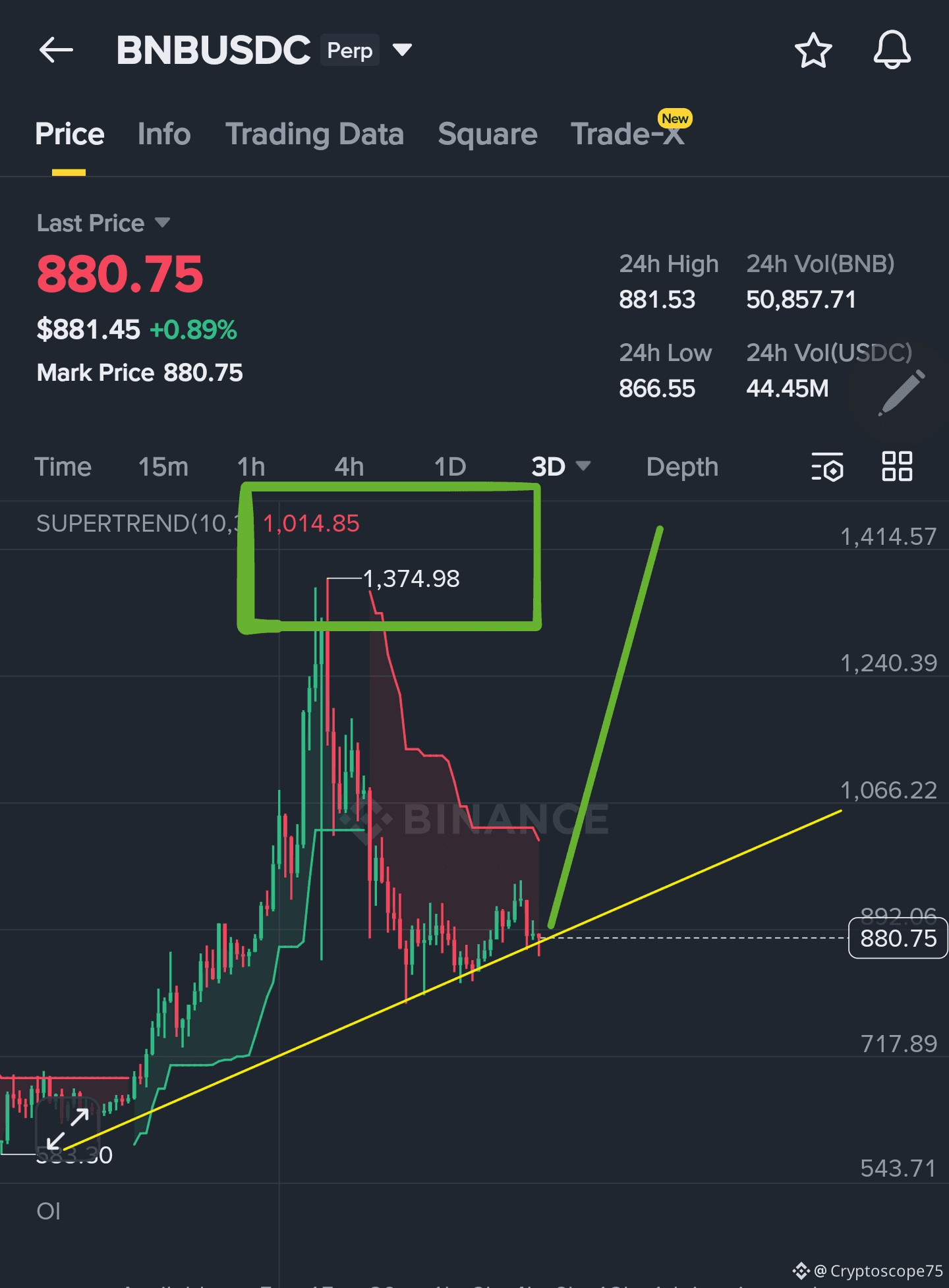

$BNB is currently trading around the $880 zone, a key technical area where long-term trend support and recent price compression intersect. On the structure side, price is holding above the rising trendline after completing a deep correction from the $1,374 cycle high, suggesting the market is attempting to stabilize and rebuild momentum.

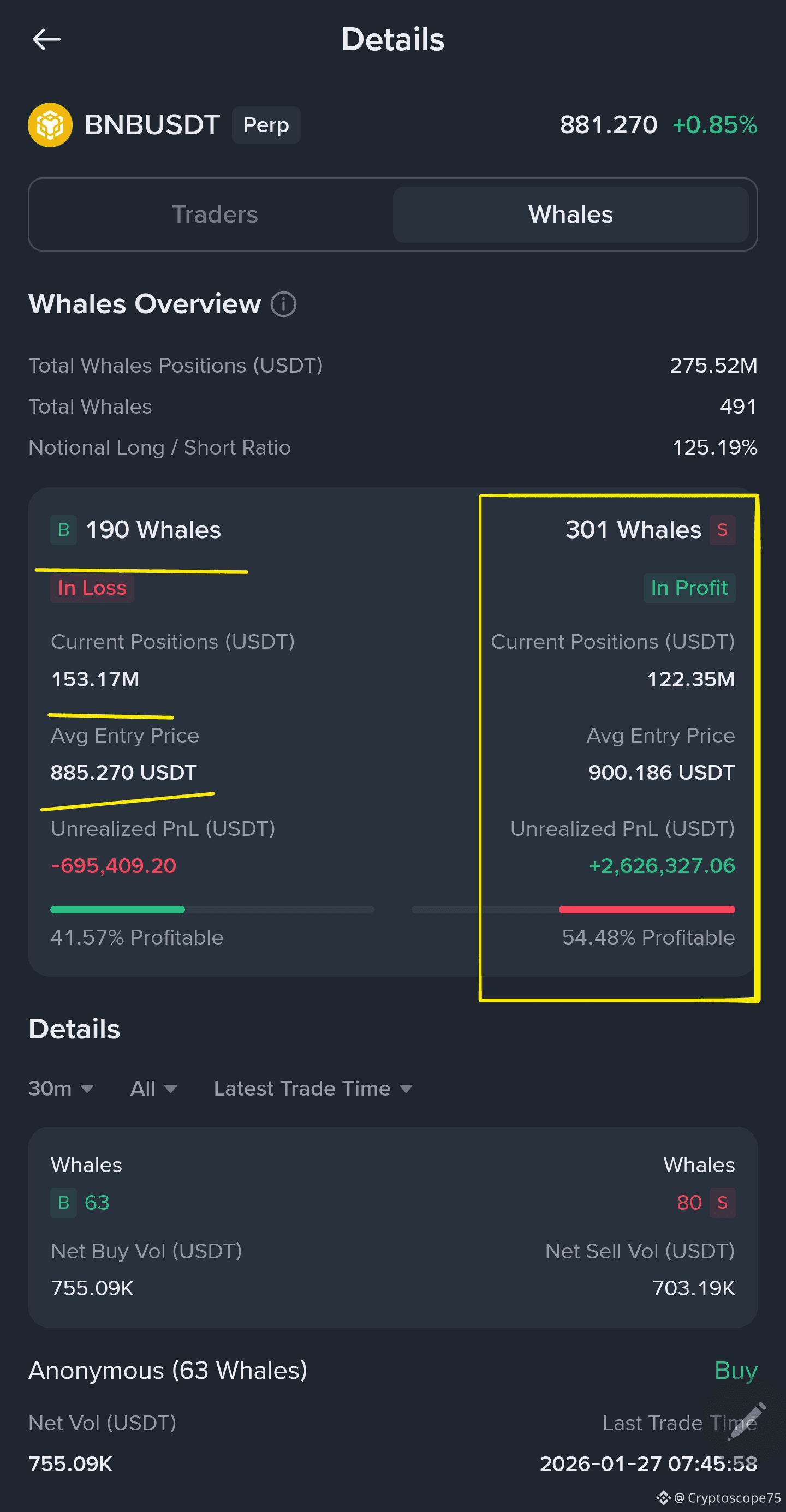

Whale positioning adds an important layer of insight. Data shows a larger number of whales positioned short and currently in profit, with average short entries near the $900 region. Meanwhile, a significant portion of long whales are underwater, indicating that short-side liquidity remains dominant in the short term.

This dynamic points to a high-tension zone: structurally supported price action versus profitable whale shorts. A sustained hold above trend support could pressure short positions, while failure to maintain this base would validate continued downside control.

The next expansion move will likely be decided by which side of this range breaks first.