Most blockchain discussions obsess over motion: faster transactions, higher throughput, and constant activity. Yet when examining Plasma, a more interesting—and largely ignored—question emerges: what makes money stay still?

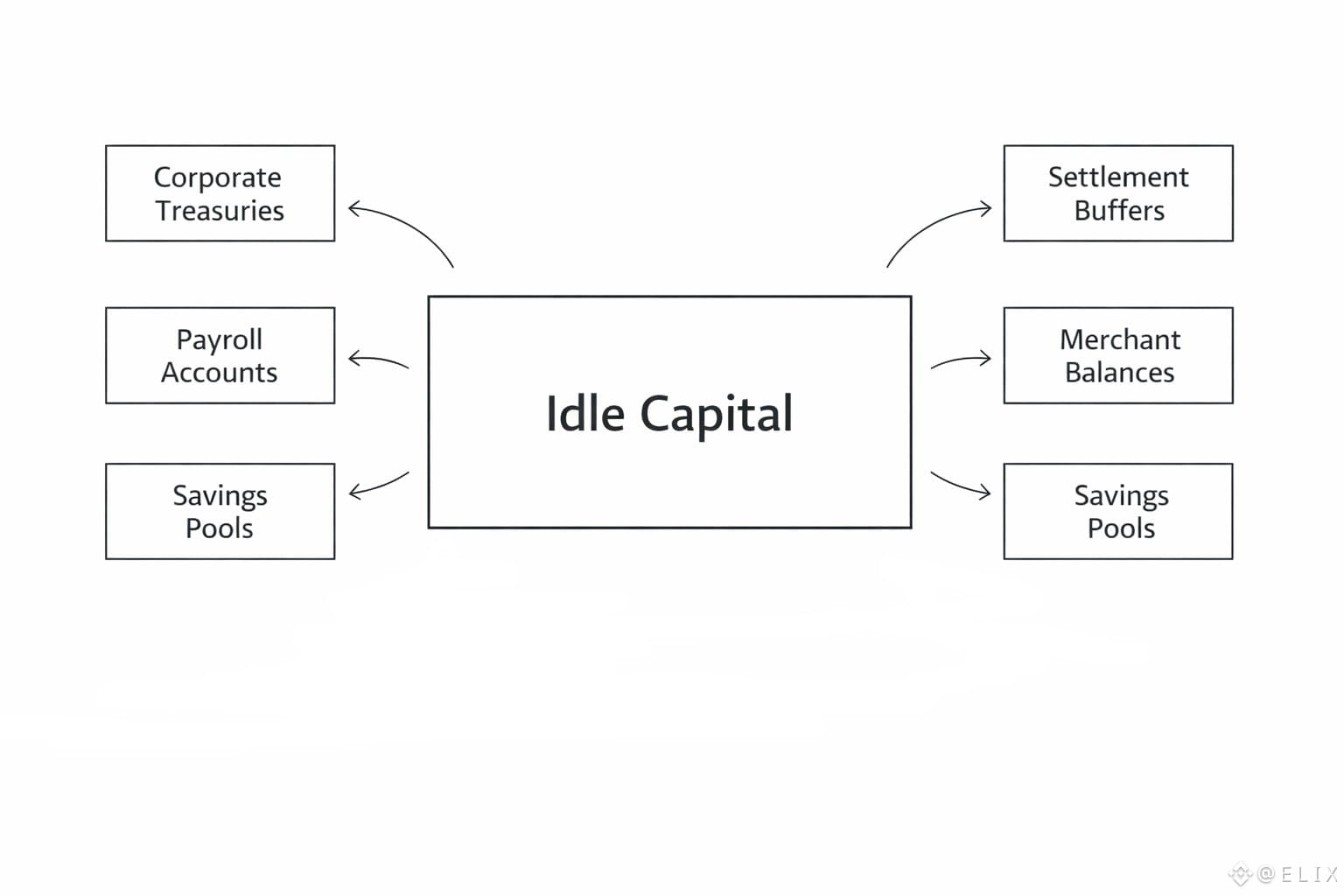

In the real financial world, stillness is the norm. Capital sits idle in corporate treasuries, payroll accounts, settlement buffers, merchant balances, and savings pools for long periods of time. Traditional banking, payment rails, and accounting systems are designed around this reality. Crypto, by contrast, rarely is. Plasma is one of the few networks that deliberately optimizes for financial stillness rather than perpetual movement.

That shift begins with a single design choice—and it changes everything.

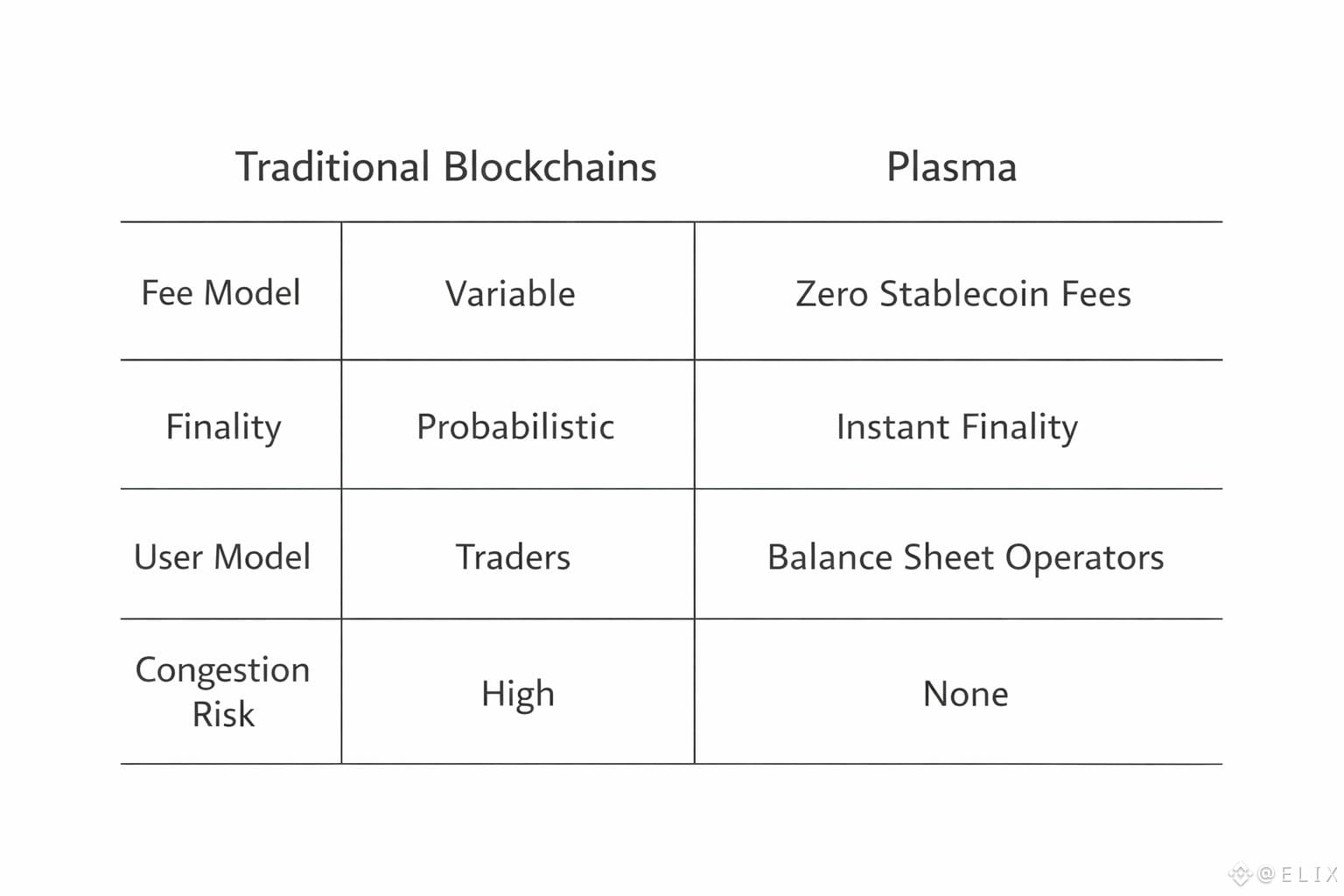

Most blockchains implicitly treat every user as a trader. Fees fluctuate, congestion is unpredictable, and finality is probabilistic. These dynamics may suit speculation, but they break down completely for financial operations. Treasury teams, payroll departments, and compliance officers require certainty. Plasma reorients the model by treating users as balance-sheet operators. Its goal is not market excitement, but to make money boring again—reliable, predictable, and explainable to auditors.

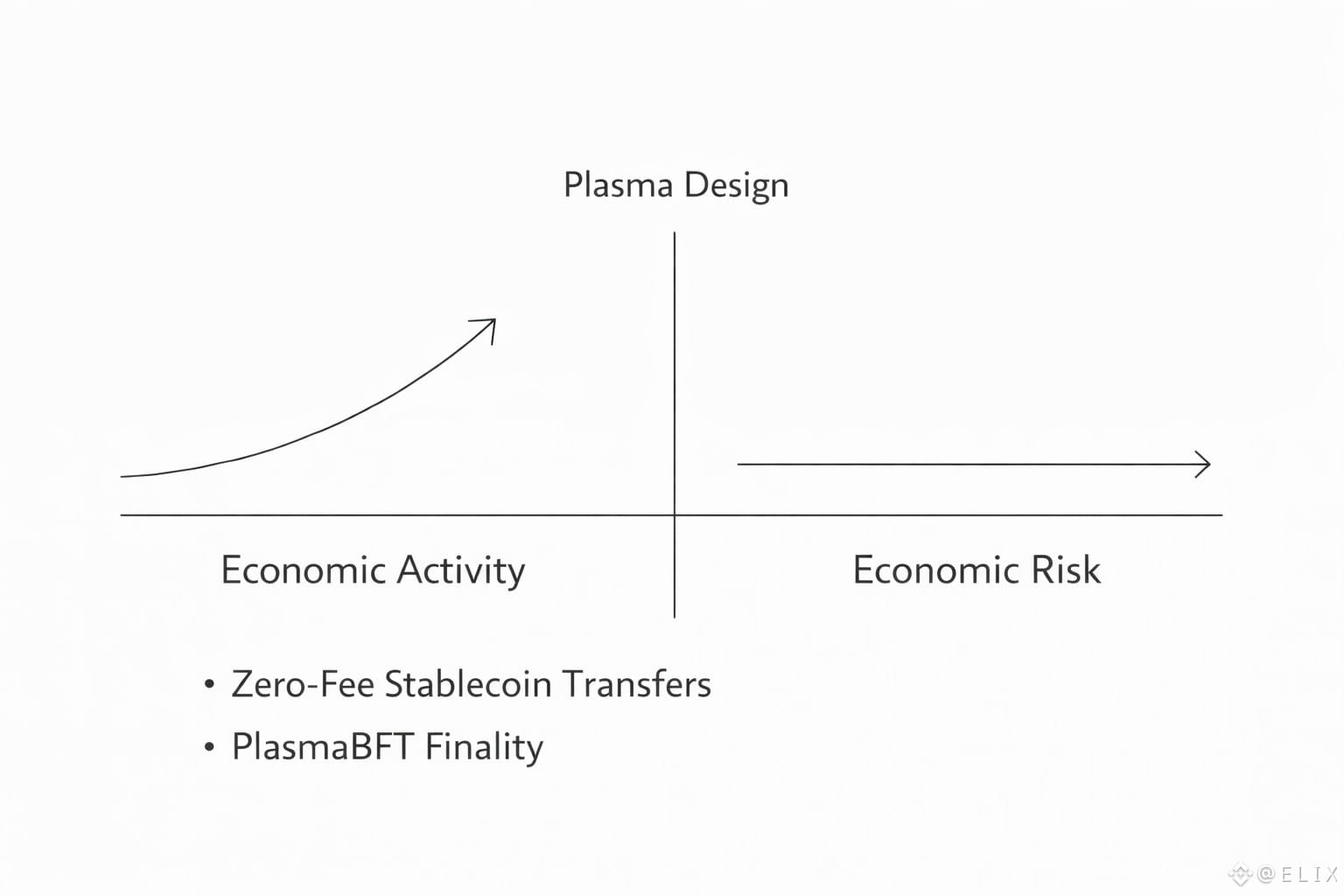

A critical but underappreciated feature of Plasma is how it separates economic activity from economic risk. On most chains, increased usage introduces higher fees, congestion, and settlement uncertainty. Activity itself becomes a source of risk. Plasma removes this coupling. Zero-fee stablecoin transfers ensure that higher usage does not distort costs. PlasmaBFT finality guarantees that once a transaction is confirmed, it is final—no reorgs, no probabilistic settlement, no waiting.

For businesses, this distinction is foundational. A payroll system cannot tell employees that salaries cost more this week because the network was congested. Accounting teams cannot justify fluctuating settlement costs to regulators. Plasma avoids importing the fragility of traditional finance while also avoiding its dependence on centralization.

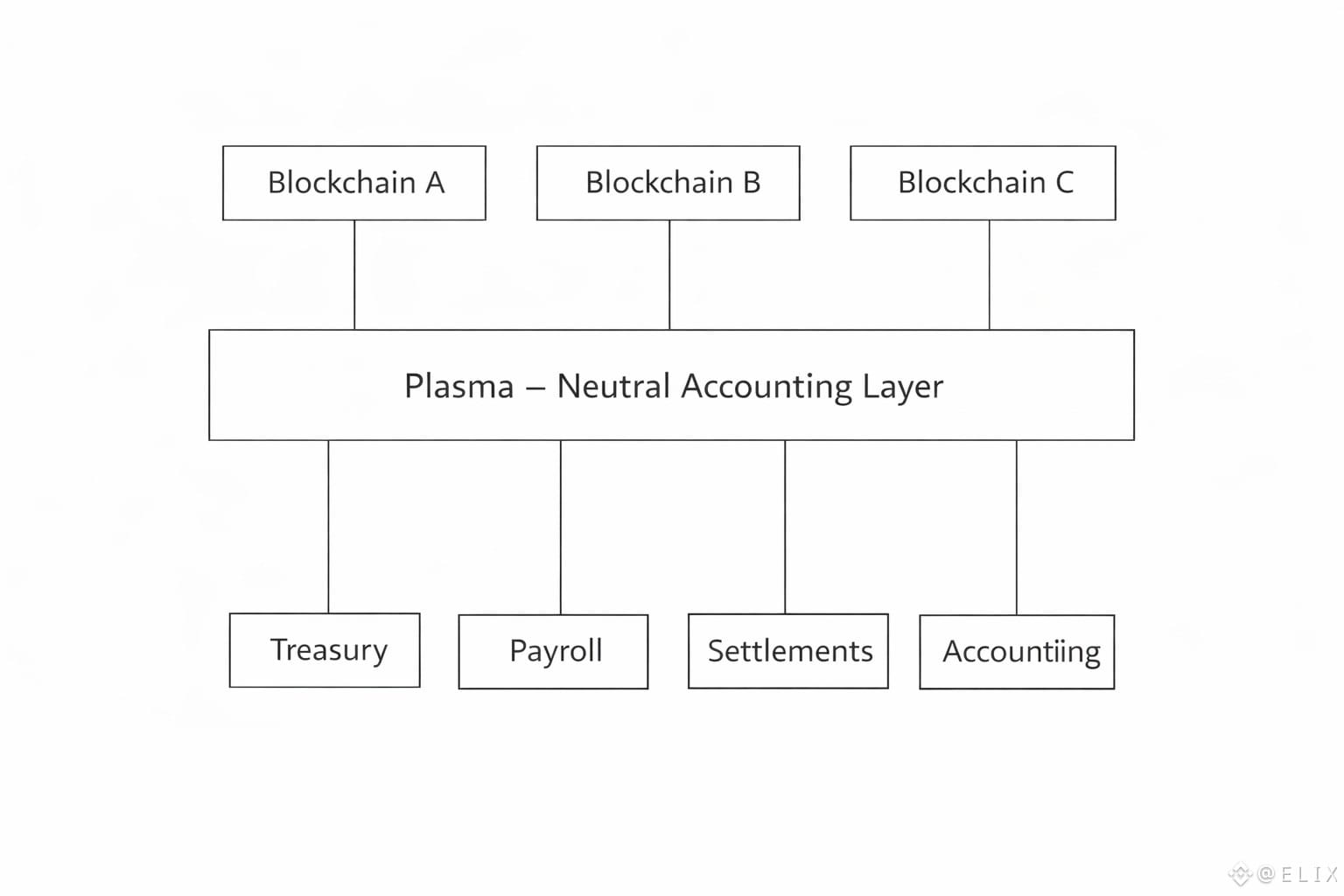

Another overlooked perspective is Plasma’s role as a neutral accounting layer between blockchains. Rather than competing to host every application, Plasma functions as a financial backbone. Assets may live elsewhere, but balances and settlements remain legible and verifiable on Plasma. This architecture resembles clearinghouses more than smart-contract platforms—and that distinction matters.

Plasma also takes an unusual approach to trust. Instead of attempting to manufacture credibility, it borrows it. By anchoring security to Bitcoin—slow and limited, but deeply trusted—Plasma separates trust from execution. Bitcoin provides assurance; Plasma handles efficiency and usability. This division between belief and action is rare in crypto and remarkably powerful.

Privacy in Plasma is similarly misunderstood. It is not about hiding wrongdoing; it is about reducing unnecessary exposure. Financial teams have no incentive to broadcast internal transfers, payroll, or vendor payments to the public. Plasma provides confidentiality by default while remaining verifiable when required—aligning with real compliance needs rather than opposing them.

Equally important is cognitive simplicity. Most blockchains force users to constantly consider gas prices, confirmation times, bridges, and liquidity fragmentation. Plasma removes these decisions entirely. When systems stop demanding attention, trust forms naturally. People rely on infrastructure they do not need to monitor.

This leads to a different adoption curve. Plasma grows quietly through integration, not viral incentives. One treasury connects, then another. A single payroll setup becomes recurring usage. Growth is slower, but far more durable. This is infrastructure adoption, not community hype.

Even decentralization is reframed. Plasma does not attempt to decentralize every application. Instead, it decentralizes financial truth. Balances, settlements, and records are neutral and verifiable, while applications remain flexible. This mirrors the internet itself: shared protocols at the base, diverse interfaces at the top.

Resilience may be Plasma’s most underappreciated quality. It is designed for long periods of low excitement. Its security and relevance do not depend on transaction volume or speculative interest. When markets contract and speculation fades, Plasma continues to function. It is anti-fragile precisely because speculation is not its purpose.

In many ways, Plasma represents crypto’s maturation. It recognizes that value does not require constant growth metrics or narrative cycles. Reliability, predictability, and silence are forms of value—especially in finance. That may feel uncomfortable in a market conditioned to chase momentum, but it is exactly what real financial systems demand.

Plasma does not attempt to overthrow banks overnight. It quietly replaces the most inefficient parts. Fees disappear. Finality becomes absolute. Accounting becomes straightforward. Over time, expectations shift. Once people experience money that simply works, everything else begins to feel broken.

This is why @Plasma cannot be compared to high-performance L1s or DeFi ecosystems. It is not an application platform. It is not a scaling solution. Financial infrastructure must be predictable, auditable, and built to last decades.