Key Points :

Strong Institutional Demand: US XRP-spot ETFs have seen five consecutive days of net inflows ($9.16M latest), pushing total inflows to $1.25 billion and outperforming SOL ETFs. This contrasts with ongoing Bitcoin ETF outflows.

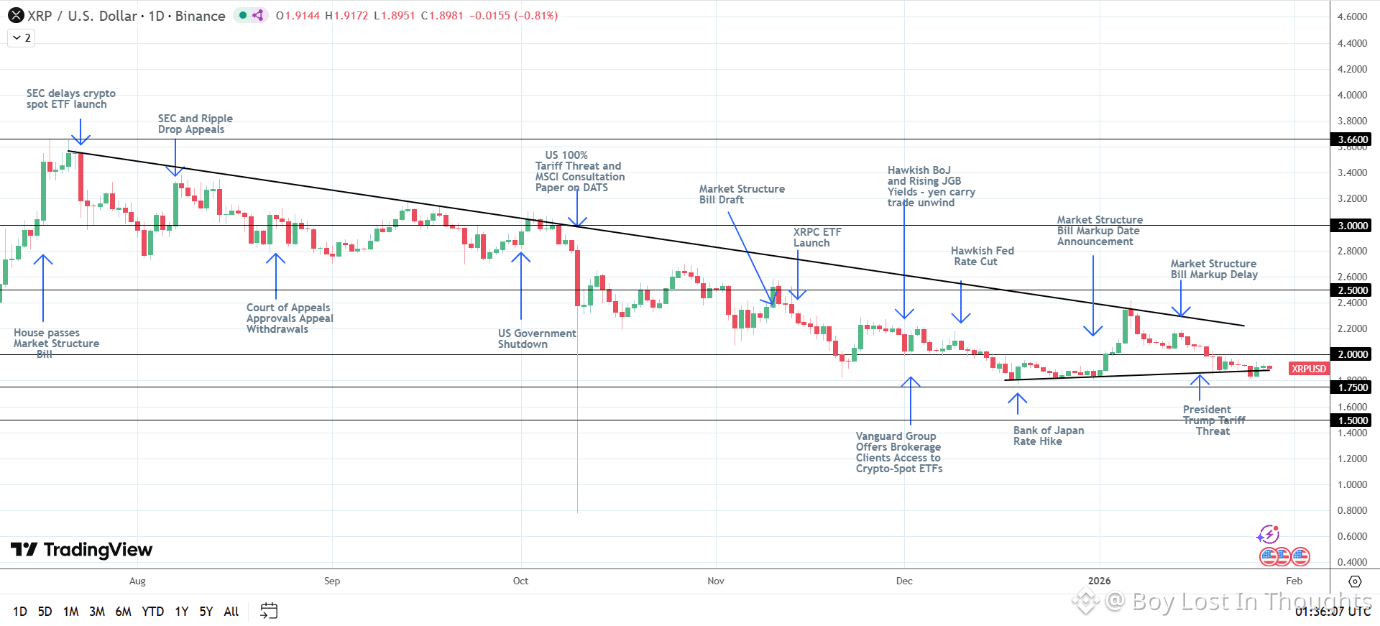

Regulatory Catalyst: The US Senate Agriculture Committee has rescheduled its crucial markup of the crypto Market Structure Bill for January 29. Progress here renews hope for crypto-friendly laws, boosting XRP adoption sentiment.

Bullish Price Targets: Driven by ETF demand and regulatory optimism, XRP is targeting $2.50 in the short term and $3.00 in the medium term (4-8 weeks), with a longer-term goal of $3.66.

Decoupling from Bitcoin: XRP is showing resilience and potential decoupling from broader crypto trends, gaining despite BTC ETF outflows.

Risks to Watch: Threats to the rally include hawkish central bank signals (Fed/BoJ), further delays to crypto legislation, a reversal to XRP ETF outflows, and a break below the key $1.85 support level.

Technical Picture: While XRP trades below its 50-day and 200-day EMAs (bearish signals), strong fundamentals are currently offsetting this. Reclaiming the $2.00 level is critical for confirming a bullish trend reversal.