Breaking Through the Crypto Noise

In a world flooded with blockchain projects, Plasma stands out by addressing a fundamental problem: the friction of using crypto as actual money. Most users don’t abandon crypto because they dislike the technology—they quit because transactions feel cumbersome. Wallet prompts, unpredictable fees, and delayed confirmations turn small payments into frustrating experiences. Plasma’s mission is simple yet revolutionary: make stablecoins behave like real money, instantly and seamlessly.

A Layer-1 Built for Usability and Speed

Plasma is a Layer-1 blockchain designed for both developers and users. Developers enjoy full Ethereum compatibility, with Solidity contracts and the Reth execution layer slotting in without headaches. Users experience lightning-fast transactions, with block finality under one second and a network capable of processing over 1,000 transactions per second. Already, the network has processed 140 million transactions across 3 million wallet addresses, proving that speed and reliability are not just promises—they’re reality.

Gasless Transfers: Redefining Payments UX

One of Plasma’s standout innovations is gasless USDt transfers. Simple transactions don’t require holding the native token; a paymaster covers backend fees. Even when fees are necessary, they can be paid in stablecoins rather than volatile tokens. Fees are denominated in dollars, eliminating the confusion and risk associated with crypto volatility. For users, this creates a frictionless payment experience, allowing crypto to feel like actual money rather than a technical experiment.

High Security Anchored in Bitcoin

Plasma doesn’t compromise on security. The network is anchored to Bitcoin, offering neutrality and censorship resistance, while its consensus protocol, PlasmaBFT, locks in checkpoints rapidly. Validators operate via Proof-of-Stake, starting with 5% inflation that gradually drops to 3% over time. Combined with EIP-1559-style fee burning, Plasma maintains both economic stability and network security, ensuring a robust foundation for transactions and data storage alike.

A Stablecoin Ecosystem That Works

Plasma supports over 25 stablecoins, including USDt, AUSD, USDS, and rUSD. At launch, the network had $2 billion in liquidity, which soared to $5.5 billion in just one week, and now sits at over $7 billion in inflows. Integrations with platforms like Aave, Stripe Bridge, ZeroHash, Rain, and Oobit make stablecoins usable for everyday payments, lending, and merchant acceptance worldwide. With support for 100+ countries, 100+ currencies, and 200+ payment methods, Plasma is already bridging the gap between crypto and traditional finance.

Cross-Chain Capabilities and Developer Freedom

Plasma is chain-agnostic, enabling seamless cross-chain interactions via the NEAR Intents module and bridges like Stargate. Its root chain and child chain architecture allows specialized chains for payments, swaps, or apps, summarizing activity to the root for security while preserving speed and efficiency. Developers benefit from features like account abstraction and session keys, enabling batch transactions without pre-buying gas, making Plasma an extremely versatile platform for complex financial applications.

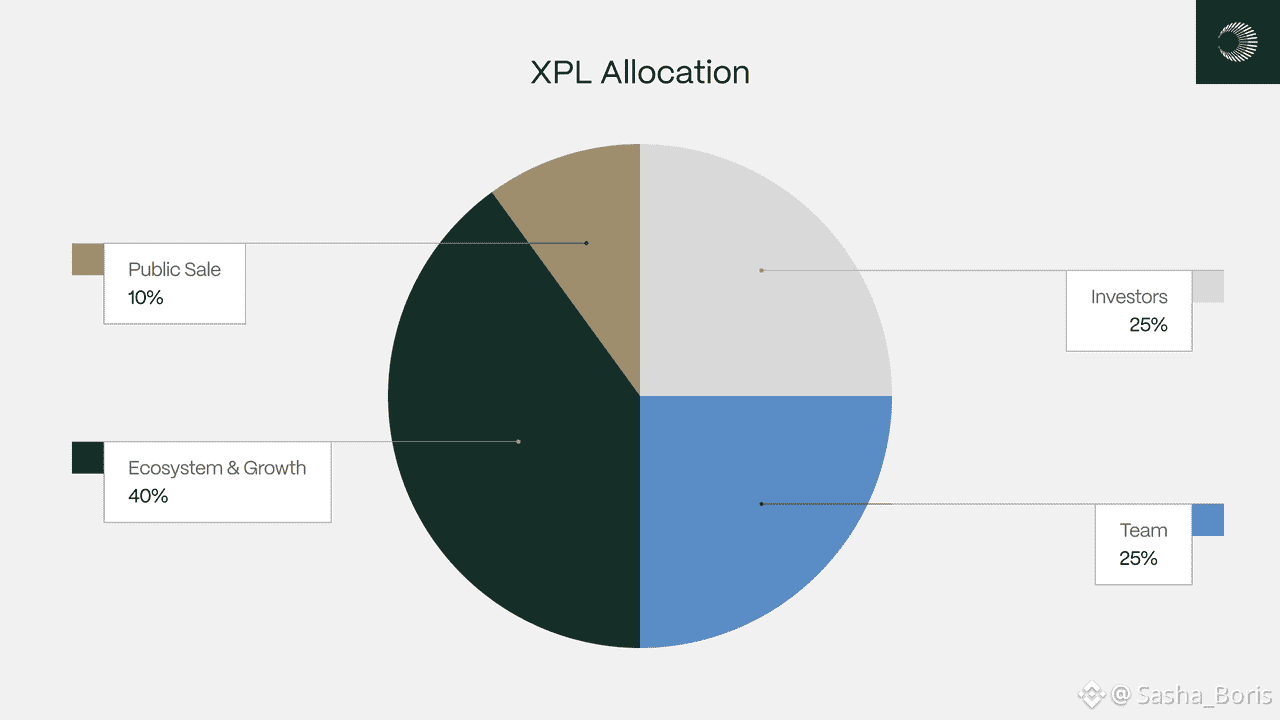

Thoughtful Tokenomics With $XPL

The $XPL token powers the network with a carefully designed economic model. Total supply is capped at 10 billion, with low circulating supply in the early years to minimize selling pressure. Inflation starts at 0% for the first three years to encourage adoption, then gradually rises to a low, stable rate. Validators stake $XPL to secure the network, process payments, and store data. Meanwhile, fee burning offsets inflation, maintaining economic balance. Token allocation prioritizes ecosystem growth, grants, and strategic stakeholders, ensuring long-term sustainability.

Real-World Impact and Adoption

Plasma isn’t just theoretical—it’s already enabling practical financial activity. The network has over 500,000 deployed contracts and 20,000 tokens, with a TVL surpassing $7 billion. Its ecosystem supports freelancers, small businesses, and institutions alike, especially in emerging markets. Maple’s SyrupUSDT lending pool, for example, holds $1.1 billion TVL, primarily from institutional funds. By focusing on retention, reliability, and predictable fees, Plasma ensures that users keep returning, making crypto payments a habit rather than an experiment.

Strategic Backers and Market Validation

Plasma has attracted strong financial and strategic support from Bitfinex, Founders Fund, Framework Ventures, Flow Traders, DRW, Shine Capital, and Tether. Its ICO involved over 1,100 wallets, raising $500 million in USDT and USDC, proving market confidence and credibility. These partnerships not only provide capital but also industry expertise, integration potential, and adoption credibility.

Risks and Considerations

Like any ambitious project, Plasma faces challenges:

Stablecoin dependency: USDt market and regulation may impact adoption

Competition: Other low-fee chains and Ethereum L2s

Validator incentives: Gasless transfers must not compromise security or invite spam

Decentralization: Currently, the team operates validators, though decentralization is planned

Despite these risks, the network’s payments-first design and developer-friendly infrastructure position it to become a cornerstone for crypto-based financial activity.

Why Plasma Is the Future of Crypto Payments

Plasma is redefining what crypto payments can be. It combines speed, security, and scalability with a UX-focused stablecoin experience that feels like real money. With $XPL powering validator incentives, Bitcoin anchoring for neutrality, and an ecosystem integrating DeFi, merchant adoption, and fiat on-ramps, Plasma is more than a blockchain—it’s a payments rail for the modern world.

In a landscape where only 1% of on-chain transfers are true payments, Plasma demonstrates that reducing friction, building trust, and ensuring reliable execution are the keys to mainstream adoption. The chains that truly win won’t just boast fast transactions—they’ll make users forget they’re using crypto, while seamlessly moving money anywhere, anytime.