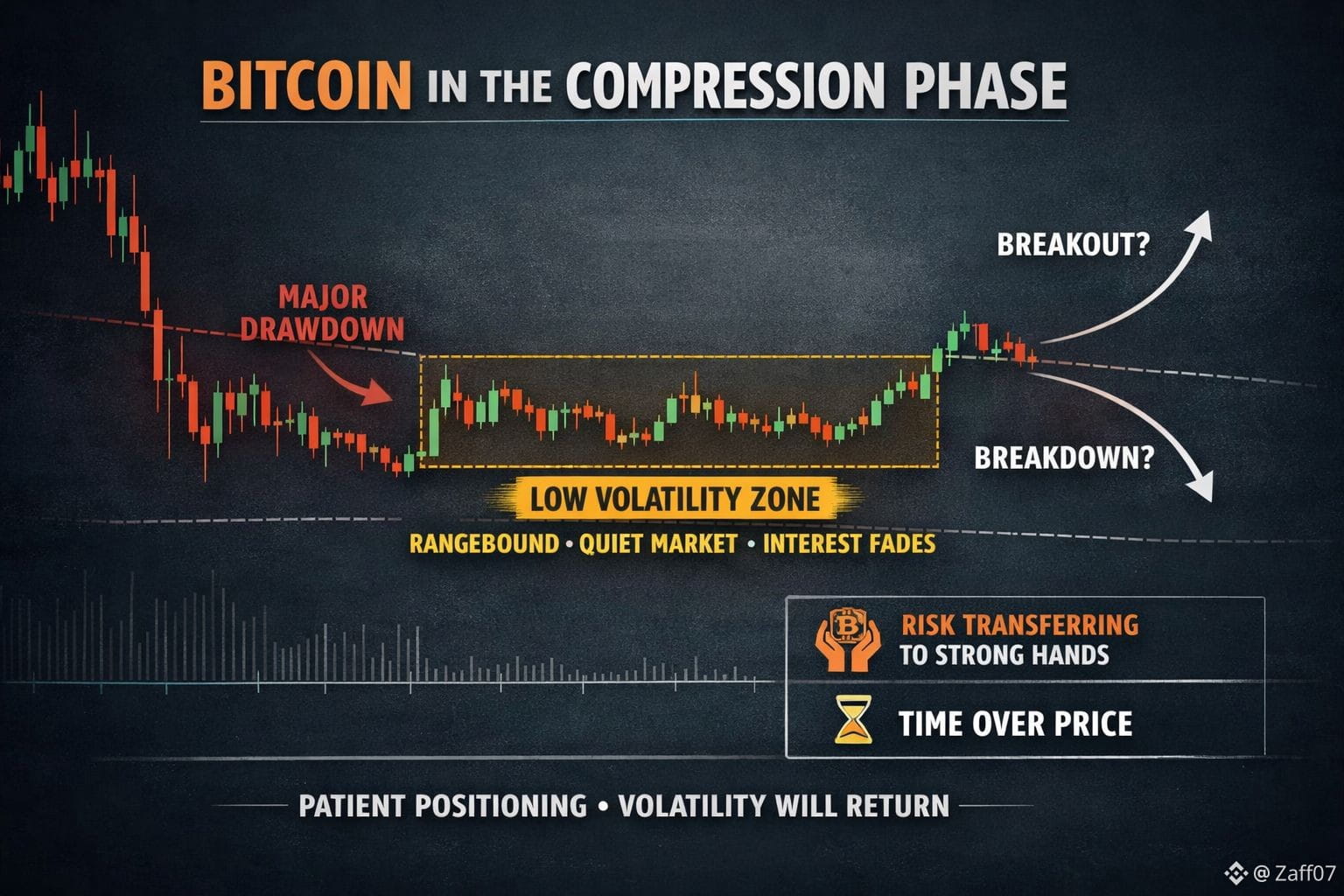

$BTC and the Compression Phase No One Likes to Trade

There’s another condition I pay close attention to the Bitcoin.

Not price spikes, Not headlines.

But volatility compression after a major drawdown.,

Historically, BTC doesn’t reverse when confidence returns,

It reverses when interest disappears.

Right now, price action is slow. Ranges are tight. Momentum feels dead.

That’s usually when most traders lose patience and step away.

And that’s important.

This phase doesn’t reward excitement.

It rewards positioning.

When BTC trades sideways after a deep correction, it often signals that selling pressure is being absorbed quietly. Not aggressively. Not visibly.

But steadily.

That doesn’t mean a breakout is imminent.

It means risk is being transferred from weak hands to strong ones.

Upside still looks uncertain.

Narratives are still missing.

But that’s exactly how these windows form.

This isn’t about catching the exact low.

It’s about recognizing when time replaces price as the main weapon.

If price breaks lower, risk can still be managed.

If it holds and volatility expands upward, entries won’t feel comfortable anymore.

I’m not predicting a move.

I’m observing a condition.

The market isn’t offering clarity.

It’s offering positioning before clarity.

Are you still waiting for volatility to return before acting,

or are you respecting the silence as part of the setup?

$BTC #Bitcoin #MarketStructure #CryptoCycles #RiskReward #tradingpsychology #BTC走势分析 #MarketSentimentToday