If you ask a regulator what they need from a financial system, they won’t say “transparency.” They’ll say something more specific: proof. Proof that participants are eligible. Proof that assets settle correctly. Proof that obligations are fulfilled. Proof that markets don’t hide criminal flows or systemic risks. But if you ask institutions what they need, you’ll rarely hear the word “proof.” You’ll hear: privacy. Privacy from competitors. Privacy from counterparties. Privacy from predatory data scrapers. Privacy from informational leakage that distorts price discovery. Between those two demands sits the design space Dusk chose to occupy.

If you ask a regulator what they need from a financial system, they won’t say “transparency.” They’ll say something more specific: proof. Proof that participants are eligible. Proof that assets settle correctly. Proof that obligations are fulfilled. Proof that markets don’t hide criminal flows or systemic risks. But if you ask institutions what they need, you’ll rarely hear the word “proof.” You’ll hear: privacy. Privacy from competitors. Privacy from counterparties. Privacy from predatory data scrapers. Privacy from informational leakage that distorts price discovery. Between those two demands sits the design space Dusk chose to occupy.

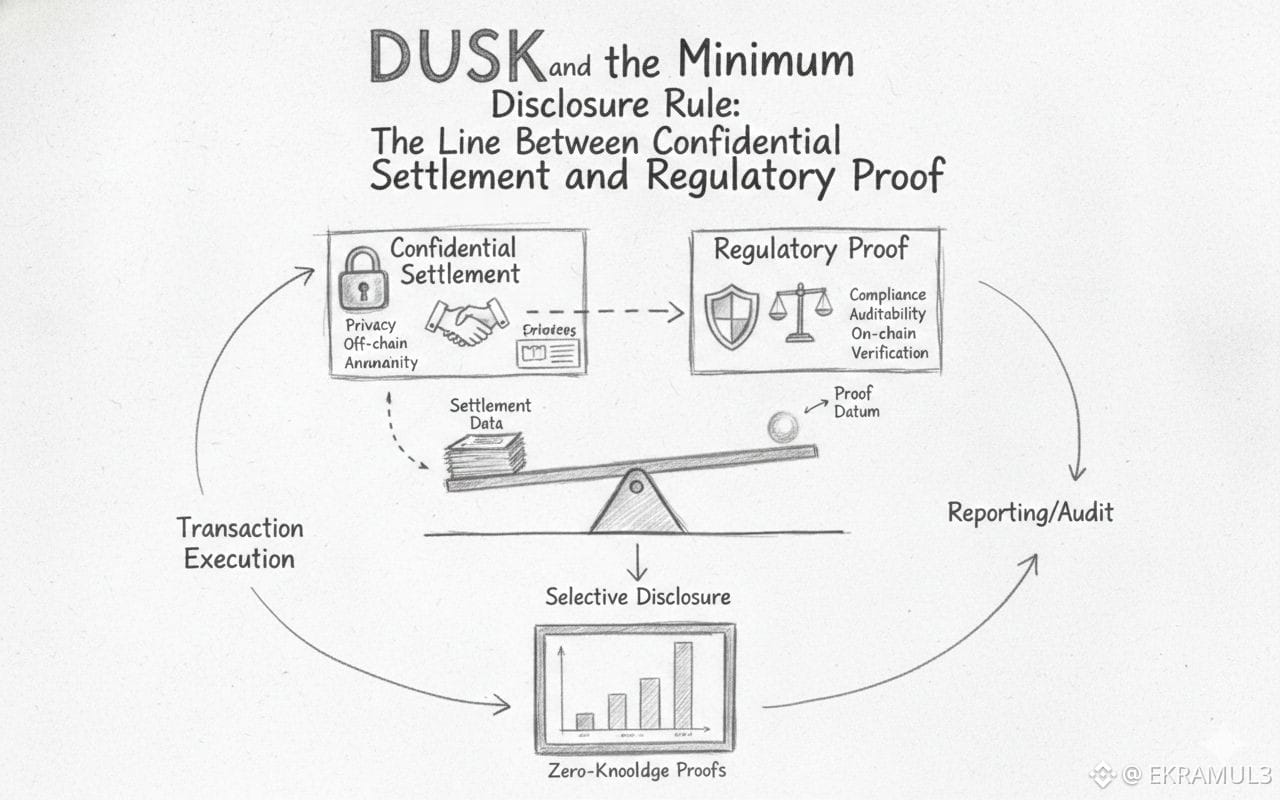

Dusk’s architecture implicitly acknowledges what the crypto industry still refuses to articulate: the real world operates on a minimum disclosure rule. You disclose the smallest amount of information required to prove correctness to the party entitled to verify it and nothing more. Traditional blockchains break this rule by default. They disclose everything to everyone, all the time, regardless of entitlement. That may be philosophically attractive to transparency maximalists, but to regulated finance it is a structural failure mode.

In regulated markets, disclosure is never absolute. It is contextual. A venue sees one slice of information. A clearinghouse sees another. A regulator sees a different one entirely. In some cases, even the issuer of the instrument does not see the full map of ownership changes until settlement reports are aggregated. Public blockchains collapse these layers into a single global visibility domain. Dusk separates them again, using confidentiality at the execution layer and proofs at the compliance layer.

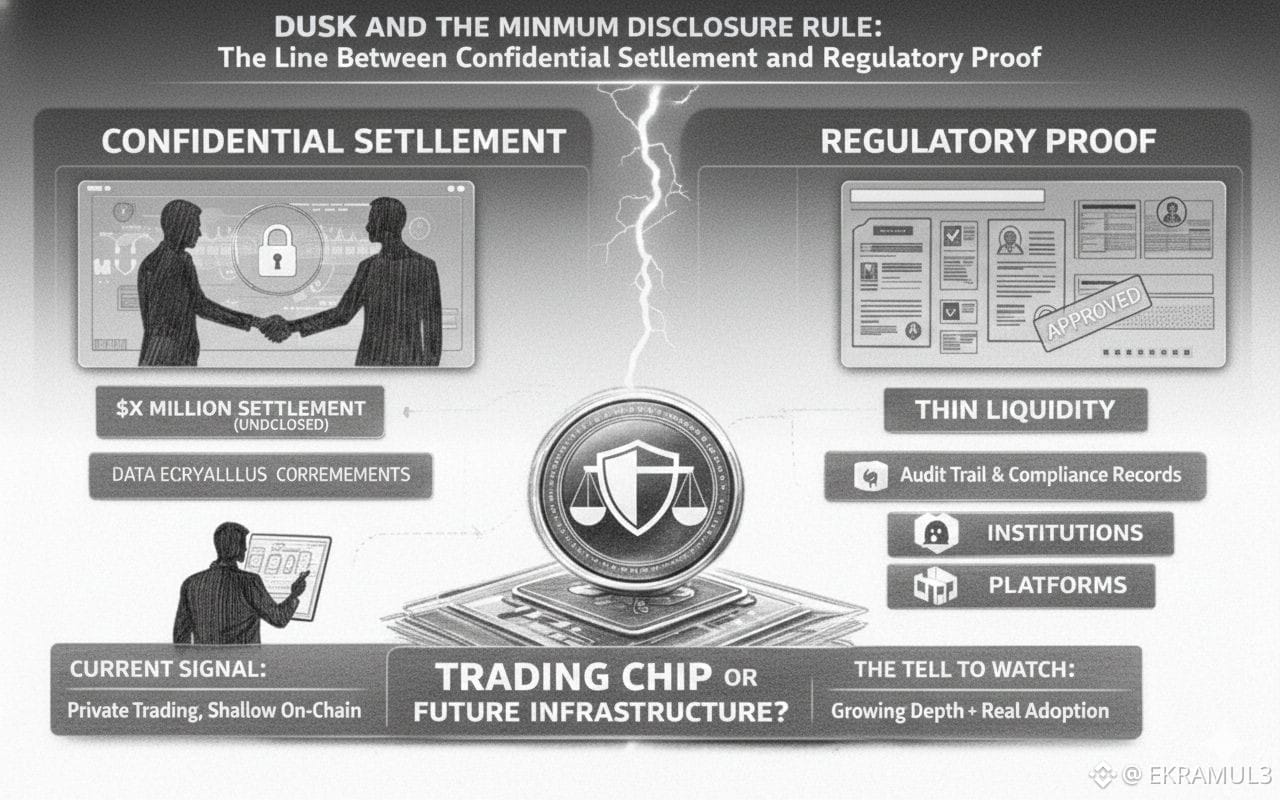

The line Dusk draws is not arbitrary. It comes from market structure itself. There are pieces of data that distort markets when public block sizes, counterparty identities, portfolio reallocations, collateral positions, credit exposures and there are pieces of data that break regulation when private KYC eligibility, sanctions checks, beneficial ownership, suitability, tax reporting, suspicious activity reporting. Dusk’s selective privacy model enforces the idea that what must stay hidden and what must stay provable are not in conflict once the system becomes capable of routing visibility to the correctly entitled observer.

The line Dusk draws is not arbitrary. It comes from market structure itself. There are pieces of data that distort markets when public block sizes, counterparty identities, portfolio reallocations, collateral positions, credit exposures and there are pieces of data that break regulation when private KYC eligibility, sanctions checks, beneficial ownership, suitability, tax reporting, suspicious activity reporting. Dusk’s selective privacy model enforces the idea that what must stay hidden and what must stay provable are not in conflict once the system becomes capable of routing visibility to the correctly entitled observer.

This is why Dusk refuses the typical crypto framing of privacy as an ideological shield. In the Dusk model, privacy is a visibility routing function. It decides who sees what, not whether anyone sees anything. Zero-knowledge proofs enable a new category of settlement event: an event the market can observe without absorbing sensitive metadata, while the regulator can audit without exposing that metadata to competitors, counterparties, or the public. The effect is that both sides get what they need without inheriting the other’s risk profile.

The most interesting engineering choice is that compliance is not layered externally. It is integrated into execution. Transfer restrictions, eligibility checks, supervisory disclosure rights, and settlement correctness are enforced inside the transaction lifecycle, not in the UI, not in middleware, not in off-chain paperwork. When compliance becomes programmable, minimum disclosure becomes enforceable. When compliance is bolted on, minimum disclosure collapses into ad-hoc agreements and unverifiable logs.

And this leads to the uncomfortable conclusion crypto avoids: auditable privacy requires more discipline than transparency. Transparency is noisy but easy. You show everything and let off-chain actors make sense of it. Privacy with compliance requires tight scoping of who gets to know what, when, and how they can prove that they knew it legitimately. This is exactly how securities markets already behave not because they enjoy secrecy, but because they need to preserve competition, prevent signaling risk, and avoid the weaponization of information.

In this light, Dusk stops looking like a “privacy chain” and starts looking like a market infrastructure chain one that understands that the minimum disclosure rule is not a philosophical preference but a structural constraint. It is the rule that allows RWAs, tokenized bonds, tokenized funds, corporate issuance, and compliant stable settlement to exist without turning the entire financial pipeline into public gossip.

In this light, Dusk stops looking like a “privacy chain” and starts looking like a market infrastructure chain one that understands that the minimum disclosure rule is not a philosophical preference but a structural constraint. It is the rule that allows RWAs, tokenized bonds, tokenized funds, corporate issuance, and compliant stable settlement to exist without turning the entire financial pipeline into public gossip.

If Dusk’s model scales, the irony is that the crypto industry will eventually admit the rule was never optional. The first time a tokenized bond reprices because settlement flows leaked to the public, or a fund loses alpha because portfolio shifts became visible mid-rebalance, or a corporate issuance fails because beneficial ownership attribution became public, the market will rediscover the minimum disclosure rule the hard way.

Dusk just chose to implement it before the failure cases arrived.