Dusk Network is easiest to understand if you start from a simple truth about finance. Markets cannot run on a fully transparent ledger without creating problems that regulators and institutions will not accept. Positions, counterparties, cap tables, settlement instructions, and even routine treasury flows are sensitive. At the same time, finance cannot run in a black box either because you still need provable correctness, settlement finality, and the ability to demonstrate compliance. Dusk is built for that exact tension. Its documentation describes it as a privacy blockchain for regulated finance, where users can have confidential balances and transfers, institutions can meet regulatory requirements on chain, and developers can still build with familiar tooling.

Dusk That is why this project matters. Privacy here is not presented as a vibe or a feature for hiding. It is presented as infrastructure that lets real financial activity exist on public rails without exposing everything to everyone. Dusk leans into the idea of auditable privacy, meaning you can keep sensitive data confidential while still proving the system is behaving correctly, and still enabling disclosure when rules require it. This is also why you keep seeing the word settlement in how they talk about the network, because if you are serious about tokenized assets and regulated activity, settlement finality is not a side quest, it is the product.

Dusk What I like about Dusk is that it does not try to force a single privacy mode onto every flow. On DuskDS, value can move through two native transaction models. Moonlight is public and account based, meaning it fits transparent flows and integrations that need full visibility. Phoenix is shielded and note based, using zero knowledge proofs so transfers can be validated without revealing the same details to observers. Both settle on the same chain, but they expose different information, which is the point.

Dusk That dual lane design becomes even clearer at the wallet level. Their wallet terminology explains a profile as a pair of accounts, a public account for Moonlight transfers and a shielded account for Phoenix transfers. It is a quiet but important detail, because it makes privacy practical instead of ideological. You can keep confidential movement when confidentiality is necessary, and still keep transparent movement available when transparency is demanded.

Dusk The deeper story is that Dusk has been evolving from a single chain narrative into a modular stack narrative. In the multilayer architecture update, Dusk describes a three layer modular stack with DuskDS as the consensus, data availability, and settlement layer, DuskEVM as the EVM execution layer, and a forthcoming privacy layer called DuskVM. The reason they give is straightforward, reduce integration costs and timelines while keeping the privacy and regulatory posture that is supposed to make Dusk different.

Dusk This modular direction also reveals what is happening behind the scenes. DuskDS is framed as the stable settlement anchor. Execution environments can iterate faster above it without constantly changing the base assumptions that institutions care about. The core components documentation describes DuskDS as providing a secure settlement and data availability layer for compliant execution environments such as DuskEVM and DuskVM, and it also mentions a native bridge to move between execution layers.

Dusk On the builder side, DuskEVM is described as EVM equivalent, meaning developers can deploy using standard EVM tooling while inheriting security, consensus, and settlement guarantees from DuskDS. That is a strong posture because it reduces friction for developers who already live in the EVM world, while still keeping Dusk’s regulated finance thesis grounded in its settlement layer.

Dusk Now the project focus that tends to grab people is the idea of confidential securities. Dusk promotes an XSC standard, Confidential Security Contracts, designed for issuance of privacy enabled tokenized securities so traditional financial assets can be traded and stored on chain. This is the part that makes Dusk feel less like generic privacy tech and more like a chain built for capital markets that have rules.

Dusk As the stack moved toward EVM execution, Dusk also introduced a privacy engine called Hedger for DuskEVM. In their Hedger write up, they describe it as bringing confidential transactions to the EVM execution layer using a combination of homomorphic encryption and zero knowledge proofs, and they emphasize compliance ready privacy for real world financial applications. They also explicitly position Hedger as built for full EVM compatibility, integrated with standard Ethereum tooling.

Dusk The regulatory angle is not just branding either. In the NPEX regulatory edge article, Dusk says that through its strategic partnership with NPEX it gains a suite of financial licences, including MTF, Broker, ECSP, and a DLT TSS licence described as in progress. The way they frame it is important, protocol level compliance across the stack so regulated assets and licensed applications can operate under a shared legal framework.

Dusk On the interoperability and data integrity side, a November 2025 release states that Dusk and NPEX are adopting standards from Chainlink, including CCIP and data standards, to support regulated institutional assets on chain and cross chain messaging. The key takeaway is that they are trying to align with infrastructure standards that regulated systems typically demand, not only with smart contract features.

Dusk The token story is surprisingly concrete, which I appreciate. In the tokenomics documentation, Dusk states an initial supply of 500,000,000 DUSK represented across ERC20 and BEP20, and a total emitted supply of 500,000,000 DUSK over 36 years to reward stakers, giving a maximum supply of 1,000,000,000 DUSK. They also state that since mainnet is live, users can migrate tokens to native DUSK via a burner contract.

Dusk It also details staking mechanics like a minimum staking amount of 1000 DUSK and a stake maturity period of 2 epochs, described as 4320 blocks. That matters because it shows a design that expects serious validators, not just passive participation.

Dusk The on chain view of the ERC20 representation matches the supply framing for that token form. On Etherscan, the DUSK ERC20 token page lists a max total supply of 500,000,000 DUSK and shows recent 24 hour transfer activity. That is useful as a reality check when you want to distinguish between the token representation supply and the long term emitted supply described in the mainnet tokenomics.

Dusk If you want a clean timeline anchor for when the network moved into mainnet rollout mode, Dusk published a mainnet rollout post in December 2024 stating the mainnet cluster would be deployed and scheduled to produce its first immutable block on January 7, 2025, with early deposits available January 3 and early stakes on ramped into genesis on December 29. This is the sort of detail that signals Dusk treated mainnet as a controlled operational rollout rather than a single day announcement.

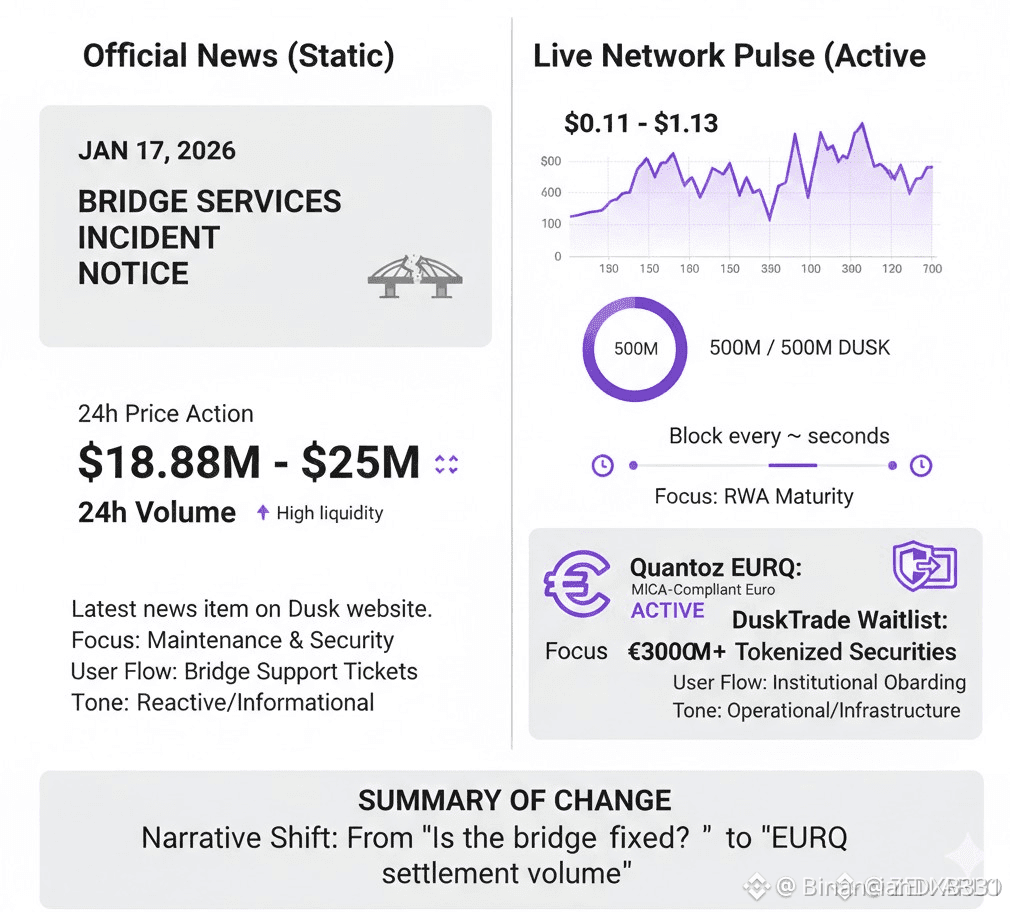

Dusk Now for the part you asked for that really matters, the latest updates, what is new, and what is next. The most important official update in January 2026 is the Bridge Services Incident Notice. In that notice, Dusk says monitoring detected unusual activity involving a team managed wallet used in bridge operations. They say they paused bridge services as a precaution, recycled related addresses, and coordinated with a major platform because part of the flow touched it. They also state that based on the information available at the time, they do not expect user losses to materialize, and they explicitly say it was not a protocol level issue on DuskDS.

Dusk That update is significant because it tells you what kind of infrastructure mindset the team is operating with. Pausing a bridge, recycling operational addresses, and communicating scope clearly is what regulated systems tend to do when something looks off. It is not glamorous, but it is the kind of operational discipline that matters if you are trying to become credible financial infrastructure.

Dusk So what is next, in a grounded way. In the near term, the bridge posture is the gate. The same incident notice makes it clear the bridge remains paused until review is concluded and they are ready to safely resume operations. That implies the next step is a hardened bridge process and a clear timeline for resumption, because safe migration rails are foundational for any ecosystem that wants serious asset flows.

Dusk Beyond the bridge, the direction is the modular stack becoming the default experience. The multilayer architecture post gives you the shape of that future, DuskDS as the settlement anchor, DuskEVM as the execution surface for broad developers, and a privacy layer to deepen confidentiality capabilities over time. The documentation reinforces this by describing DuskEVM as the EVM equivalent execution environment that inherits settlement guarantees from DuskDS.

Dusk If you want the freshest signal that development continues right now, the public pull request list for the Rusk repository shows new pull requests opened on January 30, 2026 and January 29, 2026. That is not marketing, it is active engineering work visible in the open.

Dusk For the last 24 hours update as of January 31, 2026, there does not appear to be a newer official Dusk news post than the Bridge Services Incident Notice dated January 17, 2026. The Dusk site itself lists that incident notice as the most recent news item.

Dusk What has changed in the last 24 hours that you can verify is more about live activity than new announcements. The ERC20 token page shows 24 hour transfer counts and market snapshot details, which provides a real time pulse for the token representation you linked.

Dusk feels like a project that is intentionally choosing the slower, more demanding path. It is not trying to be everything. It is trying to be the chain where regulated markets can exist without forcing all their sensitive data into public view. Phoenix and Moonlight make privacy usable instead of theoretical. Hedger signals that confidentiality is meant to work inside EVM reality, not outside of it. The modular architecture shows they want stable settlement guarantees at the base and flexible execution on top. And the bridge incident response shows the team understands that security and operational control are part of the product, not just the cryptography.