Think of two bridges.

One bridge sells “bridge coins.” You need a coin to step on, a coin to vote on paint color, a coin to earn a small cut for standing guard. The bridge may be useful, yet the coin’s value can drift because the bridge does not have one clear job. It tries to serve every type of car, every type of trade, every type of stunt.

The other bridge is built for one kind of traffic: dollar-like value moving at high count, all day, every day. Tolls are shaped for that traffic, safety rules are shaped for that traffic, and the parts that hold the bridge up are paid in a way that fits that traffic.

That second bridge is the simplest way to frame Plasma, and why XPL is not just “another L1 token.”

This piece is for two readers. First, the holder who wants a clean way to judge token value without charts or hype. Second, the builder who wants stablecoin-first flow to feel normal for users, while still keeping the chain secure and fair.

Why many L1 tokens feel busy but fail the value test

Most L1 tokens try to wear too many hats. They are fee fuel, stake bond, vote chip, reward chip, and a trade chip, all at once. That can work, yet it often leads to weak demand.

Here is the common pattern. Users only hold the bare min needed for fees. Apps pay out the token as bait, so many users sell it. Fees stay low to pull in more use, so fee burn is small. New supply keeps coming to pay stakers and fund growth. The chain can grow, while the token struggles to keep pace.

So the right question is not “Does the chain have apps?” It is, “When the chain gets used more, does the token get pulled in, or does it just get talked up?”

A plain test for value capture

A token “captures value” when real use of the chain creates a repeat loop that helps the token over time.

Most L1 tokens use some mix of these tools:

1. Users pay fees to use the chain, part of those fees go to block makers, and in some models a base fee is burned.

2. Holders stake tokens to help secure the chain, they earn rewards for that stake.

3. The chain adds sinks, like fee burn, lockups, or rent, that reduce sell flow.

4. The chain adds “must-hold” hooks, like gas-only rules or stake rules.

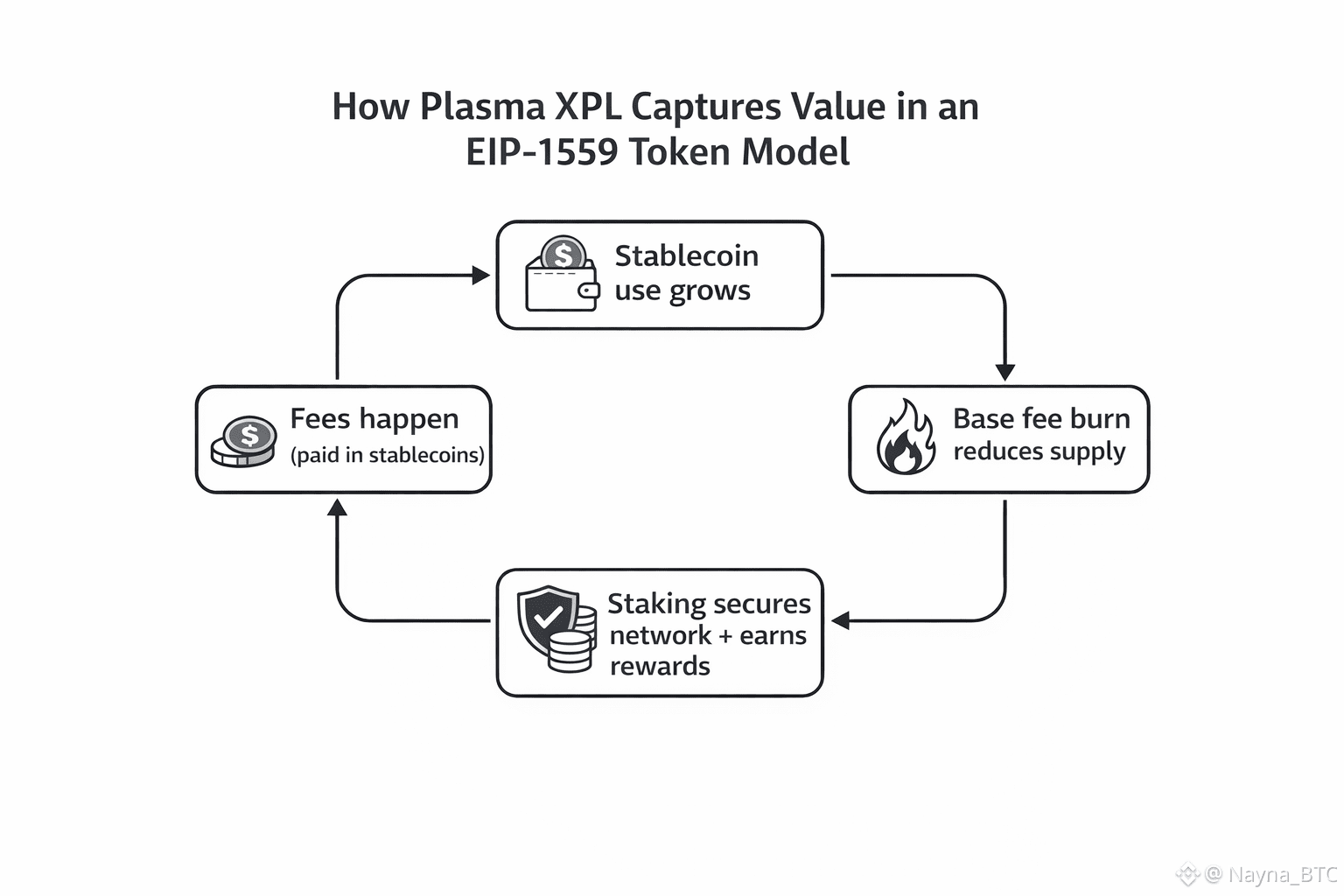

Plasma leans on two simple levers that are easy to explain: staking for safety, and fee burn tied to chain use. Plasma describes an EIP-1559 style fee model where a base fee is burned, while a tip can go to the block maker.

That is the base layer. The more interesting part is how Plasma treats user demand.

Plasma’s core choice: stablecoin flow is the main traffic

Stablecoins are now a main way people move value on-chain. By late 2025, public reports and research notes were already calling out stablecoin supply above $300B.

In late January 2026, one public market series put total stablecoin market cap around $308B (Jan 23, 2026).

That matters because stablecoin use repeats. Pay, settle, pay again. Trade desks move size each hour. Firms batch pay staff and vendors. These are loops, not one-off spikes.

Plasma is built as a stablecoin chain, so the token model can be tuned for repeat payment load, not just peak hype load. Plasma’s own docs frame stablecoin-native tools as a core part of the chain.

The big twist: make the chain feel token-light for users

Most chains still force users to hold the native token for gas. That adds friction at the worst time, right when you want the first send to feel easy.

Plasma takes a different path. It supports “custom gas tokens,” so users can pay fees using whitelisted ERC-20 tokens like USD₮ or BTC, with a protocol-run paymaster that handles the gas flow.

Plasma also documents a system for sponsored, fee-free USD₮ transfers under a tight scope, where users do not need to hold XPL up front.

At first glance, this sounds like it would hurt XPL. If users can pay fees in stablecoins, why would anyone hold the native token?

Because XPL is not trying to be a “user tax.” It is designed to sit under the chain as the safety asset and the value link, while users live in the asset they already think in.

That is a quiet but big shift from the usual “everyone must hold the coin” plan.

Where XPL demand comes from

Instead of betting on forced user holding, XPL demand is tied to the parts of the chain that must be solid.

1. Validators stake XPL to take part in consensus and secure the chain, and holders can delegate stake to earn rewards without running nodes.

2. Plasma’s validator rewards plan is described as starting at about 5% per year, stepping down by 0.5% per year until a 3% long-run rate, with inflation only turning on when the full validator and stake-delegation setup is live.

3. Plasma says it uses reward slashing, not stake slashing, so bad actors can lose rewards without wiping staked capital.

4. Plasma describes an EIP-1559 style base fee burn, so chain use can reduce supply over time.

This is the heart of XPL vs a typical L1 token. Many L1s put token demand in the hands of every new user. Plasma puts token demand in the hands of the people and firms who secure the chain, while making user flow easier.

Utility is not “one feature,” it is a stack

When people say “utility token,” they often mean “it pays gas.” That is only one thin slice.

A better way to see XPL is as a stack of roles that fit a payments chain:

XPL is the asset that supports staking and chain safety. It is the unit used to pay and align validators. It is also the unit that links chain use to burn, so heavy chain use can matter for supply over time. Plasma’s docs also frame XPL as the native token used to support the network and reward those who validate.

Meanwhile, users can stay in stablecoins for daily use. That lowers drop-off. In a payments chain, less drop-off is not just “nice UX.” It changes how fast real use can grow.

Real use, not sci-fi: what this design is built to support

Start with flows that already exist.

Stablecoin pay flow often has high count and low margin. That means small friction hurts more than small fees. If a user must buy a gas token, sign extra steps, and watch price moves just to send a dollar token, many will quit.

Plasma’s stablecoin-native path is built to remove that early friction. Custom gas tokens aim to let a user pay fees in a token they already hold. Sponsored USD₮ sends aim to make some transfers fee-free under clear rules.

For builders, this can mean fewer support tickets, fewer “why did my send fail” moments, and a smoother first run for new users.

One snapshot of current market context for XPL

Token value is not only price. Still, it helps to anchor the mind with a live read.

A Plasma block explorer view on Jan 28, 2026 showed XPL around $0.13, market cap shown around $276M, and total chain tx count around 145.68M at that moment.

This is not a promise or a pitch. It is a state check that the chain has real activity and that XPL has a market that can be tracked.

A clean way to compare XPL to a typical L1 token

If you want a simple frame, do not start with “more TPS.” Start with the flow.

Ask these three things.

First, what is the chain’s main traffic? Many L1s try to be all things. Plasma is built with stablecoin flow as the main job.

Second, does the chain cut user friction without breaking the token model? Plasma’s custom gas tokens and fee-free USD₮ path cut friction for users, while XPL keeps a clear role in staking and fee burn.

Third, is the reward and supply path easy to explain? Plasma’s public notes and docs lay out a step-down reward plan and a long-run target, with clear timing tied to validator rollout.

If a token can pass these tests in plain words, it is easier to trust.

Quick checklist for a reader deciding if XPL fits their view

- If you think stablecoin use keeps rising, a chain tuned for that flow has a strong tailwind.

- If you care about first-time user flow, custom gas tokens reduce the need to touch XPL for basic actions.

- If you want value capture tied to use, base fee burn plus staking demand is a simple loop to track.

- If you prefer a security model that aims to reduce capital wipe risk, reward slashing is a clear design choice.

Closing thought

Many L1 tokens ask the user to care about the token first, then learn the chain.

Plasma flips that. It tries to make the chain feel natural for stablecoin use, while XPL sits in the layer that keeps the system honest, pays the people who secure it, and links real chain use to token math.

In simple terms, XPL is built to be the “under the hood” asset of a stablecoin-first chain, not a toll that every new user must learn on day one.