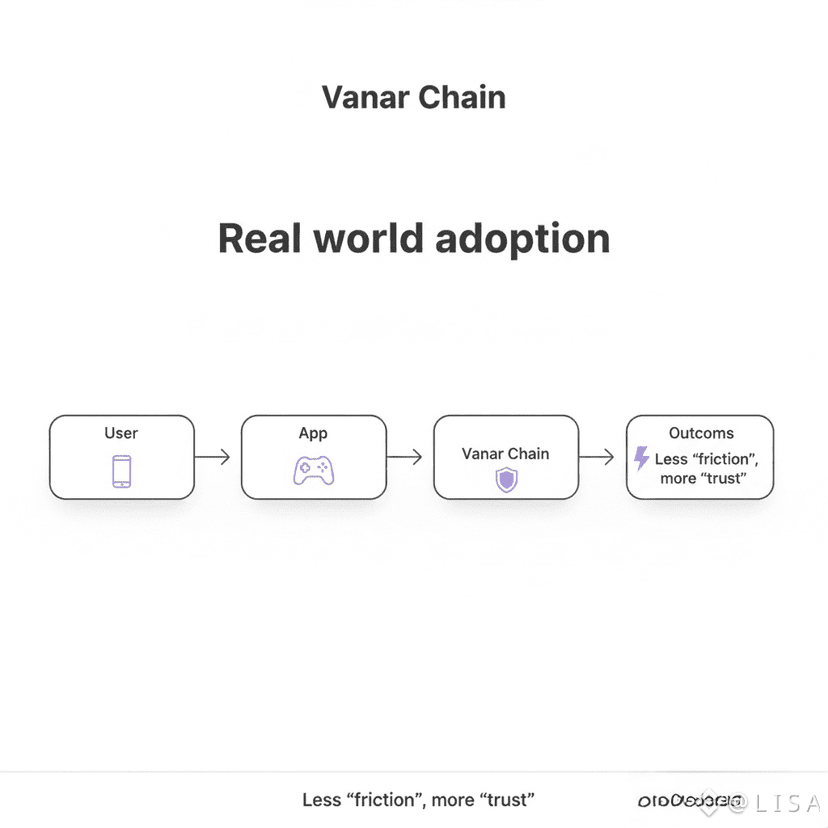

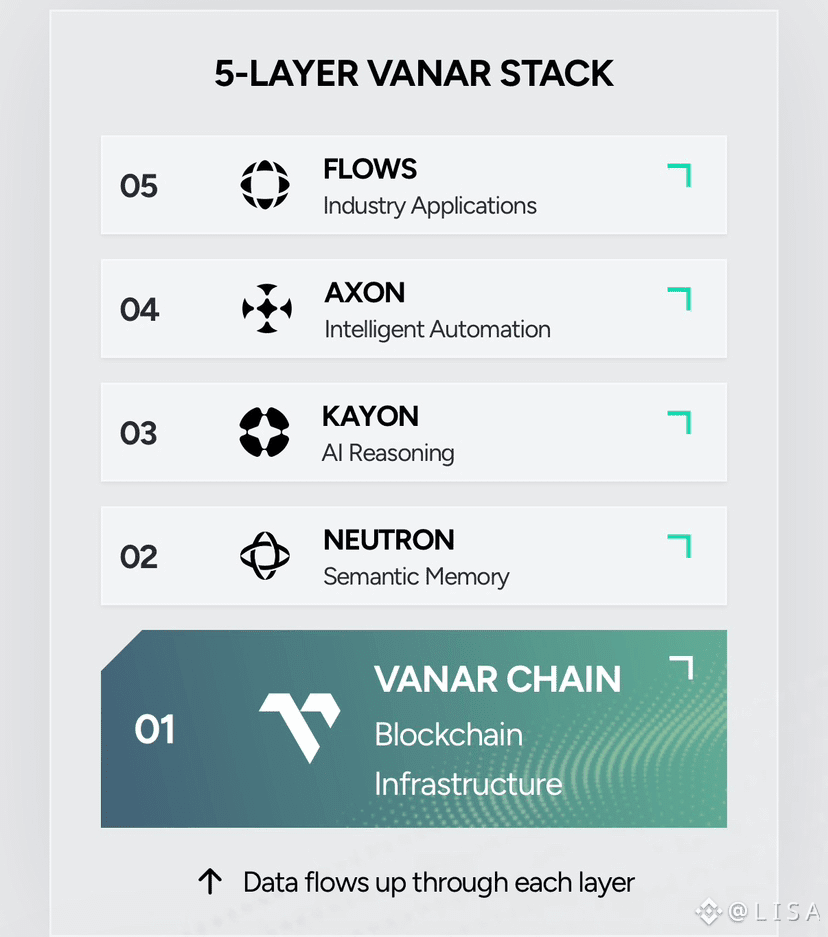

There’s something happening with Vanar Chain that goes beyond the usual blockchain project trajectory. While most Layer 1s focus on being faster or cheaper, Vanar’s built an entire ecosystem around a specific thesis: AI and blockchain need to be integrated at the infrastructure level, not bolted together as an afterthought. Now they’re seeing whether that thesis translates into real developer adoption and working applications.

The network launched its mainnet in 2024, and the numbers tell an interesting story. Nearly twelve million transactions processed. Over 1.5 million unique wallet addresses created. More than a hundred strategic partnerships across different sectors. These aren’t vanity metrics from airdrop campaigns. They’re indicators of actual ecosystem activity.

The Developer Ecosystem Taking Shape

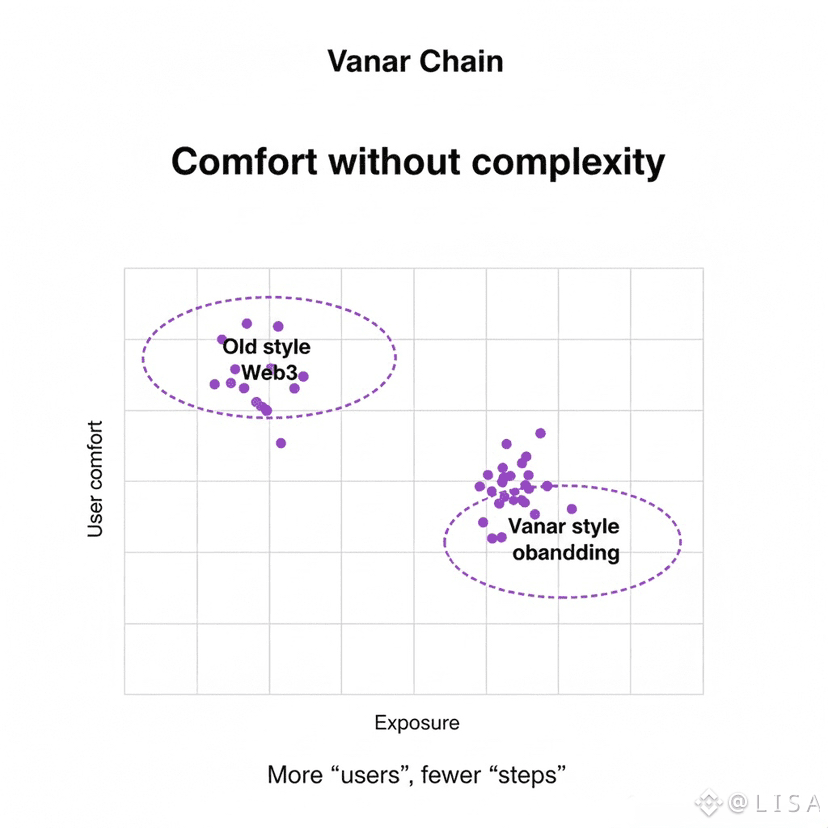

What makes Vanar’s ecosystem different is how they’ve structured support for builders. Transaction costs are fixed at half a cent per transaction. Not variable gas that spikes during network congestion. A flat rate developers can budget around when planning applications. This seemingly small detail changes the economics of what’s viable to build.

They’re running developer programs that go beyond just providing documentation. Vanar Academy offers comprehensive courses from blockchain fundamentals through advanced development. University partnerships bring in fresh talent from traditional computer science programs. Internship programs connect aspiring developers with Vanar’s core team for mentorship and guidance.

They’re running developer programs that go beyond just providing documentation. Vanar Academy offers comprehensive courses from blockchain fundamentals through advanced development. University partnerships bring in fresh talent from traditional computer science programs. Internship programs connect aspiring developers with Vanar’s core team for mentorship and guidance.

The technical infrastructure matters for what developers can actually build. Full EVM compatibility means Ethereum developers can deploy existing contracts without modification. But Vanar adds capabilities other chains don’t have. Neutron provides AI-driven data compression that turns large files into compact Seeds stored directly on-chain. Kayon enables smart contracts to query and reason over that data intelligently.

Gaming developers get APIs for Unity and Unreal Engine that abstract away blockchain complexity. Financial application developers get tools for compliance-ready data storage and verification. AI developers get infrastructure for building agents with persistent memory and on-chain context.

Gaming Projects Going Operational

The gaming sector shows Vanar’s ecosystem approach in action. World of Dypians runs entirely on Vanar infrastructure with over thirty thousand active players. That’s significant scale for Web3 gaming. The game features AI-powered NPCs that respond intelligently to player actions through integration with BNB Chain’s AI capabilities.

Viva Games represents mainstream gaming coming to Vanar. Ten studios worldwide. A hundred million mobile users across their portfolio. Games developed for Disney, Hasbro, Star Wars, Hello Kitty, The Smurfs. These aren’t crypto-native studios experimenting with blockchain. They’re established mobile gaming companies with proven track records integrating Vanar’s technology into existing titles.l

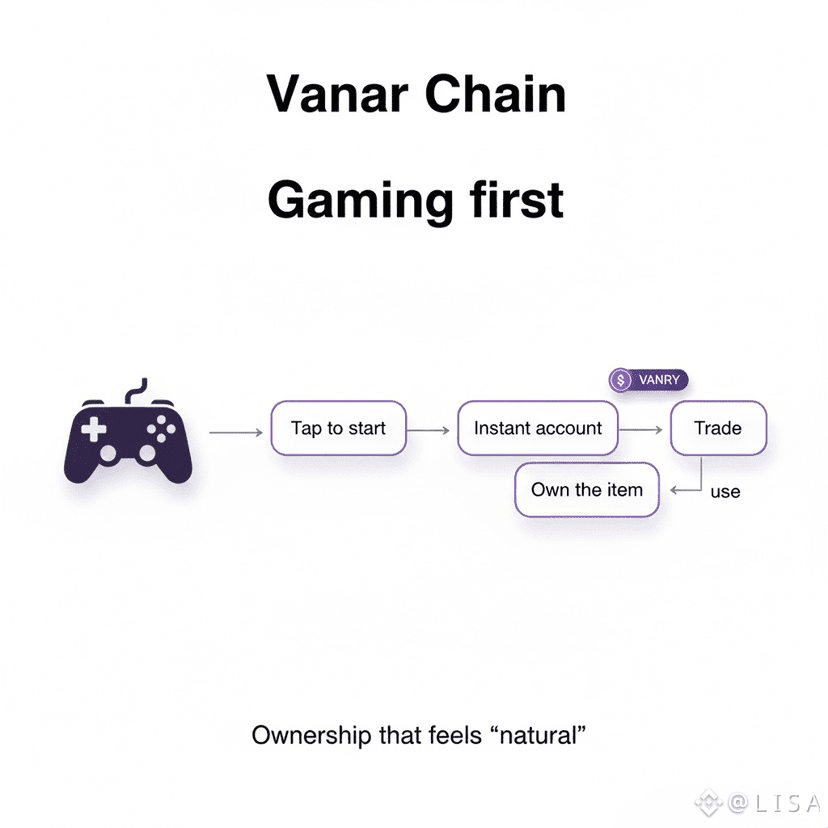

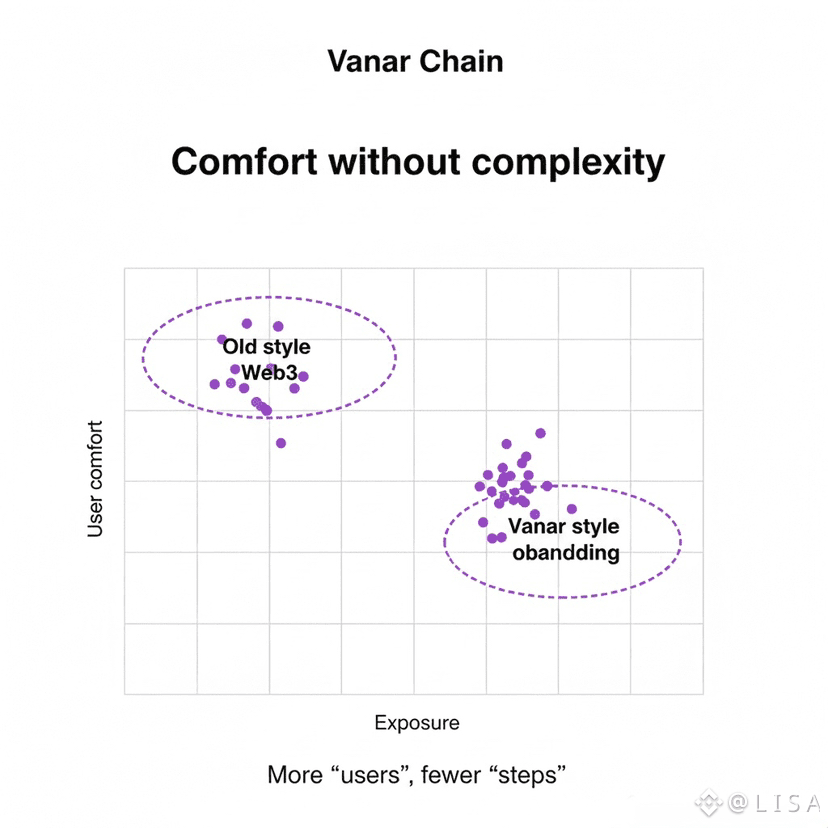

Their integration focuses on Vanar’s Single Sign-On solution. Players don’t need to understand wallets or private keys. The Web3 functionality works behind the scenes while the gaming experience remains familiar. This approach targets mass adoption rather than blockchain enthusiasts.

Farcana brought tactical shooter gaming with AI-driven elements. PvP integrated as a social platform connecting gamers across over a hundred titles. Real Ape Arcade, Trinity DAO, NitroDome, GALXE, and SWAYE all joined the ecosystem with different gaming experiences. Each project leverages Vanar’s infrastructure in specific ways suited to their use cases.

The gaming focus makes sense strategically. Gamers represent mainstream users who don’t care about blockchain technology but do care about ownership, fair economies, and compelling experiences. If Vanar can deliver those experiences while running on-chain, it proves the infrastructure works at consumer scale.

AI Applications Finding Product-Market Fit

The AI-native infrastructure is attracting projects that couldn’t exist on other chains. Griffin AI built decentralized networks for monetizing AI agents with on-chain identity and reputation systems. These agents need persistent memory and verifiable interactions, exactly what Vanar’s architecture provides.

ChatXBT developed tools for protocol engagement using AI. Their XBT-Core and Lumi products help users interact with blockchain protocols and grow social media presence through intelligent automation. Ringfence AI created protocols for users to monetize their own data autonomously. The agentic approach puts users in control of how their information gets used and compensated.

Zebec AI launched their Smart Payment Layer on Vanar specifically for the AI-driven financial features. Fraud detection, privacy solutions, AML compliance, all powered by AI and integrated at the blockchain level. Traditional payment systems handle these through centralized databases. Zebec’s doing it on-chain with intelligent contract logic.

The myNeutron product launched in October 2025 as the first decentralized AI memory layer. It transforms knowledge into Seeds that work across different AI platforms. Users created over fifteen thousand Seeds during early access testing. The public launch added features based on real user feedback: direct chat with stored knowledge, Model Context Protocol integration, Chrome extension improvements, referral programs.

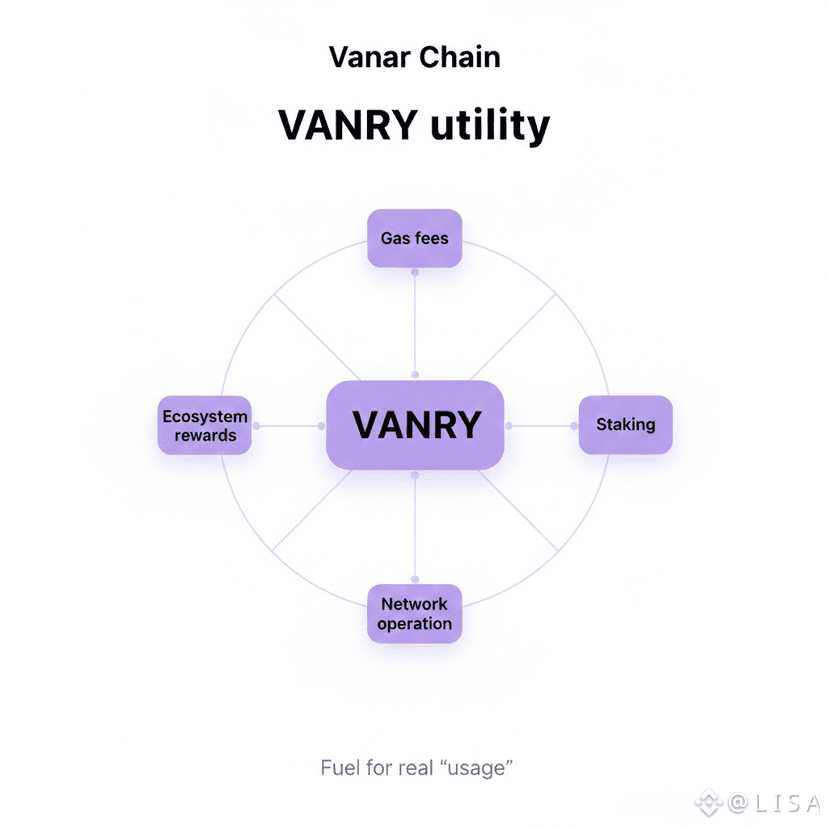

They’re moving myNeutron to a subscription model starting 2026. This creates recurring revenue tied to actual product usage. Subscriptions require VANRY tokens, which get burned during various operations. More usage means more tokens permanently removed from circulation. It’s an attempt at building a sustainable token economy based on utility rather than speculation.

Financial Infrastructure Getting Serious

PayFi applications represent another major focus area. Financial institutions need blockchain solutions but have specific requirements around compliance, data verification, and privacy. Vanar’s architecture addresses these through on-chain document storage with queryable capabilities.

The Neutron compression system handles financial documents by turning them into Seeds stored directly on-chain. No external IPFS links that might break. No centralized storage that creates dependencies. Documents live on Vanar’s blockchain where they’re verifiable, permanent, and queryable through Kayon’s reasoning engine.

This matters for tokenizing real-world assets. Property tokenization requires deeds, inspection reports, title histories, all verifiable for compliance. Securities need documentation that auditors can access while maintaining privacy for competitive information. Traditional approaches struggle with these requirements. Vanar’s architecture handles them natively.

Several DeFi protocols deployed on Vanar taking advantage of the infrastructure. AuriSwap launched as a decentralized exchange built specifically for the ecosystem. The platform uses Vanar exclusively at launch, optimizing for the chain’s specific capabilities rather than trying to be multi-chain.

The Partnership Network

Vanar’s assembled over a hundred strategic partnerships, but the quality matters more than quantity. NVIDIA joined the ecosystem providing access to CUDA, Tensor, Omniverse, and GameWorks technologies. This gives developers building AI and gaming applications on Vanar access to industry-leading tools and infrastructure.

Google Cloud powers the validator infrastructure with renewable energy data centers. BCW Group hosts validator nodes using Google’s green energy, processing over sixteen billion dollars in fiat-to-crypto transactions across their operations. This partnership handles both infrastructure and environmental sustainability.

Regional partnerships expand Vanar’s reach into specific markets. Yellow Card integrated for African stablecoin on and off-ramps. BiLira connects Turkish users with lira-pegged stablecoins. These aren’t just names in press releases. They’re operational integrations handling real transaction volume in markets where Vanar’s infrastructure solves actual problems.

DeFi partnerships include Curve, Ethena, and other established protocols deploying on Vanar. Developer tool companies like ThirdWeb provide SDKs and APIs that make building on Vanar more accessible. Galxe brings community engagement and rewards systems. Each partnership serves specific functions in building a complete ecosystem.

The Fixed Cost Advantage

One underrated aspect of Vanar’s design is the fixed transaction fee model. While other chains deal with volatile gas prices that make budgeting impossible, Vanar charges a predictable half cent per transaction. This consistency matters enormously for commercial applications.

Imagine running a gaming marketplace where players buy and sell items. On chains with variable gas, you can’t guarantee what a transaction costs. Sometimes it’s reasonable, sometimes network congestion makes small transactions uneconomical. You’re constantly adjusting and trying to time transactions.

On Vanar, costs are predictable. A developer building a micropayment application knows exactly what infrastructure will cost at different usage levels. A gaming company can budget operational expenses without gambling on network conditions. This reliability enables business models that don’t work on chains with unpredictable costs.

The infrastructure runs on Google’s underwater high-speed network using renewable energy. Validators stake VANRY tokens to secure the network through a delegated proof-of-stake mechanism. Block times average three seconds with high throughput optimized for application needs rather than pure speed.

Developer Tools and Resources

Developer Tools and Resources

Vanar’s approach to developer support goes beyond just providing APIs and documentation. The Vanar Hub offers a seamless environment for engaging with core ecosystem features. Developers get access to complete SDKs for JavaScript, Python, and Rust with extensive documentation and example code.

The Academy provides structured learning paths from beginner through advanced levels. Courses cover blockchain fundamentals, smart contract development, integrating AI capabilities, building gaming applications, and deploying DeFi protocols. Live webinars and events supplement the coursework with direct access to experts.

Hackathons create opportunities for developers to build quickly and get exposure. Winners get support from Vanar’s VC network for funding. Exceptional products get highlighted to the partner ecosystem. The goal is reducing friction at every stage from learning to building to launching to scaling.

The gaming APIs for Unity and Unreal Engine handle blockchain interactions behind the scenes. Developers familiar with these game engines can add Web3 functionality without becoming blockchain experts. Social wallets, NFT minting, marketplace integration, quest systems, all accessible through familiar development tools.

Real Products Shipping Now

The ecosystem’s moved beyond testnet experimentation into operational applications. World of Dypians processes real gameplay with thousands of daily active users. Viva Games integrates Vanar into mobile titles with millions of downloads. AuriSwap handles DEX transactions on the mainnet.

myNeutron launched publicly with users creating Seeds and storing knowledge across AI platforms. The subscription model rolling out creates a direct revenue stream tied to product utility. Either enough people find value to pay for it, or the model needs adjustment. The market gives clear feedback.

Gaming titles run fully on-chain with AI-driven NPCs and player-owned economies. Financial applications process payments with AI-powered fraud detection and compliance. Developer tools enable building applications that weren’t economically viable on other chains due to cost structures.

The ecosystem’s growing through developer adoption rather than token price hype. Projects choose Vanar for technical reasons: fixed costs, AI infrastructure, data storage capabilities, gaming APIs. They’re building and shipping products that users actually interact with.

What’s Next For The Ecosystem

Looking ahead, Vanar’s roadmap focuses on maturing the AI-native stack. Neutron and Kayon are operational but continue developing with more sophisticated capabilities. Advanced AI tool subscriptions launching in early 2026 will test whether the utility-based token model works at scale.

Developer programs are expanding with more university partnerships and regional initiatives. The fellowship program with Google Cloud in Pakistan targets markets with high concentrations of Web3 talent. Similar programs may launch in other regions with strong developer communities.

Gaming partnerships continue growing with more mainstream studios evaluating integration. The single sign-on approach that makes blockchain invisible to players could unlock mass adoption if execution delivers compelling experiences. Financial applications are exploring more sophisticated use cases for on-chain AI and data storage.

The success ultimately depends on whether developers keep choosing Vanar for new projects and whether existing applications retain users. Ecosystem growth is measurable through transaction volume, active addresses, developer activity, and application launches. These metrics will show if the AI-native infrastructure thesis actually works.

The Broader Picture

Vanar represents a specific bet on how AI and blockchain should integrate. Rather than running AI applications on top of general-purpose chains, they’ve embedded AI capabilities into the infrastructure itself. Whether this approach wins remains an open question, but the ecosystem taking shape shows developers finding value in the architecture.

The combination of fixed costs, AI infrastructure, gaming APIs, and financial tooling attracts projects that couldn’t build effectively elsewhere. The support systems from Academy to partnerships to funding access lower barriers for developers entering Web3.

As the ecosystem matures, it’ll either prove this architectural approach enables new categories of applications or it’ll show that general-purpose chains with AI added later work just as well. Either outcome provides valuable data for the broader blockchain space trying to figure out how AI and decentralization fit together.

For now, Vanar’s ecosystem is growing with real projects shipping real products used by real people. That’s a better position than many blockchain projects ever reach. Whether it scales from thousands to millions of users depends on execution across gaming, AI applications, financial services, and developer experience. The foundation exists. Now it’s about building on it consistently.