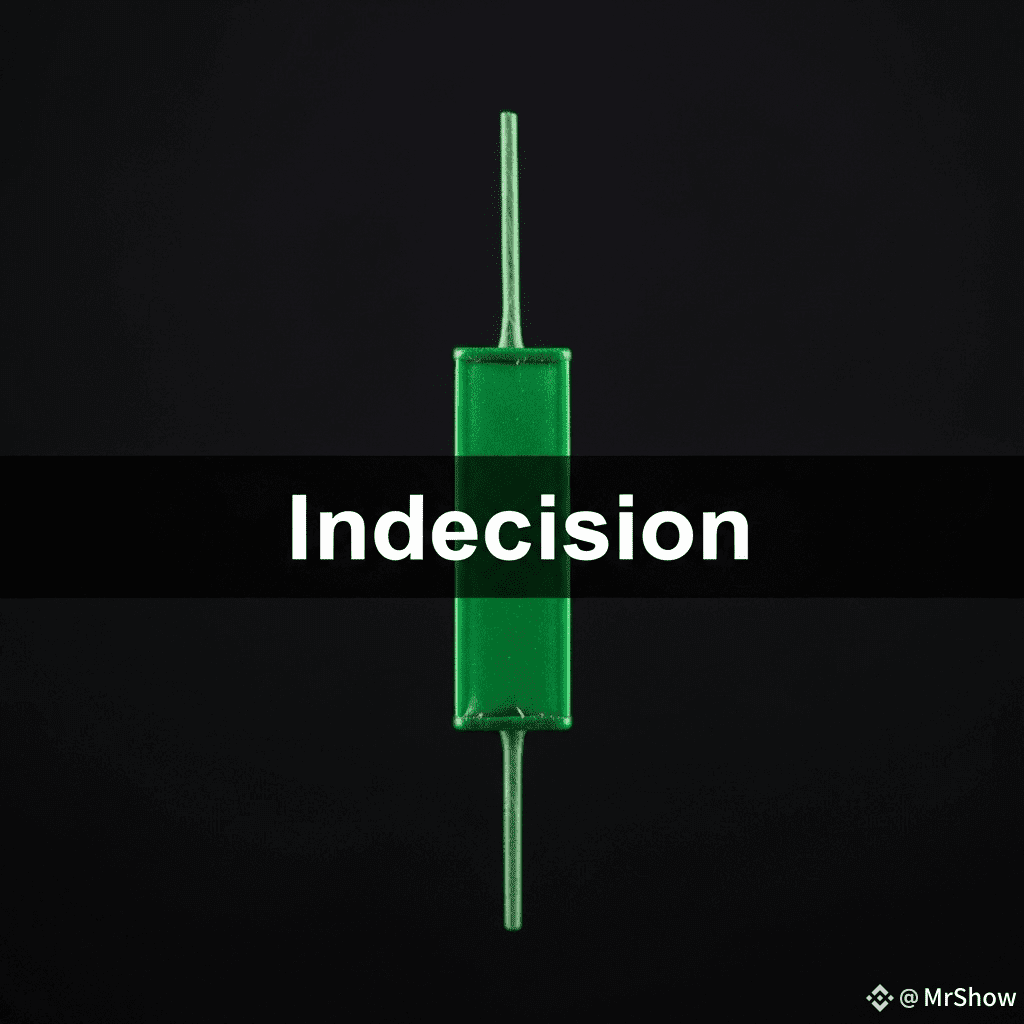

The spinning top 🎡📊 is a candlestick with a small body and long wicks on both sides. It signals indecision in the market, where neither buyers nor sellers dominate. Binance traders see it as a potential sign of consolidation or a pause before the next move.

1. 🎡⚖️ Market Indecision 🕯️

Spinning tops reflect balance between bulls and bears. Price moves both ways but closes near the open, showing no side is clearly stronger.

---

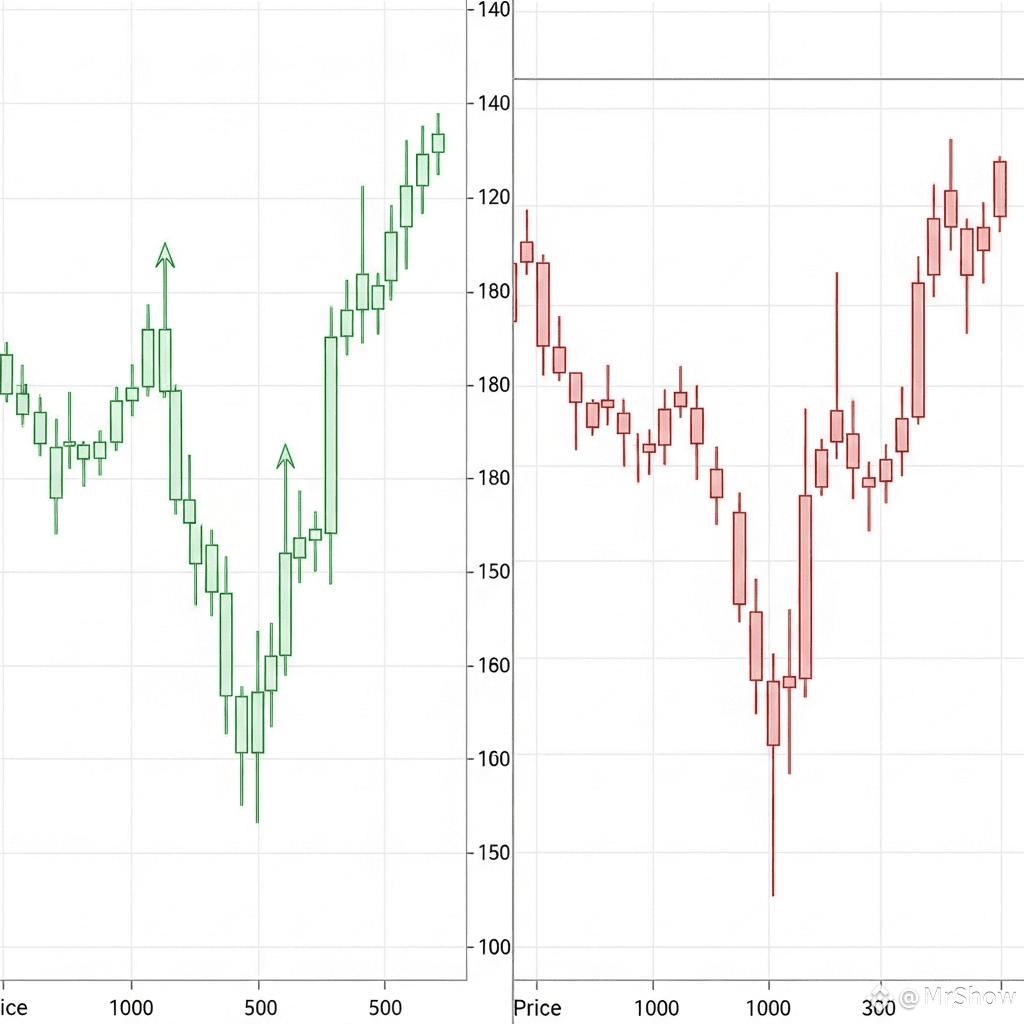

2. 📈📉 Appears in Both Trends 🔄

Spinning tops can appear in uptrends and downtrends. In an uptrend, it suggests momentum is slowing. In a downtrend, it shows sellers may be losing strength.

---

3. 💡📊 Reversal Possibility ⚠️

While not as strong as hammer or engulfing patterns, spinning tops can indicate potential reversals if confirmed by other signals. Traders watch the following candles for confirmation.

---

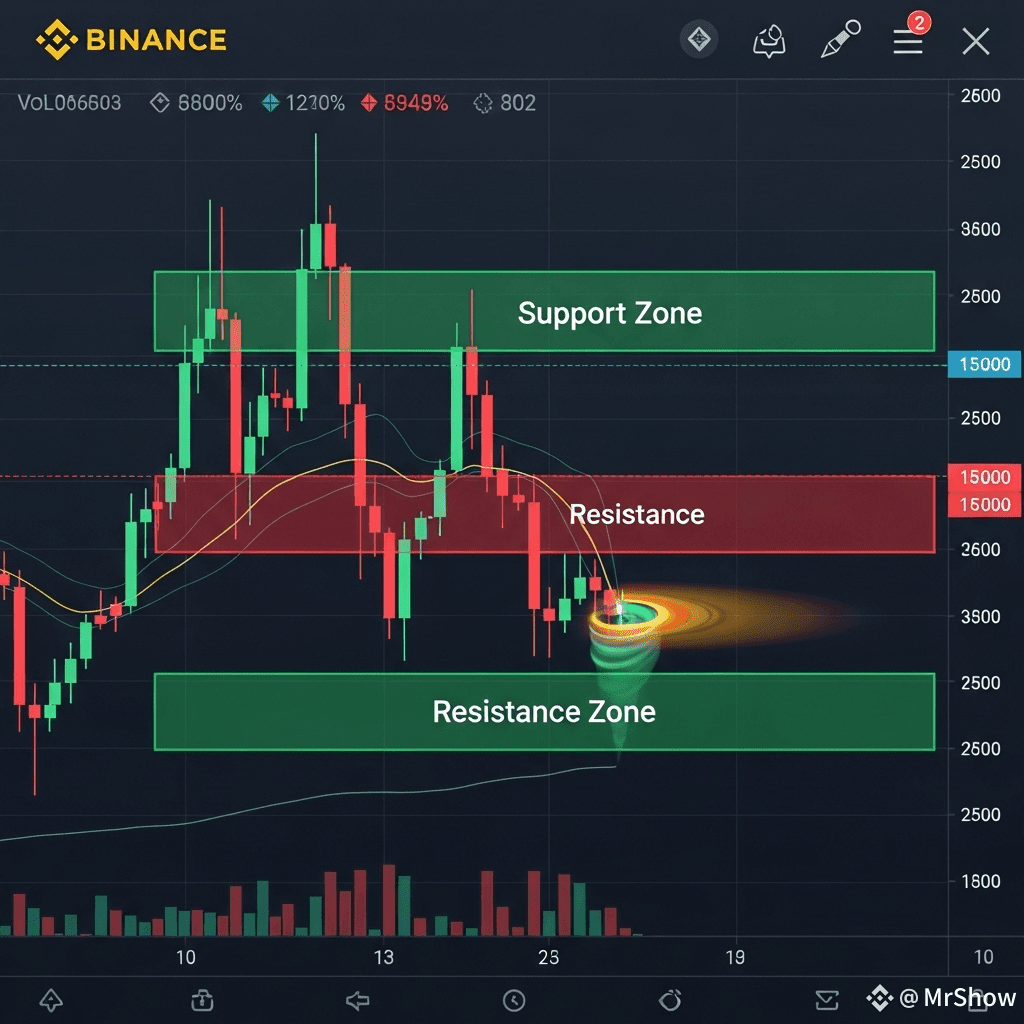

4. ⚖️📉 Use With Support/Resistance 📈

The meaning of spinning tops depends heavily on location. Near resistance, it warns of possible selling pressure. Near support, it shows buyers are holding the level.

---

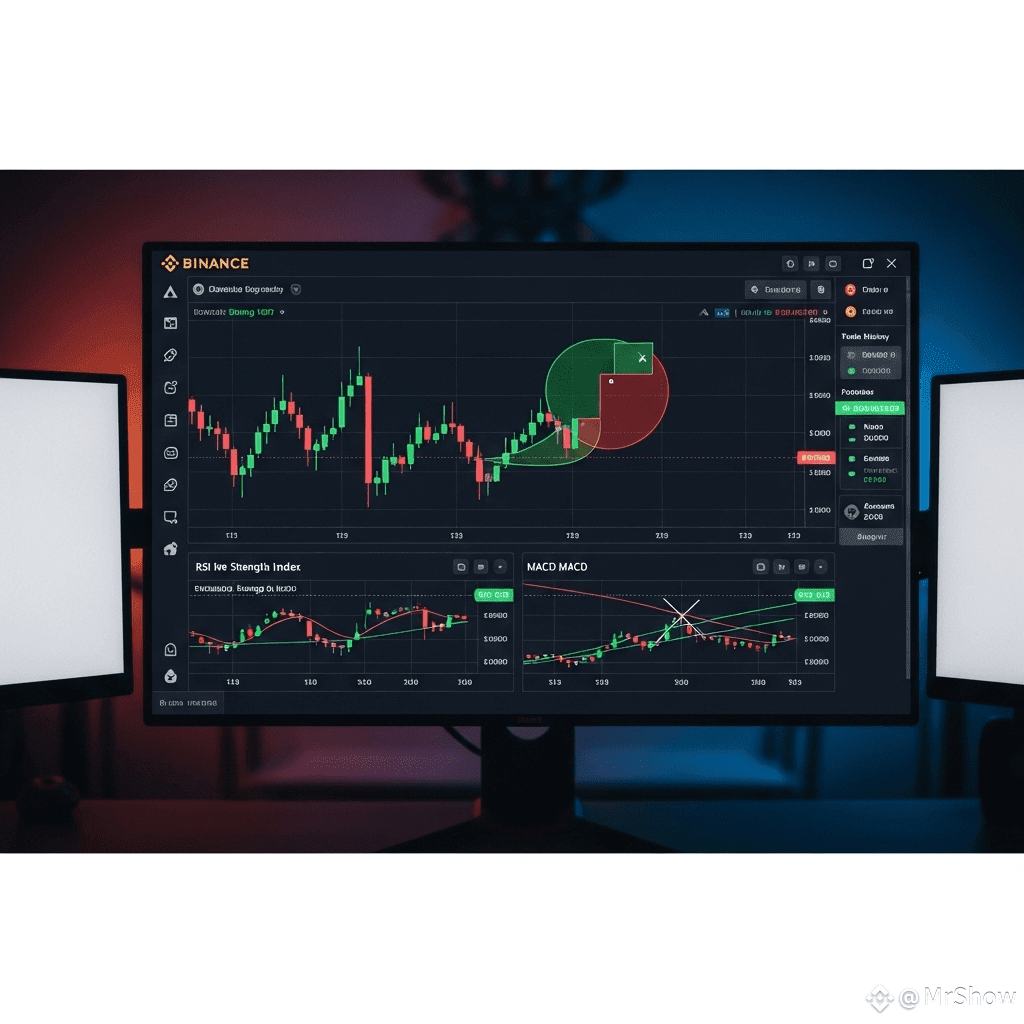

5. 🪙📊 Strategy With Spinning Tops 🛠️

Traders rarely act on spinning tops alone. Instead, they combine them with RSI, MACD, or moving averages to confirm potential reversal or continuation.

✅ Conclusion:

The spinning top 🎡⚖️📊 is a neutral candlestick showing indecision. Though not a strong reversal by itself, in the right context it can hint at slowing momentum or turning points. Combined with support/resistance and indicators, it becomes a useful caution signal in Binance trading.

#SpinningTop #Indecision #binancetrading #CandlestickAnalysis #CryptoStrategy