The blockchain industry has spent over a decade chasing a single promise: fast, cheap, global payments. Thousands of projects launched. Billions in funding deployed. Yet most people still use Venmo, Zelle, or bank transfers because crypto payments remained too slow, too expensive, or too complicated for everyday use.

Plasma enters this landscape with a different thesis entirely. Rather than building another general-purpose blockchain hoping payments emerge as a use case, they architected a Layer 1 specifically and exclusively for stablecoin transactions. It’s a bold bet that specialization beats generalization in infrastructure—and one that’s already processing $7 billion in deposits while operating across 100+ countries.

But bold doesn’t mean correct. And scale doesn’t guarantee sustainability.

The Architecture: What Purpose-Built Actually Means

Plasma claims to process 1,000+ transactions per second with sub-1-second block times and zero user fees. These aren’t just incremental improvements over existing infrastructure—they represent fundamentally different design choices that prioritize payment performance above everything else.

General-purpose blockchains like Ethereum or Solana must accommodate smart contract complexity, NFT minting, DeFi protocols, and payment transactions simultaneously. Every design decision becomes a compromise between competing use cases. Gas fee mechanisms need to price out spam while remaining affordable for small transactions. Consensus mechanisms must secure arbitrary computational complexity, not just value transfer.

Plasma eliminates these compromises by eliminating everything except stablecoin payments. No smart contract virtual machines executing complex logic. No NFT metadata bloating state. Just addresses sending stablecoins to other addresses with predictable computational requirements and standardized transaction structures.

This narrow focus enables architectural optimizations impossible on general chains. Validators can specialize hardware for transaction types they know in advance. State management becomes simpler when you’re not tracking arbitrary contract storage. Consensus can optimize for finality speed when transaction validation is computationally trivial.

The trade-off? Plasma can’t do anything except move stablecoins. You can’t build a lending protocol directly on it. No DEXs, no derivatives, no yield farming. It’s payment infrastructure, not a platform for financial innovation. Whether that’s limitation or clarity depends entirely on what you’re trying to accomplish.

The Economics: Free Isn’t Really Free

Zero transaction fees sound consumer-friendly until you remember that infrastructure costs money. Validators need compensation. Hardware, bandwidth, and security all require economic incentives. If users aren’t paying, someone else is.

Plasma’s institutional backing reveals the answer: Bitfinex, Tether, Flow Traders, DRW, Founders Fund. These aren’t passive investors—they’re entities with direct business interests in efficient stablecoin infrastructure. Market makers benefit from low-friction trading venues. Tether gains infrastructure diversification beyond Ethereum and Tron. Exchanges get cheaper settlement rails.

The economics work because value capture happens elsewhere in the ecosystem. Traditional payment processors follow similar models—consumers don’t pay transaction fees, but merchants absorb interchange costs. Plasma appears to operate validators through entities that monetize the infrastructure indirectly rather than through direct fee extraction.

This model might actually be superior for payment adoption. Charging users even nominal fees destroys use cases in emerging markets where average transaction sizes are small. A $0.50 fee on a $50 remittance is a 1% tax that makes traditional services competitive. Zero fees remove that barrier entirely.

The risk is dependency on continued institutional support. If validator economics rely on subsidies from entities with strategic interests, what happens when those interests change? Does Plasma pivot to fees, destroying its competitive advantage? Do validators exit, compromising network security? The sustainability question matters when you’re building critical infrastructure on assumptions about long-term institutional commitment.

The Geographic Strategy: Following the Money to Underserved Markets

Most crypto projects target wealthy countries with sophisticated financial infrastructure. Plasma went the opposite direction.

Yellow Card operates across Africa. WalaPay serves underbanked regions. Prive focuses on markets where traditional banking barely functions. The 100+ country footprint isn’t geographic diversity for marketing—it’s deliberate focus on populations that actually need stablecoin infrastructure rather than want it for speculation.

The 1.4 billion unbanked people globally don’t need another way to trade crypto. They need protection against local currency devaluation. Alternatives to remittance services charging 8% fees and taking four days. Payment rails that work when traditional banks won’t serve their communities or geographic regions.

This focus makes economic sense when you understand emerging market dynamics. Individual transaction values are lower—a US-Philippines remittance might average $300 rather than $3,000. But volume compensates when you’re serving millions of migrants sending money home regularly. Zero fees become essential rather than generous, because any per-transaction cost destroys unit economics at these scales.

Traditional payment networks struggle in emerging markets because infrastructure costs don’t justify profit margins on small transactions. Building physical branches, compliance operations, and correspondent banking relationships for corridors that generate thin revenue per transaction makes no business sense. Plasma’s digital-native infrastructure inverts this equation—marginal cost per transaction approaches zero once validators are operating, making high-volume, low-value corridors economically viable.

The challenge is that emerging markets also mean regulatory complexity, political instability, and currency volatility that increases operational risk. Processing payments across 100+ countries means navigating 100+ different legal frameworks, some of which haven’t decided what stablecoins are, let alone how to regulate them. One hostile regulatory action in a major market could fragment the network or force geographic restrictions that undermine the entire value proposition.

## The Tether Relationship: Strategic Infrastructure or Problematic Dependency?

Tether’s involvement in Plasma goes beyond typical investment. They’re backing the network financially, validating it institutionally, and—most importantly—making Plasma the 4th largest network by USDT balance. That concentration reveals strategic positioning that benefits both parties while creating interdependency worth examining.

For Tether, Plasma solves the infrastructure dependency problem. USDT dominates stablecoin markets but relies entirely on Layer 1s that Tether doesn’t control. Ethereum gas fees spike? USDT transfers become expensive. Regulatory pressure targets a specific chain? USDT faces existential risk on that network. Building or backing alternative infrastructure provides optionality and reduces single points of failure.

The business dynamics are revealing. Every USDT transaction on Ethereum pays gas to ETH validators—Tether indirectly subsidizes competitor infrastructure while capturing no strategic value. Moving volume to Plasma changes that equation, especially if validator economics benefit Tether or affiliated entities. It’s vertical integration disguised as ecosystem development.

For Plasma, Tether’s involvement provides instant credibility and liquidity. USDT is the dominant stablecoin globally—having deep USDT liquidity makes Plasma immediately useful for payments. But that dependency cuts both ways. If Tether’s regulatory situation deteriorates or they decide to prioritize other infrastructure, Plasma’s value proposition weakens considerably.

The concentration risk extends beyond business relationships into technical architecture. When your primary investor is also your largest user and holds meaningful validator influence, governance becomes complicated. Plasma’s consortium structure likely gives Tether significant voice in network decisions even without explicit control. That’s valuable for Tether’s strategic needs. It’s less clear whether it aligns with broader ecosystem health.

## The Interoperability Problem: Islands of Efficiency in Oceans of Friction

Plasma excels at moving stablecoins within its ecosystem. Moving value between Plasma and literally anywhere else? That’s where specialization becomes isolation.

Bridges introduce exactly the problems Plasma was designed to solve—latency, fees, security vulnerabilities. Every major bridge exploit (Ronin’s $600M, Wormhole’s $320M, Nomad’s $200M) proves that cross-chain infrastructure represents the weakest link in crypto security. Plasma can’t fix bridge security because bridges operate outside its architecture.

This matters enormously for real adoption. Users don’t think in chains—they think in capabilities. If I hold USDT on Plasma and need to interact with a DeFi protocol on Ethereum, I’m back to slow, expensive, risky infrastructure. The network becomes an isolated island that serves narrow use cases brilliantly while failing broader interoperability.

Purpose-built chains face an inherent dilemma here. Specialization creates performance advantages but limits composability. Ethereum’s strength isn’t speed—it’s that everything can interact natively. DeFi protocols compose freely. Stablecoins flow between applications without bridge risk. Plasma sacrifices this for payment optimization.

For pure payment use cases—remittances, merchant settlement, salary disbursement—the trade-off works. For anything requiring interaction with broader financial infrastructure, it’s a dealbreaker. The 25+ stablecoins on Plasma can’t easily access lending markets, liquidity pools, or yield opportunities on other chains without introducing the exact friction Plasma eliminates internally.

The path forward requires either native interoperability protocols maintaining Plasma’s performance characteristics (technically complex, requires coordination) or accepting the role of specialized infrastructure for specific use cases rather than competing broadly with general-purpose chains. The crypto industry rarely demonstrates the messaging discipline that second option requires.

## The Validator Question: Decentralization Theater or Honest Centralization?

Plasma’s institutional validator backing—Bitfinex, Tether, Flow Traders, DRW—reveals a consortium model that operates nothing like typical blockchain networks. This isn’t thousands of anonymous validators competing for rewards. It’s known, accountable entities running infrastructure for strategic business reasons.

The crypto industry’s reflexive response is to call this centralized and therefore bad. But payment infrastructure might actually benefit from known validators with capital backing and regulatory accountability. When billions in value flow through your network, “trustless” sounds great in theory but terrifying in practice. Traditional payment rails don’t let random participants process transactions for good reasons.

The issue isn’t whether consortium models can work—it’s the gap between how Plasma operates and how it’s marketed. Standard blockchain rhetoric about decentralization sits awkwardly alongside validator economics that clearly depend on institutional subsidy rather than open participation. That misalignment between messaging and reality deserves examination, especially as regulation demands accountability beyond “code is law.”

High-performance payment networks have historically required some centralization—Visa’s network isn’t decentralized, it’s reliable. Plasma appears to have chosen the same path while using crypto-native framing. Whether that’s pragmatic engineering or deceptive marketing depends on transparency around the actual governance and economic model.

## The Regulatory Gamble: Building Before the Rules Exist

Plasma processes billions in cross-border stablecoin flows while regulators worldwide are still figuring out what stablecoins are. That timing creates enormous opportunity and existential risk simultaneously.

Scott Bessent wants stablecoins defending dollar dominance. The CFTC is investigating. Congress is drafting legislation. Europe is implementing MiCA. Each jurisdiction approaches stablecoin regulation differently, and Plasma’s 100+ country footprint means exposure to every regulatory regime simultaneously.

The bet is infrastructure-first, compliance-second. Build the technical rails now, adapt to regulatory requirements later. It’s the same gamble Uber made with ridesharing. Sometimes first-mover advantage matters more than regulatory clarity. Sometimes you get shut down.

The fragmentation risk is real. If European regulations require protocol-level KYC/AML but Southeast Asian markets resist, does Plasma fork into regional versions? Does it implement geographic restrictions that defeat borderless payment promises? Traditional payment networks solved this through centralization—Visa complies jurisdiction by jurisdiction. Blockchain infrastructure promises something different, but delivering while satisfying vastly different legal systems might be impossible.

The next 24 months determine whether purpose-built payment chains become sanctioned infrastructure or regulatory nightmares. Plasma’s $7 billion in deposits happened before serious frameworks emerged. Scaling to trillions requires regulatory blessing, not just technical capability.

## The Multi-Stablecoin Problem: Flexibility or Fragmentation?

Supporting 25+ different stablecoins sounds inclusive. Operationally, it might fragment liquidity and dilute network effects that make payment infrastructure valuable.

Payment networks succeed through standardization, not diversity. Visa doesn’t process 50 versions of dollars. It processes one, with clear rules and universal acceptance. Every additional stablecoin Plasma supports increases complexity without proportionally increasing utility.

The $7 billion in deposits matters less than its distribution. If USDT represents $6 billion and the remaining $1 billion scatters across 24 other assets, you have one functional payment network and 24 vanity listings. That’s not ecosystem diversity—it’s complexity without value.

Each stablecoin also carries distinct regulatory risk. USDT faces reserve transparency scrutiny. USDC operates under different compliance. Algorithmic stablecoins triggered regulatory panic after Terra. Supporting all of them means inheriting every regulatory risk simultaneously. When one faces action, does Plasma delist it (stranding users) or keep it (risking regulatory contamination)?

For multi-stablecoin support to work, Plasma needs either dominant liquidity in 2-3 major assets (making others irrelevant) or seamless exchange mechanisms making the distinction invisible. The first makes the “25+ stablecoins” claim meaningless. The second requires DEX-like functionality introducing latency and complexity that defeats specialized infrastructure purposes.

## What Actually Matters: Performance Claims vs. Real-World Utility

The 1,000+ TPS metric is less impressive than it initially appears. Transaction throughput means nothing without context—what constitutes a “transaction” and under what conditions are those speeds achieved?

Simple stablecoin transfers are computationally trivial compared to complex smart contract execution. Plasma’s numbers are credible precisely because they optimize for one transaction type. But comparing 1,000 TPS on Plasma to 65,000 TPS on Solana is meaningless when they’re measuring fundamentally different operations.

The real question isn’t theoretical maximum—it’s sustained performance under stress. What happens when volume spikes 10x during market panic? How does Plasma handle spam attacks? Do sub-second block times hold when the mempool fills? Traditional processors like Visa handle 65,000 TPS during Black Friday after decades optimizing for burst capacity. Blockchain networks generally lack this resilience.

Users don’t care about TPS. They care whether transactions confirm quickly and reliably. Plasma’s actual advantage isn’t the number—it’s the combination of speed, finality, and fee structure making payment applications economically viable. A network doing 100 TPS consistently beats one doing 10,000 TPS with unpredictable latency.

## The Honest Assessment: Where Plasma Actually Succeeds

Strip away the marketing and examine revealed preferences. Tether putting significant USDT volume on Plasma demonstrates belief in purpose-built infrastructure advantages, regardless of public messaging. Partners like Yellow Card and WalaPay building production applications show real utility in underserved markets.

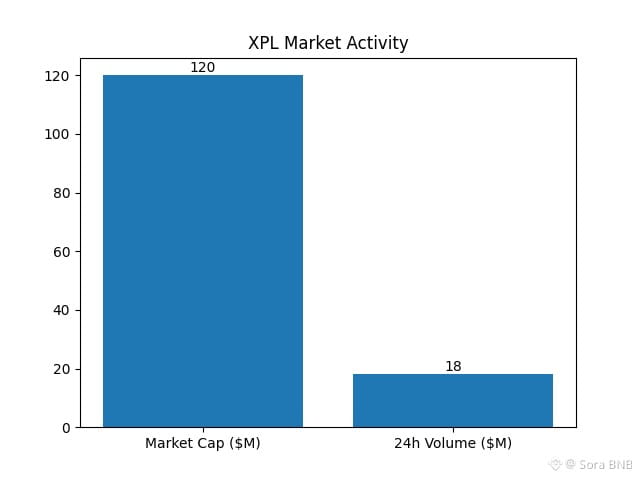

The $7 billion in deposits isn’t trivial, even if distribution across stablecoins is uneven. Ranking 4th by USDT balance indicates meaningful traction. The 100+ country footprint, if operationally functional rather than nominally claimed, represents geographic reach most chains never achieve.

Plasma likely succeeds in narrow, well-defined corridors: remittances in emerging markets, B2B settlement where wire transfer fees are absurd, merchant payments in regions underserved by traditional infrastructure. These aren’t sexy DeFi narratives, but they’re economically substantial and genuinely useful.

The failures or limitations are equally clear: interoperability with broader crypto ecosystems remains unsolved, regulatory fragmentation could destroy the borderless payment promise, dependency on institutional backing creates sustainability questions, and multi-stablecoin support fragments rather than strengthens network effects.

## The Uncomfortable Conclusion

Plasma represents what happens when infrastructure gets built for actual use cases rather than speculative narratives. That’s simultaneously its greatest strength and biggest marketing challenge. Payments aren’t exciting. Emerging market financial inclusion doesn’t generate Twitter hype. Zero fees and sub-second settlement matter more to a Filipino worker sending money home than to crypto traders chasing yield.

Whether Plasma succeeds long-term depends less on technology (which appears functional) and more on navigating regulatory complexity, maintaining institutional backing, and building contained economic loops where users rarely need to leave the ecosystem. That’s a harder problem than processing 1,000 TPS, and one where specialized infrastructure offers no inherent advantage.

The honest take? Plasma is probably the best infrastructure for what it’s trying to do—move stablecoins efficiently in underserved markets. Whether that’s enough to build a sustainable, growing network in an industry obsessed with composability and decentralization remains genuinely uncertain. Sometimes focus wins. Sometimes it’s just expensive narrowness. The next 24 months of regulatory clarity and adoption patterns will reveal which one Plasma actually built.