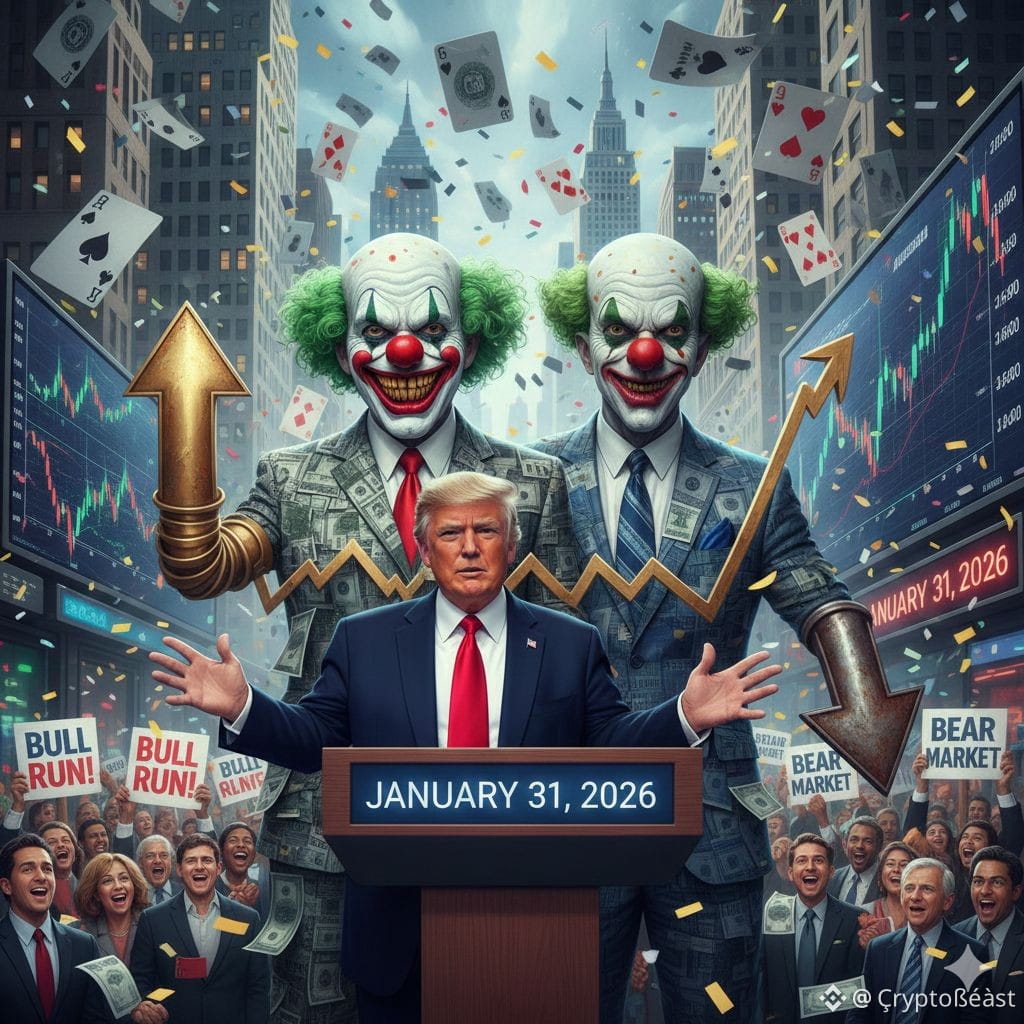

#USGovShutdown #MarketCorrection

In just 72 hours—from Tuesday to Friday—what many called the greatest precious-metals rally of the modern era reversed into one of the largest liquidation events ever recorded.

Gold plunged nearly 15%.

Silver collapsed more than 40%.

An estimated $10 trillion in paper value evaporated almost overnight.

There was no war.

No pandemic.

No major bank failure.

Yet the markets imploded.

Some see this as a long-overdue correction after an extreme rally. Others believe the speed, timing, and mechanics point to something far more calculated—a convergence of political signals, policy shifts, regulatory pressure, and institutional positioning that triggered forced selling on a massive scale.

This is the 72-hour timeline that reshaped the precious-metals market.

TUESDAY: THE SIGNAL

On January 27, 2026, President Donald Trump suggested the U.S. could benefit from a weaker dollar to boost exports.

Markets reacted instantly:

Hedge funds shorted the dollar

Asset managers increased gold exposure

Retail traders rushed into silver

The trade became overcrowded: weak dollar, strong metals.

THURSDAY: PEAK EUPHORIA

By Thursday, optimism reached extremes.

Gold hit $5,600 per ounce.

Silver surged beyond $121.

Retail inflows exploded. Analysts openly discussed silver targets of $200–$300.

FRIDAY MORNING: THE REVERSAL

At 6:00 a.m. Eastern time, Trump announced Kevin Warsh as his nominee for Federal Reserve Chair.

The reaction was immediate:

Dollar shorts rushed to cover

Metals longs scrambled for exits

CHINA STEPS BACK

Chinese exchanges raised margin requirements and reduced participation.

Liquidity disappeared.

Silver crashed from $121 to the mid-$70s.

Gold fell nearly $900 per ounce.

PAPER VS PHYSICAL

In Shanghai, futures trading surged—but physical vault withdrawals remained limited.

Reports suggested physical gold prices in Asia traded well above futures, highlighting a growing paper-physical disconnect.

MONTH-END PRESSURE

The collapse occurred on the final trading day of January, following multiple margin hikes at U.S. exchanges.

For leveraged traders, liquidation was unavoidable.

HISTORICAL ECHOES

1980: Silver spiked to $50 before collapsing after restrictions

2011: Five margin hikes preceded another major crash

2026: Critics argue the same pattern repeated

CENTRAL BANKS KEEP BUYING

As retail traders sold in panic, central banks quietly continued accumulating gold at record levels.

CORRECTION OR RESET?

Officials claim margin hikes reduce risk.

Skeptics argue timing tells a different story.

WHAT COMES NEXT

Historically, silver has recovered after violent crashes.

Whether this time will be different remains to be seen.

Three days were all it took.