Most people still analyze Layer 1 blockchains like race cars, comparing speed, fees and theoretical throughput. When I analyzed Plasma more deeply. I realized it's not even trying to win that race. Plasma is doing something more uncomfortable and far more interesting is it's redesigning how stablecoins actually move in the real world especially where money movement matters more than speculation.

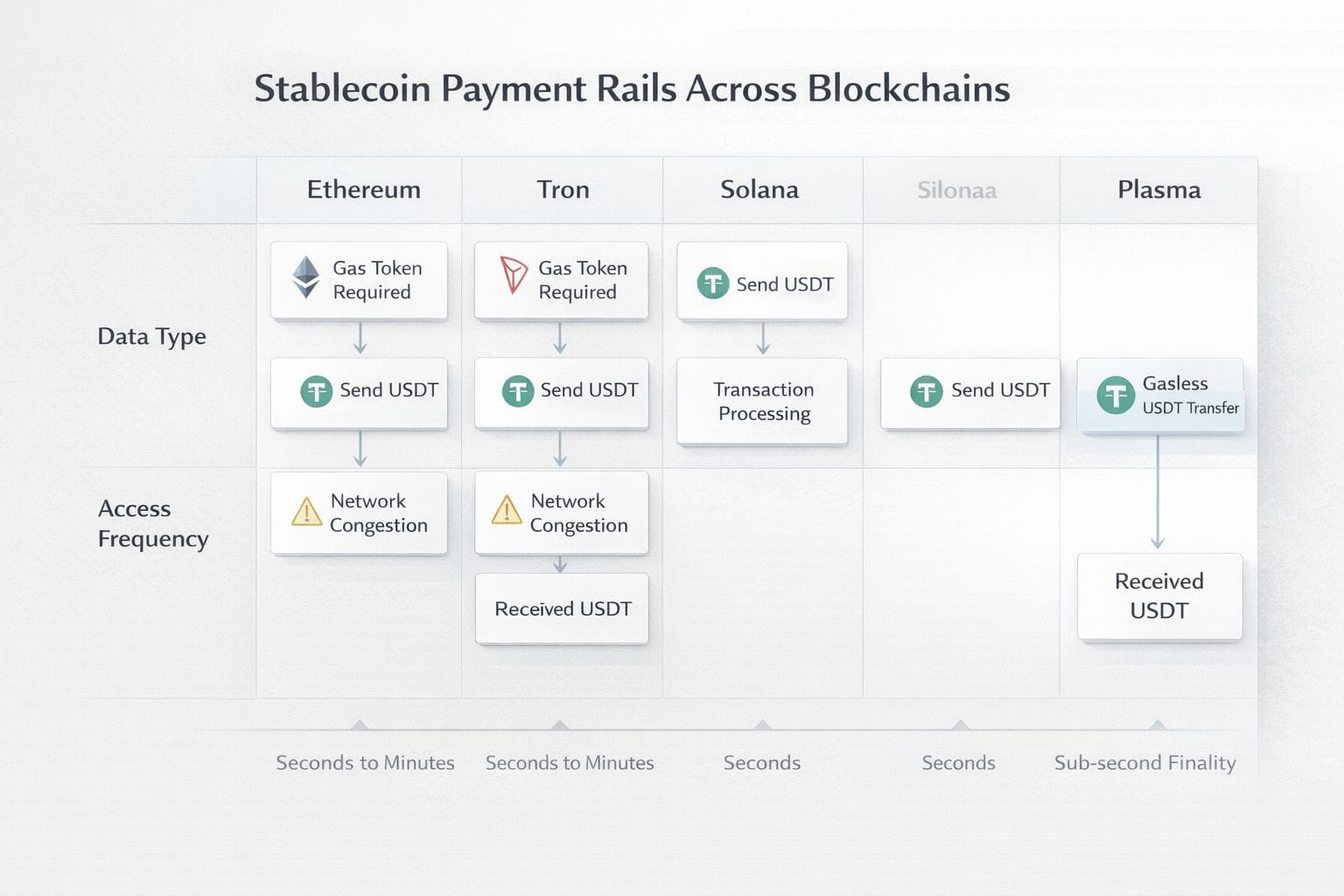

Stablecoins now represent over 70% of all on-chain transaction volume according to Visa's 2024 on-chain settlement report yet they still run on infrastructure never designed for everyday payments. Gas fees spike confirmations lag and users are expected to manage native tokens just to send digital dollars. Plasma's architecture feels like a response to that mismatch rather than another attempt to out-scale Ethereum.

Why Plasma stablecoin first design feels different once you look closely?

In my assessment Plasma most underrated decision is refusing to treat stablecoins as "just another token." Instead the chain is designed around them. Plasma allows gasless USDT transfers by subsidizing transaction fees at the protocol level meaning users can send USDT without holding XPL at all. This is not a wallet trick. It's a core economic design choice.

My research shows that according to Tether's own transparency reports USDT processed over $10 trillion in transfer volume in 2024 more than Visa and Mastercard combined. Yet a meaningful portion of that volume still flows through Ethereum and Tron both of which struggle with either congestion or centralization trade offs. Plasma sub-second finality with PlasmaBFT cuts out the waiting and makes stablecoin transfers feel instant not just a roll of the dice.

One chart lines up the average settlement times and transaction costs for USDT on Ethereum, Tron, Solana and Plasma. You can really see the differences at a glance. Another chart breaks down where people are actually sending stablecoins showing just how much USDT has taken over compared to regular crypto transfers and for folks who want the details a simple table lays out what users need on each chain like whether you need a native gas token or not so it's easy to compare.

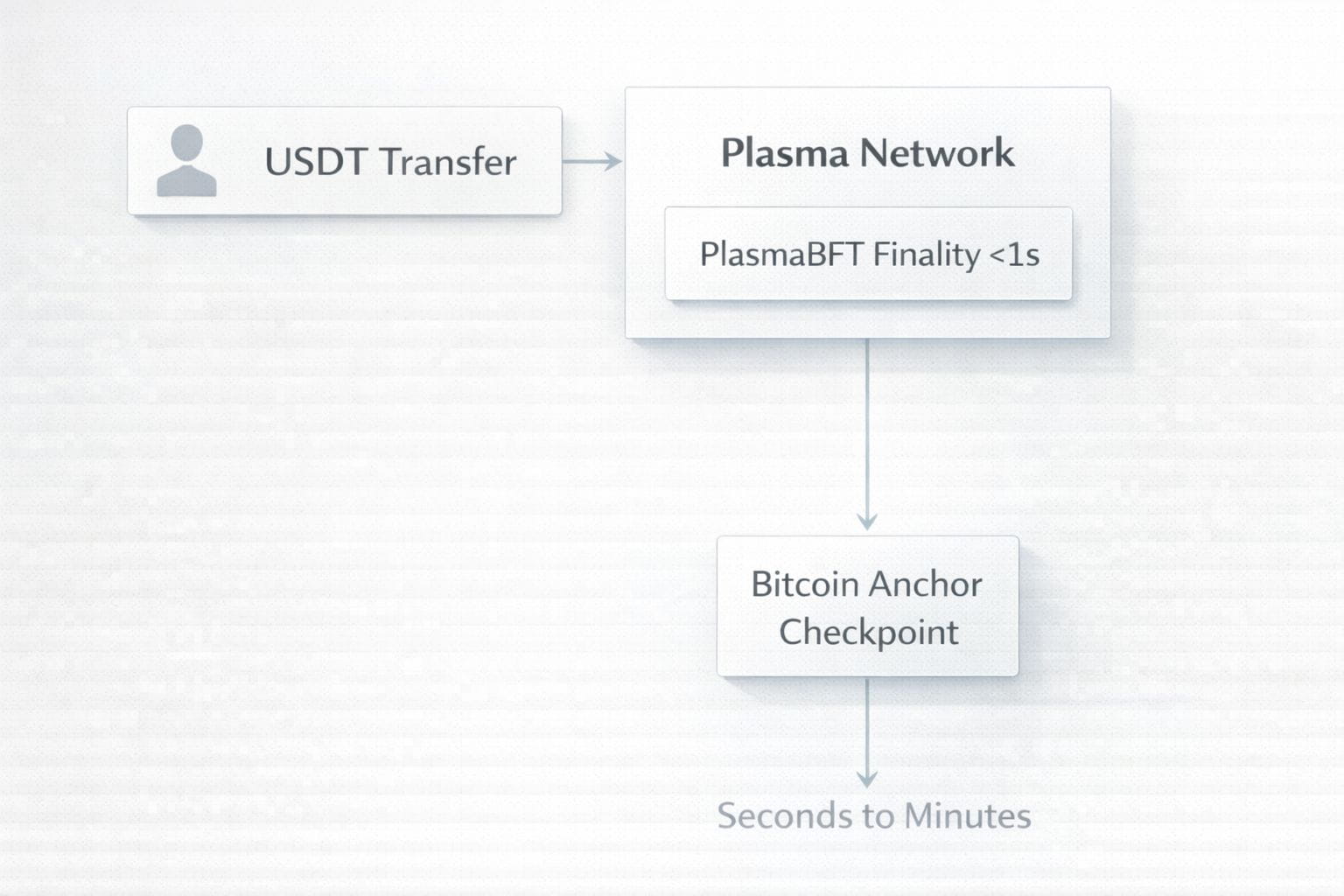

Plasma's consensus mechanism is based on a HotStuff style BFT model similar in family to what powers enterprise grade distributed systems. I often explain this to non technical readers like a tightly coordinated group chat where confirmations happen simultaneously rather than sequentially. This design enables Plasma to finalize transactions in under one second a figure confirmed in early testnet metrics shared publicly by the Plasma team and cited in Binance Academy Layer 1 overview earlier this year.

Bitcoin anchoring is not marketing. It's a strategic neutrality play

One question I kept asking while digging into Plasma was why a stablecoin settlement chain would bother anchoring to Bitcoin at all. The answer became clearer the more I studied regulatory pressure trends. According to Chainalysis 2024 Geography of Crypto report stablecoin usage is growing fastest in regions where financial censorship and capital controls are real concerns not theoretical ones.

Plasma periodically anchors state commitments to Bitcoin and uses a BTC backed asset called pBTC through a trust minimized bridge. This is not about turning Plasma into a Bitcoin DeFi playground. It's about inheriting Bitcoin neutrality and censorship resistance while still operating an EVM compatible environment. Think of Bitcoin as a public notary that Plasma checks in with it's like a way to make sure nobody can just rewrite history whenever they want.

This is not just some technical detail. It actually matters and probably more than most people think. Institutions are using stablecoins more and more and they care a lot about things like settlement finality and staying neutral politically. In late 2024 the BIS said over 90% of central banks are either researching or testing out digital currency systems. A lot of them are looking at public blockchains for settlements. So a blockchain that can honestly claim Bitcoin level neutrality but still deliver the flexibility and programmability of Ethereum? That's a rare mix.

It helps to compare how different chains anchor their security like put pure proof of stake systems, Ethereum rollups and Bitcoin anchored models such as Plasma side by side. You could also sketch out how a Plasma transaction works from the moment a user sends it through PlasmaBFT finality all the way to a Bitcoin checkpoint. That kind of visual makes the layered security model click.

Plasma's adoption numbers show it's not just theory. It's getting real traction and maybe even ahead of the curve.

What actually changed my mind was not the fancy architecture diagrams. It was the adoption numbers. During Plasma's beta public stats showed that more than $5.5 billion in stablecoin liquidity came in from institutional players right out of the gate. That matches up with coverage from CoinDesk and The Block which dug into Plasma's funding rounds and liquidity partnerships. Big names back it too Tether linked groups, Founders Fund and others.

One thing that stood out to me is Plasma EVM compatibility runs on Reth a Rust powered Ethereum client. This is not a cosmetic choice. Rust based clients are increasingly favored for performance and safety and Ethereum Foundation researchers have publicly supported client diversity as a long term resilience strategy. Plasma effectively piggybacks on this trend while tailoring execution specifically for payments rather than generalized DeFi congestion.

From a market narrative perspective Plasma lands at the intersection of three trending themes in crypto right now is stablecoin regulation clarity real world payments and Bitcoin aligned infrastructure. According to Messari's 2025 Outlook stablecoin focused blockchains are expected to be one of the fastest growing sectors as speculative cycles cool and usage driven metrics gain importance.

I keep coming back to one question when evaluating Plasma as a long term infrastructure bet. What happens when the next billion crypto users don't care about yield farming or governance tokens but just want money to move instantly, cheaply and reliably? Plasma feels less like a bet on the next bull run and more like a bet on that future.

If Plasma succeeds it won't be because traders hyped it on social media. It will be because users barely notice it working in the background. In a market obsessed with visibility building invisible financial rails might be the most contrarian strategy of all.