I’ve read countless blockchain roadmaps that promise to “change finance” but most of them quietly avoid the hardest part of money: regulation, trust and real-world usage. Moving dollars globally isn’t just about fast blocks or cheap transactions. It’s about accountability, compliance and infrastructure that people can actually rely on. That’s why Plasma immediately stood out to me.

Plasma doesn’t feel like a chain built for speculation. It feels like a chain built for responsibility.

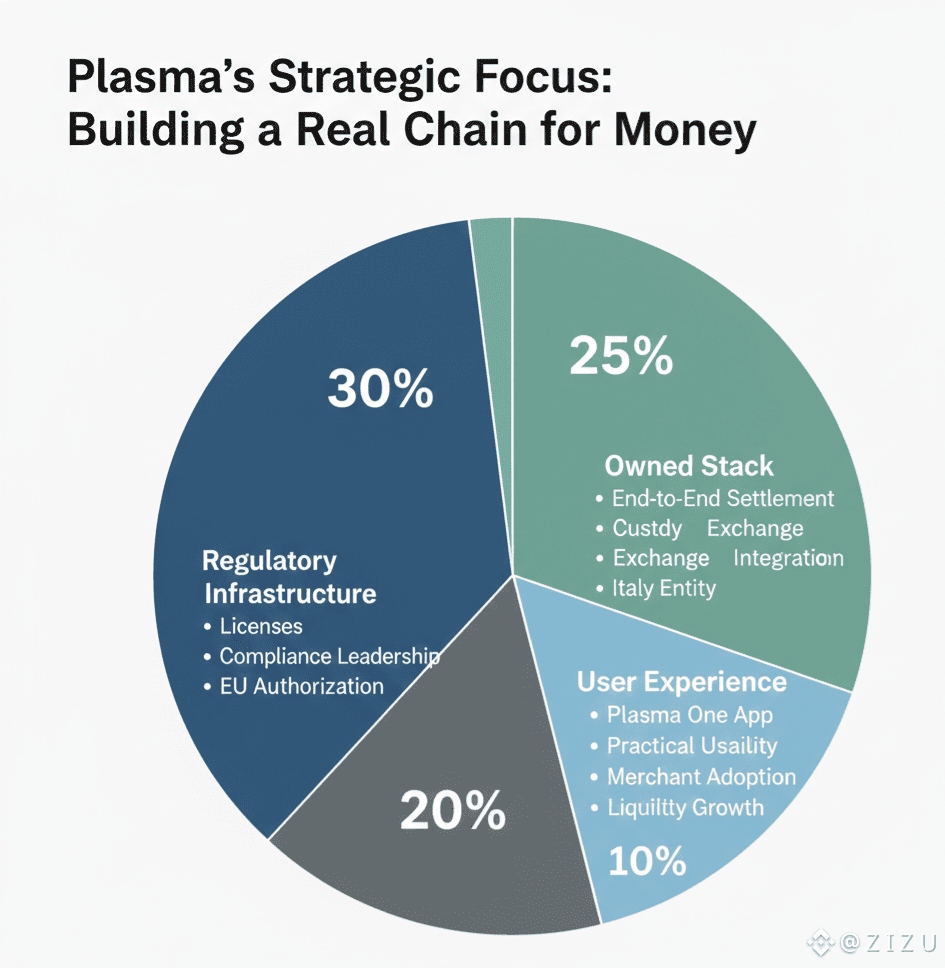

From the very beginning, Plasma has been clear about one thing: if you want stablecoins to function like real money, you can’t rely on borrowed rails or rented licenses. You have to own the stack end to end. Settlement, custody, exchange, payments, all of it has to be designed as one system. In my opinion, that mindset alone puts Plasma in a different category.

Why Owning the Stack Actually Matters

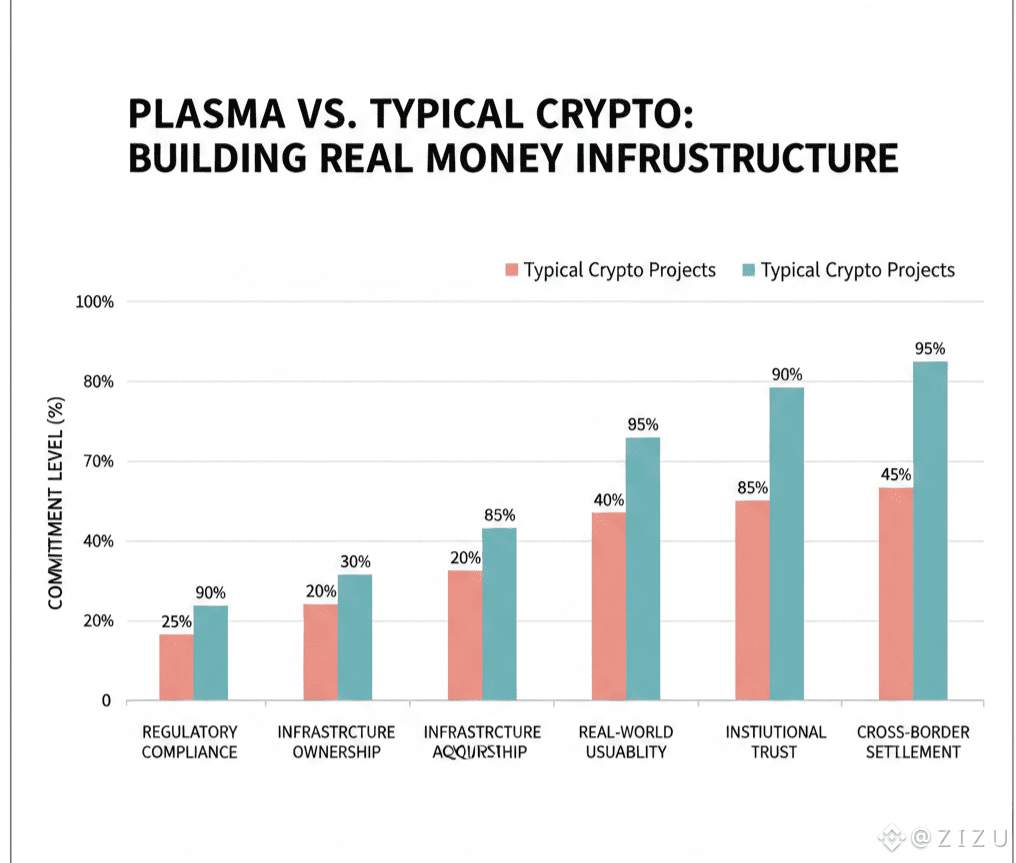

Payments is one of the most heavily regulated industries in the world, and for good reason. People trust money systems with their livelihoods. Yet many crypto projects try to shortcut this by leaning on third parties, temporary access or fragmented providers. That might work in the short term but it always introduces risk, delays and hidden costs.

Plasma is doing the opposite. By acquiring a licensed entity in Italy and building a compliance base in the Netherlands, it’s clearly committing to the long game. This isn’t about appearances. It’s about control, accountability and stability.

What I personally respect is that Plasma treats compliance as infrastructure, not friction. Hiring dedicated compliance leadership and pursuing unified European authorization shows that regulation isn’t an afterthought, it’s baked into the product. That’s how you build something institutions, merchants and everyday users can actually trust.

Europe as a Strategic Foundation

There’s a reason Plasma is anchoring itself in Europe. The region has some of the most mature payment systems and regulatory standards in the world. Establishing a strong presence in the Netherlands, one of Europe’s key payments hubs, isn’t just symbolic. It’s practical.

From my point of view, money doesn’t exist in isolation. It moves through local banking rails, merchant systems and compliance frameworks. Plasma is positioning itself exactly where those systems already work at scale. That’s how stablecoins stop feeling “separate” and start feeling normal.

Licenses Are Not Paperwork, They’re Power

One thing I strongly agree with is the idea that licenses are part of the product. They’re what make everything else possible. Proper authorization allows assets to be safeguarded, exchanged compliantly and connected directly to local money systems.

Without this, users face confusing onboarding, unnecessary intermediaries and unpredictable fees. With it, everything becomes simpler. Funds settle faster. Costs drop. Trust increases.

In real terms, this means people can hold digital dollars safely, spend them easily and move value across borders without worrying about what’s happening behind the scenes. Businesses integrate once and gain access to multiple markets through a single standard. That kind of clarity is rare and incredibly valuable.

Plasma One: Making Infrastructure Feel Human

All infrastructure is meaningless if people can’t use it. That’s where Plasma One comes in. To me, Plasma One feels like the bridge between complex financial plumbing and everyday life.

It turns stablecoins into something practical: a place to hold value, spend it, send it and settle instantly across borders. What makes this different is that Plasma isn’t outsourcing the hardest parts. It’s owning the on-ramps, off-ramps, issuing stack and regulatory framework itself.

Relying on third parties always adds friction and fragility. By controlling the entire system, Plasma can optimize for speed, cost and reliability. That’s how you make stablecoins actually useful instead of just technically impressive.

The Network Effect I Think People Are Missing

As Plasma One grows, the real impact starts to compound. Builders and businesses on Plasma gain access to regulated infrastructure they could never build on their own. Merchants settle faster. Employers run payouts more efficiently. Companies manage treasury flows without juggling multiple systems.

Once balances move cleanly across users, merchants, and regions, the network starts reinforcing itself. Settlement accelerates. Liquidity improves. Trust deepens. That’s how financial networks are supposed to grow.

Plasma isn’t trying to move fast and break things. It’s trying to move carefully and build something that lasts. In a space that often prioritizes hype over substance, that approach feels refreshing.

To me, Plasma looks less like a crypto experiment and more like a serious attempt to rebuild money infrastructure for a global, digital world. By owning the regulated stack, embedding compliance, and focusing on real-world usability, it’s doing the unglamorous work that actually matters.

That’s why I believe Plasma isn’t just another blockchain.

It’s a chain designed for how money actually moves and how it should move in the future.