The journey of moving money across borders has always been complicated. Traditional banking systems create barriers through high fees, slow settlement times, and geographic restrictions that leave billions of people unable to access the financial tools they need. While stablecoins emerged as a promising solution to these problems, they’ve been running on infrastructure that was never designed specifically for them. That’s where Plasma enters the story, and it becomes immediately clear that this project was built from the ground up with one singular focus in mind.

The Origin Story: From Vision to Reality

The seeds of Plasma were planted by Paul Faecks, a founder who came to the stablecoin space with a unique perspective shaped by experience across multiple corners of the crypto ecosystem. Before founding Plasma in 2024, Faecks had worked at Deribit and later co-founded Alloy, a platform for institutional digital asset operations. Through these experiences, he witnessed firsthand how stablecoins were becoming the most practical application of blockchain technology, yet the infrastructure supporting them remained fundamentally broken. People around the world were already using stablecoins out of necessity rather than speculation, but the experience was clunky, expensive, and filled with friction.

Faecks graduated from the Technical University of Munich and brought together a team that reflected the scale of ambition required to rebuild financial infrastructure. The team of approximately fifty people assembled expertise from companies like Apple, Microsoft, Goldman Sachs, and various crypto-native organizations. They’re not just building another blockchain. They’re reimagining how digital money should move through the global economy, and the team composition reflects that this requires both traditional finance expertise and deep technical blockchain knowledge.

The founding vision centered on a simple but powerful observation. Stablecoins had grown to represent over two hundred and fifty billion dollars in value, yet they were being forced to operate on general-purpose blockchains that treated them like any other token. This created unnecessary costs, complexity, and barriers to adoption. What if someone built a blockchain that was purpose-built exclusively for stablecoin payments from day one? That question became the foundation for everything Plasma would become.

The Technical Architecture: Engineering for Efficiency

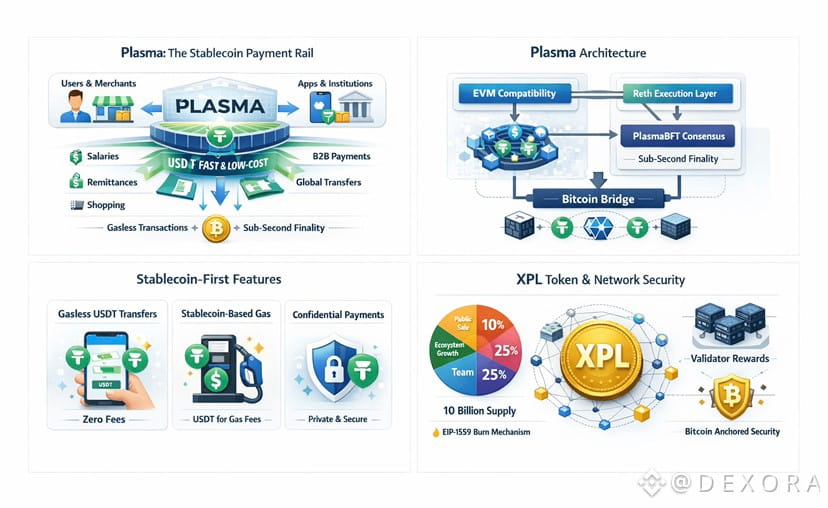

At the heart of Plasma lies PlasmaBFT, a consensus mechanism that represents a significant departure from how most blockchains operate. Built on principles derived from Fast HotStuff, PlasmaBFT was designed specifically to handle the demands of high-frequency stablecoin transactions while maintaining the security guarantees that institutional users require. The consensus layer achieves sub-second finality through a streamlined process that reduces communication overhead without compromising on Byzantine fault tolerance.

What makes PlasmaBFT particularly innovative is its approach to pipelining. Rather than waiting for each phase of consensus to complete before moving to the next, the system processes multiple stages simultaneously. Validators propose new blocks while previous rounds complete their precommit and commit phases, creating a continuous flow of confirmed transactions. This design choice enables Plasma to process thousands of transactions per second while maintaining the deterministic guarantees necessary for moving real value.

The execution layer builds on Reth, a high-performance Ethereum-compatible client written in Rust. This decision ensures that Plasma maintains full EVM compatibility, meaning developers can deploy existing Ethereum smart contracts without any code modifications. The integration between PlasmaBFT and Reth follows a loosely coupled design through the Engine API, allowing the consensus layer to handle sequencing while Reth manages transaction execution and state management. This separation of concerns delivers performance improvements while preserving the battle-tested reliability of Ethereum’s execution environment.

One of Plasma’s most distinctive technical features is its connection to Bitcoin. The network functions as a Bitcoin sidechain, periodically anchoring state commitments to the Bitcoin blockchain. This creates an additional security layer where Plasma’s transaction history inherits the immutability and censorship resistance of Bitcoin’s proof-of-work consensus. A trust-minimized bridge enables actual BTC to move into Plasma’s EVM environment, monitored by a decentralized network of independent verifiers. This Bitcoin integration provides institutional-grade security assurances while maintaining the flexibility and programmability needed for complex financial applications.

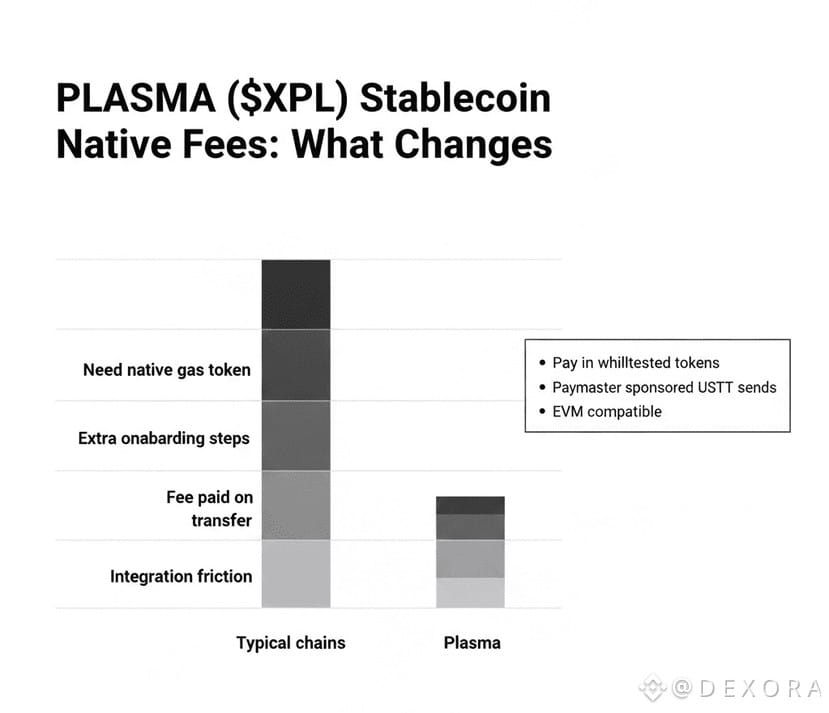

The network’s approach to transaction fees represents another fundamental innovation. Through a protocol-level paymaster system, Plasma enables zero-fee USDT transfers for simple transactions. Users can send and receive Tether without needing to hold XPL tokens or pay any gas fees, removing one of the biggest friction points in current stablecoin usage. The paymaster absorbs these costs, making everyday payments practical and accessible. For more complex operations like deploying smart contracts or interacting with decentralized applications, users pay fees that can be denominated in various assets including USDT or Bitcoin, not just the native XPL token. This gas abstraction feature ensures the network remains economically sustainable while providing a seamless experience for end users.

The Token Economics: XPL’s Role in the Ecosystem

The XPL token serves as the economic backbone of the Plasma network, fulfilling multiple critical functions that align incentives and ensure long-term sustainability. Like ETH on Ethereum or BTC on Bitcoin, XPL secures the blockchain through a proof-of-stake consensus model where validators must stake tokens to participate in block production and transaction verification. The staking mechanism deliberately avoids punitive slashing of collateral, instead implementing reward slashing where misbehaving validators lose block rewards without risking their staked capital. This design reduces the risk profile for institutional validators while still maintaining strong incentives for honest behavior.

The initial token supply stands at ten billion XPL, with a carefully structured distribution designed to balance immediate utility with long-term ecosystem growth. Ten percent was allocated to a public sale that took place in July 2025, which became oversubscribed by seven times, raising three hundred and seventy-three million dollars against a fifty million dollar target. The overwhelming response demonstrated the market’s appetite for infrastructure specifically designed for stablecoins. Forty percent of the supply is reserved for ecosystem growth initiatives, with eight percent unlocked at launch to provide immediate liquidity for DeFi partnerships and exchange integrations. The remaining ecosystem allocation unlocks gradually over three years, ensuring sustained support for network development.

Team and investor allocations follow a strict vesting schedule with tokens locked for three years and a one-year cliff, aligning long-term incentives with network success. This structure prevents early selling pressure and demonstrates the team’s commitment to building lasting infrastructure rather than seeking quick profits. For US participants in the public sale, regulatory considerations require an extended twelve-month lockup period, with distribution scheduled for July 2026.

Validator rewards follow a programmatic inflation schedule starting at five percent annually and gradually tapering to three percent as the network matures. This controlled inflation funds network security while balancing the need for long-term supply stability. As the network decentralizes over time, staked delegation will allow regular token holders to participate in consensus by assigning their XPL to validators, broadening participation without requiring everyone to run infrastructure.

The Funding Journey: Building with Institutional Support

The capital formation story behind Plasma reveals the level of conviction major investors have in purpose-built stablecoin infrastructure. The project began with a four million dollar seed round in October 2024, followed by a twenty million dollar Series A led by Framework Ventures in February 2025. The investor lineup reads like a who’s who of both crypto-native and traditional finance, including Founders Fund led by Peter Thiel, Bitfinex, and direct investment from Tether CEO Paolo Ardoino.

Additional institutional participants include DRW Cumberland, Flow Traders, IMC, and Nomura Holdings, bringing professional trading infrastructure and global distribution capabilities. The involvement of Tether and Bitfinex is particularly significant, providing direct alignment with the world’s largest stablecoin issuer. This relationship positions Plasma as a key distribution channel for USDT while ensuring deep liquidity from day one.

The public sale in July 2025 shattered expectations by attracting over one billion dollars in demand within the first ninety seconds, ultimately raising three hundred and seventy-three million dollars. The overwhelming response came without any private pre-commitments or deals, demonstrating genuine market demand for the infrastructure Plasma was building. This capital provides the runway necessary to execute on an ambitious roadmap that extends far beyond simple blockchain infrastructure into consumer-facing financial products.

The Launch: Orchestrating a Coordinated Ecosystem

On September 25, 2025, at 8:00 AM ET, Plasma’s mainnet beta went live in what would become one of the most significant blockchain launches of the year. The network didn’t launch into a vacuum. From day one, Plasma debuted with over two billion dollars in stablecoin liquidity deployed across more than one hundred DeFi partners, immediately establishing itself as the eighth-largest blockchain by stablecoin liquidity.

The strategic partnerships formed before launch ensured immediate utility rather than a slow build toward adoption. Aave, one of the largest decentralized lending protocols, deployed on Plasma with a commitment of ten million XPL tokens in incentives. Within forty-eight hours of mainnet launch, deposits into Aave on Plasma reached five point nine billion dollars, peaking at six point six billion dollars by mid-October. By late November, Plasma had become the second-largest Aave market globally across all chains, second only to Ethereum mainnet itself, with approximately one point five eight billion dollars in active borrowing. This represented eight percent of all Aave borrowing liquidity worldwide, a remarkable achievement for a network that had launched just weeks earlier.

Additional partnerships with Ethena, Fluid, Euler, and numerous other protocols provided diverse opportunities for users to deploy capital productively. The ecosystem launched with LayerZero-native assets including Tether’s omnichain USDT (USDT0), Ethena’s USDe and sUSDe, and Ether.fi’s weETH, all using the OFT standard for seamless cross-chain movement. This infrastructure enabled deep, liquid markets from the first moment users could access the network.

The launch strategy demonstrated an important principle. Rather than building infrastructure and hoping applications would come, Plasma coordinated with ecosystem partners to ensure that when users arrived, they would find a fully functional financial system ready to serve their needs. The concentrated liquidity model with carefully selected borrowable assets created deep markets that could support institutional-scale strategies, with over one point seven billion dollars in active borrowing demonstrating sustained demand.

Plasma One: Bringing Stablecoins to Everyday Users

Just days before the mainnet beta launch, Plasma announced Plasma One, described as the world’s first neobank built entirely around stablecoins. This consumer-facing application represents the other half of Plasma’s strategy, recognizing that infrastructure alone isn’t enough to drive mainstream adoption. They’re building the distribution layer that puts digital dollars directly into people’s hands, particularly in regions where access to stable currency represents a lifeline rather than a convenience.

Plasma One integrates saving, spending, and sending functions into a single application with a focus on simplicity and accessibility. Users can pay directly from their stablecoin balance while earning yields exceeding ten percent on holdings, with no lockup periods required. The platform offers both virtual and physical cards providing up to four percent cashback on purchases, usable at over one hundred and fifty million merchants across one hundred and fifty countries. All USDT transfers within the application are completely free, removing the friction that has historically limited stablecoin adoption for everyday transactions.

The neobank targets emerging markets where demand for dollar access is highest but traditional banking infrastructure creates the most barriers. The team built Plasma One with specific use cases in mind based on feedback gathered from exporters in Istanbul who need to secure digital dollars to protect earnings, merchants in Buenos Aires paying staff in stablecoins to preserve value against currency instability, and commodity traders in Dubai requiring reliable cross-border transaction capabilities. Each of these scenarios requires localized teams, language support, and integration with regional payment networks, and Plasma One is being rolled out with these considerations built in from the start.

The application is issued in partnership with Rain, a company with experience launching crypto-linked payment cards including the Avalanche Card. Virtual cards can be generated within minutes of onboarding, while physical cards provide the tangible presence many users prefer for everyday spending. The yields offered through Plasma One are generated through opportunities within the Plasma ecosystem, leveraging the network’s DeFi infrastructure and low USDT borrow rates to create sustainable returns for users.

The Competitive Landscape and Market Position

Plasma enters a market dominated by established players but with a differentiated value proposition. Ethereum currently leads in stablecoin liquidity but suffers from high and volatile gas fees that can range from three to fifty dollars during peak usage, making small payments impractical. Tron has captured significant market share through lower fees but lacks the institutional backing and innovative features that Plasma brings. New entrants like Circle’s Arc blockchain, Stripe’s Tempo payment network, and Google’s Global Currency Ledger (GCUL) demonstrate that major players recognize the need for specialized stablecoin infrastructure.

What sets Plasma apart is its comprehensive approach. It’s not just a blockchain or just a payment network or just a consumer application. It’s a vertically integrated system where each component reinforces the others. The blockchain provides the high-performance rails with zero-fee transfers and Bitcoin-level security. The DeFi ecosystem creates productive uses for capital and generates yields. The consumer application puts this infrastructure in the hands of end users through an interface that feels familiar and accessible. This full-stack approach addresses the distribution problem that has limited stablecoin adoption, even as hundreds of millions of people already use them out of necessity.

The network’s focus on institutional-grade features like confidential transactions, regulatory compliance frameworks, and Bitcoin anchoring makes it attractive to traditional financial institutions exploring stablecoin integration. At the same time, the gasless USDT transfers and user-friendly applications make it accessible to individuals who simply need better access to stable money. This dual focus on institutional and retail adoption creates multiple paths to scale.

The Path Forward: Roadmap and Future Vision

The roadmap for Plasma extends beyond simple feature additions into a strategic progression designed to build credibility and expand utility. The immediate post-launch period focuses on consolidating integrations with bridges, decentralized exchanges, and lending protocols while rolling out gasless transfers for third-party applications beyond native wallets. A merchant toolkit is planned to provide invoicing capabilities, payment links, and refund flows, addressing the practical needs of businesses that want to accept stablecoin payments.

Over the next three to nine months, the network plans to introduce external validators and enable delegation, activating the staking economy and distributing network control beyond the initial validator set. This progressive decentralization is essential for maintaining credibility as a neutral settlement layer. Expansion beyond USDT to include USDC and DAI with feature parity will diversify the stablecoin options available while maintaining the zero-fee transfer experience that makes Plasma attractive.

Confidential transaction features are on the roadmap, pairing privacy capabilities with compliance guardrails. This addresses enterprise use cases like payroll and private business-to-business settlements where transaction confidentiality is important but must coexist with regulatory requirements. The planned Bitcoin bridge enhancements will strengthen the connection to the world’s most secure blockchain while enabling more sophisticated uses of BTC within the Plasma ecosystem.

Looking further ahead, the vision extends to becoming the credit layer for stablecoin infrastructure in the new global financial system. This means deepening integrations with on-ramps and off-ramps, expanding relationships with foreign exchange providers, and building out a licensed payments and custody stack so that onchain credit connects to real-world settlement and distribution at scale. These capabilities would plug predictable onchain credit into merchant settlement, treasury services, and cross-border payment corridors for both individuals and institutions.

Challenges and Considerations

The project faces meaningful challenges that will test its ability to deliver on ambitious promises. Maintaining zero-fee transactions as volume scales requires careful economic management to ensure the paymaster system remains sustainable without creating spam vulnerabilities. The network’s initial validator set is small, and achieving meaningful decentralization while maintaining performance will require careful coordination as external validators are onboarded.

Token unlock schedules create potential pressure points, particularly the large ecosystem allocation that unlocks gradually over three years and the US participant distribution scheduled for July 2026. Managing this supply expansion while maintaining price stability and network growth represents a delicate balancing act. The XPL token experienced significant volatility in the weeks following launch, dropping from an initial high above one dollar and sixty cents to below thirty cents before recovering, demonstrating the challenges of price discovery in a newly launched asset.

Competition in the stablecoin infrastructure space is intensifying, with well-funded competitors bringing different approaches to similar problems. The network needs to prove that its specialized focus translates into meaningful advantages over general-purpose blockchains that continue to improve their own stablecoin capabilities. Building and maintaining relationships with regulators across multiple jurisdictions will be essential as governments worldwide develop frameworks for digital currency infrastructure.

The Broader Implications

What Plasma represents extends beyond a single blockchain project. It’s a test of whether specialized infrastructure can outcompete general-purpose solutions for specific use cases. The crypto industry has long operated under an assumption that flexible, programmable blockchains should support every possible application. Plasma challenges that assumption by suggesting that sometimes focus and specialization create better outcomes than generalization and flexibility.

If Plasma succeeds in becoming the dominant infrastructure for stablecoin payments, it validates a model where different types of value transfer happen on purpose-built networks optimized for their specific requirements. This could reshape how we think about blockchain architecture, moving away from the idea of universal platforms toward an ecosystem of specialized chains that excel at particular functions while remaining interoperable through bridges and cross-chain protocols.

The project also represents a bridge between crypto-native innovation and traditional finance. By combining Bitcoin’s security model with Ethereum’s programmability while adding stablecoin-specific optimizations and consumer-facing applications, Plasma creates a system that can serve both worlds. The institutional backing from traditional finance players alongside crypto-native investors suggests a convergence is possible where the best ideas from each domain combine into something neither could build alone.

A New Chapter for Digital Money

We’re seeing the early stages of what could become a fundamental transformation in how money moves globally. Plasma launched with impressive numbers, but numbers alone don’t tell the full story. The real measure of success will be whether the network becomes essential infrastructure that people rely on without thinking about it, the same way they rely on email or text messaging today without considering the underlying protocols.

The vision of everyone, everywhere having permissionless access to saving, spending, and earning in digital dollars remains audacious. It requires not just good technology but sustainable economics, regulatory cooperation, and genuine utility that makes people’s lives better. Plasma has assembled the pieces, from Bitcoin-secured architecture to institutional-grade DeFi to consumer-friendly applications. Now comes the harder part: execution at scale over years, not months.

If this infrastructure succeeds in bringing trillions of dollars onchain while maintaining the security, decentralization, and accessibility that make blockchain technology valuable, it won’t just be another successful crypto project. It will represent a genuine advance in global financial infrastructure, expanding access to stable money for billions of people who need it most. That’s the promise Plasma is working to fulfill, and the next few years will reveal whether purpose-built infrastructure can deliver where general-purpose solutions have struggled. The foundation has been laid. The ecosystem is live. The real journey is just beginning