Dusk Network, I see a project that picked a difficult lane on purpose. Most chains are built for everything and end up being great at nothing. Dusk chose one clear mission from the start: become infrastructure for financial applications where privacy is required, compliance is real, and settlement must be final. That single choice shapes everything else, from the way transactions are modeled to how the network is designed for regulated assets.

The heart of Dusk is the idea that finance cannot run on full public exposure. In real markets, balances, counterparties, shareholder records, and issuance terms are not meant to be visible to everyone. At the same time, regulated finance cannot accept a pure black box either. Dusk tries to sit exactly in that middle space by building confidentiality into the protocol while still enabling verification when it is needed. That is why the project keeps returning to privacy plus auditability in its official positioning.

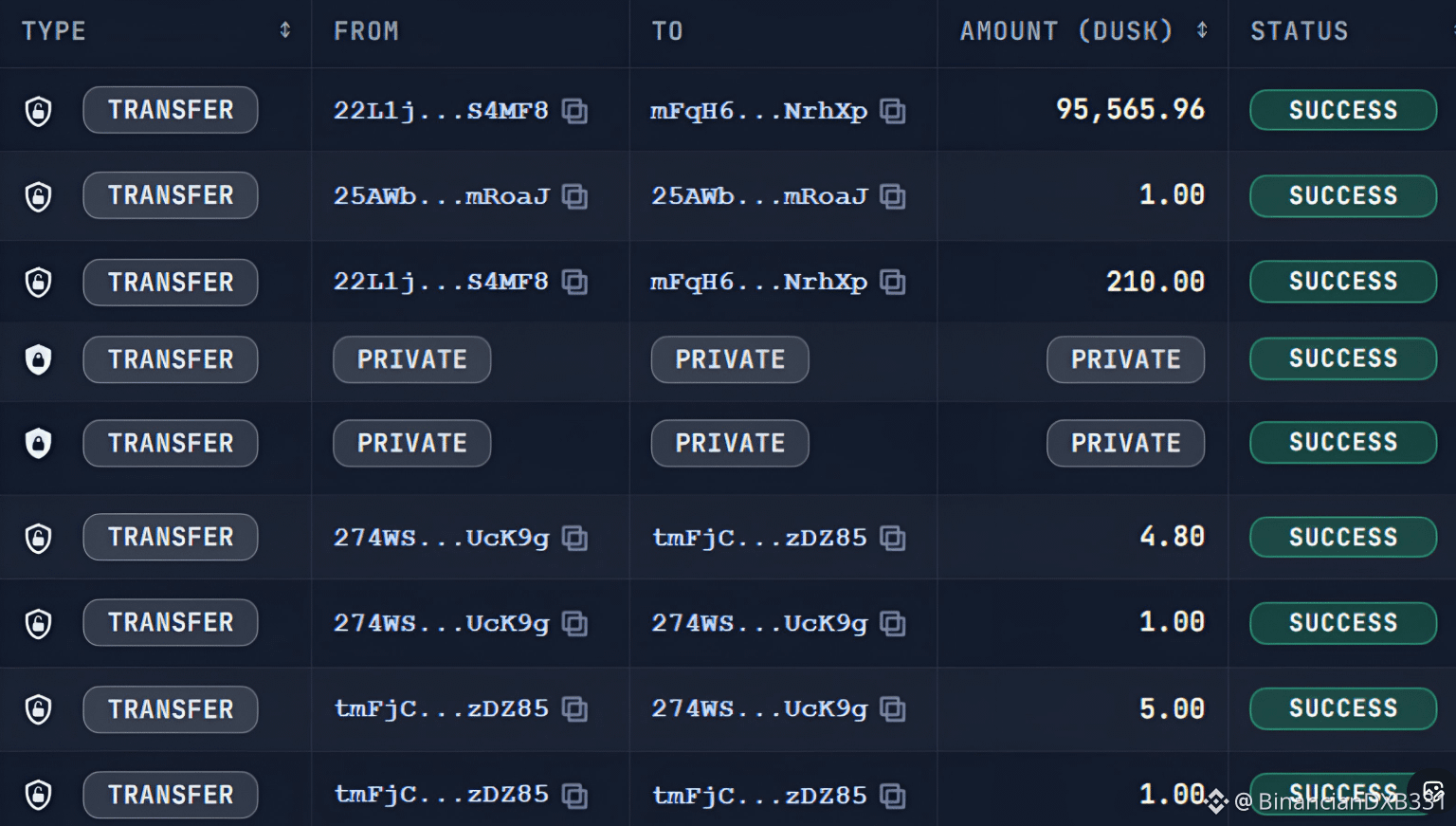

Under the surface, Dusk is not just saying privacy and hoping it works out. It uses a dual transaction approach. One track is public when transparency is required, and another track is shielded when confidentiality is the correct default. The documentation describes these as Moonlight for public transactions and Phoenix for shielded transactions, and that split is a big deal because it reflects how financial systems actually behave. Some actions must be visible, others must be private, and forcing everything into one mode usually breaks either usability or compliance.

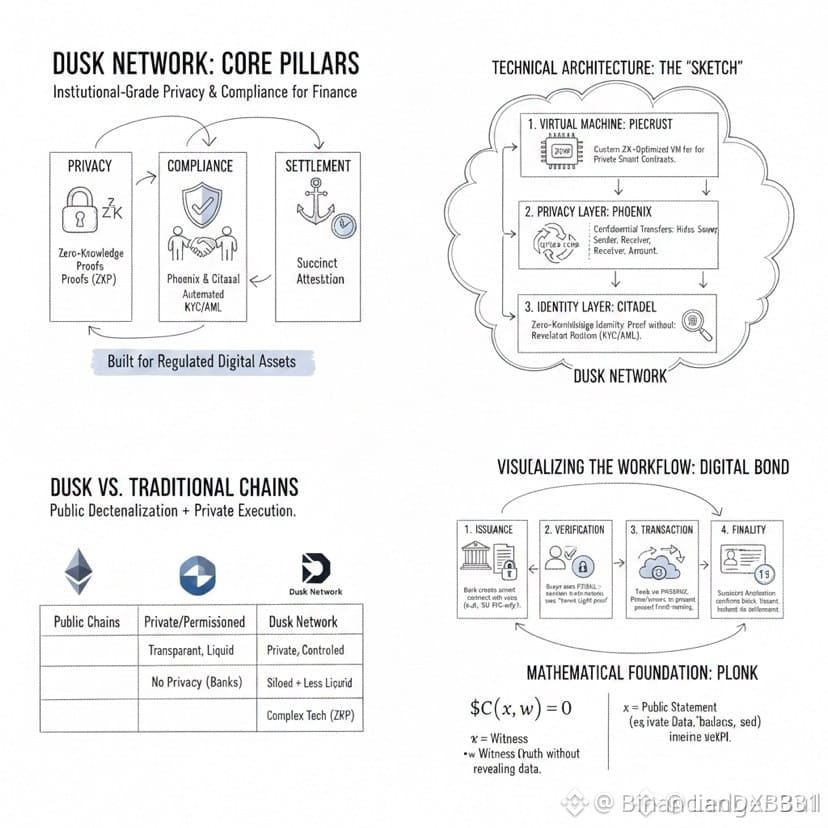

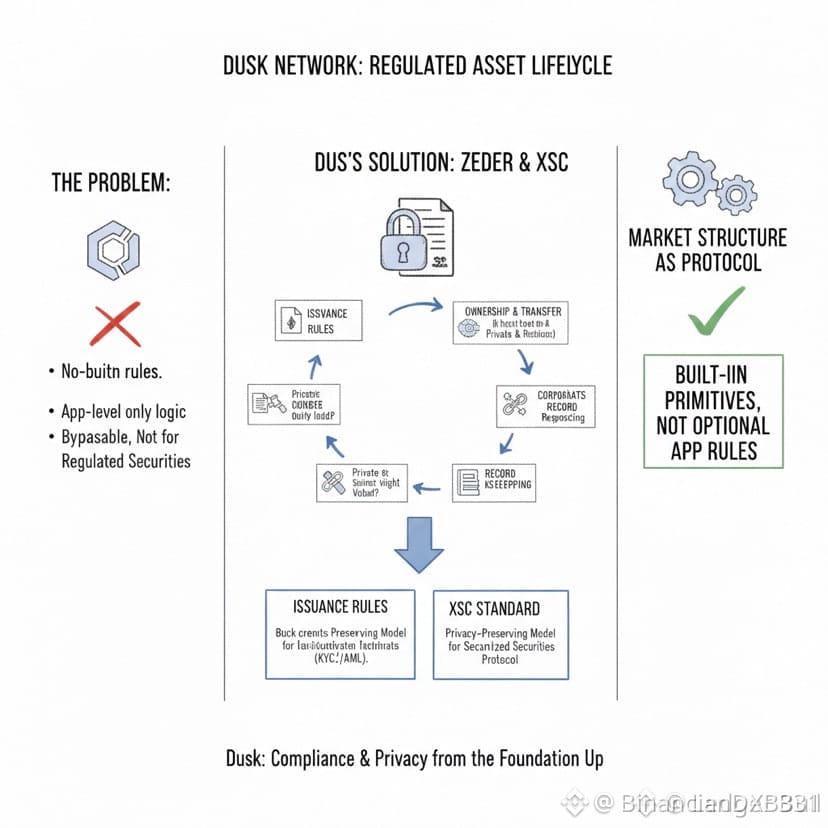

Where Dusk starts to feel truly specialized is in how it treats regulated assets. A security is not just a token that moves around. It has lifecycle rules. Who is allowed to hold it, how ownership is recorded, how transfers are restricted, how dividends and voting work, and how you rebuild records at snapshot points. This is the area where Dusk pushes beyond generic smart contract narratives. The project describes Zedger as a privacy preserving model built for security token requirements, and it connects directly to the XSC standard that Dusk highlights for confidential tokenized securities. In other words, Dusk is trying to turn market structure into protocol primitives, not a set of optional app level rules that can be bypassed.

The architecture is also intentionally modular. Instead of forcing everything into one execution layer, the system is described as DuskDS for consensus and settlement, with execution environments built on top, including an EVM equivalent environment called DuskEVM. That modular design matters because it keeps the settlement layer focused on what finance needs, while still giving builders a familiar path to deploy and iterate using EVM tooling. It is a practical bridge between regulated infrastructure goals and developer adoption realities.

Consensus and finality are another part of the story that often gets overlooked. Dusk documentation describes a proof of stake approach designed for fast deterministic finality. In financial rails, finality is not a nice to have. It is the difference between a completed settlement and ongoing risk. Dusk keeps pointing to that requirement, which is consistent with its stated target market.

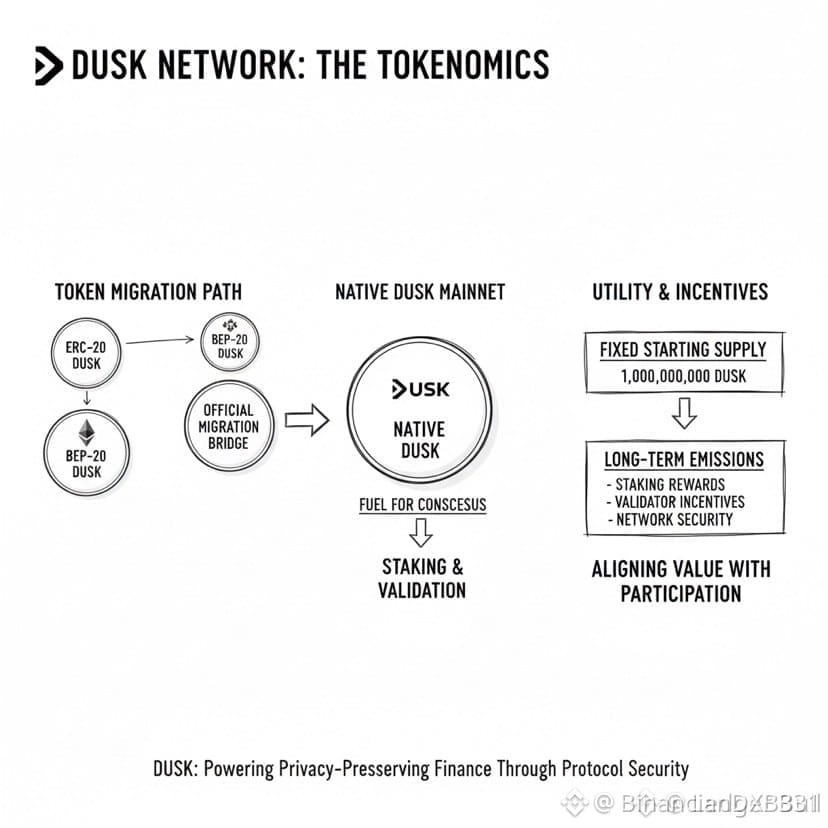

Then there is the token side, but I think it is only useful when it is tied back to the system. DUSK exists as ERC20 and BEP20 representations with a migration path to native DUSK on mainnet through the official mechanism described in documentation. The tokenomics model is built around a fixed starting supply and long-term emissions for staking rewards, aligning the token with network security participation rather than pure narrative value. If you are tracking the project seriously, the token story makes the most sense when you view it as the fuel for consensus and the incentive layer for validators and stakers, not as a separate speculative universe.

On recent progress, the project has been publishing updates that fit the regulated finance thesis instead of drifting into random hype. One of the more important signals from late 2025 is the announcement around adopting standards connected to Chainlink and NPEX, framed around bringing regulated European securities on chain with interoperability and market data standards. That is the kind of move that suggests Dusk is thinking about institutional workflows and integration paths, not just building in isolation.

The most current and operationally meaningful update is the bridge incident notice dated January 17, 2026. Dusk reported unusual activity involving a team managed wallet used in bridge operations, paused bridge services, rotated addresses, and implemented mitigations while stating that the main DuskDS network itself was not impacted. They also made it clear that bridge services would remain paused until a broader hardening pass is completed, and linked reopening plans to the broader rollout timeline. This is not the fun part of any project, but it is the part that shows whether a team treats infrastructure like infrastructure.

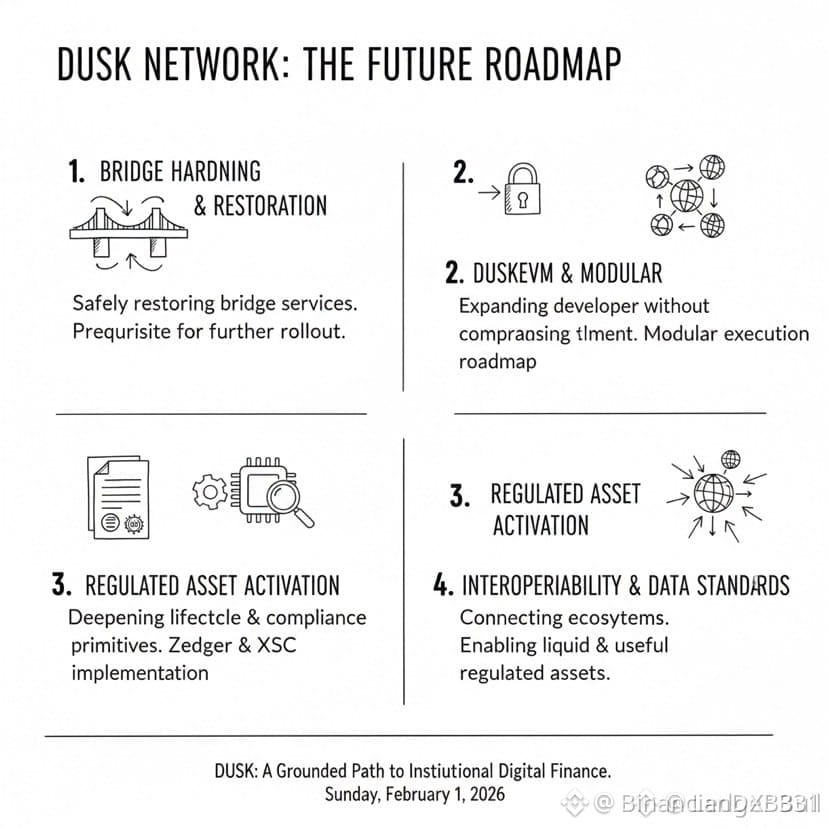

So, what is next, in a grounded way. First, completing the bridge hardening and safely restoring those services. The project itself has framed this as a prerequisite for moving forward with connected rollout steps. Second, continuing to push DuskEVM and the modular execution roadmap, because that is how Dusk expands developer access without compromising the settlement layer design. Third, deeper activation of the regulated asset stack, especially the lifecycle and compliance primitives that make Zedger and XSC more than concepts. Fourth, continuing interoperability and data standard work, because regulated assets do not become liquid and useful if they stay trapped inside one ecosystem.

For the last 24 hours specifically, I do not see a newer official project post on the Dusk site than the January 17, 2026, incident notice, so the newest verified change in the official record remains that operational update and the ongoing paused bridge status while the security hardening work continues.

Dusk is not trying to win by being the loudest chain. It is trying to win by being the chain that regulated finance can actually use. The privacy work is not a gimmick, it is designed into the transaction model. The compliance angle is not a slogan, it is expressed through asset primitives and lifecycle rules. The modular design is not just technical style, it is a way to keep settlement serious while still meeting developers where they are. If Dusk keeps executing with that same discipline, the project has a clear identity in a market where most projects do not.