The edge isn't in technical analysis or fundamentals. It's access to political information that reaches markets later.

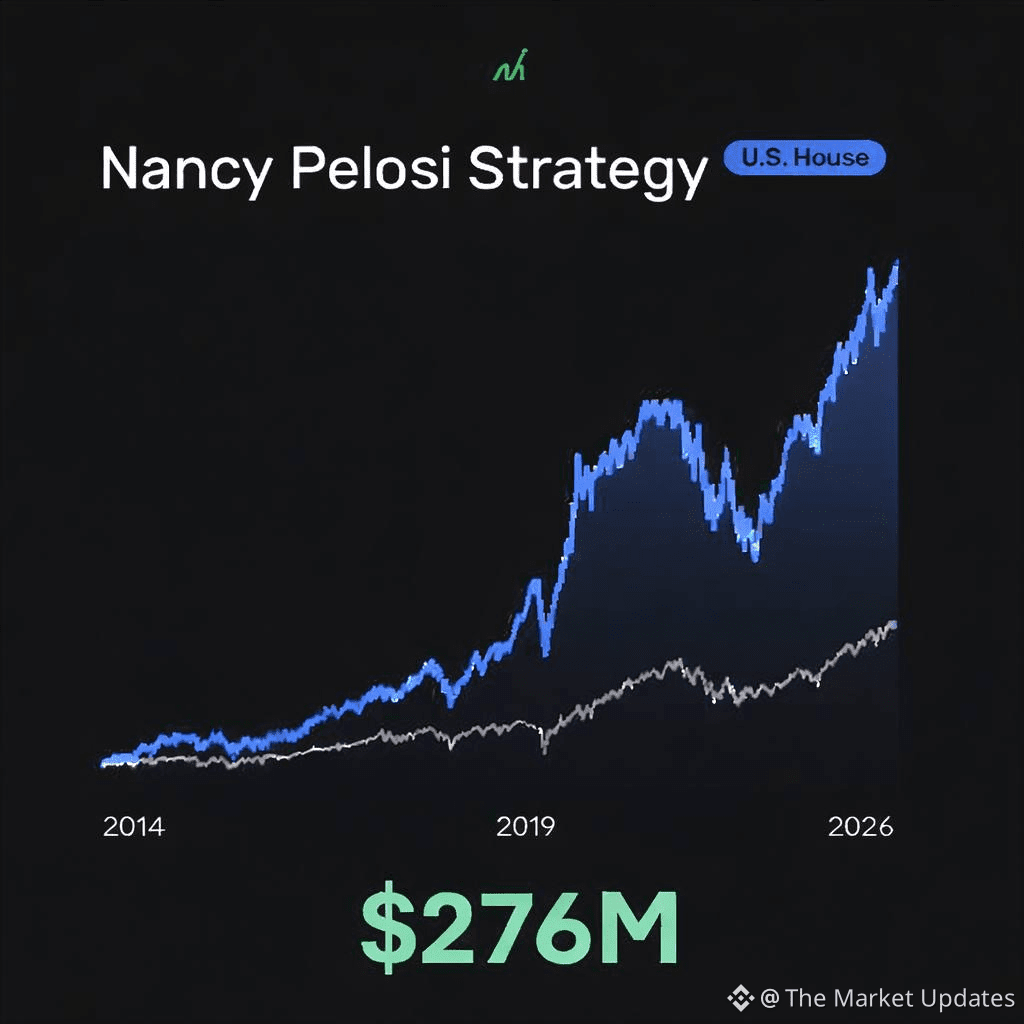

Nancy Pelosi’s portfolio has outperformed hedge funds, the S&P 500, and even Warren Buffett’s long-term average.

In 2024 alone, her returns were estimated at around 70.9%, while hedge funds averaged near 11% and the S&P 500 returned about 24.9%.

In 2025 too, she beat S&P 500's return despite being one of the most volatile years. Her official salary is $174,000 per year.

Her conservative net worth estimate is $276 million.

Analysts say her option value put it above $500 million, but even the conservative number is enough to show the gap.

That gap cannot be explained by salary. Over 38 years in Congress, her total lifetime income is only $7-8 million before tax. Less than 3% of her current wealth.

So how does $174,000 turn into $276 million?

FIRST, THE TOOL IS OPTIONS.

Most of the money is not made by buying stocks. It is made by buying long dated call options. Options allow control of large stock positions using small capital.

But leverage alone does not explain the consistency. The second part is where the options are placed.

Almost all positions are in industries that are directly shaped by government policy: Semiconductors, Big Tech, Energy, Payments, Cybersecurity, Healthcare, AI.

These are the exact sectors affected by:

• Subsidies

• Regulation

• Antitrust

• Government spending

• Defense budgets

• Healthcare rules

Policy decides winners and losers here. That is the real edge: early awareness of political direction.

Now look at the timing.

• 2008 – VISA IPO

Pelosi bought Visa at its IPO. At the same time, Congress was debating credit card regulation that would decide how payment networks operate.

Visa listed, surged immediately, and Congress controlled the rulebook.

• 2022 – NVIDIA AND THE CHIPS ACT

Pelosi exercised Nvidia call options just weeks before the CHIPS Act vote. The CHIPS Act sent $52 billion to US semiconductor companies.

After backlash, the position was sold.

Nvidia later became one of the biggest stocks in the world.

• 2024 – MICROSOFT EXIT

Microsoft was sold shortly before stronger antitrust pressure became public. That is exiting before regulatory risk is priced in.

• 2025 – TEMPUS AI

Pelosi bought calls on Tempus AI on Jan 14, 2025.

Strike: $20

Cost: $50K–$100K

The trade was disclosed on Jan 17 and became public Jan 21. That same day, the stock jumped 35%. By October 2025, the stock was up 185%. By January 2026, the position was worth about $263,000.

Retail traders and algorithms copied the trade immediately after disclosure. The disclosure itself became a price catalyst.

• 2025 – BROADCOM

Calls bought in June 2024. Exercised in June 2025 at $80 strike. Stock trading near $250 at exercise.

20,000 shares were acquired for $1.6M. Market value was about $5M at exercise. By December 2025, those shares were worth almost $7M.

Estimated profit: $5.38 million.

• 2025 – VISTRA

Calls bought the same day as Tempus.

Strike: $50

By early 2026, the stock was trading near $185. Another policy sensitive sector: energy. The pattern is always the same:

Position first →

Policy clarity later →

Market reaction →

Disclosure triggers copy buying.

Now add the legal structure.

The STOCK Act:

• Allows disclosures up to 45 days late

• Penalty is about $200

• No criminal enforcement history

• No member of Congress has ever been convicted under it

So the structure becomes: Trade first, Disclose later, Face no real penalty

And now there is a second layer.

Pelosi’s trades are tracked by:

• Apps

• Hedge funds

• Retail traders

• ETFs like $NANC

• Automated copy-trading systems

When her disclosure hits, buying pressure appears automatically. Her reputation itself moves prices.

This is why Tempus and Vistra jumped after disclosure.

Not because fundamentals changed that day. Because people followed the name. So the full formula becomes:

Political access

Options leverage

Policy-sensitive sectors

Weak enforcement

Copy-trading feedback loops

That is how a $174,000 salary becomes a $276 million portfolio