Most traders stare at candles 📈 including myself.

Few watch funding rates + open interest (OI) in perpetual futures — yet these reveal who’s actually betting, long vs short, and how strong conviction really is.

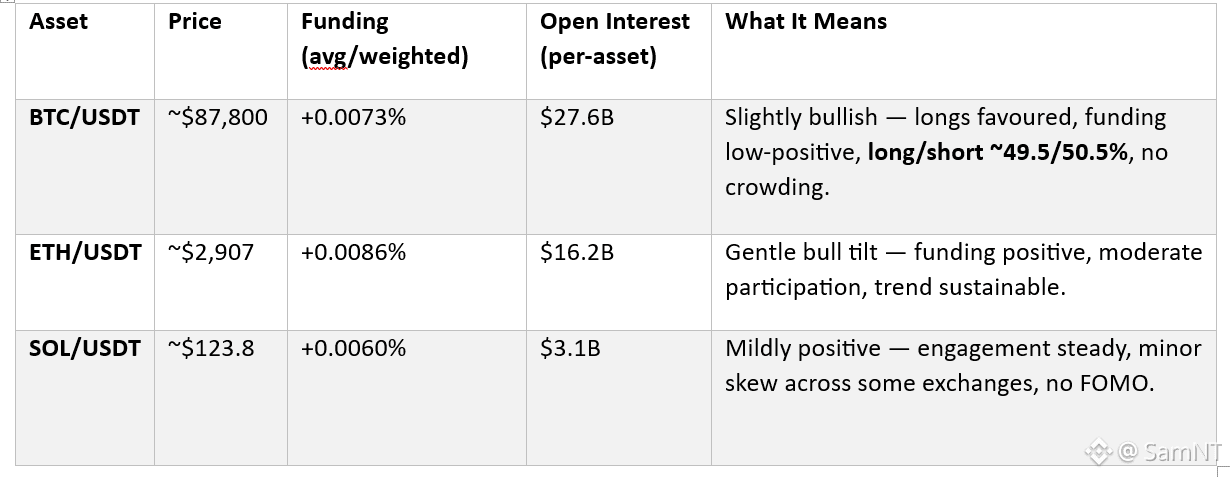

Here’s a live, aggregated snapshot (~Jan 27, 2026,

10:30–11:00 AM GMT) — numbers you can check yourself:

Details in the screenshot [Fig 1]

🔍 What This Really Means

Funding = who pays whom (longs pay shorts if positive, shorts pay longs if negative).

Open Interest = real “skin in the game” per asset — higher OI = more conviction

Long/Short Ratios reveal neutrality or bias — BTC is almost neutral now (~49.5/50.5%)

Funding/OI alone aren’t the full story — consider:

🔍Spot demand can move price without affecting funding.

🔍 Exchanges differ (Binance retail-heavy, Bybit/KuCoin skew possible).

🔍Funding resets every 8 hours — rates lag in sudden moves.

Current signals: Cautious optimism ✅

Mild long bias across majors.

Balanced positioning, no extreme euphoria.

Quiet directional formation — watch funding spikes (>0.03–0.05%) or flips negative for early warnings.

🧠 Pro Edge Tips

Combine: Funding + OI + long/short ratios + spot/on-chain flows.

Track sustained extremes → crowding or reversal signals.

Refresh every 8 hours or use live dashboards/alerts.

💬 Community Question?

Have you ever been fooled by a strong price move, only to

see funding/OI/long-short ratios tell a different story?

Share yout insights in the comment section.

🔗 Live Verification Tools

Coinalyze — Funding, OI, long/short, charts: coinalyze.net

CoinMarketCap Funding Dashboard — exchange averages & heatmaps: coinmarketcap.com

CoinGlass — predicted rates, long/short, per-exchange breakdowns: coinglass.com/FundingRate

Binance Real-Time Funding — official perp funding & OI: generallink.top

Trade the signal — not the noise. Stay sharp 🚀