Introduction

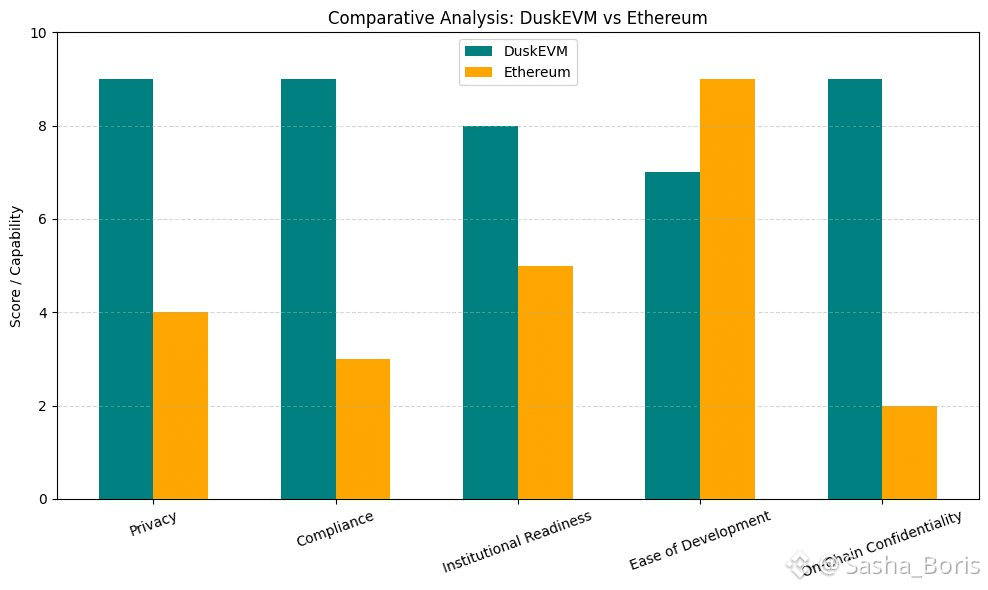

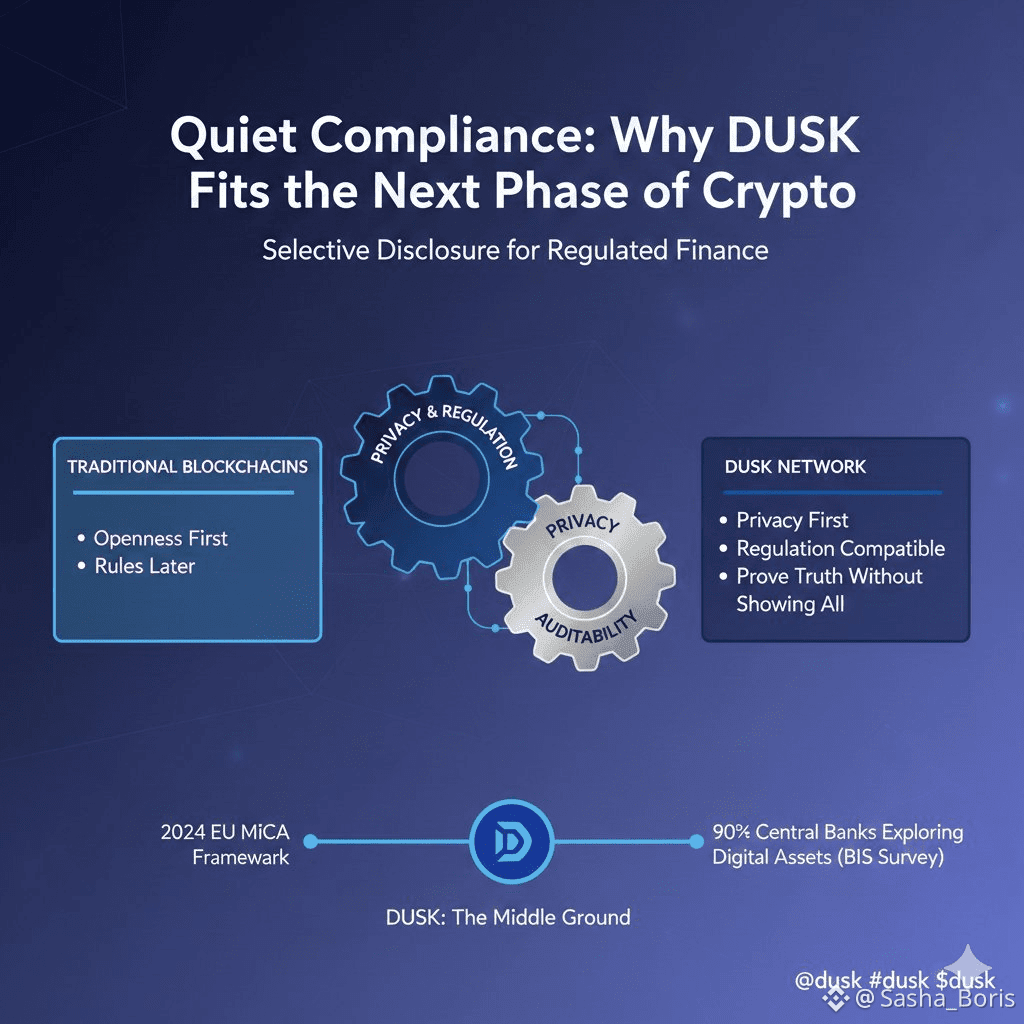

The evolution of blockchain technology has highlighted a fundamental tension: transparency versus privacy. Public blockchains such as Ethereum have demonstrated that decentralized ledgers can manage financial transactions at a global scale. Yet, their inherent transparency—where all transactions are publicly visible—clashes with the requirements of regulated financial markets, where confidentiality, compliance, and operational speed are critical.

Dusk blockchain emerges as a solution to this challenge. Built with institutional finance in mind, Dusk integrates privacy-enhancing zero-knowledge cryptography with a purpose-built consensus mechanism, enabling confidential transactions that comply with regulatory standards. This article provides a deep dive into Dusk’s technology, governance, tokenomics, and market positioning, illustrating how privacy and compliance can coexist in a decentralized system.

The Need for Privacy with Compliance

In traditional finance, confidentiality safeguards positions, prevents front-running, and protects strategic information. Public blockchains, while transparent, compromise this confidentiality because all account balances and transaction histories are visible by default. For regulated entities, this creates operational and reputational risks, as sensitive trading activity becomes publicly accessible.

Dusk addresses this by leveraging Zero-Knowledge Proofs (ZKPs), a cryptographic technique that enables participants to prove compliance with rules—such as anti-money laundering (AML) checks or securities transfer restrictions—without revealing sensitive underlying data. This selective disclosure mechanism allows auditors and regulators to verify compliance while preserving the privacy of market participants.

This approach makes Dusk particularly appealing to financial institutions operating under stringent European regulations such as MiCA and MiFID II, allowing them to maintain Monero-style privacy while remaining fully compliant with legal frameworks.

Technology Overview

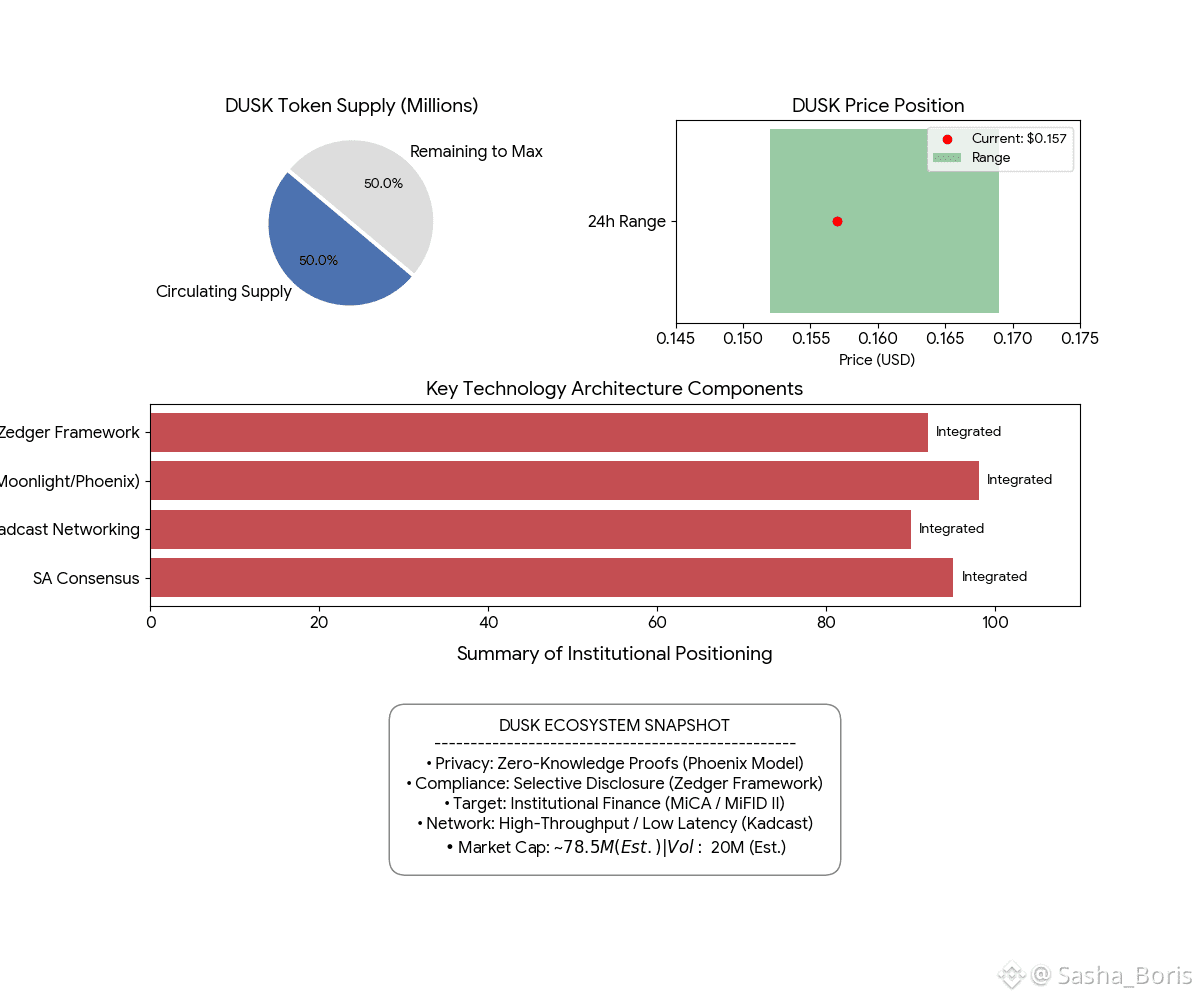

Dusk is built from scratch rather than forking existing blockchain architectures, ensuring its design aligns with the needs of regulated financial markets. Its core technology components include:

Succinct Attestation (SA) Consensus

The SA consensus mechanism is a proof-of-stake protocol designed for speed, security, and finality. Transactions are confirmed in seconds, satisfying high-throughput, low-latency requirements of financial markets. Validators attest blocks using zero-knowledge proofs, ensuring compliance verification without exposing transaction details.

Kadcast Networking

To optimize transaction propagation, Dusk employs Kadcast, a peer-to-peer network protocol inspired by the Kademlia distributed hash table. Kadcast organizes nodes into hierarchical trees, allowing efficient message dissemination across the network. This design reduces congestion, minimizes bandwidth consumption, and enhances network speed and reliability.

Dual Transaction Models

Dusk supports two complementary transaction models:

Moonlight – An account-based model similar to Ethereum. Used for operations where transparency is acceptable or required.

Phoenix – A UTXO-based model that allows obfuscation of transaction amounts and participants while still enabling verification of compliance for authorized auditors.

This dual approach allows Dusk to handle both public and privacy-sensitive activities on the same chain.

Zedger Smart Contract Framework

On top of the transaction layers, Dusk provides Zedger, a smart contract platform designed for confidential securities token offerings (STOs) and corporate actions. Zedger enables on-chain management of dividend distributions, share issuance, private auctions, and other corporate governance functions while preserving confidentiality.

Tokenomics and Incentives

The Dusk network uses DUSK, its native token, to incentivize participants and secure network operations:

Staking and Consensus – Holders of DUSK can participate in SA consensus, produce blocks, and earn transaction fees.

Compliance-aligned Participation – Validators must comply with regulatory rules to participate in consensus, aligning economic incentives with legal compliance.

Transaction Fees – All network fees are paid in DUSK, reinforcing the token’s utility and circulation.

This combination of economic incentives and regulatory alignment discourages malicious behavior, promoting network security and stability.

Market Adoption and Institutional Relevance

Dusk targets real-world, regulated financial markets. Its capabilities include:

Issuance and Redemption of Securities – Facilitating tokenized financial instruments.

Corporate Governance – On-chain dividend distribution, share issuance, and other corporate actions.

Private Auctions and Asset Transfers – Allowing selective disclosure to auditors and regulators without exposing sensitive details publicly.

Unlike pure privacy coins such as Monero, Dusk balances privacy with compliance, enabling regulated institutions to participate confidently. Fast settlement and the Kadcast network architecture reduce congestion and operational risk, making the platform competitive with traditional financial infrastructures.

Privacy and Compliance: Side by Side

Dusk addresses a critical question: Can a public blockchain preserve confidentiality without becoming unusable in regulated finance?

Privacy – Market participants can keep positions, allocations, and counterparties confidential, protecting their strategic advantage.

Compliance – Selective disclosure ensures that regulatory checks, sanctions screening, and jurisdictional rules are verifiable when required.

A practical example illustrates this balance: a mid-sized asset manager issuing tokenized fund shares to qualified investors needs to enforce compliance rules while keeping portfolio positions confidential. On a fully transparent chain, every rebalance is public intelligence; on a fully private chain, regulatory proof may be impossible. Dusk’s selective disclosure model allows validation of compliance without revealing sensitive details, maintaining both market integrity and access.

This privacy + auditability model is also a retention strategy. Institutions are more likely to continue using the platform after the first audit or compliance review if privacy is preserved, reducing churn and promoting long-term adoption.

Market Context and Token Metrics

As of January 27, 2026:

DUSK Price: ~$0.157

24-Hour Range: ~$0.152–$0.169

Market Cap: High tens of millions USD

24-Hour Trading Volume: Low tens of millions USD

Circulating Supply: Just under 500 million tokens

Maximum Supply: 1 billion tokens

These figures are not a price story but a liquidity and survivability context. Traders focus on execution quality and liquidity, while investors consider network retention, adoption, and institutional engagement as leading indicators of durable activity.

Challenges and Risks

While Dusk’s design is promising, there are inherent risks:

Cryptography Complexity – Zero-knowledge proofs must be rigorously audited to prevent vulnerabilities.

Institutional Adoption – The network’s success depends on acceptance by banks, exchanges, and asset managers.

Regulatory Changes – Dusk aligns with European standards today, but evolving global regulations could require adjustments.

Execution and Competition – Established blockchains have liquidity, developer communities, and market recognition, which Dusk must compete against.

Execution matters: real applications, governance, and integration tooling will ultimately determine whether Dusk can meet its ambitious promise.

Conclusion

Dusk represents a thoughtful approach to combining transparency, privacy, and compliance in a blockchain platform designed for institutional finance. Its key differentiators include:

Succinct Attestation Consensus for fast, final, and compliant block validation

Kadcast Networking for efficient and low-congestion communication

Dual Transaction Models (Moonlight & Phoenix) supporting both transparent and confidential operations

Zedger Smart Contracts enabling tokenized corporate actions and confidential securities management

Zero-Knowledge Compliance for regulatory proof without exposing sensitive data

DUSK Tokenomics aligning economic incentives with regulatory compliance and network security

By addressing both privacy and compliance as first-class requirements, Dusk positions itself as a potential foundation for future regulated securities markets. Its design acknowledges the realities of institutional finance: confidential strategies must coexist with verifiable compliance, and retention is as important as adoption.

While risks remain, Dusk demonstrates that privacy and regulation are not mutually exclusive in decentralized systems. Its combination of advanced cryptography, regulatory alignment, and practical financial utility makes it one of the most intriguing projects in the blockchain landscape today.