Every generation of financial infrastructure is shaped by the tradeoffs it silently accepts. In traditional markets, liquidity comes at the cost of custody, leverage comes with fragility, and safety is purchased by surrendering control to layers of intermediaries. Crypto promised an escape from those constraints, yet over time it reproduced a familiar dilemma of its own: to unlock liquidity, assets must be sold, rehypothecated, or placed at constant risk of liquidation. Plasma begins from the premise that this compromise is no longer acceptable.

The story behind Plasma XPL is not about building faster rails or launching another yield primitive. It is about reframing what collateral means in a world where capital is expected to remain productive, composable, and sovereign at the same time. Instead of treating collateral as something to be temporarily sacrificed for liquidity, Plasma treats it as enduring infrastructure. Something that can be mobilized repeatedly without losing its identity or ownership.

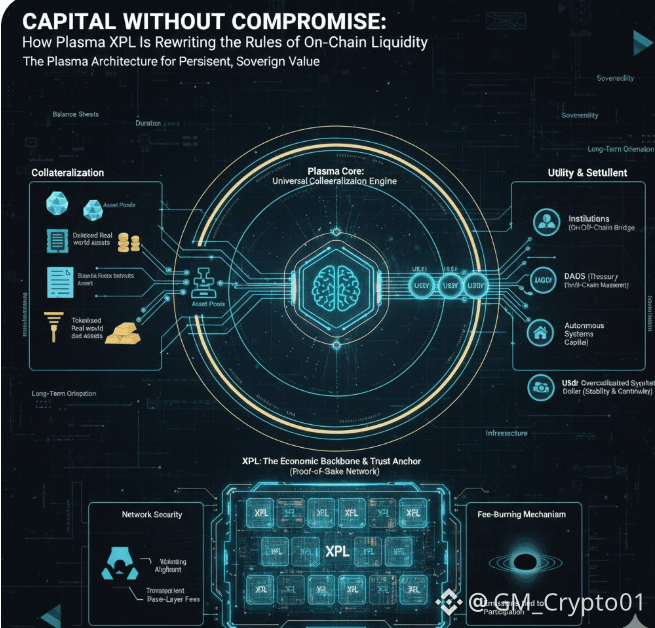

This distinction becomes critical as on-chain finance grows up. Institutions, DAOs, and increasingly autonomous systems do not think in isolated trades. They think in balance sheets, duration, and continuity. Selling assets to access liquidity is not strategy; it is friction. Plasma’s universal collateralization model addresses this head-on by allowing liquid digital assets and tokenized real-world assets to be deposited as collateral to mint USDf, an overcollateralized synthetic dollar. Liquidity is created without liquidation. Exposure is preserved. Capital remains intact while still becoming useful.

That simple shift changes how on-chain value behaves. Liquidity stops being an event and becomes a state. Instead of cycling assets in and out of positions, users and systems can operate with persistent collateral backing ongoing activity. This is particularly relevant as more real-world assets move on-chain. Treasuries, credit instruments, commodities, and yield-bearing products are not designed to be flipped; they are designed to anchor portfolios. Plasma gives these assets a native role in decentralized finance without forcing them into speculative molds.

XPL sits at the center of this architecture not as a narrative token, but as the asset that secures trust in the system itself. Every monetary system relies on something foundational: reserves, guarantees, or enforcement mechanisms that give participants confidence to transact. In Plasma, XPL fulfills that role by securing the network, aligning validators, and underpinning the integrity of collateralization and settlement. Its value is not abstract. It emerges from the fact that without XPL, the system’s guarantees would not hold.

The design choices around XPL reflect this long-term orientation. Distribution, vesting, and incentives are structured to favor endurance over acceleration. Rather than front-loading supply for short-term attention, Plasma emphasizes gradual participation, ecosystem seeding, and validator alignment. Long vesting schedules and conservative emissions are not cosmetic signaling; they are structural decisions that recognize infrastructure cannot be rushed without breaking later.

At the protocol level, Plasma operates as a Proof-of-Stake network built for financial-grade settlement. Validators stake XPL to secure consensus, transactions finalize with transparency, and the system is engineered to support high-volume, low-friction value transfer. Zero base-layer fees are not a marketing gimmick here; they are a requirement for making stable, programmable money viable at scale. Payments, collateral movements, and settlement flows cannot tolerate unpredictable costs if they are to support real economic activity.

Inflation and supply dynamics are handled with similar restraint. Emissions are tied to actual network participation rather than abstract timelines, activating as validators and delegation come online. At the same time, a fee-burning mechanism permanently removes base fees from circulation, creating a counterweight that links long-term supply behavior directly to usage. As more value moves through the system, the network itself becomes more economically efficient.

What ties all of this together is USDf. It is not positioned as another algorithmic experiment or fragile peg, but as a collateral-backed instrument designed for stability and continuity. USDf allows users to access liquidity while keeping their assets working in the background. For institutions, it offers a bridge between on-chain settlement and off-chain balance sheets. For decentralized systems, it provides a reliable unit of account that does not require constant unwinding of positions.

Seen through this lens, Plasma is less concerned with competing for mindshare and more focused on correcting a structural inefficiency that has existed for decades. Capital has always been forced to choose between safety and flexibility. Plasma challenges that assumption by building a system where liquidity, ownership, and security are no longer mutually exclusive.

XPL’s relevance flows directly from this design. It does not depend on speculative demand to justify itself. Its role is structural, embedded in the security, settlement, and credibility of the network. As adoption grows, as collateral flows deepen, and as real-world finance increasingly intersects with decentralized rails, XPL accrues value not because it promises returns, but because it secures a system that others rely on.

Markets tend to reward noise before fundamentals. Plasma appears comfortable operating on the opposite timeline. It is building for a future where on-chain finance is not an alternative experiment, but a parallel financial system capable of supporting real assets, real institutions, and real economic behavior. In that future, collateral is not something you give up to gain liquidity. It is the foundation upon which liquidity is built.

That is the long game behind Plasma XPL. Not speed for its own sake. Not yield without substance. But capital without compromise, secured by infrastructure designed to last.