Regulated financial assets cannot rely on probabilistic outcomes. In traditional finance, the same instruction must always produce the same result — regardless of timing, load, or infrastructure conditions. When this principle breaks, reconciliation issues, audit failures, and operational risk follow.

This is where many public blockchains fall short. Transaction ordering, validator behavior, or network congestion can subtly influence execution outcomes. While acceptable for experimentation, this variability becomes a blocker for institutions managing regulated assets.

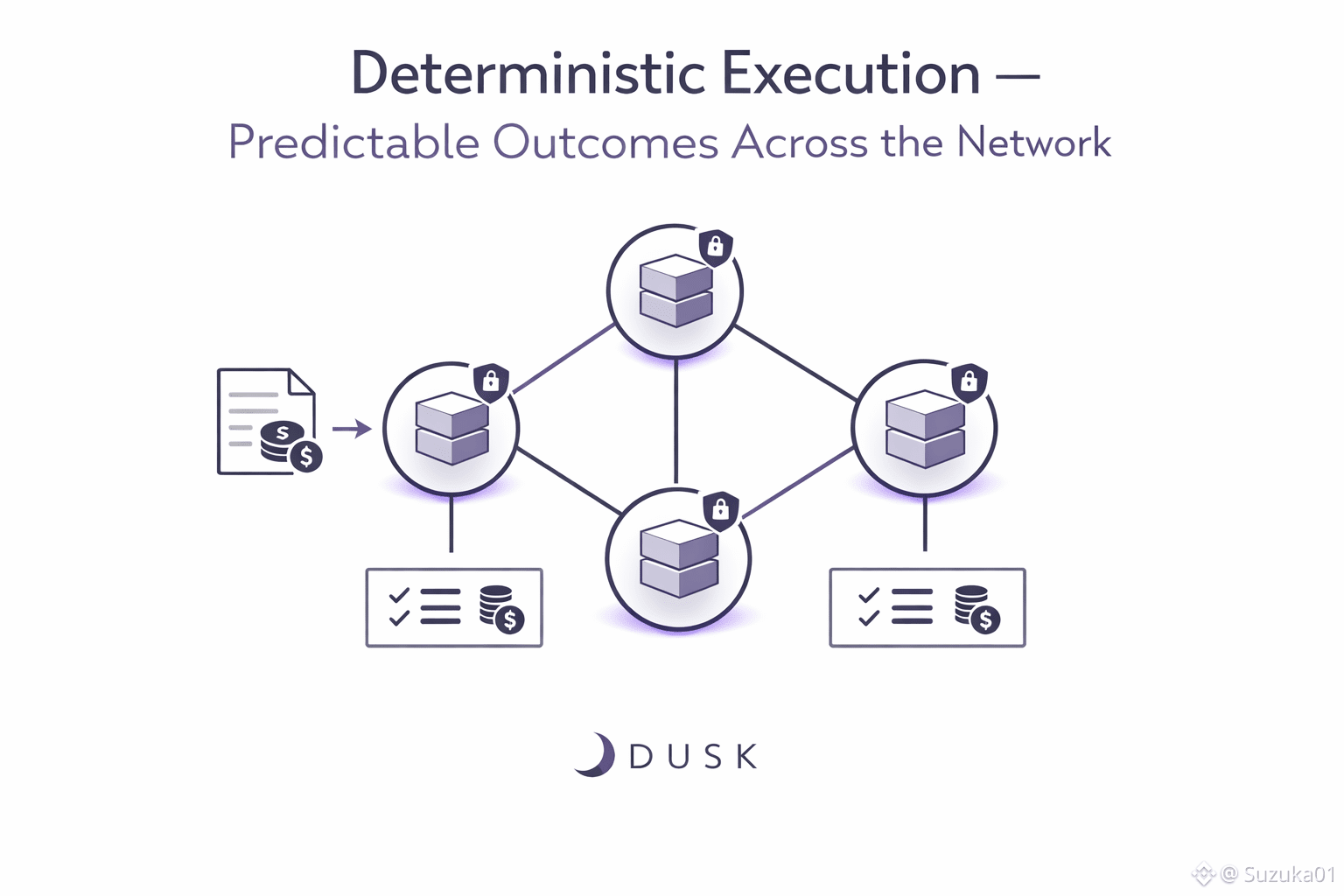

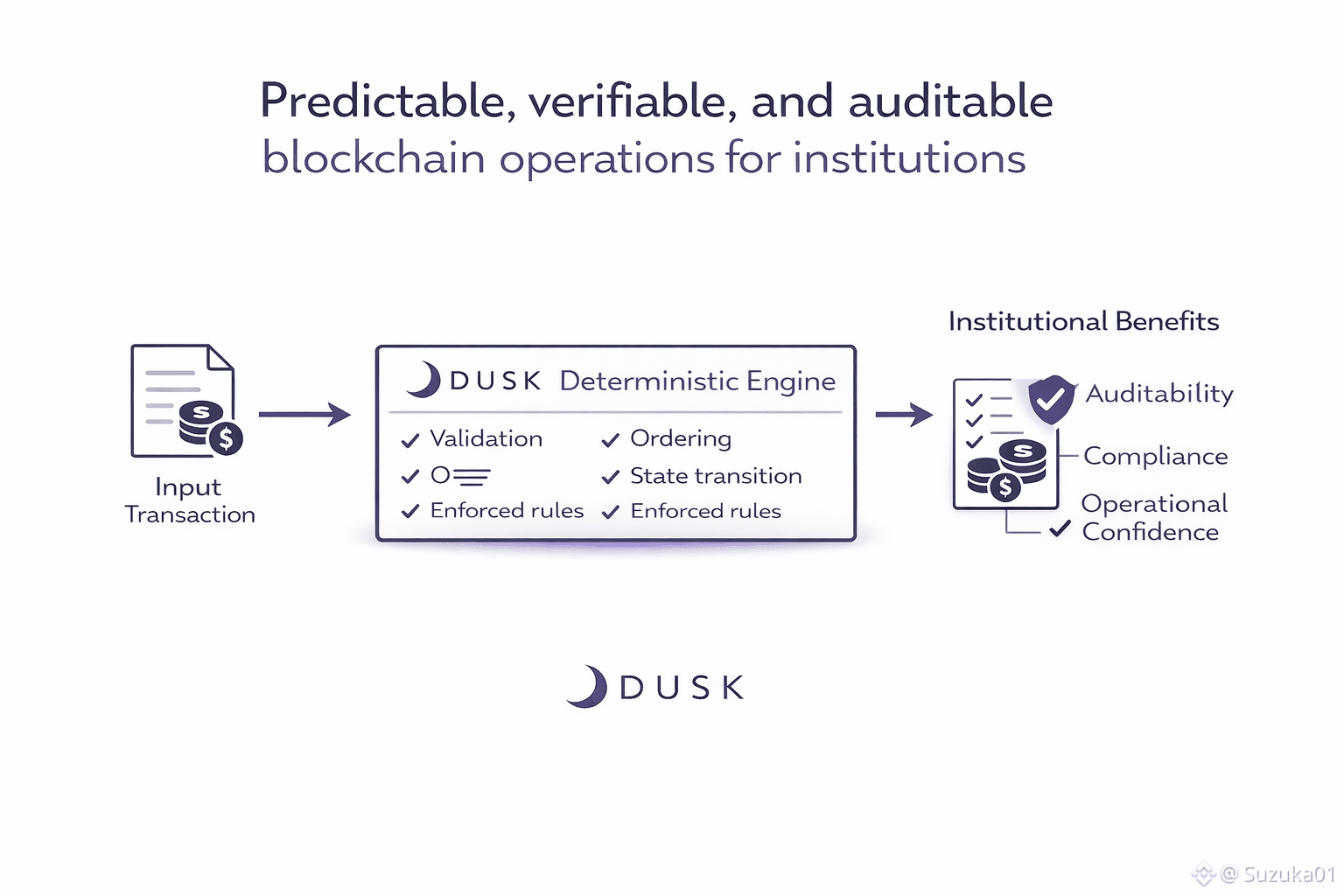

DUSK is designed around deterministic execution at the protocol level. Every transaction follows predefined validation rules, execution paths, and state transitions that are identical across all nodes. If a transaction is valid once, it is valid everywhere — with no dependency on local conditions or probabilistic behavior.

For institutions, this predictability enables reliable settlement, reproducible audits, and automated compliance checks. Transactions can be replayed and verified with confidence, without introducing manual reconciliation or off-chain assumptions. This is critical for environments where legal and regulatory accountability depends on exact reproducibility.

DUSK’s architecture also supports modular compliance. Core settlement logic remains stable, while compliance or reporting requirements can evolve without disrupting execution guarantees. This separation allows institutions to adapt to regulatory changes without risking inconsistencies in transaction outcomes.

Deterministic execution is not a performance optimization or developer convenience. It is a foundational requirement for deploying regulated financial workflows on-chain. By enforcing deterministic behavior at the protocol level, DUSK provides the reliability institutions need to move from pilots to production.