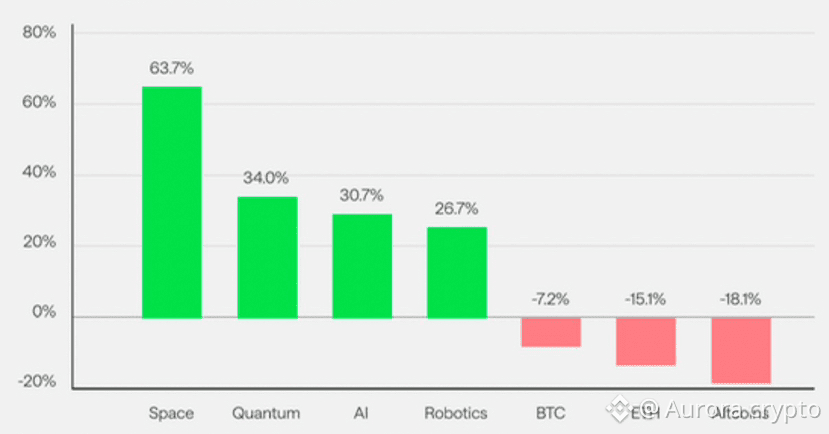

If you’re still waiting for that explosive "Altseason" or clinging to the old textbook theory of capital rotating from Bitcoin to Altcoins, Wintermute just delivered a brutal reality check. Let’s be real: the rules of the game have been completely rewritten.

Why is the "Moon" dream drifting away

2025 is no longer a playground for the retail-driven "luck-based" gems we used to love. Instead, we’re living in a world of "walled gardens" built by institutional giants.

Trapped Liquidity: Instead of trickling down to altcoins like the good old days, liquidity is now locked tight within ETFs and corporate treasuries. These big players only care about the "large-caps."

* The Altcoin Burnout: The numbers don't lie. Previous altcoin rallies used to last an average of 61 days. Now? They fizzle out in just 19 days.

* The Cruel Irony: While retail investors are busy chasing high-risk AI memes, institutions are quietly farming systematic yields and sophisticated derivatives.

Welcome to the "New Normal"

To put it bluntly: this isn't a bear market—it’s a "mature" market.

The days of "a rising tide lifts all boats" (where BTC going up meant the whole market turned green) are effectively over. Unless ETFs get broader mandates or a miracle happens where stock market capital floods back into crypto, those glorious "Uptober" dreams are likely a thing of the past.

The market is becoming more stable, but also much "duller." A cold, institutional professionalism has replaced the explosive, emotional highs of the retail era.

Do you think we’re being too pessimistic, or has the era of "overnight millionaires" truly come to an end? Let me know what you think in the comments.