For years, blockchain has lived with an unresolved contradiction. On one side sits radical transparency, the idea that every transaction should be visible, verifiable, and immutable. On the other sits reality: markets do not function in public view. Businesses negotiate privately. Traders protect their positions. Institutions operate under regulations that demand confidentiality alongside accountability. Ethereum chose transparency as its default, and in doing so unlocked composability and trust. But it also quietly disqualified itself from large parts of real finance.

Most attempts to fix this problem treated privacy as an overlay. Mixers obscured flows but broke compliance. Zero-knowledge systems promised confidentiality but often required entirely new models that felt foreign to Ethereum developers. The industry oscillated between extremes: either full anonymity that regulators could never accept, or partial obfuscation that slowed systems to a crawl. Hedger exists because Dusk took a different starting point. Instead of asking how to hide transactions on Ethereum, it asked how regulated finance actually works, and then built privacy to fit that world.

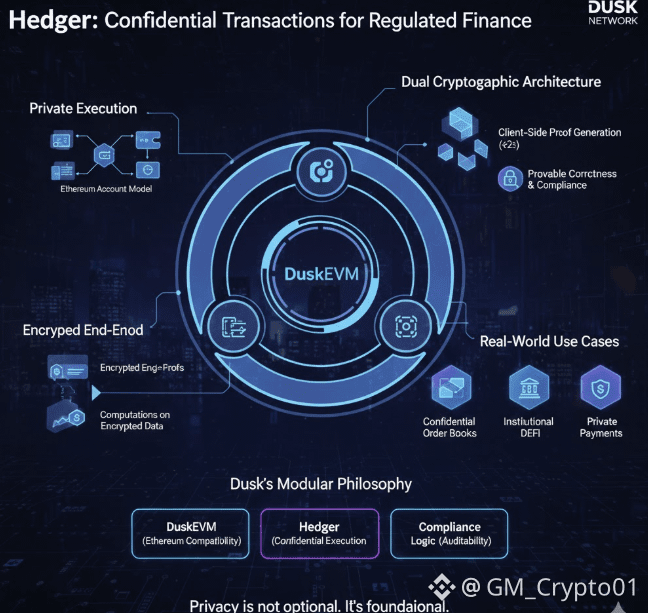

The result is not a bolt-on feature, but a rethinking of what private execution should look like in an account-based environment. Hedger is designed specifically for DuskEVM, which mirrors Ethereum’s account model rather than forcing developers into unfamiliar UTXO abstractions. That choice alone removes a massive amount of friction. Privacy no longer requires rewriting applications from scratch or sacrificing compatibility. Smart contracts behave the way developers expect. Wallets behave the way users expect. Confidentiality is woven into execution, not layered on top of it.

What makes Hedger particularly relevant today is its cryptographic architecture. Zero-knowledge proofs are already well understood in crypto: they allow a system to prove that a transaction is valid without revealing its contents. But on their own, they often struggle with performance, flexibility, or auditability. Hedger adds homomorphic encryption to the mix, enabling computations to be performed directly on encrypted data. This is a subtle but powerful shift. Data stays encrypted end to end, yet balances can be updated, transfers can be validated, and logic can execute without ever exposing sensitive values.

This dual approach changes how privacy behaves under scrutiny. Transactions remain confidential by default, but the system can still produce cryptographic proofs that regulators, auditors, or counterparties can rely on. In traditional finance, privacy does not mean invisibility; it means controlled disclosure. Hedger mirrors that principle on-chain. Sensitive information is hidden from the public, but correctness and compliance are always provable.

Performance is where many privacy systems quietly fail. Complex cryptography often turns user experience into a waiting game, making private execution feel exotic and impractical. Hedger avoids this trap by generating proofs client-side in under two seconds. From the user’s perspective, private transactions feel normal. From an institution’s perspective, this responsiveness is critical. Trading systems, settlement flows, and financial operations cannot tolerate long delays just to preserve confidentiality.

The implications become clearer when you look at real use cases. Consider a confidential order book. In transparent DeFi, large traders expose their positions the moment they place orders, inviting front-running and strategic exploitation. In traditional markets, this information is protected. Hedger enables the same dynamic on-chain. Orders can be placed, matched, and settled without revealing sizes or strategies, while the underlying system remains provably fair and auditable. That single capability bridges a gap that has kept serious market participants on the sidelines.

Hedger also reflects Dusk’s broader philosophy around modularity. Privacy is not expected to solve settlement, compliance, or performance by itself. It is one component in a system where each layer does its job cleanly. DuskEVM provides Ethereum compatibility. Hedger provides confidential execution. Compliance logic can sit alongside without being undermined. This separation is what allows the system to scale without becoming brittle.

There is a deeper shift happening here, one that goes beyond cryptography. Hedger challenges the idea that transparency is the only path to trust. In mature financial systems, trust comes from guarantees, enforcement, and auditability, not from public exposure of every detail. By proving that confidentiality and accountability can coexist on-chain, Dusk reframes what “trustless” infrastructure can look like.

This matters as blockchain moves from experimentation into production. Enterprises and institutions are not looking for novelty; they are looking for infrastructure that mirrors the constraints they already operate under, while offering the efficiencies of decentralization. Hedger speaks their language. It does not ask them to abandon compliance or operational discipline. It meets them where they are, and quietly removes the obstacles that kept blockchain impractical.

DuskEVM, with Hedger at its core, starts to look less like an alternative playground and more like a settlement layer for real markets. Developers get Ethereum tooling without privacy hacks. Institutions get confidentiality without regulatory blind spots. Regulators get provability without surveillance theater. None of these parties have to compromise as much as they used to.

The significance of Hedger is not that it introduces new cryptographic ideas, but that it makes them usable. It takes research-grade concepts and embeds them into an environment that feels familiar, performant, and production-ready. That is how infrastructure actually changes behavior: not by forcing people to adapt, but by removing the reasons they couldn’t participate before.

As demand for confidential execution grows, especially in areas like securities, private payments, and institutional DeFi, systems that treated privacy as optional will feel increasingly incomplete. Hedger’s advantage is that it was never optional. It was designed as a core assumption, aligned with how financial systems operate in the real world.

In that sense, Hedger is less about hiding transactions and more about enabling markets to function honestly on-chain. It proves that privacy does not have to be adversarial to regulation, and that compliance does not require surrendering confidentiality. Dusk is not trying to make Ethereum invisible. It is making it usable for the parts of finance that transparency alone could never serve.