For years, the crypto narrative has been dominated by the "casino" – a high-stakes whirlwind of meme coins, leverage, and overnight liquidations. While that volatility captures headlines, it masks a much more significant shift happening in the plumbing of global finance.

Plasma (XPL) isn't another playground for speculation. It is a purpose-built Settlement Layer, designed to do for money what the internet did for information: make it instant, invisible, and incredibly cheap.

Moving From "Gambling" to "Settling"

The difference between a speculative asset and a settlement layer is the difference between a poker chip and a wire transfer. You don't want your wire transfer to be "exciting"; you want it to be boringly efficient.

Most blockchains struggle with Gas Friction. To send $100 in USDT on many networks, you often need a separate native token to pay for the "gas." If you don't have it, you're stuck. Plasma removes this barrier by elevating stablecoins to "first-class citizens." On Plasma, the stablecoin is the focus, not the obstacle.

Real-Life Scenario: The Cross-Border Business

Imagine a mid-sized clothing brand in Italy sourcing silk from a supplier in Thailand.

• The Old Way: They use the SWIFT network. It takes 3 to 5 days, loses 3% in intermediary fees, and the exchange rate is a mystery until the money arrives.

• The Plasma Way: The Italian brand sends USDT via Plasma. The transaction settles in sub-seconds. Because Plasma supports gasless transfers and stablecoin-based fees, the brand doesn't need to manage a portfolio of volatile utility tokens. They just move value.

The Architecture of Trust

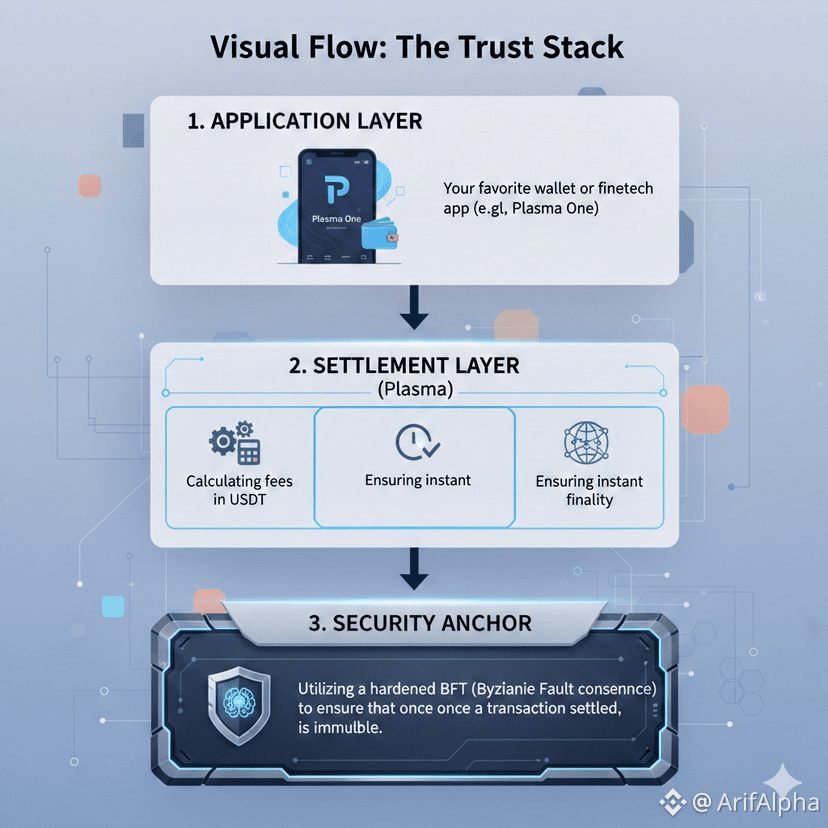

Trust in a "casino" is based on the hope of a win. Trust in "infrastructure" is based on the certainty of the outcome. Plasma achieves this through a specific technical hierarchy:

1. Application Layer: Your favorite wallet or fintech app (e.g., Plasma One).

2. Settlement Layer (Plasma): Where the logic of the stablecoin lives—calculating fees in USDT, ensuring instant finality.

3. Security Anchor: Utilizing a hardened BFT (Byzantine Fault Tolerance) consensus to ensure that once a transaction is settled, it is immutable.

By specializing in payments rather than general-purpose "everything" apps, Plasma avoids the congestion that turns other networks into expensive, slow-moving traffic jams during market volatility.

Why 2026 is the "Scale Leap" Year

As we move through 2026, the data shows a clear trend. With over $13 billion in cross-chain flows and institutional partnerships with giants like Crypto.com for custody, Plasma is no longer in the "experimental" phase. It has become a foundational rail for:

• Corporate Treasuries: Moving idle cash between international subsidiaries without FX slippage.

• Retail Payments: Cryptocurrency debit cards that actually work at the point of sale because the merchant doesn't have to wait 10 minutes for a block confirmation.

• Real-World Assets (RWA): Tokenized bonds and credit lines that require a stable, compliant environment to move from investor to issuer.

The Mindshare Shift

The real innovation of Plasma isn't just the code—it’s the reframing of the user experience. When you use a fintech app, you don’t think about "the database." When you use Plasma, you shouldn't have to think about "the blockchain." You are simply using digital dollars that move at the speed of light.

By stripping away the "casino" elements—the complex gas management, the high-risk liquidity pools, and the speculative noise—Plasma provides a clean, professional environment for the next trillion dollars of global commerce to settle.

What do you think is the biggest "friction point" currently stopping your non-crypto friends from using stablecoins for daily payments? Would you like me to dive deeper into how Plasma handles "Gasless" transactions or perhaps explore the specific institutional custody solutions being used by XPL today?