A few months back, I had some tokens staked on a smaller network. Nothing adventurous. I wasn’t farming aggressively or chasing emissions, just letting them sit while I waited for the market to pick a direction. Then an unlock landed. Overnight, a chunk of supply hit the market, price slid, and weeks of staking rewards evaporated almost instantly. I remember staring at the chart thinking how familiar this felt. The chain itself worked fine. Transactions were fast. Nothing broke. What hurt wasn’t the tech, it was the timing. The realization that every position had an unspoken countdown attached to it, tied not to usage or demand, but to when more tokens were scheduled to show up.

That experience points to a bigger problem that shows up again and again in infrastructure tokens. Supply doesn’t always grow smoothly. It expands in steps. Those steps create pressure that has nothing to do with whether the network is being used or not. Developers can be shipping. Users can be transacting. But if a large tranche unlocks, the market reacts anyway. Stakers feel it when rewards lose value faster than they accrue. Traders feel it when price action becomes predictable around calendar events. Even long-term holders end up managing positions defensively, not because the system is failing, but because supply mechanics inject uncertainty into everything else. For a network that wants to act as stable infrastructure, especially for payments, that kind of background volatility chips away at trust.

It’s a bit like managing water flow through a dam. Slow, consistent release keeps everything downstream predictable. But when gates open in bursts, even if total volume hasn’t changed much, the shock disturbs the entire system. Planning becomes reactive instead of stable.

@Plasma by design, takes a conservative approach at the protocol level. It doesn’t try to be a general-purpose playground. It’s built around stablecoins and settlement, not experimentation. EVM tooling works, but the network deliberately avoids the chaos of meme tokens or high-gas applications. Day-to-day throughput stays steady, usually in the five to ten transactions per second range, according to recent dashboard data. That consistency matters for merchants and payment flows, where predictability beats peak capacity. Late-2025 upgrades, including changes to execution architecture, kept block times under a second even during stress tests. From a systems perspective, plasmaBFT plays a big role here, batching consensus steps so blocks finalize without every validator talking to every other validator each round. The behavior is predictable. It’s efficient, but intentionally capped to avoid overload. The Bitcoin relay setup follows the same philosophy. By anchoring certain settlements to Bitcoin’s security model and limiting eligible assets, it reduces volatility risk, even if that means sacrificing some flexibility.

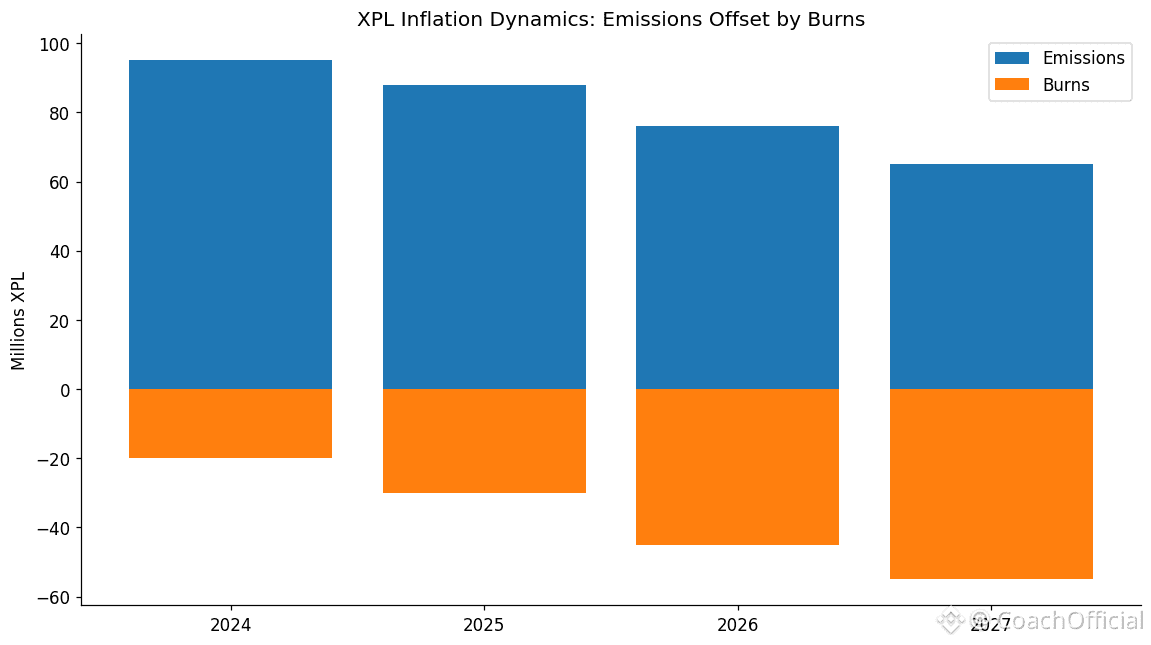

Where things get more complicated is the token itself. XPL isn’t flashy. It pays fees when sponsorship doesn’t apply, though most basic USDT transfers bypass gas entirely through the paymaster. Validators stake it to participate in consensus and earn inflation-based rewards, which currently sit around five percent annually and are scheduled to taper closer to three percent over time. There are burns tied to usage, meant to counterbalance emissions during high-volume periods. Governance runs through $XPL as well, with votes on things like staking thresholds or incentive structures. Ecosystem grants are funded through periodic unlocks, which are supposed to bootstrap growth without central control. On paper, it’s clean. In practice, unlock timing still matters more than many holders want to admit.

Right now, the market reflects that tension. With a market cap around two hundred million dollars and roughly 1.8 billion tokens circulating out of a much larger total supply, liquidity is decent but not immune. Daily volume in the fifty to sixty million range means unlocks don’t go unnoticed. Since listings in late 2025, stablecoin deposits have climbed into the billions, and validator participation sits comfortably above five hundred nodes. The network itself isn’t struggling. The question is whether the token can absorb ongoing supply without becoming a headwind.

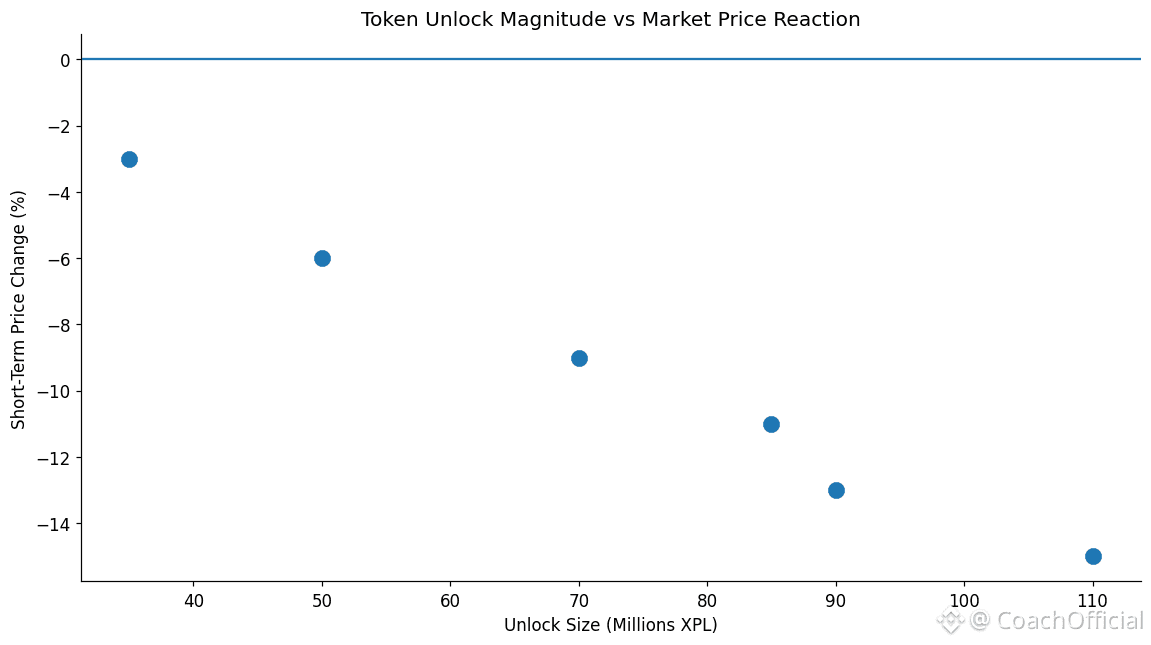

Short-term price behavior tends to orbit those unlock dates. The January 28, 2026 ecosystem release is a good example. Events like that attract attention, spike volume, and often create brief optimism around “growth incentives.” But if recipients sell to cover costs or de-risk, the market feels it immediately. I’ve traded enough of these setups to recognize the pattern. You can play the event, but you’re rarely building something durable unless broader demand steps in at the same time.

Longer term, the picture depends on whether usage actually compounds. If payment flows continue to grow, if integrations like mobile wallets bring in repeat activity, and if staking demand rises alongside transaction volume, then emissions become background noise rather than a dominant force. That’s how dilution stops mattering: not because it disappears, but because it’s outweighed by real demand. Plasma’s zero-fee model for simple transfers helps here. Habits form when people don’t think about costs. But habits take time.

The risks are still there. #Plasma narrow focus could be a strength or a ceiling. Larger chains with broader ecosystems might absorb payment flows if they offer comparable costs. Monthly incentive unlocks run through 2028, and if burns don’t keep up, circulating supply could expand meaningfully year over year. A particularly ugly scenario would be an unlock landing during a market drawdown. Validators might unstake to sell, security ratios could dip, and confirmation times could stretch just when reliability matters most. That kind of feedback loop doesn’t require a bug or an attack. It just requires misaligned incentives at the wrong moment.

There’s also the governance angle. Future votes could adjust emissions or expand grants. Those decisions might make sense for growth, but they also carry dilution risk if not paired with usage. Tokenomics aren’t static. They evolve with politics as much as math.

In the end, this comes back to something simple. Infrastructure proves itself not on launch day, but on the second transaction, then the tenth, then the thousandth. If users keep coming back because the system works and costs stay predictable, unlock pressure fades into the background. If they don’t, supply mechanics become the story. Plasma sits right on that line, and time will decide which side it settles on.

@Plasma #Plasma $XPL