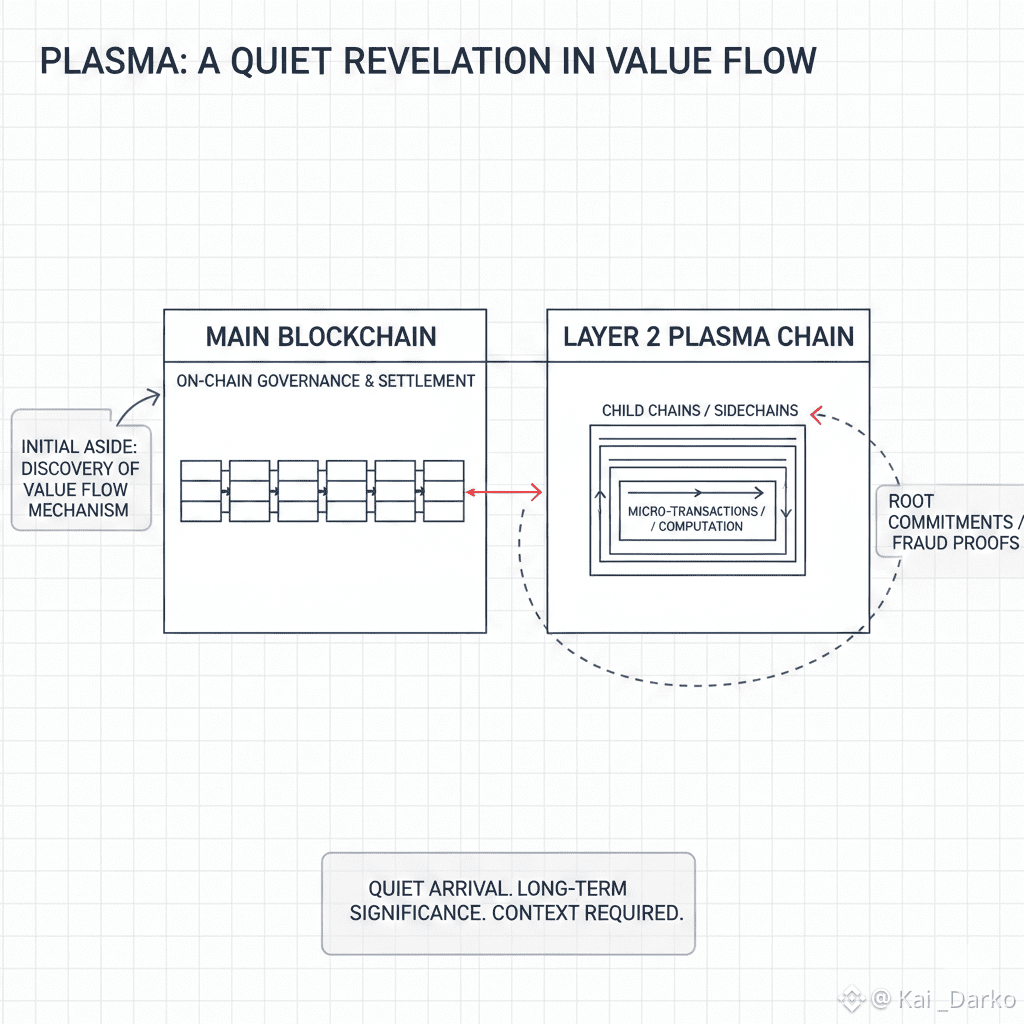

@Plasma My introduction to Plasma didn’t feel like a headline moment. It was more like stumbling across a small aside in an ongoing discussion about how value actually flows through blockchain systems. I wasn’t searching for a new network, and Plasma didn’t seem eager to announce itself. That subtlety mattered. Over time, you notice that the projects with lasting significance rarely arrive with urgency. They appear quietly, almost presuming that anyone with enough context will recognize their intent without being persuaded.

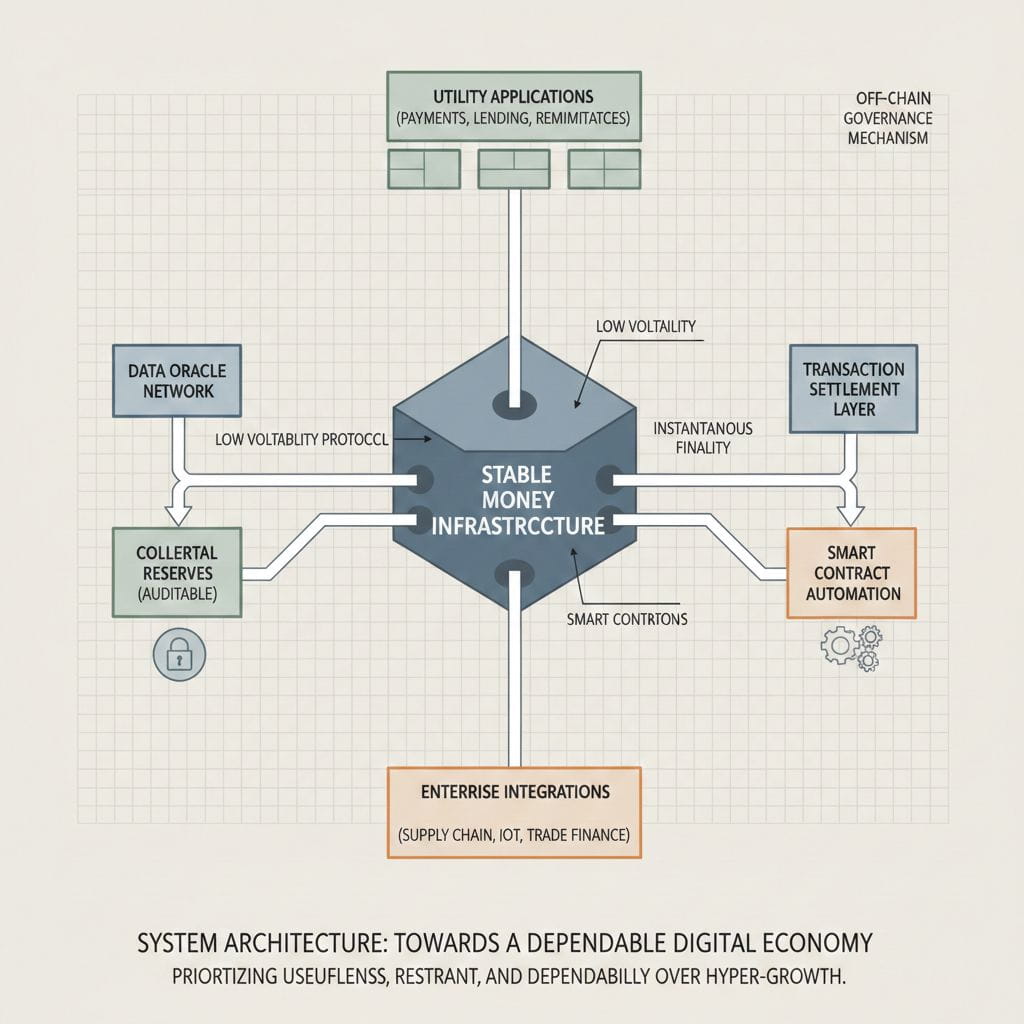

Plasma steps into a space that isn’t particularly flashy. It lives in the realm of stablecoins arguably the least exciting yet most practically used segment of crypto. These assets have become the backbone for real-world activity: international transfers, savings in unstable economies, and everyday transactions. Yet they continue to operate on infrastructure never designed for them. They function as add-ons to systems optimized for entirely different purposes, tolerated rather than truly supported.

What Plasma seems to acknowledge, without drawing attention to it, is how strained this setup has become. Transferring stablecoins often means holding a separate token just to cover fees. Settlement can feel ambiguous, even when dealing with modest sums that still carry real significance. Institutions experience these processes as makeshift, while retail users in high-adoption regions often sense their fragility. None of this qualifies as a catastrophic breakdown, but the accumulated friction quietly erodes confidence.

Rather than attempting to solve every problem, Plasma deliberately narrows its scope. Stablecoins are not treated as a side feature but as the foundation of the entire system. That decision reflects a certain discipline. By building around assets intended to behave like money, Plasma implicitly prioritizes dependability over excitement. Consistency, predictability, and familiarity take precedence. This mindset doesn’t generate buzz, but it resonates with those who’ve watched real-world usage drift away from more theatrical narratives.

What’s most noticeable is how little Plasma tries to overengineer the experience. Moving a stablecoin is supposed to feel straightforward, almost mundane. There’s no push for users to adopt new habits or manage unnecessary complexity just to perform basic transactions. That restraint feels deliberate, even protective, as if the system is designed to stay out of the way. It reflects a belief that financial tools meant for everyday use should operate quietly rather than demand attention.

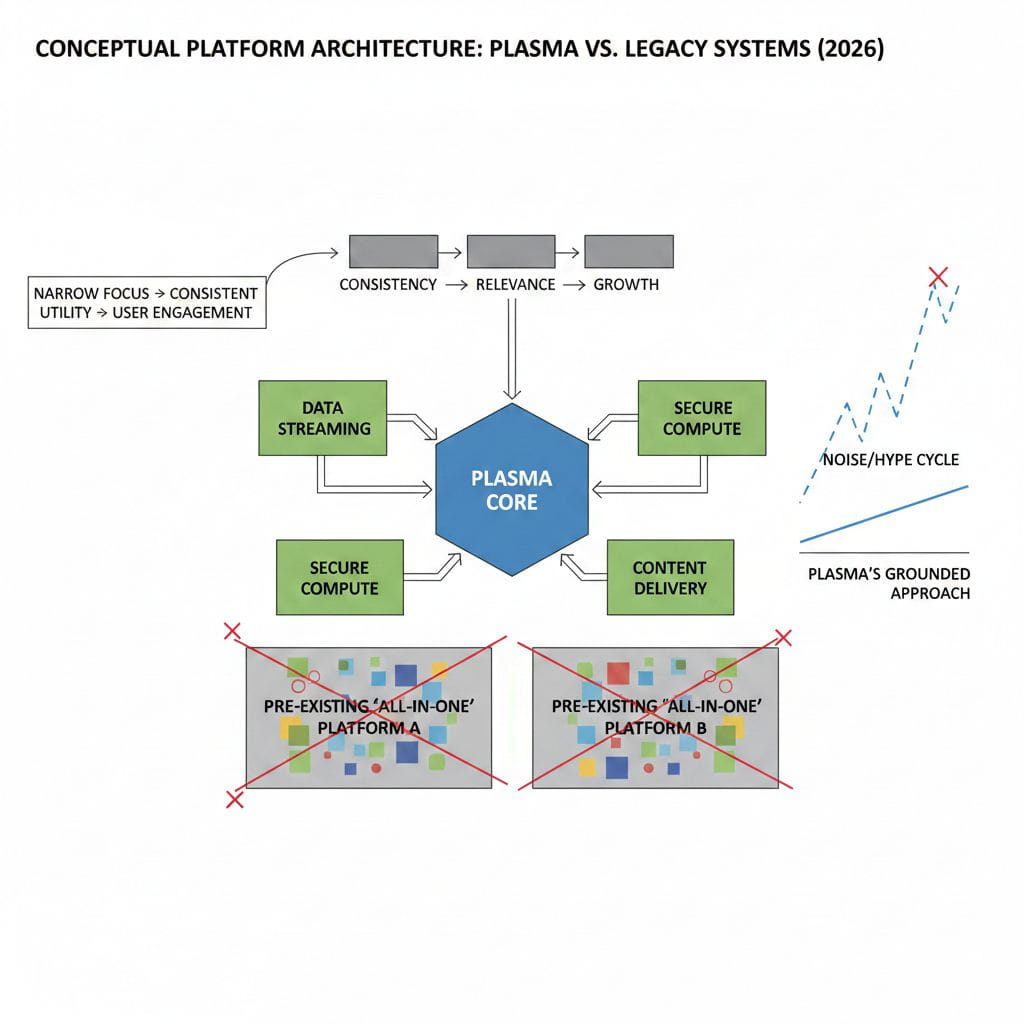

Naturally, this simplicity involves compromises. Plasma doesn’t aim to support every possible application or foster endless experimentation. As a result, it may miss out on certain developer communities or speculative enthusiasm. But that same restraint brings clarity. The project seems more focused on getting things right than on getting noticed, even if that means slower, quieter growth.

For someone who has watched multiple hype cycles crest and collapse, this approach feels grounded. Many earlier platforms tried to be all things at once and ended up excelling at very little. Plasma appears comfortable occupying a narrower lane, trusting that consistency builds relevance more effectively than noise ever could.

Still, skepticism is warranted. Any platform positioning itself as financial infrastructure must prove its durability. Its behavior during congestion, regulatory shifts, or market stress will ultimately matter more than its early design philosophy. Adoption beyond its initial user base will also be a test. Serving institutions and high-usage regions requires more than technology it demands trust, partnerships, and patience.

There’s also the question of whether neutrality can survive scale. Incentives have a way of reshaping systems over time. While anchoring security externally may offer conceptual comfort, governance in practice is rarely simple. Plasma’s long-term credibility will depend on how well it manages these pressures without drifting from its original intent.

What makes Plasma compelling, despite these open questions, is its demeanor. It doesn’t claim to have reinvented finance. It behaves more like a craftsman responding to existing patterns rather than forcing new ones into existence. In a space obsessed with disruption, that quiet responsiveness feels refreshing.

I wouldn’t describe my outlook as bullish experience has made me cautious with that language. But I am interested. Interested in what happens when infrastructure is designed around the most practical, least glamorous part of crypto. Interested in whether steady reliability can still matter in an ecosystem driven by attention. And interested in whether Plasma can resist the temptation to amplify its voice as it grows.

If there’s a broader direction suggested here, it isn’t radical transformation. It’s a subtle recalibration a move toward treating stable digital money as infrastructure rather than performance. Whether or not Plasma succeeds, that instinct seems aligned with where the industry ultimately needs to head: not louder or faster, but more useful, more restrained, and dependable even when no one is paying attention.