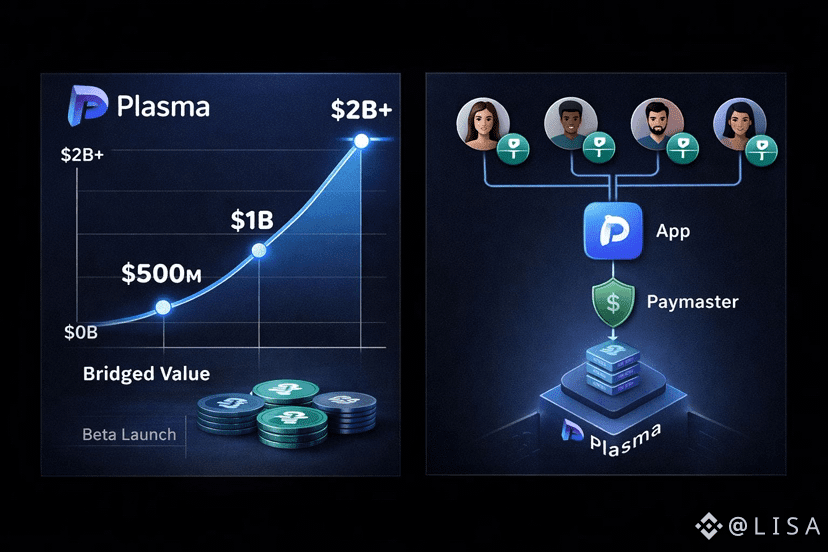

Three weeks after launching mainnet, Plasma held eight billion dollars in net deposits. That number tells a story about more than just hype or speculation. It reveals something about how blockchain infrastructure gets built when teams prioritize interoperability and ecosystem partnerships from day one rather than treating them as afterthoughts.

Most blockchains launch their mainnet first, then spend months or years trying to connect with other networks and onboard applications. Plasma flipped this sequence. They built the bridges before opening the gates. When mainnet went live on September 25, 2025, users didn’t face the usual cold start problem of empty markets and isolated liquidity. The infrastructure was already there, waiting.

The LayerZero Foundation

The LayerZero Foundation

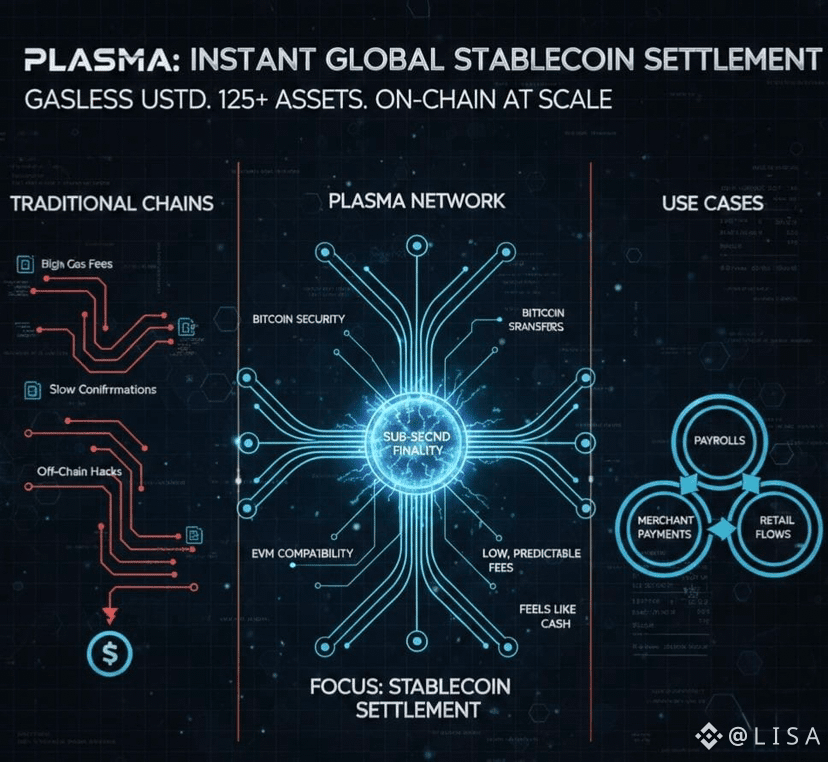

The partnership with LayerZero wasn’t just another integration announcement. It formed the foundational layer enabling Plasma’s launch strategy. LayerZero provides the messaging protocol that lets different blockchains communicate securely. For Plasma, this meant assets could flow seamlessly from established chains like Ethereum, Arbitrum, Optimism, and Base without users dealing with wrapped tokens or complex bridging workflows.

Stargate served as Plasma’s official bridge from launch day. Users moving assets encountered zero slippage on transfers. The interface connected directly from both Plasma’s frontend and partner applications like Aave. There was no hunting through different sites or tutorials. Click to deposit, instant transfer, funds arrive on Plasma ready to use.

The technical implementation relied on the Omnichain Fungible Token standard that LayerZero developed. Major asset issuers launched their tokens as OFTs, giving them native Plasma support from block one. USDT0, USDe, USDai, weETH, XPL, XAUT0, USR, ENA, PENDLE, and AUSD0 all worked immediately. No waiting for bridge contracts to get audited weeks after launch. No period where only a few assets trade while others remain stuck on other chains.

Fast Swaps powered by Aori let users swap into Plasma-native assets like XPL from multiple chains in under a second. The experience felt instant because the infrastructure handled complexity behind the scenes. Users saw a simple interface while the protocol coordinated cross-chain messaging, liquidity routing, and settlement automatically.

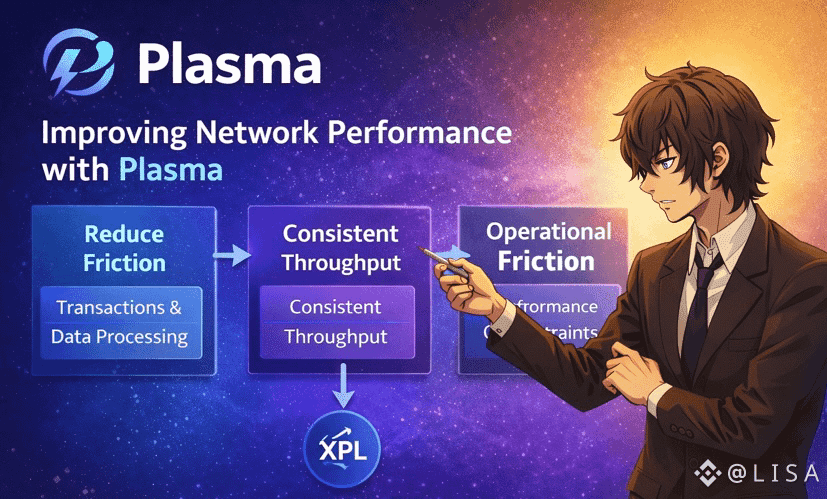

This infrastructure enabled what Plasma calls their liquidity flywheel. Assets bridge in easily, find immediate utility in DeFi protocols, generate yield that attracts more deposits, which creates deeper markets that attract more protocols. The cycle accelerates when friction stays low at every step.

Pre-Planned Liquidity Commitments

Pre-Planned Liquidity Commitments

While technical infrastructure mattered enormously, Plasma also secured concrete capital commitments before launch. These weren’t promises or projections. Partners locked real funds that would flow to Plasma on day one. The approach removed the chicken-and-egg problem that plagues most blockchain launches where users wait for liquidity while liquidity waits for users.

Ether.fi committed over five hundred million dollars in weETH before Plasma even launched. Their restaking application ranks as the sixth largest dApp by total value locked across all of crypto. Having them ready to deploy immediately sent a signal about institutional confidence. When mainnet went live, weETH bridged over and found markets waiting through Stargate integration.

Within a month, Plasma held the largest weETH supply across all blockchains. Roughly six hundred million dollars locked in smart contracts on a network that was weeks old. That kind of migration doesn’t happen without deliberate partnership development and infrastructure that actually works from launch.

Ethena brought their synthetic dollar protocol USDe to Plasma as a day-one asset using the OFT standard. Unlike weETH which had pre-planned liquidity, Ethena’s deployment relied on organic growth driven by incentives after launch. The strategy worked. Plasma quickly became Ethena’s largest market outside Ethereum mainnet. The combination of zero-fee transfers and integrated DeFi protocols created natural demand for dollar-denominated assets.

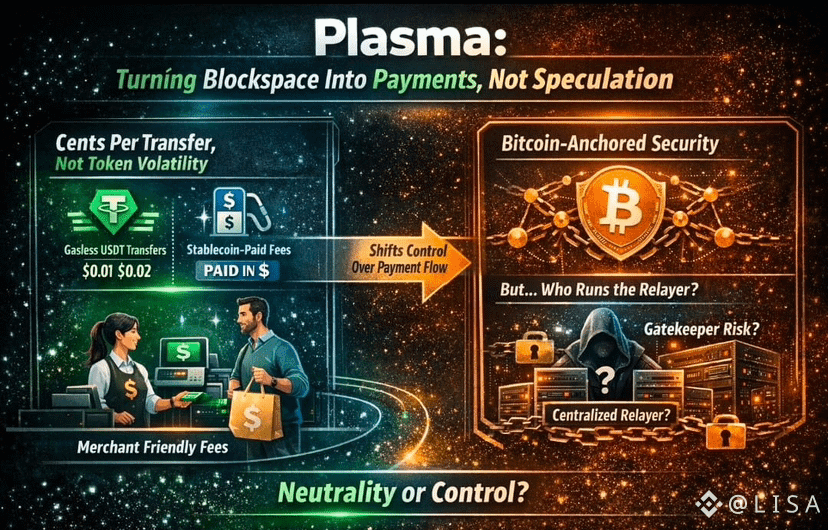

USDT0 proved critical as the primary medium of exchange. Tether’s omnichain version of USDT launched with five billion dollars in initial supply across the Plasma ecosystem. The asset became the backbone for automated market makers, lending markets, and payment applications. USDT0’s interoperability through LayerZero enabled seamless movement of billions in liquidity with near-instant settlement.

Lorenzo, one of USDT0’s co-founders, explained the significance: the product laid the foundation that makes Plasma possible and demonstrates truly unified digital liquidity that works fast, scales effectively, and remains chain-agnostic. The approach treats liquidity as a shared resource rather than isolated pools trapped on individual networks.

Post-launch incentives accelerated adoption further. USDT0 surged to seven billion dollars in deployed supply, making it the fourth-largest stablecoin across connected blockchains. The rapid growth validated the thesis that reducing friction for stablecoin transfers unleashes pent-up demand for efficient digital dollar infrastructure.

Aave’s Strategic Deployment

Aave launched on Plasma with support for multiple key assets including USDT, USDe, sUSDe, Tether Gold, WETH, and weETH. The lending protocol set supply and borrow caps through governance proposals, with risk analysis from Chaos Labs and LlamaRisk. Chainlink provided price feeds ensuring accurate valuations for collateral and borrowed positions.

The deployment went beyond basic lending markets. Plasma introduced Liquid Leverage markets with five hundred million dollars capacity for USDe and four hundred fifty million for sUSDe. These enable leveraged stablecoin strategies directly on-chain without the complex position management traditional leveraged trading requires.

For Aave, outsourcing interoperability to LayerZero while focusing on incentive design proved effective. The industry-leading lending market saw immediate adoption on Plasma. Linking directly from Aave’s interface on launch day made deposits frictionless. Users knew exactly where to go with a single click.

The combination of Plasma’s zero-fee USDT transfers and Aave’s established lending infrastructure created new possibilities for capital efficiency. Stablecoin holders could deploy funds earning yield while maintaining liquidity to seize opportunities as they emerged. The tight integration between base layer and application layer made strategies viable that wouldn’t work with high transaction costs.

The combination of Plasma’s zero-fee USDT transfers and Aave’s established lending infrastructure created new possibilities for capital efficiency. Stablecoin holders could deploy funds earning yield while maintaining liquidity to seize opportunities as they emerged. The tight integration between base layer and application layer made strategies viable that wouldn’t work with high transaction costs.

Ethena integrated with Aave markets offering one billion dollars of combined capacity for USDe and sUSDe, with Binance providing liquidity support. Depositors earn Ethena Points while leveraged strategies claim additional rewards through Merkl. The layered incentive structure compensates different participants for different contributions to ecosystem growth.

Building The Developer Ecosystem

Beyond the major DeFi protocols, Plasma focused on making development accessible. Full EVM compatibility means developers working with Ethereum tools face no learning curve. Foundry, Hardhat, and other familiar frameworks work directly. Smart contracts deploy without modification. Wallets like MetaMask connect seamlessly.

The fixed transaction cost model removes a major planning headache. Developers building consumer applications need predictable costs. On chains with variable gas, estimating operational expenses becomes guesswork. Network congestion can make features economically unviable overnight. Plasma charges a flat fee enabling accurate budget projections.

Documentation provides ready-to-use parameters for MetaMask integration including RPC endpoints, chain IDs, and block explorer links. OKX Wallet announced testnet integration giving developers and users familiar environments for testing applications before mainnet deployment. The barrier to entry stays low throughout the development cycle.

Plasma’s architecture implements protocol-level paymasters allowing applications to sponsor gas fees for users. Someone transacting on Plasma can pay fees in whitelisted stablecoins without holding the native XPL token. This abstracts blockchain complexity for end users who just want applications that work.

For example, minting an NFT only requires USDT in the user’s wallet. No acquiring a separate gas token first. No explaining why they need two different assets to complete one transaction. The technical complexity exists but gets handled invisibly. From the user perspective, it works like any Web2 application.

Cross-chain connectors launched with clear status indicators. LayerZero support went live on testnet giving developers time to integrate and test before mainnet. The infrastructure treats interoperability as a core feature rather than an optional add-on. Applications can assume assets move between chains reliably.

Projects like Tellura positioned themselves as RWAFi protocols tokenizing Earth’s layers and connecting to real-world assets. The creative layer approach requires micropayments and smooth cash flow. Plasma’s zero-fee USDT transfers and stablecoin-paid gas remove friction that makes small transactions uneconomical on other chains.

The Consumer Product: Plasma One

The Consumer Product: Plasma One

While infrastructure partnerships and developer tools attracted protocols and builders, Plasma needed direct consumer access to achieve mainstream adoption. Enter Plasma One, announced as the first neobank built natively for stablecoins. The product bundles saving, spending, and earning digital dollars into one application.

The thesis addresses a distribution problem. Hundreds of millions of people worldwide already use stablecoins out of necessity rather than speculation. But existing interfaces remain clunky. Applications lack proper localization. Converting to cash involves friction. Distribution traditionally relies on centralized exchanges, generic crypto wallets, and fragmented cash networks.

Plasma One aims to solve these issues through an integrated experience. Users can pay directly from stablecoin balances while earning ten percent plus yields. Physical and virtual cards offer four percent cash back. Coverage extends to more than one hundred fifty countries with acceptance at approximately one hundred fifty million merchants globally.

The cards issue through Rain, the company behind similar products like the Avalanche Card. Signify Holdings provides the issuance infrastructure with a Visa license. Users load their card with stablecoins starting with USDT and expanding to others gradually. Payments deduct directly from the stablecoin balance without manual top-ups or conversions.

Onboarding takes minutes rather than days. Complete sign-up, verification, and receive a virtual spending card immediately. Order a premium physical card in-app when needed. The speed matters enormously for markets where people need dollar access urgently.

The yield generation comes from Plasma’s DeFi ecosystem. The blockchain is built around non-volatile assets and cheap USDT borrow rates. This makes key DeFi strategies far more efficient and profitable on Plasma without substantially increasing risk. Yield isn’t manufactured through unsustainable token emissions. It comes from actual protocol usage and capital efficiency.

Zero-fee USDT transfers work between Plasma One users instantly. Sending digital dollars to friends or businesses costs nothing. No minimum amounts. No waiting periods. Money moves at the speed of messages. This capability alone changes how stablecoins function for everyday payments.

Zero-fee USDT transfers work between Plasma One users instantly. Sending digital dollars to friends or businesses costs nothing. No minimum amounts. No waiting periods. Money moves at the speed of messages. This capability alone changes how stablecoins function for everyday payments.

Security implements layered protection including biometric sign-in and advanced encryption. Rather than seed phrases that users lose or compromise, Plasma One uses hardware-backed keys. Only the account holder can access their funds. Card controls let users set spending limits, freeze cards instantly, and receive real-time transaction alerts.

The rollout strategy focuses initially on markets where dollars are most in demand. Istanbul, Dubai, Buenos Aires feature prominently. Teams gathered feedback from users and merchants in these locations to customize the experience. Local language support, regional staff, and integration with peer-to-peer cash systems address specific market needs.

Strategic Market Focus

The Middle East represents an early target given existing large capital movements and stablecoin penetration. Merchants in the region face challenges accessing dollar liquidity through traditional banking. Remittance flows remain substantial but expensive through legacy channels. Stablecoins provide an alternative that’s faster and cheaper when the infrastructure works correctly.

Buenos Aires faces currency instability and capital controls. Residents seek dollar exposure to preserve purchasing power. Traditional access requires navigating parallel exchange markets with significant spreads. Digital dollars via Plasma One offer permissionless access without depending on informal networks or taking counterparty risk.

The geographic targeting reflects where product-market fit exists today rather than where Plasma hopes to expand eventually. Going deep in specific markets with localized solutions beats spreading thin trying to serve everyone simultaneously. Once the model proves viable in high-demand regions, expansion to additional markets becomes straightforward.

For off-ramping to local currencies and bank accounts, Plasma One connects with regional partners. FX providers handle conversions. Card networks enable spending. Banks facilitate withdrawals. Timing and fees depend on the specific region and partner. The partnership model lets Plasma optimize each market individually.

The Broader Infrastructure Play

Stepping back, Plasma’s approach represents a specific thesis about blockchain infrastructure development. Rather than building another general-purpose chain competing on speed or cost alone, they identified a specific use case where existing solutions fall short. Stablecoins move trillions of dollars annually but the infrastructure remains fragmented.

By focusing exclusively on optimizing for digital dollar movement, Plasma made different architectural choices than chains trying to support all possible applications. The zero-fee USDT transfer model only works because the entire system is designed around stablecoin economics. The protocol-level paymaster enabling fee payment in any whitelisted token makes sense when most transactions involve stablecoins anyway.

The Bitcoin-anchored security adds institutional credibility. Plasma periodically saves transaction history to Bitcoin’s blockchain. This creates an audit trail on the most secure and decentralized network in existence. For financial institutions evaluating blockchain infrastructure, that security guarantee matters significantly.

The EVM compatibility ensures Plasma isn’t isolated. Ethereum’s ecosystem includes millions of developers and thousands of applications. Being able to deploy those applications to Plasma without modification removes migration barriers. The same code, tools, and workflows that work on Ethereum work on Plasma.

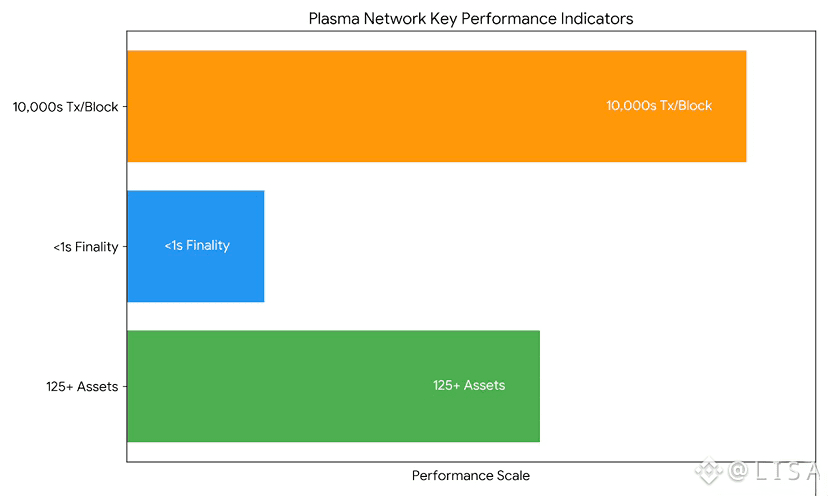

The PlasmaBFT consensus mechanism aims for sub-second finality and over one thousand transactions per second throughput. These specifications target payment use cases where users expect near-instant confirmation. Waiting fifteen seconds or thirty seconds for settlement breaks the experience when someone’s trying to pay at a checkout counter.

Real Usage Emerging

Three weeks after launch, the eight billion dollars in net deposits represented real capital finding utility. That liquidity wasn’t locked in yield farming schemes hoping to exit quickly. It moved through lending markets, provided liquidity to exchanges, and enabled payment applications.

Developers deployed applications because the infrastructure worked reliably from day one. Users bridged assets because the experience felt seamless. Protocols integrated because the capital was already there. The coordination across infrastructure providers, capital partners, application developers, and end users showed what’s possible when blockchain launches prioritize interoperability and ecosystem development upfront.

Plasma One’s phased rollout continues as the team iterates based on real user feedback. Early access focuses on markets with clearest demand while new features develop. The consumer product needs to deliver exceptional experience to compete with established fintech applications. Getting the details right matters more than rushing to scale.

The testnet period gave developers time to build and test before mainnet pressures. The launch coordination ensured major partners were ready simultaneously. The liquidity commitments removed cold start problems. The infrastructure partnerships enabled seamless asset movement. Each element connected to support the others.

Looking At What’s Next

Looking At What’s Next

The success so far validates the focused approach but doesn’t guarantee long-term dominance. Competition exists from established chains with vastly larger ecosystems. TRON processes the majority of global stablecoin volume. Ethereum remains the center of DeFi innovation. Circle recently launched Arc for institutional stablecoin infrastructure. Stripe acquired Bridge and launched Tempo for stablecoin payments.

Plasma’s differentiation relies on being purpose-built for stablecoins rather than retrofitted. The zero-fee transfers matter when someone’s sending fifty dollars for remittances. The predictable costs matter when developers budget for payment applications. The integrated experience of Plasma One matters when competing for users who don’t care about blockchain technology.

Whether these advantages prove sufficient depends on execution across multiple fronts. The blockchain infrastructure needs to scale without compromising security or decentralization. The DeFi ecosystem needs to grow beyond launch partners. Plasma One needs to acquire and retain users in competitive markets. The developer ecosystem needs to produce applications that people actually use regularly.

Token unlock schedules will test market dynamics. Major releases approach in the first year after launch. How holders respond to increasing circulating supply will impact price stability. The validator reward structure starts at five percent annual inflation, declining by half a percent yearly to a three percent baseline. Base fees burn following an EIP-1559 model to balance emissions over time.

The Bitcoin bridge development continues as a critical piece of infrastructure. Direct BTC transfers into Plasma’s EVM environment enable use cases that aren’t possible on most chains. Privacy features on the roadmap address concerns about transaction transparency for financial applications. These technical developments take time but expand what’s possible to build.

Infrastructure For Global Money Movement

Plasma entered the market with a clear value proposition. They’re building the most efficient rails for moving digital dollars globally. The infrastructure works because major pieces fit together thoughtfully. LayerZero enables interoperability. Partner commitments provide liquidity. DeFi protocols create utility. Plasma One delivers consumer access. Each component reinforces the others.

The eight billion dollars in three weeks demonstrates demand exists for better stablecoin infrastructure. Users will migrate to solutions that remove friction. Developers will build where infrastructure enables their applications to succeed. Capital will flow to where it finds productive yield. Getting those dynamics aligned from launch created momentum.

Whether Plasma captures significant market share long-term depends on continued execution. The infrastructure foundation exists. The partnerships are operational. The consumer product launches soon. Now it’s about proving the model works at scale across diverse markets with real users making real payments for real value.

The blockchain industry has seen many grand visions fail in execution. It’s also seen focused solutions find product-market fit and grow sustainably. Plasma’s launch suggested they learned from both outcomes. Building infrastructure first, securing partnerships early, launching with liquidity, and focusing on specific use cases where they can win. Time will show if the strategy works as more data emerges about actual usage patterns and retention.

For now, Plasma represents an interesting experiment in how to launch blockchain infrastructure correctly. They’re addressing a real problem with stablecoins needing better payment rails. They built partnerships before opening to users. They secured capital commitments to avoid cold start problems. They’re targeting markets with clearest demand. The approach shows thoughtfulness about what actually matters for adoption versus what makes impressive announcements.

The next year will determine if the infrastructure they built can support the scale they’re targeting. Eight billion dollars in three weeks is a promising start. Maintaining that growth while keeping the system secure, decentralized, and efficient presents different challenges. Building a consumer product people trust with their money is harder than attracting speculative capital. Competing with established payment networks requires sustained excellence in user experience.

Plasma has the pieces in place. The infrastructure works. The partners committed. The capital arrived. Now comes the hard part of proving the thesis about specialized blockchain infrastructure for stablecoins actually works better than general-purpose alternatives. The market will provide clear feedback through usage, retention, and whether developers keep choosing to build on Plasma versus other options.