusk solves this not by weakening finality but by placing legal and compliance triggers outside the finality boundary. This separation preserves mathematical integrity while allowing regulatory reality to breathe.

The economic implication is subtle but enormous: Dusk can support assets that continue to exist after issuance. Most tokenization experiments in crypto are one-way drops. Issuers tokenize, send and exit. Real securities are lifecycle products they pay coupons, distribute dividends, execute tenders, enforce ownership rules, and eventually redeem. None of these operations fit into the naive “finality = end” model. They do fit into Dusk’s “finality = closure of one phase, not the disappearance of the next” model.

The regulatory implication is equally important. Without a post-finality window, regulators are forced into binary modes: they either see everything or they see nothing. Both are unacceptable. Total transparency is a liability. Total opacity is a violation. Dusk gives regulators the mode they actually operate in: conditional visibility during a controlled phase with precise scope. This matches how clearing agencies, transfer agents and market supervisors already work today not at the speed of social media, but at the speed of law.

If crypto ever intends to support RWAs, tokenized funds or regulated settlement venues, it must confront the uncomfortable reality that finality was never a single event. Dusk is the first chain to treat finality as multi-layered: technical, economic, legal and operational. Only the first layer can be instantaneous. The rest require both compliance and time.

That is why Dusk doesn’t just build a blockchain. It builds a timeline.