Why Does the Market Dump When you Buy & Pump When you Sell?!" 🤔

Ever feel like the market is watching your trades? You buy, and it tanks. You sell, and it moons. But it’s not bad luck—it’s bad timing.

Most traders unknowingly buy at resistance and sell at support, making emotional decisions instead of anticipating market shifts.

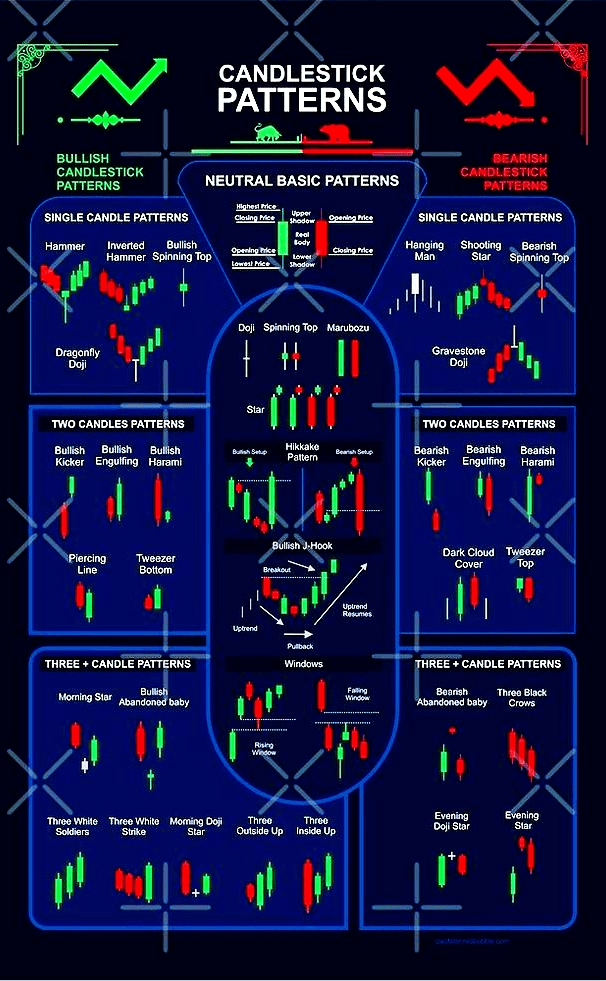

5 Key Candlestick Patterns to Master Trend Reversals (4H Timeframe) 📊

1️⃣ Engulfing Candle (Bullish/Bearish)

A strong candle that fully engulfs the previous one.

💧 Bullish: After a downtrend → signals an upward reversal.

🩸 Bearish: After an uptrend → signals a downward reversal.

2️⃣ Morning Star / Evening Star

A three-candle pattern showing trend exhaustion.

Morning Star: Downtrend → small-bodied candle → strong bullish candle = BUY signal.

Evening Star: Uptrend → small-bodied candle → strong bearish candle = SELL signal.

3️⃣ Hammer & Inverted Hammer

Long lower wick, small real body. Indicates buyers stepping in.

Appears at the end of a downtrend = bullish reversal.

4️⃣ Shooting Star

Opposite of a hammer: Small body, long upper wick.

Appears at the top of an uptrend = bearish reversal signal.

5️⃣ Doji (Indecision Candle)

Small body, nearly equal open/close price.

Signals uncertainty—watch the next candle for confirmation.

How to Avoid Buying High & Selling Low💡

Wait for Confirmation: One candle isn’t enough—look for follow-through.

Check Volume: Real trend shifts come with high volume.

Use Support & Resistance: Never buy into resistance or sell into support.

Be Patient: The best trades come to those who wait.

Next time FOMO kicks in, check the 4H candlestick patterns & trade with confidence—not emotion!

Practice Here 👇🏻

For Such Useful Content Follow @Mr Curious ♥️

❤️ Like 🫂 Follow 🔄 Repost ⌨️ Comment

Your support keeps us going! Thanks for inspiring us to deliver top investment insights.✨

Thanks 🔥

#BSCTradingTips #Write2Earn #candlestick #candlestick_patterns #MrCurious