The Brutal Reality:

📉 Down 96% from ATH = one of crypto's biggest casualties

⚠️ Trading below key EMAs = technical bearish structure

📊 MACD downtrend = momentum still negative

🌊 Macro headwinds pressuring entire crypto market $KAVA

But Here's What Changed:

💰 Total inflows: 78,235 USDT (significant uptick)

🐋 Large holder inflows: 43,341 USDT (55% of total flow)

🤖 AI-first pivot: $3M funding for AI dApp scaling

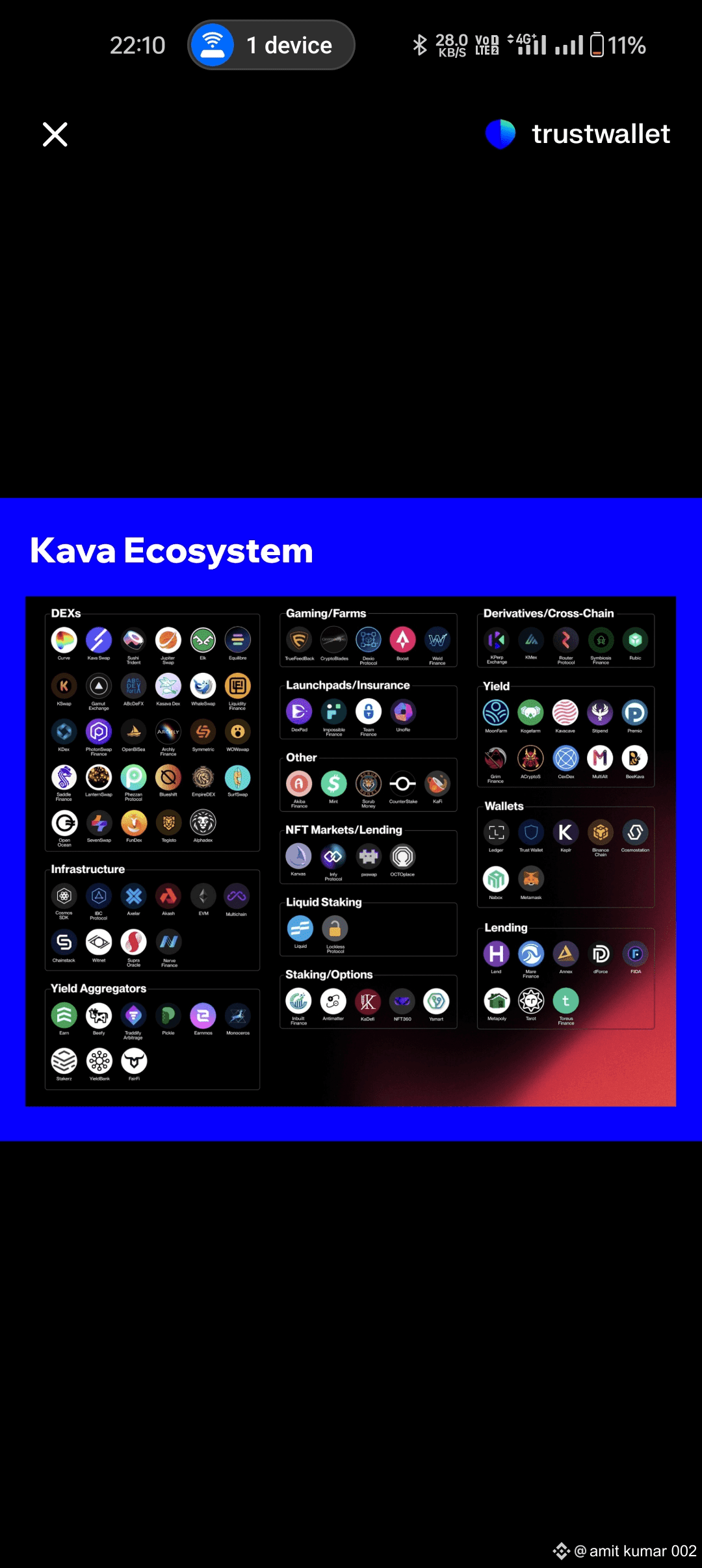

⚡ EVM-Cosmos bridge: Unique dual compatibility advantage

The Whale Logic:

🧠 Contrarian accumulation at maximum pessimism

📊 96% drawdown = limited downside, massive upside potential

🤖 AI narrative early = positioning before mainstream adoption

🏗️ Infrastructure play = long-term value creation

Why This Matters:

✅ USDt integration = institutional-grade liquidity rails

⚡ Yield farming incentives = TVL growth catalyst

🛠️ GPU marketplace = real utility beyond speculation

🌐 Cross-chain AI = addressing actual market need

Risk Assessment:

⚠️ Technical damage severe = could go lower

🎲 AI pivot execution risk = promises vs delivery

⏰ Macro uncertainty = crypto winter not over yet

Historical Context:

📊 Chainlink 2018: Down 95%, whales accumulated, then 100x

🚀 Solana 2022: Similar pattern, infrastructure plays recover hard

💎 Pattern recognition: Smart money buys maximum fear

💡 Poll: Is this the KAVA bottom signal?

🐋 Yes, whales know something we don't

🤔 Too early, more pain ahead

📈 Dead cat bounce, fade the rally

🎯 Waiting for technical confirmation

Comment your thoughts 🤔

Eth may go 5100 in next week