The crypto world is vibrating after Changpeng Zhao (CZ) dropped a bombshell at Davos: We might be entering the first-ever Bitcoin Supercycle.

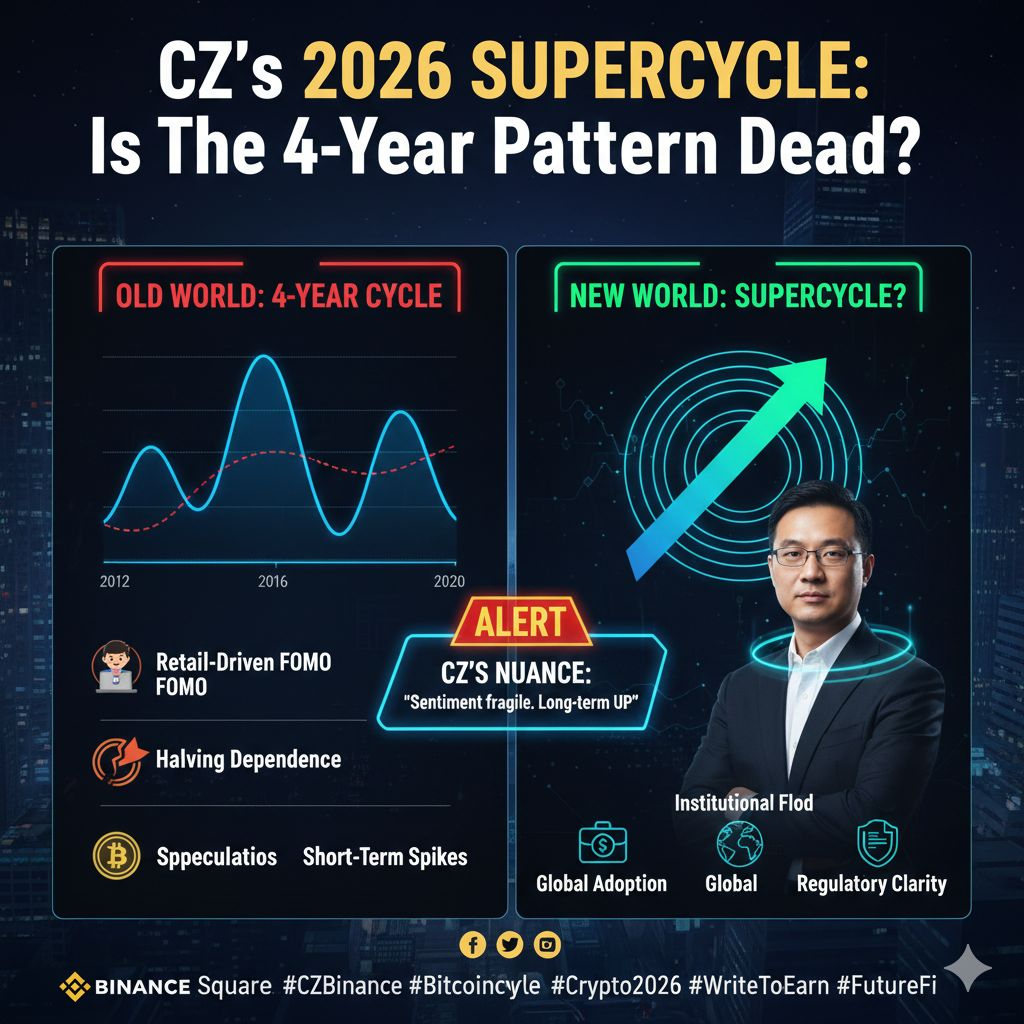

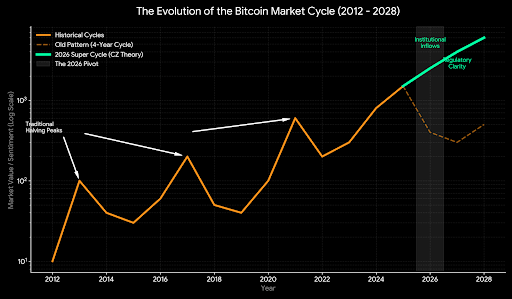

For years, we’ve lived by the "4-Year Cycle" (Halving -> Pump -> Dump). But CZ is suggesting that the old playbook is being tossed out the window. Here’s the breakdown of what he actually said and why it matters for your portfolio right now.

1. The "Death" of the 4-Year Cycle?

Historically, Bitcoin peaks roughly 14–18 months after a halving. But CZ believes 2026 is different. Why? Because for the first time, we have global political alignment.

The "Pro-Crypto" Era: With the U.S. and other major economies flipping to a pro-crypto stance, the structural demand is overriding the halving math.

The Shift: We aren't just looking at a speculative spike; we’re looking at a structural market regime change.

2. It’s About "Smart Money," Not Just Hype

CZ pointed out that the 2026 momentum isn't just retail FOMO. It’s being fueled by:

Institutional Flood: Corporate treasuries and ETFs are creating a "supply shock" that doesn't care about 4-year timelines.

Regulatory Clarity: The SEC’s move to take crypto off the "priority review" list in late 2025 has opened the floodgates for "Safe Money" to enter the building.

3. The "CZ Reality Check" (Don't Ignore This)

While the headlines scream "Moon," CZ has been more nuanced in his recent Square posts and AMAs. He openly admitted that market sentiment is still fragile.

Confidence vs. Certainty: After the recent slide toward $75k and liquidations, CZ noted his confidence in the timing "softened" slightly due to FUD.

Feature Old World: 4-Year Cycle New World: 2026 Supercycle

Primary Driver Retail FOMO & Speculation Institutional Adoption & Sovereign Wealth

Timing Anchor The Halving (Every 210,000 blocks) Global Liquidity & Regulatory "Green Lights"

Price Volatility Extreme (80-90% Bear Market drops) "Dampened" Volatility (Shallow pullbacks)

Market Narrative "Digital Gold" for Tech Geeks Global Alternative Monetary Infrastructure

Main Players Early Adopters & Retail Traders Wall Street, Central Banks, & Fortune 500s

Regulatory Status The "Wild West" (Grey Area) Standardized Assets (Clear Compliance)

Institutional Adoption & Sovereign Wealth

Old World: 4-Year Cycle New World: 2026 Supercycle

Primary Driver Retail FOMO & Speculation Institutional Adoption & Sovereign Wealth

Timing Anchor The Halving (Every 210,000 blocks) Global Liquidity & Regulatory "Green Lights"

Price Volatility Extreme (80-90% Bear Market drops) "Dampened" Volatility (Shallow pullbacks)

Market Narrative "Digital Gold" for Tech Geeks Global Alternative Monetary Infrastructure

Main Players Early Adopters & Retail Traders Wall Street, Central Banks, & Fortune 500s

Regulatory Status The "Wild West" (Grey Area) Standardized Assets (Clear Compliance)

Feature Old World: 4-Year Cycle New World: 2026 Supercycle

Primary Driver Retail FOMO & Speculation Institutional Adoption & Sovereign Wealth

Timing Anchor The Halving (Every 210,000 blocks) Global Liquidity & Regulatory "Green Lights"

Price Volatility Extreme (80-90% Bear Market drops) "Dampened" Volatility (Shallow pullbacks)

Market Narrative "Digital Gold" for Tech Geeks Global Alternative Monetary Infrastructure

Main Players Early Adopters & Retail Traders Wall Street, Central Banks, & Fortune 500s

Regulatory Status The "Wild West" (Grey Area) Standardized Assets (Clear Compliance)

Feature Old World: 4-Year Cycle New World: 2026 Supercycle

Primary Driver Retail FOMO & Speculation Institutional Adoption & Sovereign Wealth

Timing Anchor The Halving (Every 210,000 blocks) Global Liquidity & Regulatory "Green Lights"

Price Volatility Extreme (80-90% Bear Market drops) "Dampened" Volatility (Shallow pullbacks)

Market Narrative "Digital Gold" for Tech Geeks Global Alternative Monetary Infrastructure

Main Players Early Adopters & Retail Traders Wall Street, Central Banks, & Fortune 500s

Regulatory Status The "Wild West" (Grey Area) Standardized Assets (Clear Compliance)

His Stance: He doesn't trade short-term. He’s looking at a 5–10 year horizon, where he says the direction is "very easy to predict: Up."

📈 What to Watch for Confirmation

If this is a true Supercycle, we need to see three things:

Bottom Line: CZ isn't giving you a "get rich quick" date. He’s giving you a framework. The 4-year cycle was a retail-driven phenomenon. The 2026 Supercycle is an institutional evolution.

What do you think? Is the 4-year cycle truly dead, or are we just in a massive "bull trap"? 👇 Let’s debate in the comments!

#CZBİNANCE #BitcoinSupercycle #BTC2026 #CryptoMarketAnalysis #writetoearn

BTCUSDTLöpande68,366.1+1.11%

BTCUSDTLöpande68,366.1+1.11% USDC1.0003+0.02%

USDC1.0003+0.02% BNBUSDTLöpande625.65+1.17%

BNBUSDTLöpande625.65+1.17%