The Bank of Japan decided to maintain its key monetary policy, encouraging the uncollateralized overnight call rate to remain at around 0.5%. It also continued reducing its Japanese Government Bond (JGB) holdings at a pace of about 3.3 trillion yen per month.

📊 Economic Assessment and Outlook

Japan's Economy: In a state of moderate recovery, though with some weaknesses. Business investment was on a moderate increasing trend.

Private Consumption: Showed resilience but was expected to remain flat for a while due to the dampening effect of elevated food prices.

Inflation (CPI): The year-on-year rate of increase (all items less fresh food) was around 3%, driven by factors like rising food prices and the pass-through of wage increases to selling prices. This rate was projected to decelerate toward the end of fiscal 2025.

Global Economy: Growing moderately on the whole, with significant variations:

U.S.: Maintained solid growth.

Europe: Continued to be relatively weak.

China: Growth had decelerated due to tariff impacts and adjustments in the real estate market.

Key Uncertainties: The outlook is highly uncertain, with risks from global trade policies, developments in AI-related demand, and the Chinese economy.

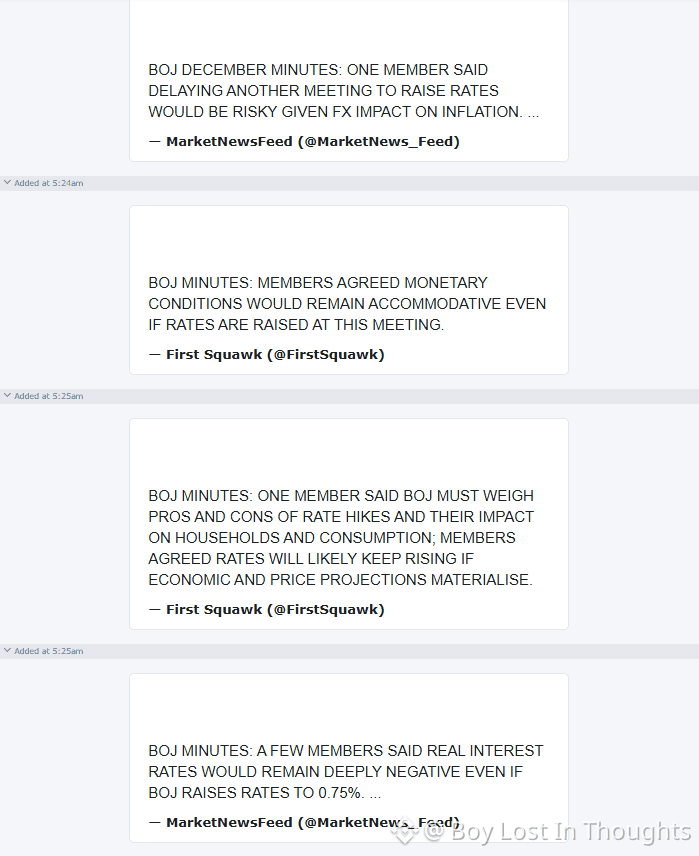

Financial Conditions: Assessed as accommodative, with strong corporate demand for funds and supportive lending attitudes from financial institutions.⚖️ Policy Deliberations and Risks

The discussion highlighted a cautious and data-dependent approach:

The consensus was to maintain the current policy to firmly anchor inflation expectations while monitoring risks.

Members noted significant downside risks, primarily from overseas economies. A slowdown abroad could hurt Japanese exports and corporate profits.

There was also concern that elevated domestic food prices could suppress household consumption despite wage growth.

The path for normalizing monetary policy (like further rate hikes or accelerating bond purchase reductions) was not signaled, indicating a preference for stability.

💎 Final Takeaway

The minutes reveal a BOJ in a holding pattern. Policymakers are confident that current settings are appropriate to support the economy and ensure inflation stabilizes sustainably. The focus is squarely on monitoring risks, particularly from global trade and domestic consumption, before considering any future policy shifts.