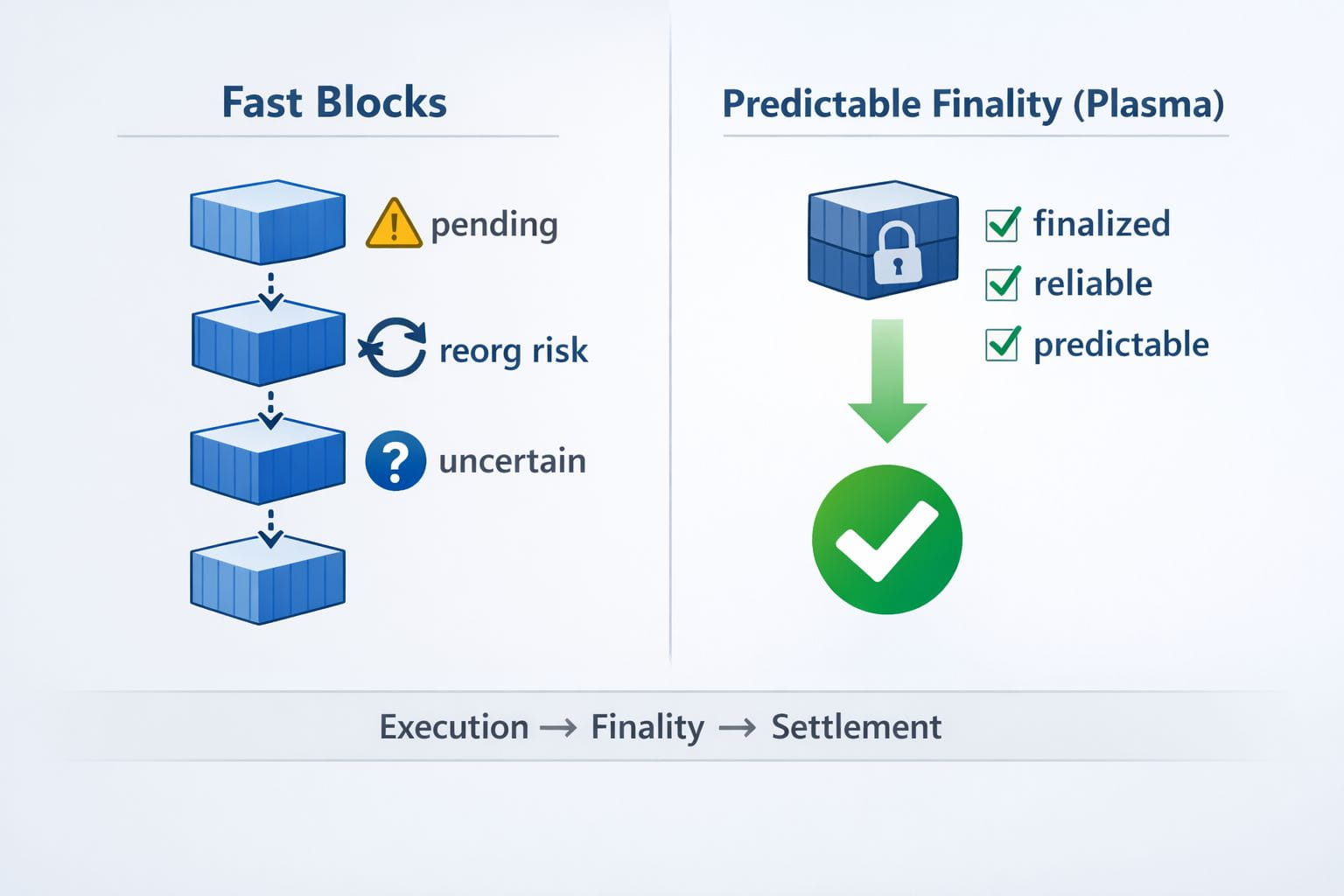

In payments, speed is often misunderstood. Many blockchain networks advertise faster block times as proof of performance, but for real-world payment systems, blocks alone don’t matter. What matters is finality — the point at which a transaction is irreversible and safe to treat as settled.

Institutions, merchants, and payment providers don’t want experiments. They want infrastructure that behaves predictably every time, especially under load. This is where Plasma takes a fundamentally different approach to blockchain design.

Rather than optimizing for raw throughput or speculative use cases, Plasma is built as a stablecoin-first settlement network, with predictable finality as a core requirement.

The Problem with Block-Centric Design

On many blockchains, transactions are considered “confirmed” once they appear in a block. But confirmation is not the same as settlement. Reorganizations, delayed finality, and probabilistic guarantees introduce uncertainty — something financial systems cannot tolerate.

For a retail user, this shows up as “pending” transactions.

For businesses, it shows up as delayed reconciliation and operational risk.

For institutions, it becomes a compliance and risk management problem.

Faster blocks may improve user perception, but they don’t solve settlement certainty.

Plasma’s Finality-First Design

Plasma approaches the problem from the opposite direction. Instead of asking “how fast can we produce blocks?”, it asks “how quickly can a transaction become final and irreversible?”

Plasma achieves this using PlasmaBFT, a Byzantine Fault Tolerant consensus mechanism derived from Fast HotStuff. This consensus model enables validators to reach agreement efficiently through structured voting rounds, allowing transactions to finalize quickly without relying on probabilistic assumptions.

The result is fast, deterministic finality — not just quick execution.

Separation of Execution and Settlement

A key architectural decision in Plasma is separating transaction execution from final settlement.

Transactions execute in an environment optimized specifically for stablecoin payments. This allows the network to handle high volumes without congestion or unpredictable behavior. Final settlement is then secured through cryptographic commitments, ensuring the state cannot be altered once finalized.

This separation reduces systemic risk:

Execution remains efficient under load

Settlement remains secure and verifiable

Network behavior stays consistent even during peak usage

For payment infrastructure, this consistency is more valuable than raw speed.

Real-World Example: Enterprise Treasury Flows

Consider an enterprise managing treasury operations across multiple regions. Funds need to move quickly between entities, often multiple times a day. Delays introduce liquidity risk. Uncertain finality complicates accounting.

On a network with slow or probabilistic finality, treasury teams must wait before acting on transactions. On Plasma, transfers finalize quickly and predictably, allowing balances to be treated as settled almost immediately.

This enables:

Faster internal reconciliation

Reduced counterparty risk

More efficient capital utilization

Why Predictability Beats Peak Throughput

Many chains perform well in benchmarks but struggle when demand spikes. Fee markets become volatile, execution slows, and user experience degrades.

Plasma is designed to avoid this pattern by focusing on payment-grade predictability:

Stablecoin-centric execution

Deterministic behavior under load

Finality that does not depend on waiting for multiple confirmations

This makes Plasma suitable for continuous, high-frequency payment flows — not just occasional transfers.

Why This Design Actually Matters

Predictable finality changes how payments are used in practice. When transactions settle quickly and reliably, businesses can automate workflows, institutions can reduce operational buffers, and users can trust that transfers are truly complete.

This is the difference between a network that looks fast in benchmarks and one that works reliably in production.

Conclusion: Payment Infrastructure Is About Trust

Payment systems succeed when participants don’t have to think about them. Predictable finality allows transactions to be treated as settled without hesitation, reducing friction across users, businesses, and institutions.

Plasma’s finality-first design reflects this reality. By prioritizing settlement certainty over headline block speed, it aligns blockchain infrastructure with how real payment systems actually operate.