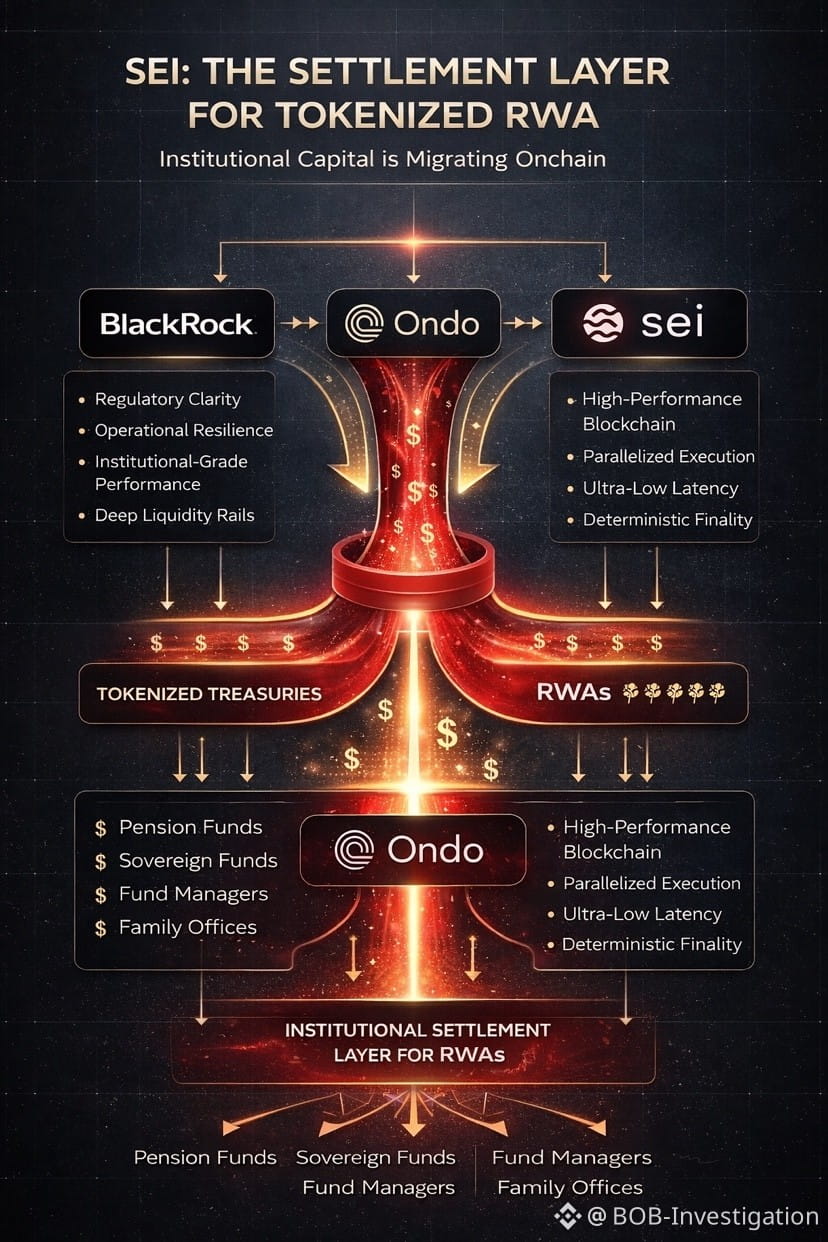

SEI x Ondo x BlackRock — Institutional Capital Is Moving Onchain

Ondo’s USDY — the largest tokenized U.S. Treasury by TVL — is now live on Sei Network, extending the BlackRock–Ondo institutional RWA stack onto a high-performance settlement layer.

This marks a structural shift:

Institutional capital is converging on Sei.

Why this matters:

BlackRock brings global credibility and institutional distribution.

Ondo provides compliant tokenized yield products.

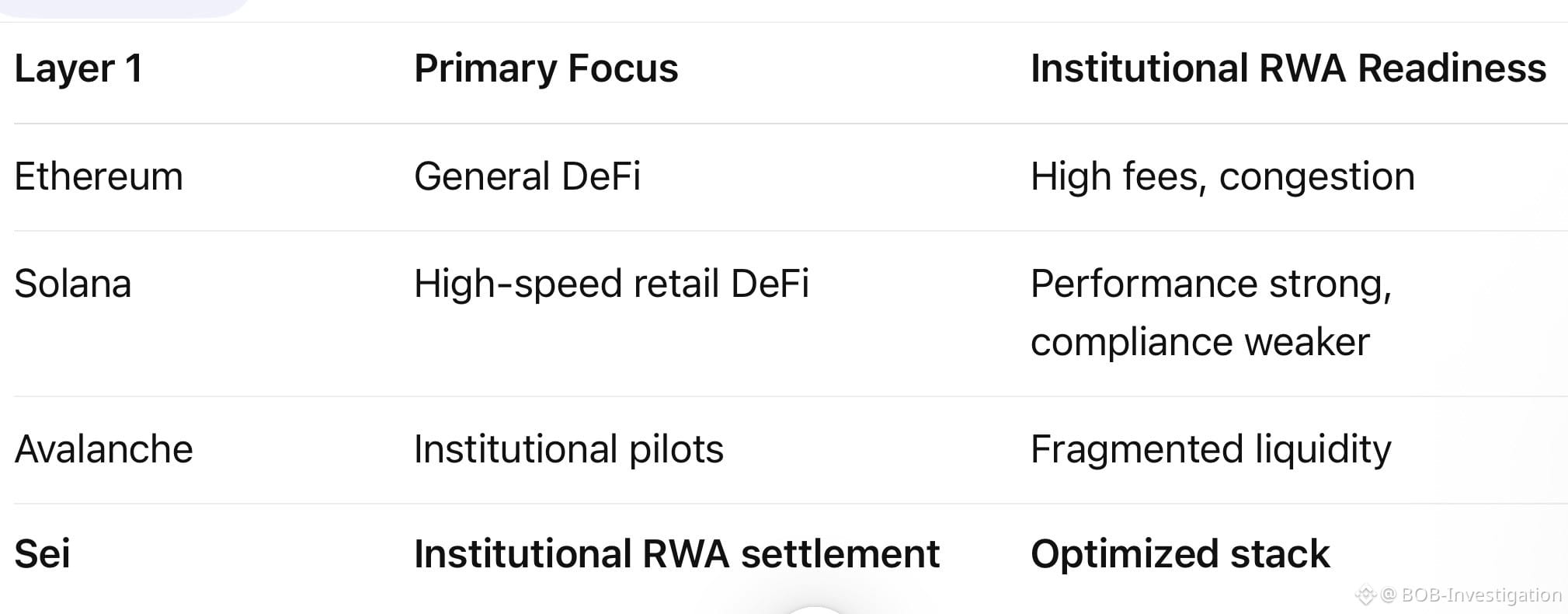

Sei delivers ultra-fast, low-latency, institutional-grade blockchain infrastructure.

Together, they form the core onchain fixed-income and RWA settlement stack.

Investment Implication:

Tokenized Treasuries are becoming the foundation of institutional DeFi.

Sei is positioning itself as the settlement layer for global onchain capital markets — not retail speculation.

This is infrastructure for trillions, not narrative.

🔥 Ultra-short X version:

BlackRock + Ondo + Sei.

Tokenized U.S. Treasuries are going institutional.

Sei is becoming the settlement layer for onchain fixed income.

This is infrastructure, not hype.