Hyperliquid’s HYPE token rallied sharply this week, fueled by a surge in silver trading and record open interest. The platform’s fee-driven buyback mechanism amplifies gains, though overbought conditions now signal possible near-term consolidation.

Key Points :

Soaring Performance: HYPE surged to $30.96, up 9.4% in a day and over 50% this week — massively outperforming the broader crypto market (+4%).

Commodities-Driven Volume: A huge spike in silver perpetuals trading drove over $1 billion in 24-hour volume on Hyperliquid, reflecting a shift into high-volatility macro assets.

Record Open Interest: HIP-3 open interest hit an all-time high near $790 million, signaling deeper liquidity and larger positions on the platform.

Buyback Mechanism Boost: Hyperliquid channels ~97% of trading fees into buybacks of HYPE, meaning higher volume directly fuels token demand.

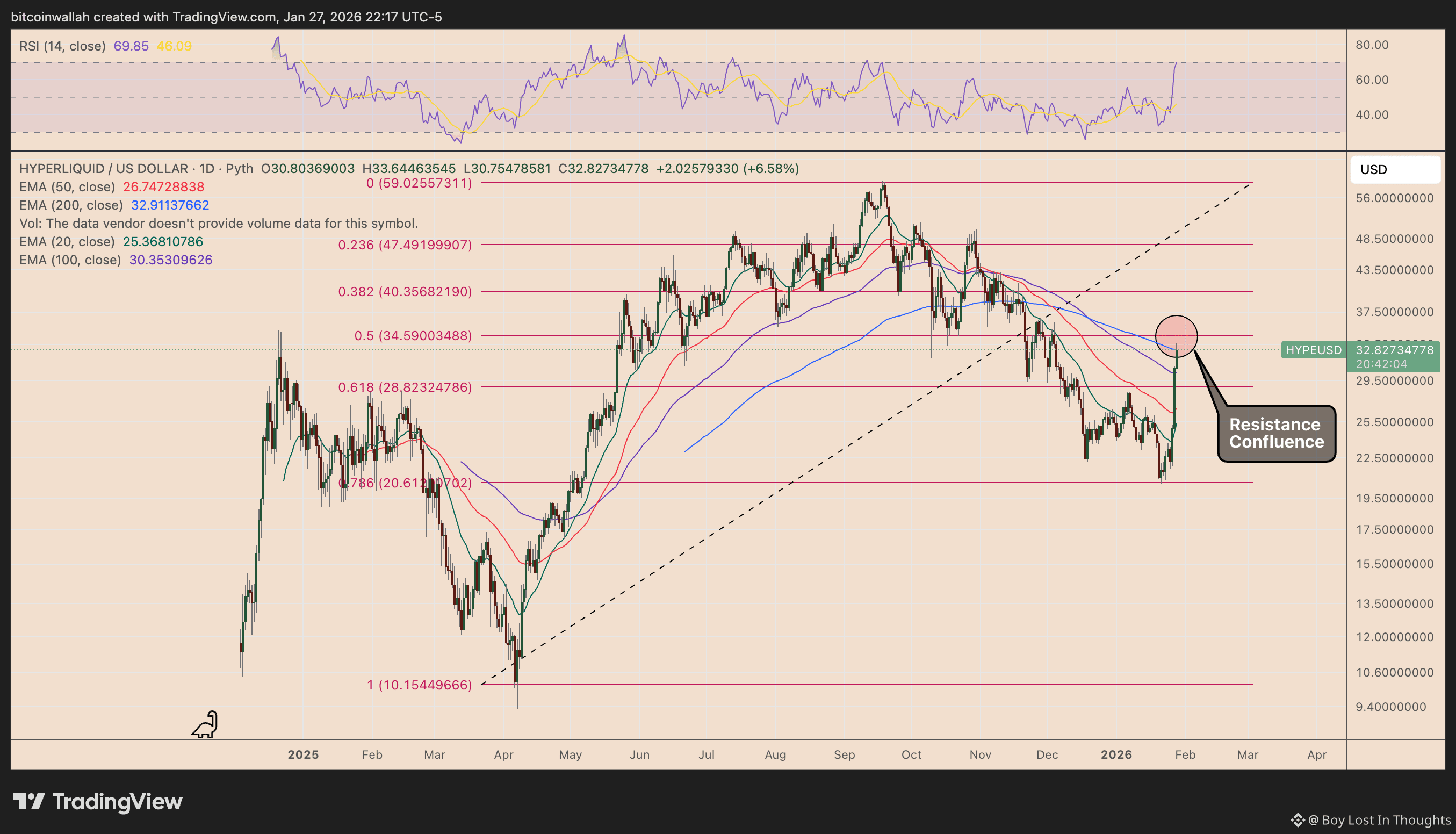

Technical Overbought Signals: HYPE is now testing key resistance levels with overbought daily RSI, suggesting a potential pullback toward $28.82 unless buyers break higher toward $40–$48.