For the better part of a decade, the cryptocurrency industry has been obsessing over a single, elusive goal that we call mass adoption. We have spent countless hours attending conferences, writing whitepapers, and engaging in late-night debates about what it would take for blockchain technology to finally break out of its speculative bubble and become a fundamental part of the global financial plumbing. We tried to solve volatility with stablecoins, which was a massive step forward, creating a digital dollar that could move globally twenty-four hours a day. Yet, even with trillions of dollars in stablecoin market cap, the average person on the street still cannot use crypto to buy a coffee, send a quick remittance to a family member without a headache, or pay for a small online subscription. The reason for this failure is not a lack of interest or a lack of utility in the assets themselves; it is the paralyzing friction of transaction fees.

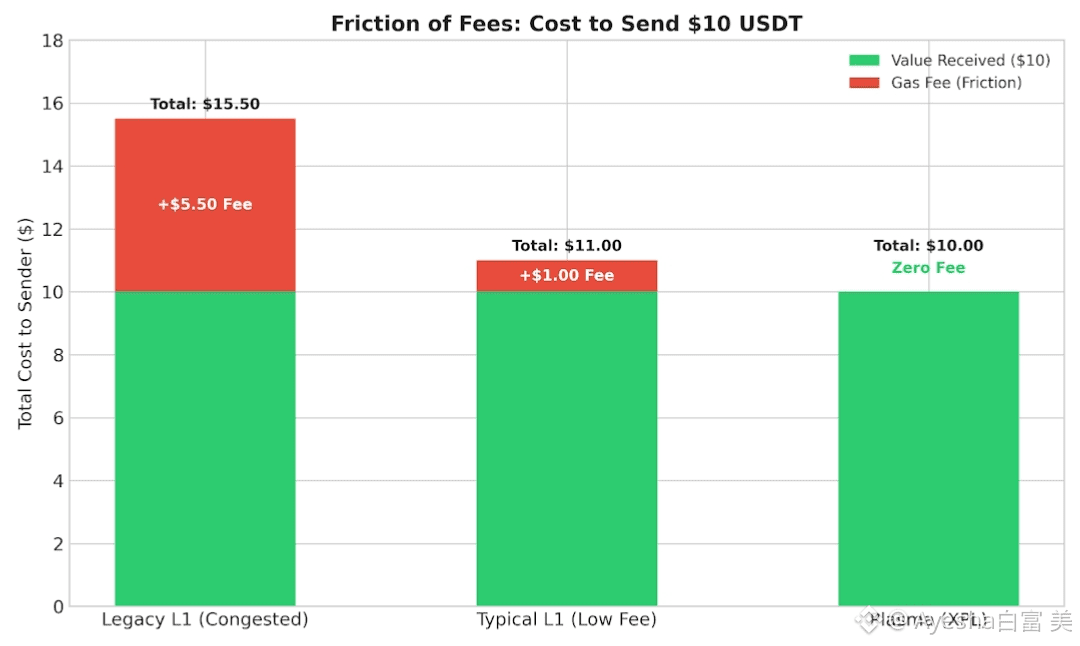

The uncomfortable truth we have largely ignored is that we built a revolutionary new financial system and then placed expensive toll booths at every single entrance and exit. Imagine if every time you sent an email to a colleague or a text message to a friend, you had to pay a variable fee depending on how many other people were emailing at that moment. You would not use email for quick chats or casual updates; you would save it only for high-value, critical communications. This is exactly the dynamic playing out in crypto today. When network congestion spikes on legacy chains, sending twenty dollars in USDT can cost ten dollars in gas fees. This economic reality completely destroys the viability of micropayments, daily commerce, and high-frequency transactions. It forces users to treat digital currency as a static asset rather than a fluid medium of exchange. As long as users have to mentally calculate the tax on spending their own money, crypto will remain a niche financial sport rather than a global utility.

This is the precise bottleneck that Plasma was built to shatter. Plasma is not just another general-purpose Layer 1 blockchain trying to do everything for everyone. It is highly specialized infrastructure engineered with a singular focus, which is to be the fastest and cheapest settlement layer for stablecoins, specifically USDT. The defining characteristic of Plasma, and the feature that will serve as the true catalyst for mass adoption, is the introduction of gasless USDT transfers.

When you remove the concept of gas fees from a stablecoin transaction, you fundamentally change user psychology. You move from a mindset of scarcity and hoarding to a mindset of fluidity and spending. Zero fees mean that sending five cents is just as economically viable as sending five million dollars. This opens the door for entirely new business models that were previously impossible on-chain. Consider streaming payments for content, where you pay fractions of a cent per second of video watched, or real-time payroll where workers receive their wages every hour instead of every two weeks. Think about cross-border remittances where a migrant worker can send fifty dollars home to their family without losing ten percent of it to network intermediaries. These aren't futuristic concepts; they are immediate realities once the friction of gas is removed.

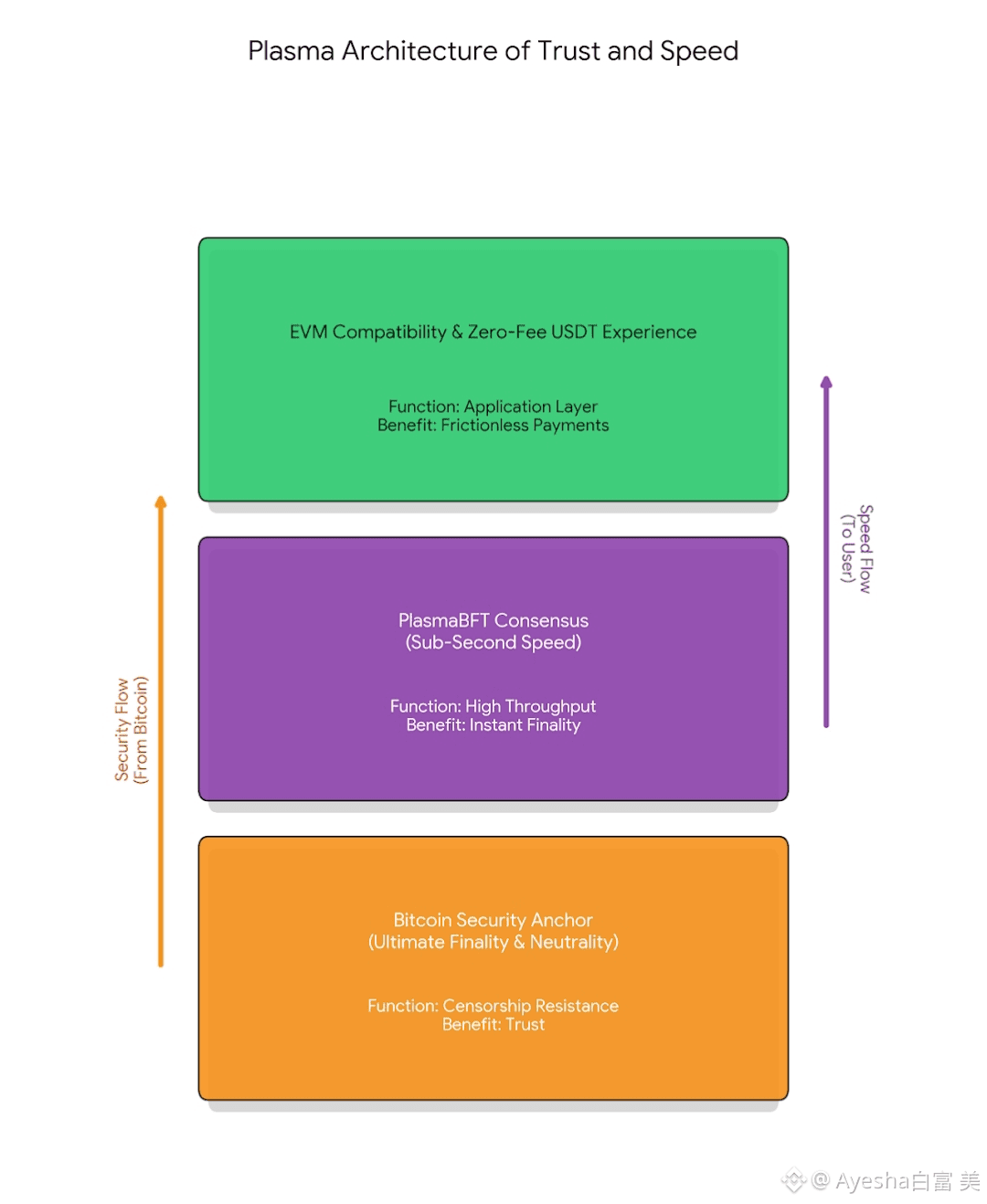

However, achieving zero fees cannot come at the expense of security or decentralization, otherwise, we are just rebuilding a slower version of PayPal. This is where the architectural genius of Plasma comes into play. It solves the scalability trilemma by utilizing a hybrid approach. For raw speed and finality, it uses PlasmaBFT, a consensus mechanism designed to confirm transactions in under a second. This provides the instant gratification that modern consumers expect from their payment apps. But for ultimate security and neutrality, Plasma anchors itself to the Bitcoin network. By leveraging Bitcoin's unparalleled hash rate for final settlement security, Plasma ensures that while transactions are fast and free, the network itself remains censorship-resistant and incredibly secure. It is like building a hyper-speed maglev train on top of the bedrock foundations of the global financial system.

Furthermore, Plasma recognizes that adoption doesn't just come from retail users; it comes from developer integration. If it is difficult for existing applications to migrate, they won't come. That is why Plasma was built with full EVM compatibility using Reth. This means that any application, wallet, or service currently running on Ethereum or other EVM chains can deploy on Plasma with minimal changes. They get to offer their user base the incredible benefit of zero-fee stablecoin transactions without having to learn a new programming language or rebuild their entire tech stack.

We are standing at the precipice of the next major cycle in digital assets. The previous cycles were defined by speculation, infrastructure building, and grand promises. The cycle we are entering now will be defined by utility and actual economic velocity. The winners will not be the chains with the most theoretical throughput, but the chains that people actually use to move value in the real world. By removing the single biggest barrier to entry, which is the gas fee, Plasma has positioned USDT to finally become the global, frictionless medium of exchange it was always intended to be. Mass adoption doesn't happen when a technology gets more complex; it happens when it becomes invisible. When you can send digital dollars around the world as easily as sending a text message, without worrying about the cost, you won't even think about the blockchain underneath. You will just call it money. That is the future Plasma is powering.