For years, blockchain innovation has been obsessed with spectacle: faster blocks, louder narratives, bigger promises. Yet the most transformative financial systems rarely announce themselves. They fade into the background, becoming so reliable that users stop thinking about them. @Plasma belongs to this quieter category of innovation. It is not trying to reinvent money, but to finally let digital dollars behave like money should—predictable, neutral, and boring in the best possible way.

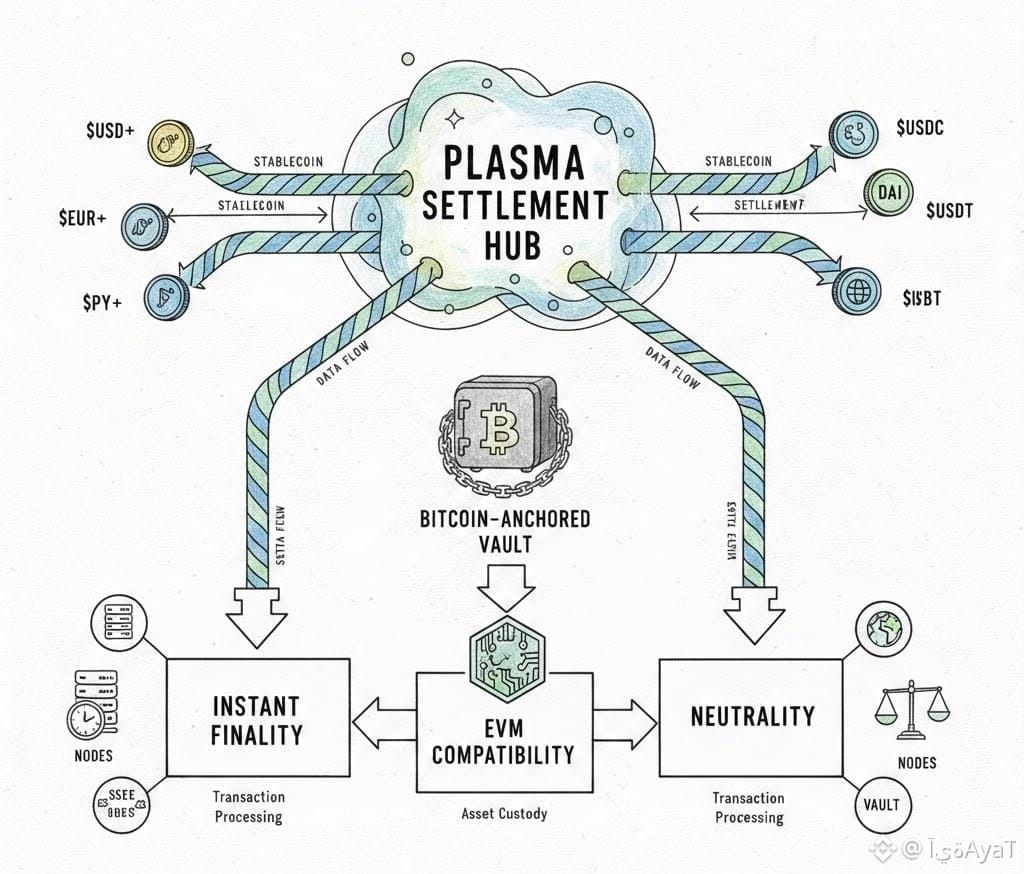

Stablecoins have already won the adoption battle. From remittances in high-inflation economies to institutional settlement rails, they move billions daily. The problem is that the infrastructure beneath them was never designed with this role in mind. On most chains, stablecoins compete with NFTs, memecoins, and experimental contracts for blockspace and attention. Plasma begins from a different premise: if stablecoins are the dominant use case, then the chain itself should be optimized around their needs.

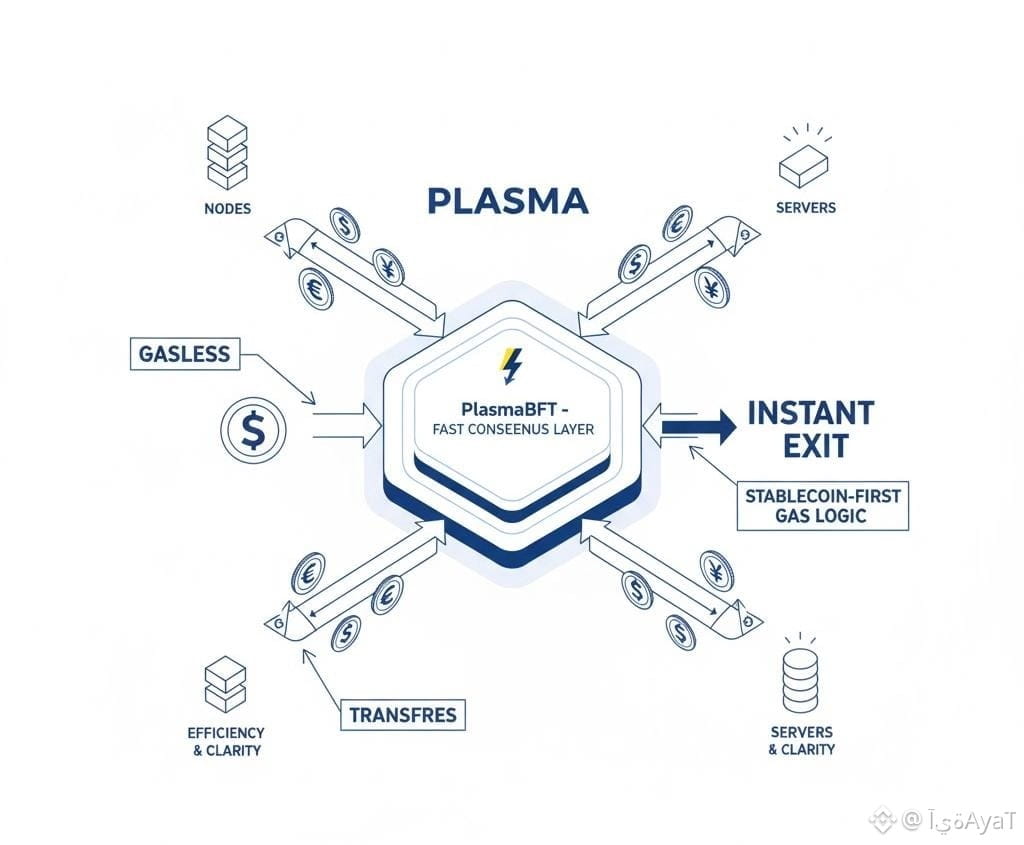

This design choice reshapes everything. Gasless USDT transfers are not a marketing feature but an economic statement. When the cost of sending money disappears, users stop timing transactions or calculating fees and start treating the network like a utility. Sub-second finality reinforces this shift. Settlement no longer feels probabilistic or delayed; it feels immediate, closer to handing over cash than waiting for confirmations.

Plasma’s full EVM compatibility ensures that this new financial calm does not come at the cost of flexibility. Developers are not forced into a new paradigm or proprietary environment. Instead, familiar Ethereum tooling runs atop an execution layer tuned for settlement rather than speculation. The result is subtle but powerful: applications behave the same, while the underlying experience becomes smoother and more predictable.

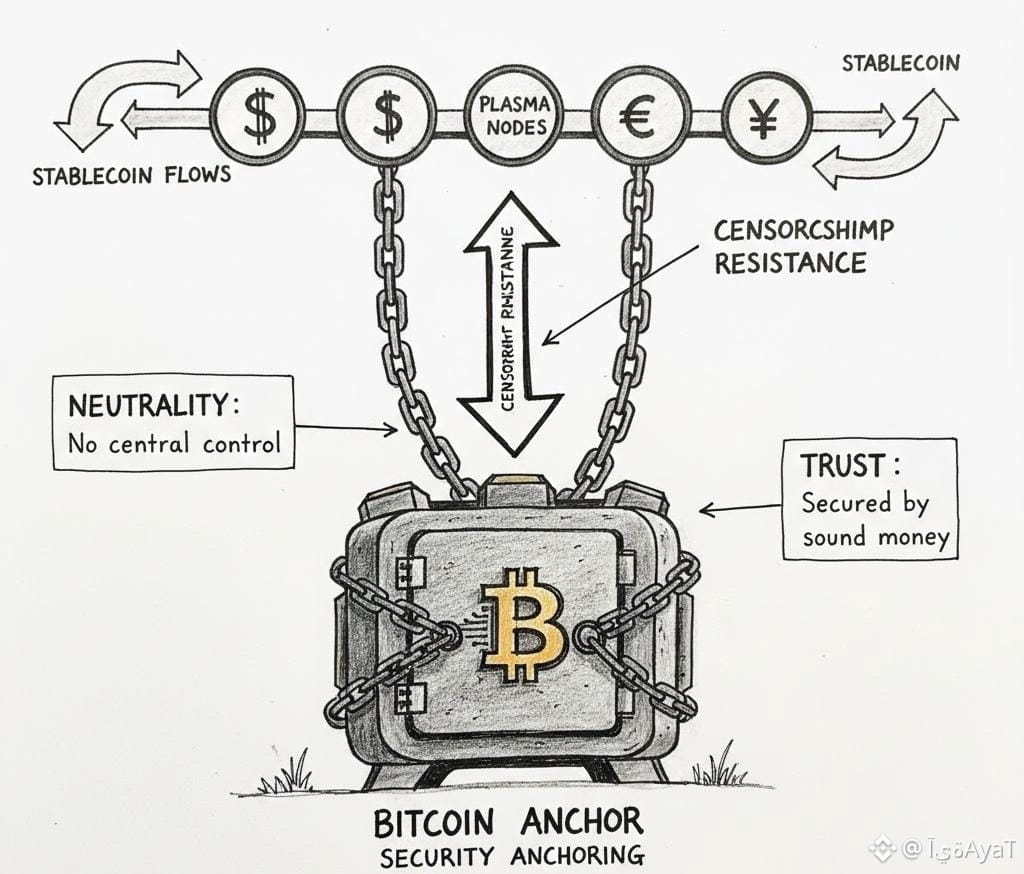

The most unconventional element, however, lies beneath the surface. By anchoring security to Bitcoin, Plasma borrows credibility from the most battle-tested neutral system in crypto. This is not about copying Bitcoin’s monetary policy, but about inheriting its political properties. Bitcoin’s resistance to capture and censorship gives Plasma a gravitational center that is difficult to bend toward short-term interests. For stablecoins used in global payments, neutrality is not philosophical—it is operationally essential.

This combination—stablecoin-first economics, instant finality, familiar execution, and Bitcoin-anchored security—positions Plasma less like a typical Layer 1 and more like financial infrastructure. It resembles a high-speed rail system rather than a racetrack. The goal is not to win bursts of attention, but to move value continuously, safely, and without drama.

In high-adoption retail markets, this translates into something rare in crypto: confidence. Users do not need to understand consensus algorithms or gas dynamics. For institutions, it offers something equally scarce: a settlement layer that behaves consistently under load, aligned with compliance realities and payment logic rather than speculative cycles.

Plasma’s real innovation is restraint. By refusing to be everything at once, it becomes something dependable. In a space addicted to novelty, that may be the most radical move of all.