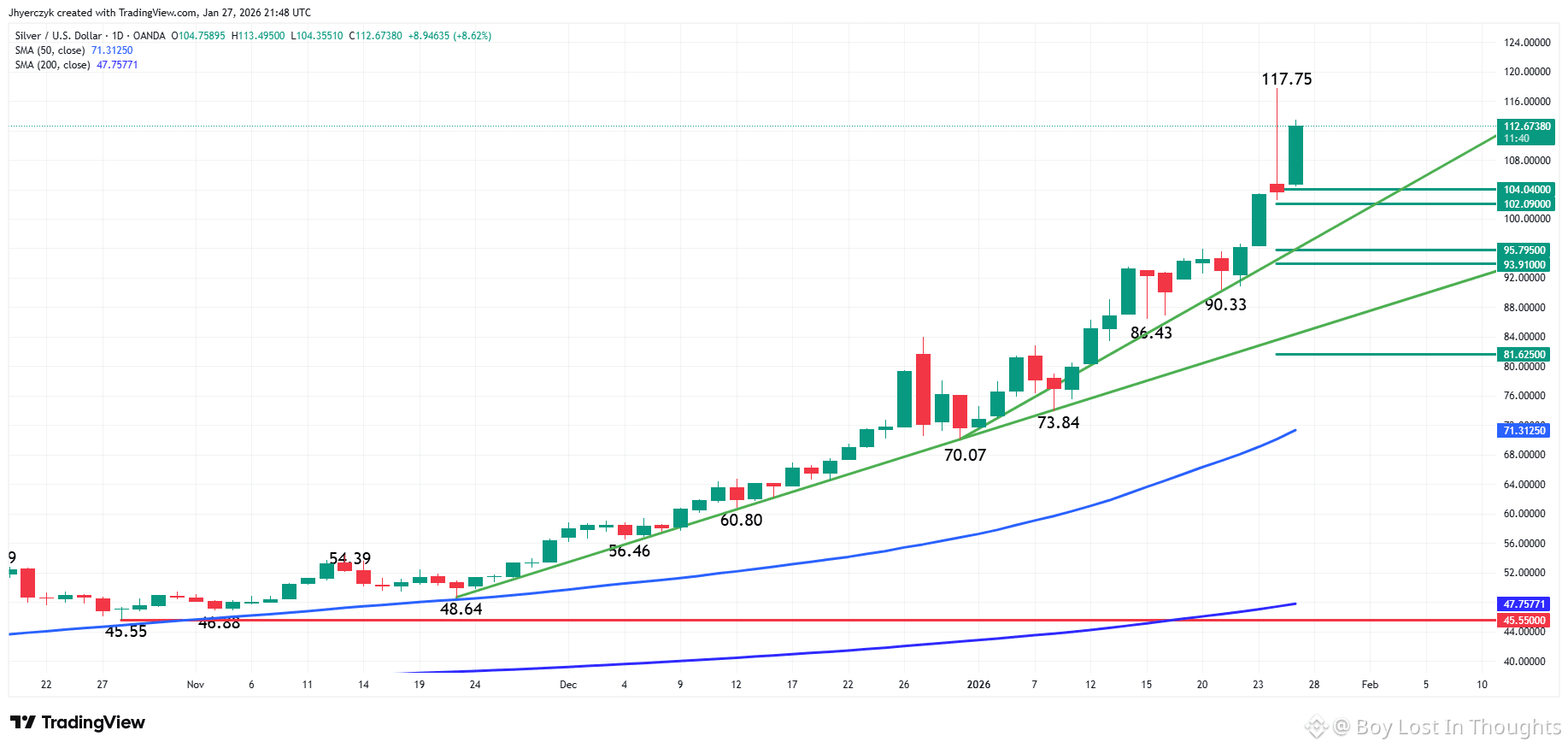

Silver's rally shows signs of overheating, prompting a search for where real value might lie. While the overall uptrend that started at $70.07 remains intact, the formation of an inside day pattern signals trader indecision. The analysis warns the metal is significantly overvalued after its rapid ascent and identifies two key retracement zones ($104.04-$102.09 and $95.79-$93.91) as areas where investor interest could re-emerge on a pullback. A notable technical shift is expected in early February, as the 50-day moving average will begin rising more sharply, providing a clearer gauge of value. The conclusion stresses this is a hunt for better entry points within the ongoing uptrend, not a forecast of its end.

Key Points:

Current Signal: Silver formed an "inside day" pattern on Tuesday, indicating trader indecision and a potential pause or shift in momentum following its parabolic surge from $70.07.

Overvaluation Warning: The analysis concludes silver is currently "significantly higher than time and extremely overvalued," moving to identify areas of real value rather than predicting a full trend reversal.

Key Value Zones: Two major retracement zones are highlighted as potential areas where investors might find value:

$104.04 – $102.09

$95.79 – $93.91

Moving Average Shift: The 50-day moving average is set to accelerate upward starting February 2nd, as old, lower prices from the $40s and $50s roll off its calculation. This will make it a more precise tool for identifying value.

Critical Distinction: The analysis anticipates a potential shift in sentiment or a pullback, not a change in the overall bull trend, which began at the major low of $70.07.