Headline: Crypto Prices Drop Again Amid Liquidity Fears and Global Risk Sentiment

Short intro:

Bitcoin and other cryptocurrencies continued their downward trend as liquidity concerns and macroeconomic tensions weighed on risk assets. Bitcoin’s slide below recent support levels underscores the market’s struggle amidst external pressures.

What happened:

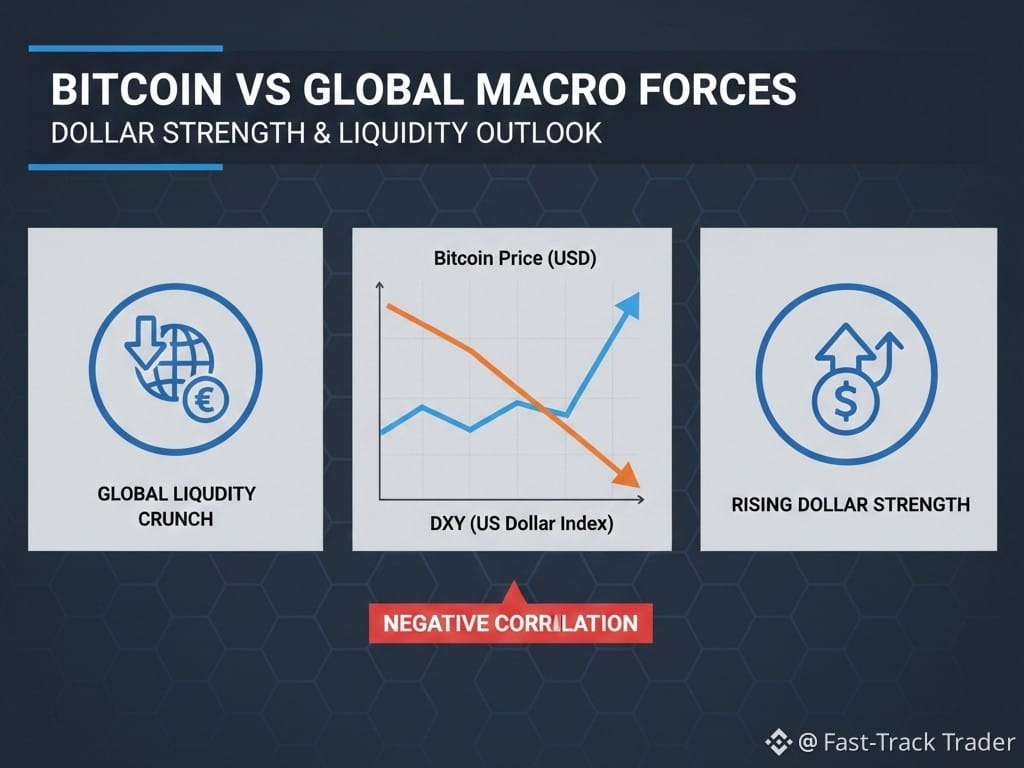

Bitcoin slipped sharply in trading, reaching levels not seen since April 2025 before stabilizing somewhat. Broader risk aversion, strengthened U.S. dollar liquidity, and geopolitical tensions contributed to weaker demand for risk assets like cryptocurrencies. Analysts noted that Bitcoin is acting less as a speculative “political trade” and more like a high‑liquidity risk asset tied to broader financial trends.

Why it matters:

Understanding how macroeconomic forces — such as monetary policy expectations, inflation data, and risk sentiment — affect crypto helps traders and investors navigate volatility. When liquidity tightens and safe‑haven demand rises (e.g., for gold), risk assets like Bitcoin often trend lower.

Key takeaways:

Bitcoin fell to lows not seen since April 2025 before retracing.

Weaker liquidity and stronger dollar sentiment hurt risk asset demand.

Crypto is behaving more like a risk asset correlated with broader markets.

#Bitcoin $BTC #Liquidity #Macro #RiskAssets