Stablecoins represent one of the most important shifts in modern finance.

They move real economic value — not testnet tokens, not speculative placeholders — but instruments used daily for payments, remittances, treasury operations, and on-chain liquidity.

As stablecoin usage grows, the conversation naturally shifts from speed to something more fundamental:

Can the infrastructure moving this value be trusted to remain neutral over time?

This is where Plasma makes a deliberate and important design choice through its Bitcoin-anchored security model.

Neutrality Is a Requirement, Not a Feature 🔒

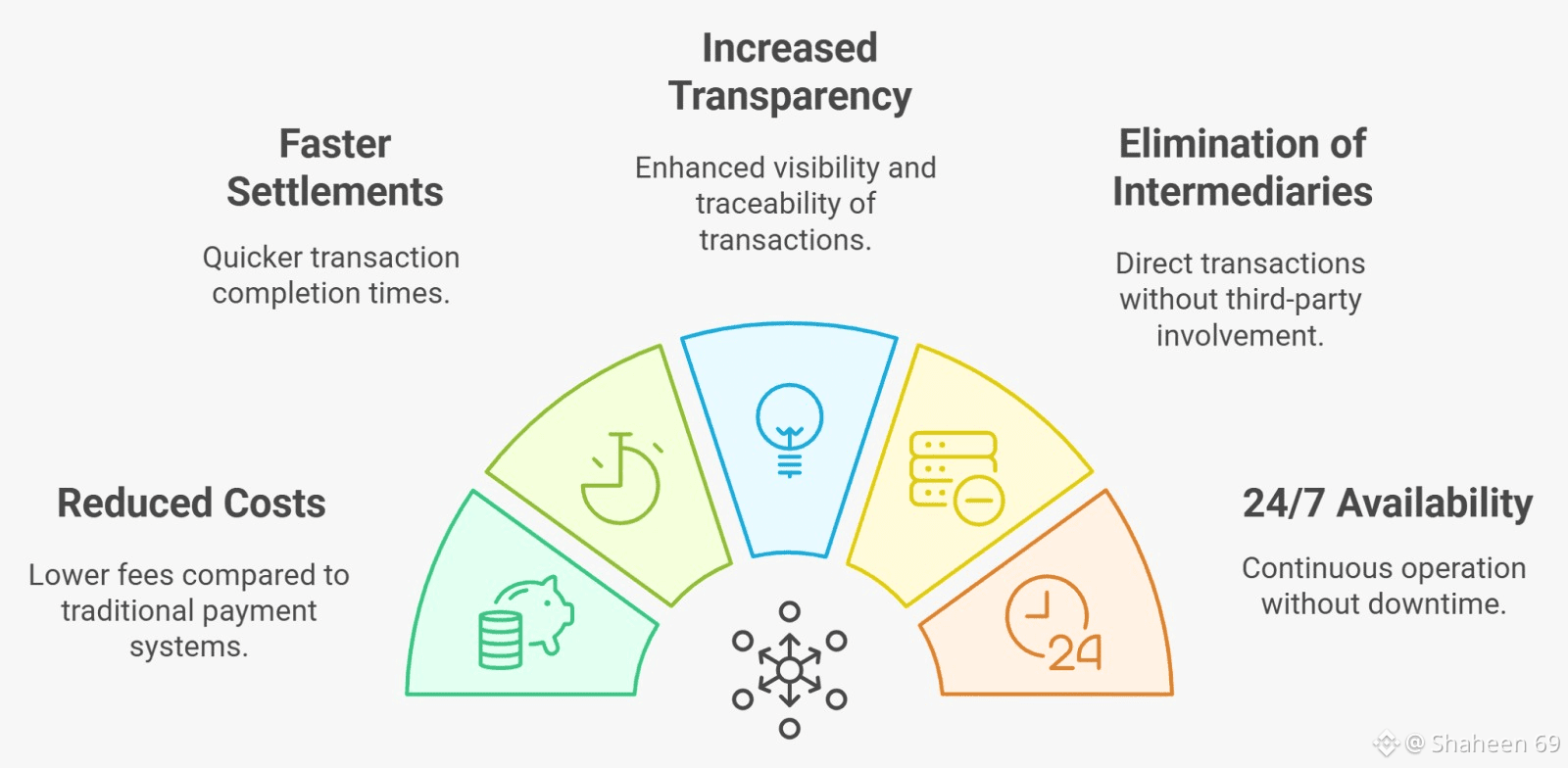

Financial infrastructure must be predictable.

Users and institutions need confidence that:

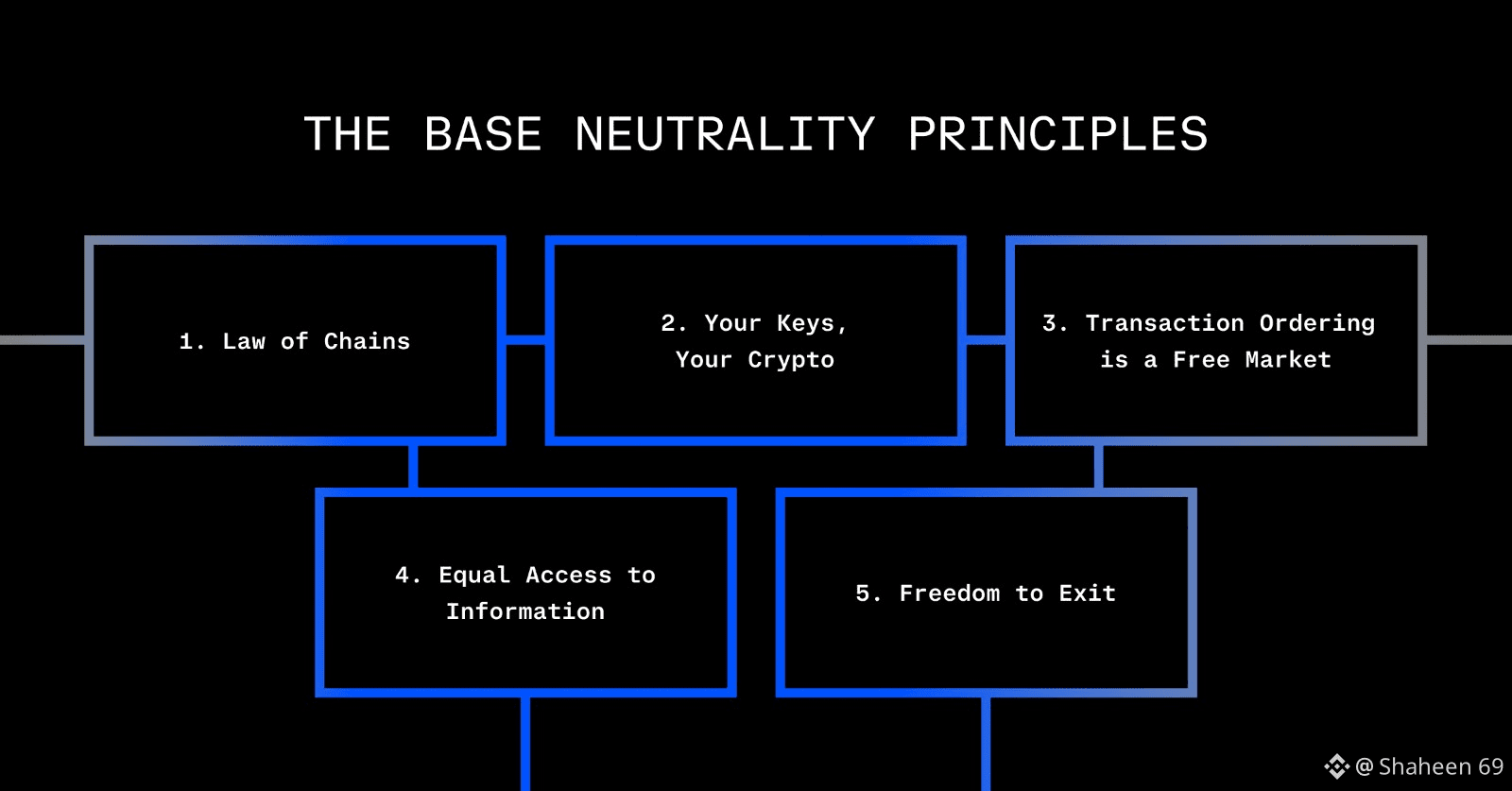

transactions cannot be arbitrarily censored

settlement rules do not change unexpectedly

access to the network cannot be selectively restricted

Payment systems that rely on discretionary control or opaque governance introduce uncertainty. That uncertainty becomes a barrier as transaction volumes increase.

Plasma’s security design is explicitly oriented toward neutrality — reducing the risk that any single actor or small group can influence settlement outcomes.

Why Bitcoin as a Security Anchor Matters 🧱

Bitcoin is widely regarded as the most battle-tested and censorship-resistant blockchain in existence.

By anchoring security assumptions to Bitcoin, Plasma aims to:

strengthen long-term trust guarantees

inherit resilience from a highly decentralized network

reduce reliance on subjective governance decisions

This approach aligns Plasma with infrastructure that prioritizes durability over short-term optimization.

For stablecoin settlement, where confidence compounds over time, this matters far more than raw throughput.

Stablecoins Are Systemically Important 🪙

Stablecoins are no longer niche crypto tools.

They function as:

digital dollars for emerging markets

settlement assets for exchanges

liquidity rails for DeFi

operational capital for businesses

Infrastructure that supports these flows must be designed with systemic importance in mind.

Bitcoin-anchored security helps position Plasma as a settlement layer capable of supporting long-duration, high-value usage — not just experimental activity.

Institutional Trust Is Built on Constraints 🏦

Institutions do not adopt systems because they are flexible.

They adopt systems because they are constrained in predictable ways.

Bitcoin’s security model represents:

limited discretion

clear rules

resistance to unilateral change

By aligning with these principles, Plasma signals that it is not optimizing for rapid narrative cycles, but for long-term financial reliability.

This is especially important for:

payment processors

stablecoin issuers

treasury operations

cross-border settlement providers

Aligning Retail and Institutional Needs 🌍

Retail users care about:

simplicity

speed

low friction

Institutions care about:

neutrality

censorship resistance

predictable settlement

Plasma’s architecture bridges these priorities by combining:

stablecoin-native UX

sub-second finality

Bitcoin-anchored security assumptions

This alignment allows the same infrastructure to serve both everyday users and large-scale financial actors without compromise.

Why This Matters in the Long Run 🧠

As stablecoins continue to integrate into global finance, scrutiny will increase.

Regulators, institutions, and users will all ask the same question:

Can this infrastructure be trusted to behave consistently over time?

Chains that optimize only for performance may struggle under this scrutiny. Chains that optimize for neutrality and reliability are more likely to endure.

Plasma’s Bitcoin-anchored approach reflects an understanding that settlement infrastructure is judged not by novelty, but by resilience.

Final Thought 🌐

The future of stablecoins will not be decided by who is loudest.

It will be decided by which networks provide:

neutral settlement

fast and final execution

confidence under pressure

By anchoring its security assumptions to Bitcoin, Plasma positions itself as infrastructure designed to move real value — quietly, reliably, and at scale.

#Plasma #BitcoinSecurity #StablecoinInfrastructure #CryptoPayments #BlockchainFinance @Plasma $XPL