A few months back, I had some funds staked in a privacy-focused setup. Nothing big. Just letting capital sit, earn a bit, and stay out of the spotlight. When a governance vote came up about upgrading oracle feeds, I figured I’d take part. What caught me off guard was how empty the vote felt. Less than ten percent of staked tokens showed up. The proposal still passed, but it didn’t feel reassuring. A week later, a small exploit surfaced tied to an edge case the upgrade didn’t fully cover. I’ve traded infrastructure tokens long enough to know how these stories usually go. That moment made it clear how fragile things get when governance exists on paper, but not in practice, especially on chains handling sensitive financial flows.

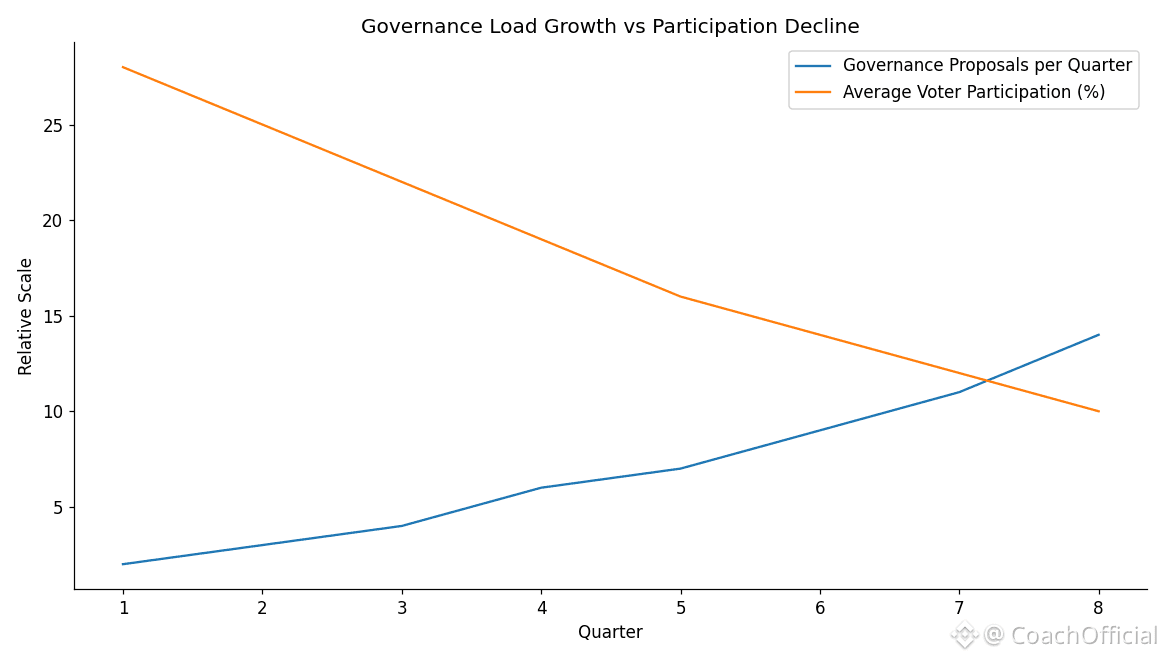

That’s the recurring problem here. Governance sounds powerful, but most holders treat it like background noise. Tokens get staked, rewards roll in, and proposals scroll by untouched. Over time, decisions end up made by whoever bothers to show up, not necessarily whoever understands the risks best. The result isn’t dramatic at first. It shows up as slow fixes, rushed upgrades, or parameters that favor short-term incentives over long-term stability. On chains built for finance, where privacy and compliance overlap, low participation raises the stakes. A poorly reviewed proposal doesn’t just tweak fees. It can affect data exposure, settlement behavior, or regulatory posture in ways that are hard to undo.

It reminds me of local association meetings where hardly anyone attends. A few regulars make decisions for everyone else. Most of the time, it’s fine. Until something goes wrong. Then suddenly the people who didn’t show up feel the consequences without having had a voice.

#Dusk itself is designed for a very specific lane. It’s not trying to be everything. It’s built as a layer-1 for private, compliant financial activity, especially things like tokenized securities and regulated DeFi. Zero-knowledge proofs sit at the core, letting transactions stay confidential while still being auditable when required. That’s what makes it appealing for institutional use. This works because instead of full transparency, it opts for selective disclosure, which aligns better with real financial rules. Developers can build systems where value moves quietly, settles quickly, and still passes compliance checks without awkward workarounds. The Chainlink oracle integration late last year helped with that, piping external data into private contracts without blowing open sensitive positions. More recently, the rollout of DuskEVM brought Ethereum-style execution into this environment, wrapping familiar tooling in privacy by default and handling stress tests without choking on gas costs.

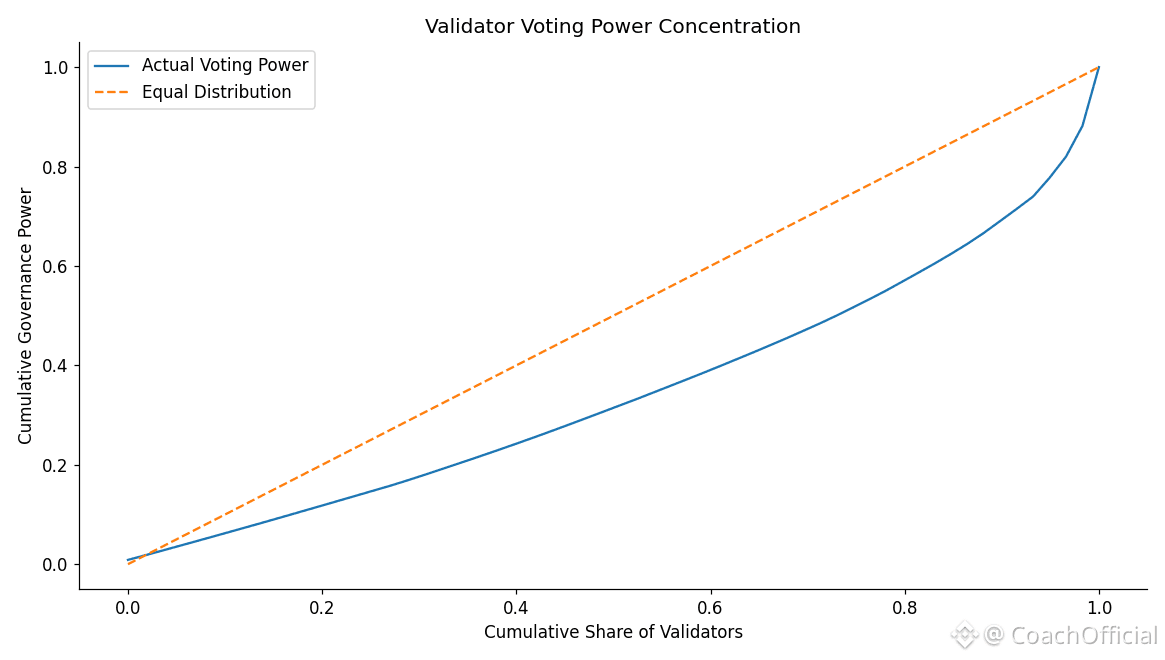

Under the hood, the chain uses a segmented proof-of-stake design. Validators are grouped into committees to process blocks in parallel, which keeps finality under ten seconds most of the time. It’s a conscious trade-off. Less randomness, more speed. That makes sense when the target users care about predictable settlement more than maximal decentralization. You see this in real usage, like the early NPEX pilots, where tokenized shares settle on-chain without dragging out confirmations. But this structure only holds if staking and governance stay healthy. Committees need balance. Parameters need tuning. And those decisions depend on people actually voting.

The $DUSK token itself doesn’t try to be clever. It pays for transactions. It gets staked to secure the network. A portion of fees is burned. Emissions started high to bootstrap participation and taper over time. Validators and delegators earn rewards, but they also carry slashing risk. Governance is tied directly to staking. If you want influence, you have to lock up tokens and show up. Recent votes have covered things like bridge upgrades, emission adjustments, and treasury allocation for ecosystem growth as the RWA push accelerates. All of that only works if enough of the supply is actively engaged rather than passively parked.

From a market standpoint, the numbers are modest but not insignificant. Around eighty million in market cap. Roughly five hundred million tokens circulating. About forty percent staked. That’s enough to function, but not enough to feel bulletproof. Participation can slip without much warning.

Short-term trading around $DUSK tends to follow the usual pattern. Privacy narratives heat up, volume spikes, price runs, then cools off. Early 2026 was a good example, with daily volume jumping on regulatory chatter and new integrations. I’ve traded those moves. They’re real, but fleeting. Long-term value here depends on something quieter. Whether institutions actually settle assets regularly. Whether governance keeps up as proposals become more frequent. Whether voters adapt as the ecosystem grows faster than the old quarterly cadence ever expected.

That’s where the risk sharpens. Other privacy-focused chains are competing for the same builders, often with larger communities. Rapid expansion means more proposals, more complexity, and more chances for apathy to creep in. If turnout stays low while decisions stack up, it becomes easier for small groups to steer outcomes. A particularly bad scenario would be a contentious vote during a stressful moment, like a validator outage or bridge issue, where low participation lets weak rules slip through. That’s how security erodes quietly, without a headline exploit.

In the end, governance either becomes a habit or a liability. Networks like this don’t fail because the tech breaks first. They fail when people stop paying attention. Over time, it’s the second vote, the third proposal, the routine participation that tells you whether governance scales with the ecosystem or falls behind it.

@Dusk #Dusk $DUSK