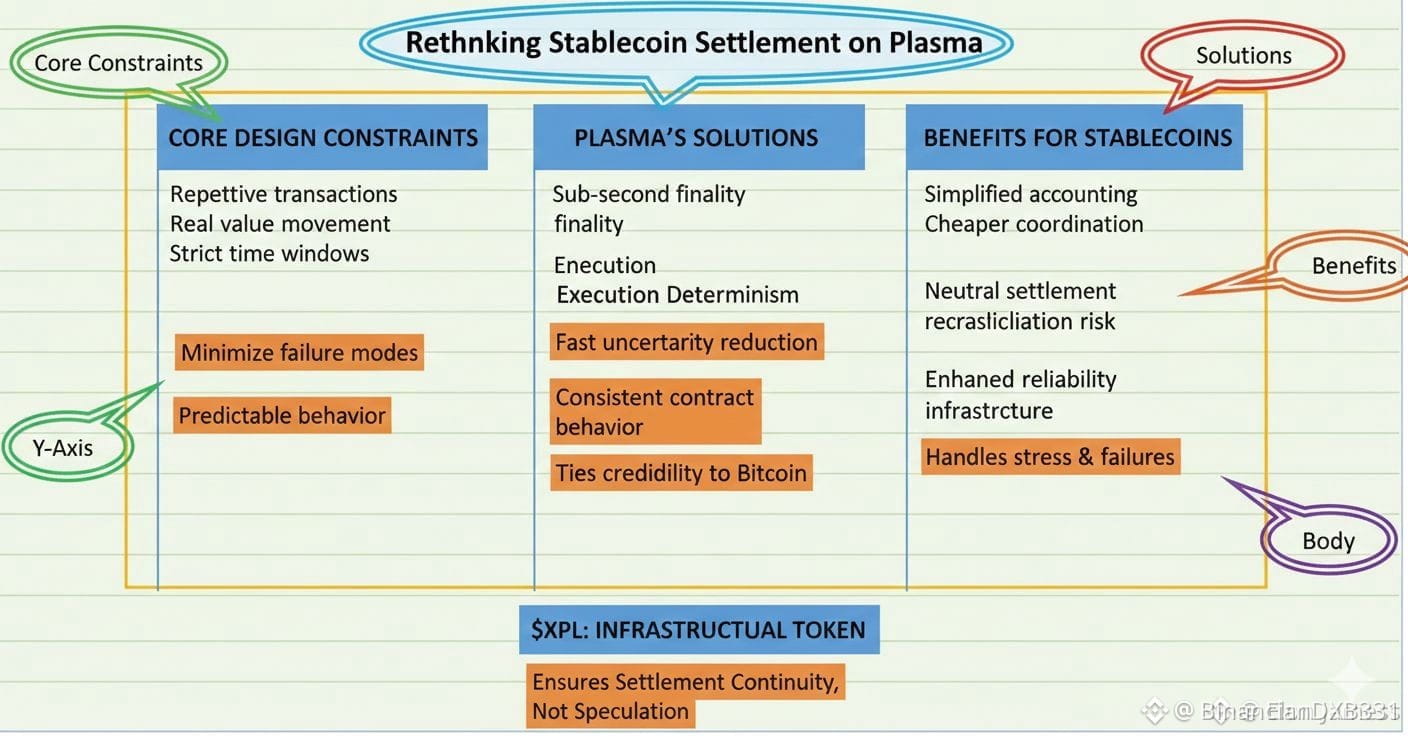

Most people talk about stablecoins by looking at speed or transaction numbers. But real settlement systems are shaped more by how they handle stress and failures than by best case numbers. Plasma shows this clearly because it is built to limit risks instead of chasing features

Stablecoins are not like speculative crypto trading. They are repetitive, move real value, and follow strict time windows. Delays, fee spikes, or transaction reordering don’t just annoy users they create real reconciliation problems for companies

Plasma treats these risks as core design constraints. It shapes how execution and settlement work together instead of leaving them to chance. Predictable behavior is the goal, not hype numbers

One key aspect is how fast uncertainty disappears. Sub second finality does more than speed confirmations. It reduces the time window where transactions can be contested or repriced. For stablecoins this makes accounting simpler and coordination cheaper

Execution determinism is also important. Plasma is EVM compatible not just for developers but to ensure contracts behave consistently under load. This avoids defensive coding patterns and reduces complexity for applications at scale

Security anchoring is another constraint. Plasma ties settlement credibility to Bitcoin. This externalizes trust assumptions. For stablecoins the question is whether value is final. Anchoring makes settlement more conservative and reliable

$XPL is an infrastructural token not speculative. Its role is to keep settlement continuity under normal usage patterns. It is not for bursts of activity or hype. Stablecoins are moving toward neutral settlement, and minimizing failure modes is key

Stablecoin transactions are repetitive, value dense, and operationally time-bound. Plasma’s architecture accepts this reality and builds inward from these constraints. Fast finality, predictable execution, and external security anchoring are central

Sub second finality shrinks uncertainty. Deterministic execution avoids surprises. Bitcoin anchoring strengthens trust. XPL supports continuity. All of this ensures stablecoin settlement works under real world conditions

Plasma does not try to be everything. It focuses on reliable settlement for stablecoins and predictable behavior. Infrastructure is designed around failure constraints, not just throughput or hype

Stablecoins behave differently from speculative activity. They require systems that can handle stress. Plasma reduces reconciliation risk by compressing uncertainty, stabilizing execution, and linking security externally

$XPL is tied to network operations. Its purpose is reliability not speculation. As stablecoins become neutral settlement tools, infrastructure that minimizes failure surfaces matters more than expressive features

Predictable execution compounds over time. Fast finality reduces disputes and simplifies accounting. Security anchoring moves trust from probabilistic to conservative. Plasma is built around these realities

Stablecoin networks need reliability under load not just speed under ideal conditions. Plasma treats failure modes as design constraints. XPL helps maintain steady operation. Execution is deterministic. Settlement is fast. Trust is anchored

Stablecoin settlement works when networks handle edge cases, stress, and partial failures. Plasma focuses on these constraints. XPL maintains continuity. Execution is predictable. Finality is fast. Security is anchored to Bitcoin

This is different from most blockchains. Plasma does not chase every possible use case. It optimizes for reliable settlement, predictable execution, and minimal failure risk under real world usage

Stablecoins are repetitive, value dense, and time sensitive. Plasma architecture accepts this reality. Fast finality reduces uncertainty. Deterministic execution avoids surprises. Bitcoin anchoring ensures reliable settlement

XPL is not a utility token for hype. It enables infrastructure continuity. Plasma is built inward from real stablecoin use. Sub second finality shrinks uncertainty. Execution behaves consistently. Bitcoin anchoring strengthens security

Plasma is designed for predictable behavior under stress, not feature breadth. It builds on stablecoin realities. XPL supports network continuity. Execution is deterministic. Settlement finality is fast. Trust is externally anchored

Stablecoins need settlement layers that are dependable under stress. Plasma compresses uncertainty, preserves execution determinism, and anchors security to Bitcoin. XPL enables steady operation. Predictable settlement is possible

Plasma’s design does not try to redefine blockchain use. It accepts how stablecoins are used today and builds inward. Fast finality, predictable execution, Bitcoin anchoring, and XPL infrastructure combine to make settlement reliable

Stablecoins are becoming neutral settlement tools not speculative assets. Infrastructure that minimizes failure surfaces is more important than expressive blockchain features. Plasma focuses on reliability first

Fast finality reduces disputes. Execution determinism avoids volatility. Security anchoring increases trust. XPL maintains continuity. Plasma infrastructure is built around failure constraints and real usage

Stablecoin networks that handle stress succeed. Plasma delivers that by shrinking uncertainty, ensuring deterministic execution, and linking security externally. XPL is infrastructure not speculation. Settlement is reliable

Stablecoins are repetitive, high value, and time sensitive. Plasma’s architecture addresses this reality. Fast finality reduces uncertainty. Execution is deterministic. Bitcoin anchoring ensures settlement credibility. XPL supports steady operation

Plasma is not about feature breadth. It is about reducing risk and making settlement predictable under real world conditions. XPL is infrastructure. Execution behaves consistently. Settlement finality is fast. Trust is anchored externally

This approach is what makes Plasma different. Instead of chasing hype, it builds inward from real stablecoin usage. XPL ensures continuity. Predictable execution, sub second finality, and Bitcoin anchoring reduce failure risk and improve settlement