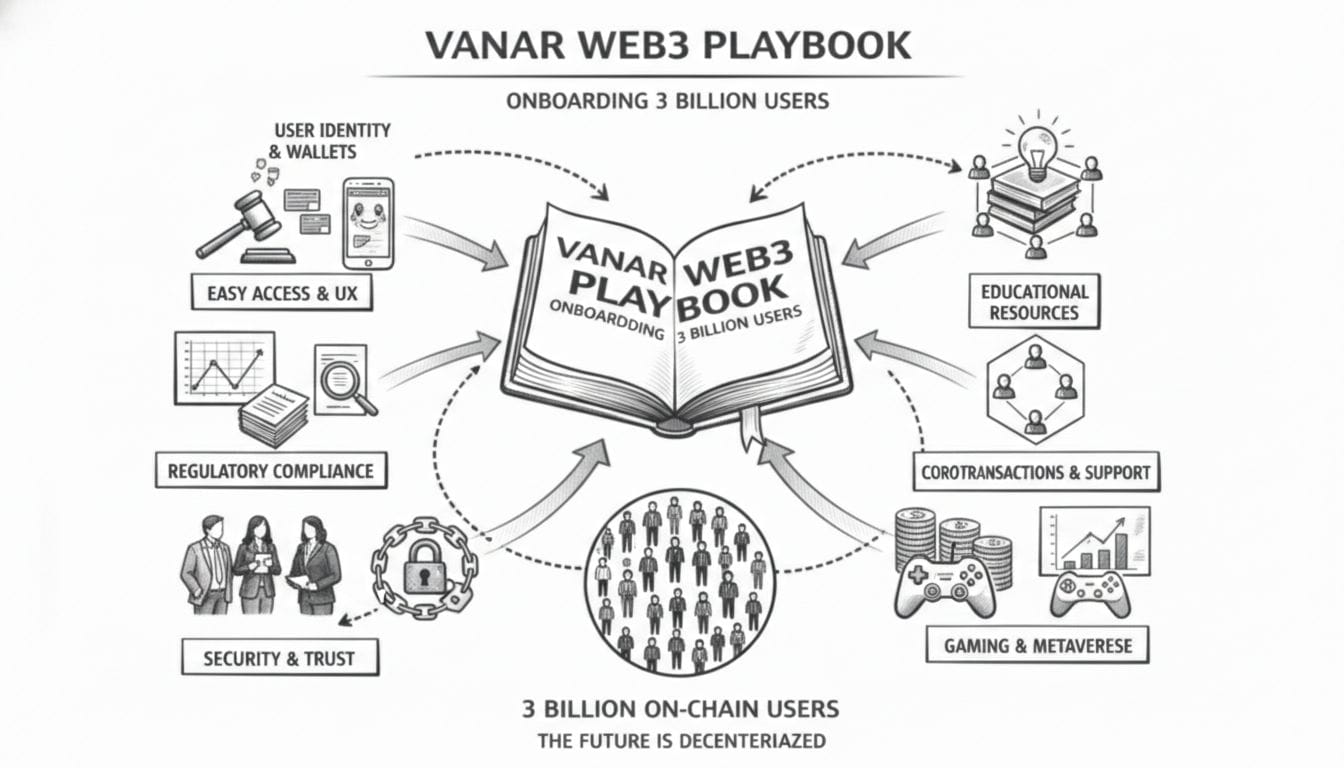

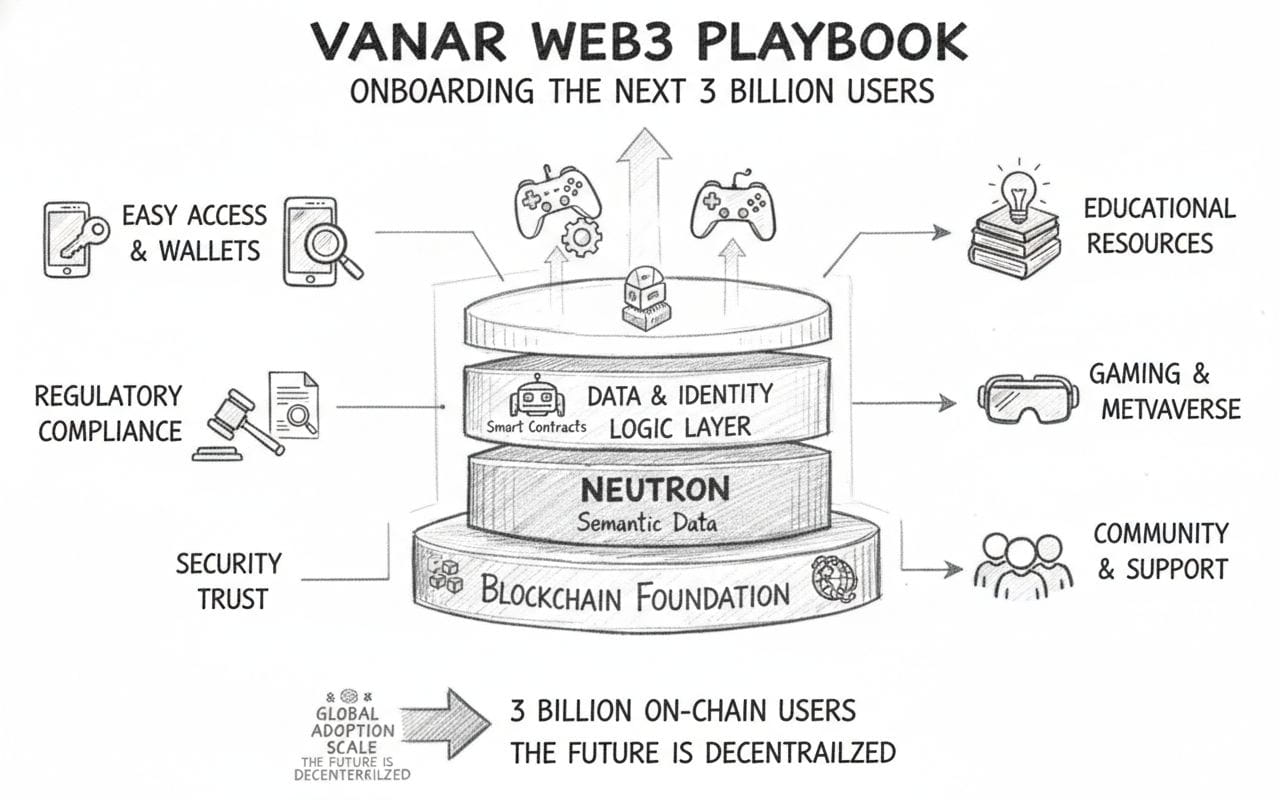

Crypto keeps asking how we onboard “the next billion users,” but the industry rarely interrogates who these users are or what they actually want. The assumption is that the future wave will look like today’s native crypto cohort yield-seeking, wallet-managing, speculation-tolerant power users. Vanar rejects that assumption entirely. Their bet is simpler and more realistic: the next 3 billion users aren’t coming for trading they’re coming for culture.

Crypto keeps asking how we onboard “the next billion users,” but the industry rarely interrogates who these users are or what they actually want. The assumption is that the future wave will look like today’s native crypto cohort yield-seeking, wallet-managing, speculation-tolerant power users. Vanar rejects that assumption entirely. Their bet is simpler and more realistic: the next 3 billion users aren’t coming for trading they’re coming for culture.

Culture moves through:

gaming,

entertainment,

IP,

brands,

loyalty,

digital identity,

fandom,

and social experiences.

These surfaces already have billions of users. They just don’t have on-chain economics yet. Vanar’s playbook is about grafting blockchain capabilities into these cultural surfaces without forcing users to become crypto natives.

This is the difference between mass onboarding and mass exit.

Don’t Build for Crypto Users Build for Cultural Users

Crypto-onboarding UX fails because it assumes users want:

self-custody day one,

token speculation day one,

marketplaces day one,

DeFi day zero,

RPC concepts,

signing transactions,

bridging across chains.

None of these are motivations for cultural users.

Cultural users want:

status,

identity,

cosmetics,

loyalty perks,

digital goods,

community access,

fan experiences,

personalization,

recognition.

Web3 keeps asking them to learn a new financial system. Vanar asks instead:

What if the financial system stayed invisible and the cultural system gained superpowers?

That’s a conversion funnel that can scale.

Make the Chain Disappear Without Removing Value

Web3’s “UX problem” isn’t just about UI it’s about cognitive framing. Users shouldn’t think:

“I’m using a blockchain.”

They should think:

“I’m upgrading my character,”

“I’m redeeming a perk,”

“I’m unlocking a chapter,”

“I’m customizing my identity.”

The blockchain should be:

invisible,

reliable,

fast,

persistent,

portable.

In Vanar’s playbook, blockchain becomes plumbing, not a product surface. Just like users don’t think about TCP/IP when using Instagram, they shouldn’t think about consensus when interacting with digital assets.

Onboard Brands, Not Retail

Retail is expensive to acquire and easy to lose.

Brands already possess:

audiences,

distribution,

trust,

cultural capital,

marketing budgets,

partnerships.

Instead of convincing one user at a time, Vanar’s strategy is to onboard distribution nodes. With each brand onboarded, thousands to millions of users follow without ever learning the word “web3.”

This is how real infrastructure scales:

credit cards scaled through merchants,

streaming scaled through studios,

consoles scaled through publishers,

mobile scaled through app ecosystems.

Web3 will scale through brands. Vanar is structured accordingly.

Move From Token Ownership to Asset Participation

Move From Token Ownership to Asset Participation

The crypto-native UX pattern is:

buy the token → hold → speculate → exit

Cultural UX is instead:

access → participate → upgrade → express → redeem

These are identity verbs, not financial verbs. Vanar’s pipeline turns on-chain assets into:

identities,

cosmetics,

memberships,

experience passes,

loyalty artifacts.

These are far more universal than speculation. Billions of users already consume digital identity assets today just not on-chain yet.

Treat Attention as a Commodity and IP as an Asset Class

If you analyze the last 30 years of consumer technology, you realize the most valuable commodity in culture isn’t capital it’s attention. Brands pay to capture it. IP monetizes it. Platforms broker it.

Blockchain has never tokenized attention at scale. Vanar’s playbook does exactly that by giving IP the tools to:

activate audiences,

reward behaviors,

distribute assets,

monetize fandom,

extend lifecycles.

This aligns with how entertainment has always monetized just without the intermediaries extracting surplus value.

Liquidity Comes From Culture, Not Speculation

Crypto liquidity cycles die fast because they depend on market reflexivity. Cultural liquidity cycles don’t die they compound. Fandom, identity, memes, scarcity, and status are all non-financial liquidity primitives.

Culture has persisted for millennia without token speculation. With on-chain economics, it finally gains programmability.

Vanar isn’t trying to financialize users it’s trying to economize culture.

Make Sovereign Identity a Byproduct, Not a Barrier

Sovereign on-chain identity matters but crypto makes it a prerequisite. Vanar makes it a progression. Users start with low-friction identities and escalate to sovereignty only when they capture value worth securing.

This mirrors how Web2 evolved:

accounts came before wallets,

emails came before domain names,

cloud storage came before self-hosting.

This sequencing is crucial for mass onboarding.

Why This Playbook Has a Non-Zero Chance of Actually Scaling to 3B

Because it does not rely on: ✘ speculation,

✘ yield hunting,

✘ token literacy,

✘ custody complexity,

✘ trading behavior,

✘ wallet UX,

✘ financial motivation.

It relies on: ✔ culture,

✔ identity,

✔ entertainment,

✔ brands,

✔ IP,

✔ attention,

✔ loyalty,

✔ interoperability.

These are long-tail, billion-user primitives that preceded crypto and will outlive it. Crypto is the augmentation layer not the starting point.

The Thesis in One Line

Vanar’s path to 3 billion users is not to make more people trade it’s to make more culture economically programmable.

And that is a mission normal users can join without ever touching MetaMask.